Press release

Credit Card Market expanding at a CAGR of 39.22% during the FY 2022 FY 2027 period

Quadintel published the latest research report on the Credit Card market. In order to comprehend a market holistically, a variety of factors must be evaluated, including demographics, business cycles, and microeconomic requirements that pertain precisely to the market under study. In addition, the Credit Card market study demonstrates a detailed examination of the business state, which represents creative ways for company growth, financial factors such as production value, key regions, and growth rate.Credit card is one of the earliest modes of cashless transaction that allows cardholders to borrow funds to pay for goods and services from merchants that accept card payments. The credit limit is determined based on customers credit score, history, and income. The credit card market is smaller than that of the debit card. Commercial banks in India such as State Bank of India, HDFC Bank Limited, and ICICI Bank Limited, and Kotak Mahindra Bank Limited, as well as international firms such as American Express and City Bank are the major players in the market.

Request To Download Sample of This Strategic Report: - https://www.quadintel.com/request-sample/india-credit-card-market/QI042

Market insights:

The total value of credit card transactions is expected to reach INR 51.72 Trn by FY 2027, expanding at a CAGR of 39.22% during the FY 2022 FY 2027 period The volume of credit card transactions is projected to expand at a CAGR of ~26.43% during the forecast period. In FY 2021, a significant increase in the value of credit card transactions was witnessed. This rise was the result of a surge in the number of transactions per credit card and cardholders. The banking system reported over 1.2 million new credit card additions in November 2021.

Segment insights:

The market can be segmented based on type of lenders. It is dominated by private banks, which have ~70% share in total credit card balances. The share of cards issued by private banks slowed down during the first two quarters of FY 2021. It showed a sharp growth during the last two quarters of FY 2021 and in the second and third quarter of FY 2022. It is expected to continue developing in the next few years. The share of new card originations of private banks increased in the third and fourth quarter of FY 2021, as compared to the same quarters of FY 2020.

COVID-19 impact analysis:

In the wake of the pandemic, the National Payments Corporation of India (NPCI) encouraged customers and providers of emergency services to adopt digital payment systems, ensuring the safety of contactless transactions. As a result, transactions increased to some extent. However, reduced international travel due to restrictions imposed during the 2020 2021 period negatively impacted credit card usage during that time. Revenue levers are likely to be hard to pull as several customers are unwilling to use credit cards frequently. Therefore, various cost management strategies need to be adopted by issuers to attract customers and attain a competitive and robust future for the credit cards market.

Access full Report Description, TOC, Table of Figure, Chart, etc. @ - https://www.quadintel.com/request-sample/india-credit-card-market/QI042

Table of Contents:

Market Overview

Market Definition and Scope

Market Dynamics

Market Industry Analysis

Market, Regional Analysis

Analysis of Leading Companies

Competitive Intelligence

Research Process

Market Analysis and Forecast, By Product Types

What aspects regarding the regional analysis Market are included in this report?

Geographical regions covered in the report include North America, Europe, Asia Pacific, Latin America and Middle East and Africa region.

The report consists of detailed region-wise analysis of current and future market trends, providing information on product usage and consumption.

The growth rate of the market in every region, including their countries over the forecast period is included in the market report.

Based on what factors are the key market players assessed in this report?

The report offers detailed analysis of leading companies in the market across the globe.

It provides details of the major vendors involved in the Market including Key Players

A comprehensive overview of each company including the company profile, generated revenue, pricing of goods and

the manufactured products is incorporated in the report.

The facts and figures about market competitors along with standpoints of leading market players are presented in the report.

The recent developments, mergers and acquisitions related to mentioned key players are provided in the market report.

Request full report - https://www.quadintel.com/request-sample/india-credit-card-market/QI042

About Quadintel:

We are the best market research reports provider in the industry. Quadintel believes in providing quality reports to clients to meet the top line and bottom line goals which will boost your market share in today's competitive environment. Quadintel is a 'one-stop solution' for individuals, organizations, and industries that are looking for innovative market research reports.

Get in Touch with Us:

Quadintel:

Email: sales@quadintel.com

Address: Office - 500 N Michigan Ave, Suite 600, Chicago, Illinois 60611, UNITED STATES

Tel: +1 888 212 3539 (US - TOLL FREE)

Website: https://www.quadintel.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Market expanding at a CAGR of 39.22% during the FY 2022 FY 2027 period here

News-ID: 2639284 • Views: …

More Releases from Quadintel

Smart Textiles for Military Market Business Expansion Strategies for the Market …

Quadintel's recent global " Smart Textiles for Military Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample…

China Home Appliances Market A Deep Dive into the Market: Trends, Insights, and …

Quadintel's recent global " China Home Appliances Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of…

Wireless Healthcare Market Unlocking New Growth Avenues in the Market: Strategie …

Quadintel's recent global " Wireless Healthcare Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of This…

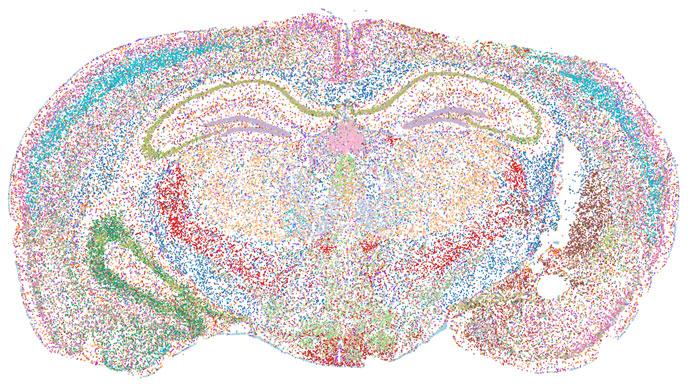

Spatial omics Market The Impact of Economic Conditions on the Market in 2023-203 …

Quadintel's recent global " Spatial omics Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of This…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…