Press release

Treasury and Risk Management Market SWOT Analysis, Share, Challenges, Growth Strategies and Forecast to 2028

According to our latest market study on "Treasury and Risk Management Market Forecast to 2028 - COVID-19 Impact and Global Analysis - by Component, Deployment, Enterprise Size, Application, and End-User," the market size is projected to reach US$ 7,156.90 million by 2028 from US$ 4,739.39 million in 2021; it is expected to grow at a CAGR of 6.1% from 2021 to 2028.Treasury and risk management analysis is defined as overseeing a company's working capital, including making strategic plans on the best possible ways to keep the organization solvent. This involves monitoring funds to maintain liquidity and lowering the organization's financial and operational risks. An organization's treasury risk can be effectively handled by improving cash visibility, implementing a liquidity plan, establishing regulation & compliance guidelines, implementing fraud prevention tools, and installing multiple layers of legal protection. Solutions in treasury and risk management market analysis automate treasury tasks and link cash & risk management workflows to core business processes in banks and other financial institutions. With treasury and risk management software, users can integrate cash flows, commodity positions, transactions, and treasury and risk management industry data and optimize through processing with full-view & actual-time analysis, audit trails, and compliance reporting.

Get Sample PDF Brochure at: https://www.theinsightpartners.com/sample/TIPRE00011232/?utm_source=OpenPR&utm_medium=10452

Artificial intelligence (AI) helps the finance industry streamline and optimize different processes, ranging from credit decisions to quantitative analysis in treasury and financial risk management. The AI solutions facilitate more accurate assessments of traditionally underserved borrowers, including millennials, in the credit decision-making process, thus, helping banks and credit lenders make smarter business decisions. Further, AI smoothens and automates the financing process in several banks, investment firms, and wealth management firms. For instance, aixigo AG uses AI-based wealth management solutions for providing digital transformation, private banking, retail banking, robo advisors, and asset management services. The robo advisor software of aixigo AG uses AI to replace human components at the point of sale during the financial investment process.

Companies Mentioned:

• Broadridge Financial Solutions, Inc.

• FIS

• Oracle Corporation

• Pricewaterhousecoopers International Limited (PWC)

• SAP SE

• Fiserv, Inc.

• Calypso Technology, Inc (Adenza)

• Kyriba Corp

• Mors Software

• Wolters Kluwer

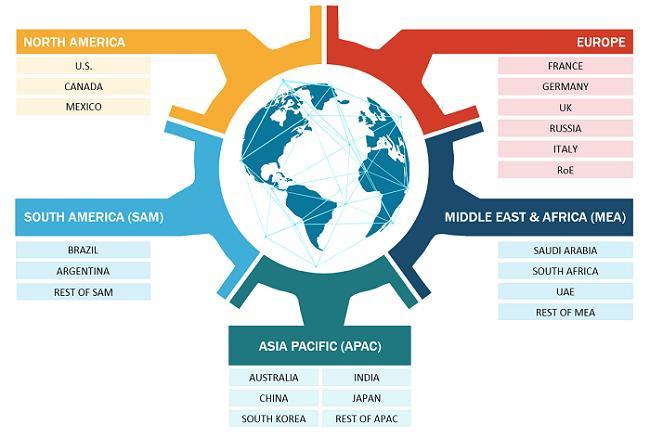

The report on Treasury and Risk Management market gives a rundown of market segmentation. Moreover, it provides particulars pertaining to market size, valuation and CAGR of each region and segment for all years from 2017 until 2028. PEST analysis for each region is given as well.

Deployment-Based Market Insights:

Based on deployment, the treasury and risk management market is bifurcated into cloud-based and on-premises. The cloud-based segment led the market with a larger share in 2020.

Enterprise Size-Based Market Insights:

Based on enterprise size, the treasury and risk management market is bifurcated into small & medium-size enterprises and large enterprises. The large enterprises segment led the market with a larger share in 2020.

Application-Based Market Insights:

Based on application, the treasury and risk management market is segmented into account management, cash & liquidity management, compliance & risk management, and financial resource management. The cash & liquidity management segment accounted for the largest market share in 2020.

End User-Based Market Insights:

Based on end user, the market is segmented into BFSI, IT & telecom, retail & ecommerce, healthcare, manufacturing & automotive, and others. The BFSI segment led the treasury and risk management market with the largest share in 2020.

Key Elements that the report acknowledges:

• Growth rate and market size over the analysis timeframe.

• Key factors stimulating and hindering market expansion.

• Leading vendors and suppliers of the market.

• Exhaustive SWOT analysis of each company.

• Detailed PEST analysis by region.

• Opportunities and threats faced by the existing vendors in Treasury and Risk Management market.

• Strategic initiatives undertaken by leading players.

Immediate delivery of our off-the-shelf reports and prebooking of upcoming studies, through flexible and convenient payment methods - https://www.theinsightpartners.com/buy/TIPRE00011232/?utm_source=OpenPR&utm_medium=10452

Additionally, the report includes an exhaustive analysis of the market and concludes with precise estimates of the revenue generation by each segment, country, region and company. Every detail that might prove to be essential for making strategic decisions is mentioned along with solutions and suggestions from expert analysts. Each segment of the market is studied extensively to provide reliable knowledge for supplementary market investments.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

About Us:

The Insight Partners is a one-stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Healthcare, Manufacturing and Construction, Media and Technology, Chemicals, and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Treasury and Risk Management Market SWOT Analysis, Share, Challenges, Growth Strategies and Forecast to 2028 here

News-ID: 2625327 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Treasury

Corporate and Treasury bond Market 2025: Top Key Players: U.S. Treasury, U. S. C …

The report "Global Corporate and treasury bond Market" intends to provide innovative market intelligence and help decision makers take comprehensive investment evaluation. Also identifies and analyses the emerging trends along with major drivers, challenges, opportunities and entry strategies for various companies in the global Corporate and treasury bond Industry.

Corporate and treasury bond market research report provides the newest industry data and industry future trends, allowing you to identify the products…

Treasury Software Market 2019-2027 / CRM Treasury Systems, DataLog Finance And F …

The report covers the forecast and analysis of the treasury software market on a global and regional level. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million). The study includes drivers and restraints of the Nordic treasury software market along with the impact they have on the demand over the forecast period. Additionally, the report includes the…

Corporate and treasury bond Market Future Demand Analysis and Business Opportuni …

Corporate and treasury bond is where debt securities are issued and traded. The bond market primarily includes government-issued securities and corporate debt securities, and it facilitates the transfer of capital from savers to the issuers or organizations that requires capital for government projects, business expansions and ongoing operations. The bond market is alternatively referred to as the debt, credit or fixed-income market. Although the bond market appears complex, it is…

Global Corporate and Treasury Bond Market, Top key players are U.S.Treasury,,S.C …

Global Corporate and Treasury Bond Market Size, Trends, Applications, Status, Analysis and Forecast Reports 2019 to 2026

Corporate and Treasury Bond market size by players, regions, product types and end industries, history 2014-2018 and forecast data 2019-2026. This report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter’s Five Forces Analysis.

The main goal for the dissemination of…

Corporate and Treasury Bond Market Analysis by Top Key Players U.S.Treasury, U. …

When companies want to expand operations or fund new business ventures, they often turn to the corporate bond market to borrow money. A company determines how much it would like to borrow and then issues a bond offering in that amount; investors that buy a bond are effectively lending money to the company according to the terms established in the bond offering or prospectus.

Get Sample Copy of this Report @…

Corporate and Treasury Bond Market is Booming Worldwide | U.S. Treasury, U. S. C …

HTF MI recently introduced Global Corporate and treasury bond Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are U.S. Treasury, U. S. Corporate and treasury bonding Company,…