Press release

Global Open Banking Market Size, Share, Industry Trends, Region And Growth Forecast To 2031

'Open Banking Global Market Report 2022 -Market Size, Trends, And Global Forecast 2022-2026' by The Business Research Company is the most comprehensive report available on this market, with analysis of the market's historic and forecast growth, drivers and restraints causing it, and highlights of the opportunities that companies in the industry can take on. The Open Banking market research report helps gain a truly global perspective of the Open Banking industry as it covers 60 geographies worldwide. Regional and country breakdowns give an analysis of the market in each geography, with information on the size of the market by region and by country.The regions covered in the Open Banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

Request for a Sample of the Open Banking Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=5446&type=smp

The open banking market consists of sales of open banking services by entities (organizations, sole traders, and partnerships) that unites banks, third parties, and technology providers, allowing them to exchange data easily and securely for the benefit of their consumers. Open banking is a banking practice in which third-party financial service providers can use application programming interfaces (APIs) to gain access to consumer banking, transactions, and other data from banks and NBFCs. These APIs deliver a secure way to share financial information between two parties and makes it easier for consumers to compare the details of current accounts and other banking services.

Key competitors in the Open Banking market include Capital One, HSBC Bank plc, Banco Bilbao Vizcaya Argentaria S.A, NatWest Group plc, DBS Bank, Barclays, Lloyds Banking Group, Citigroup, Banco Santander S.A., and Credit Agricole.

The global open banking market size is expected to grow from $15.13 billion in 2021 to $19.14 billion in 2022 at a compound annual growth rate (CAGR) of 26.5%. The global open banking market size is then expected to grow to $48.13 billion in 2026 at a CAGR of 25.9%.

Need more for your business growth? Directly purchase the report here:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=5446

TBRC's report segments the global Open Banking market:

1) By Service Type: Transactional Services, Communicative Services, Information Services

2) By Financial Services: Bank and Capital Markets, Payments, Digital Currencies, Value Added Services

3) By Deployment Type: Cloud, On-Premises, Hybrid

4) By Distribution Channel: Bank Channels, App Market, Distributors, Aggregators

Read further on the Open Banking market here:

https://www.thebusinessresearchcompany.com/report/open-banking-global-market-report

The Table of Contents includes:

1. Executive Summary

2. Open Banking Market Characteristics

3. Open Banking Market Trends And Strategies

4. Impact Of COVID-19 On Open Banking Market

5. Open Banking Market Size And Growth

.....

27. Open Banking Market Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions In The Open Banking Market

29. Open Banking Market Future Outlook And Potential Analysis

30. Appendix

Contact us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

And check out our Blog: http://blog.tbrc.info/

Interested to know more about The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that excels in company, market, and consumer research. Located globally, it has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services, chemicals, and technology.

The World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Open Banking Market Size, Share, Industry Trends, Region And Growth Forecast To 2031 here

News-ID: 2618094 • Views: …

More Releases from The Business research company

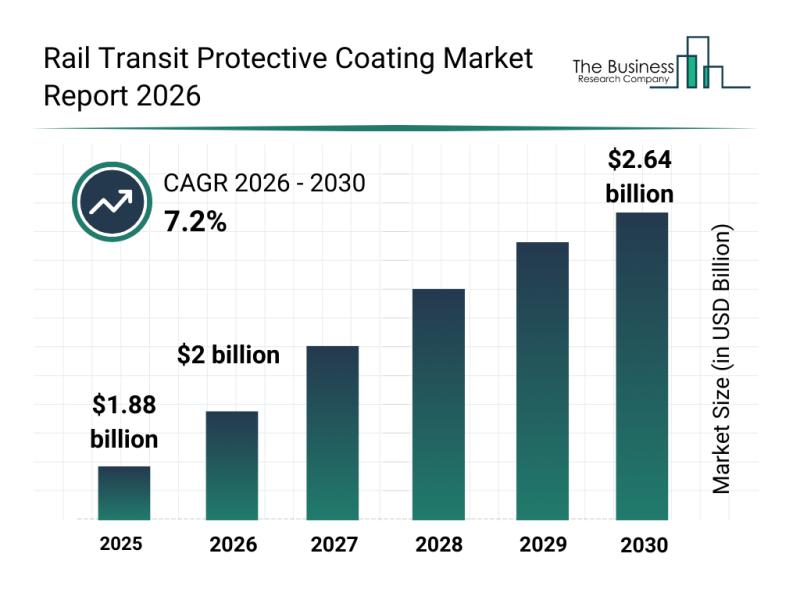

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

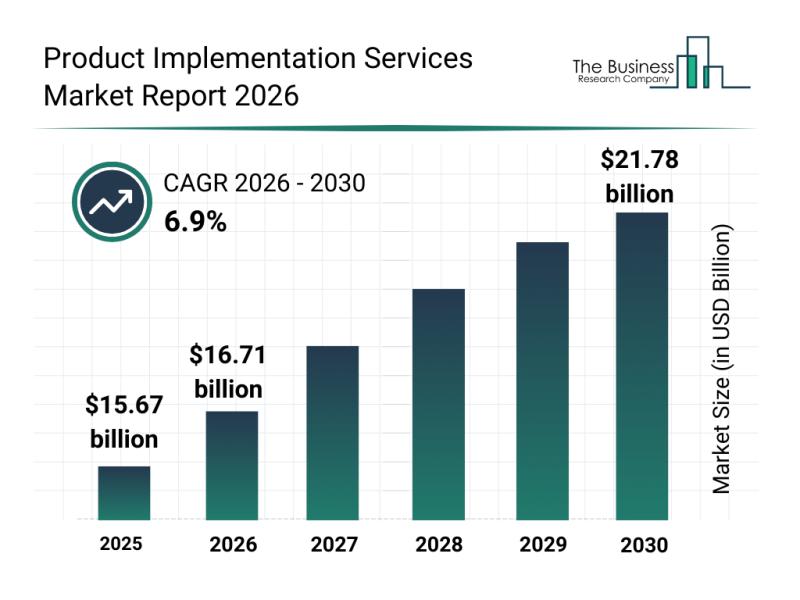

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

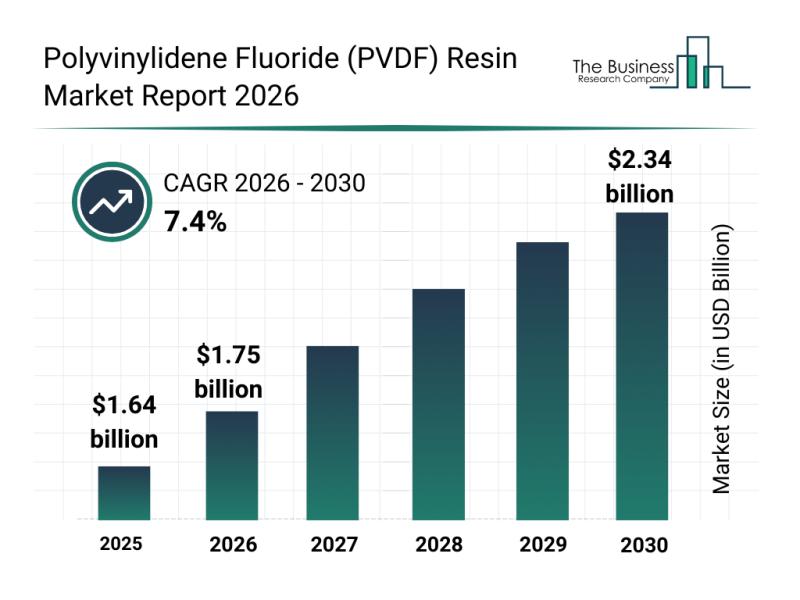

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

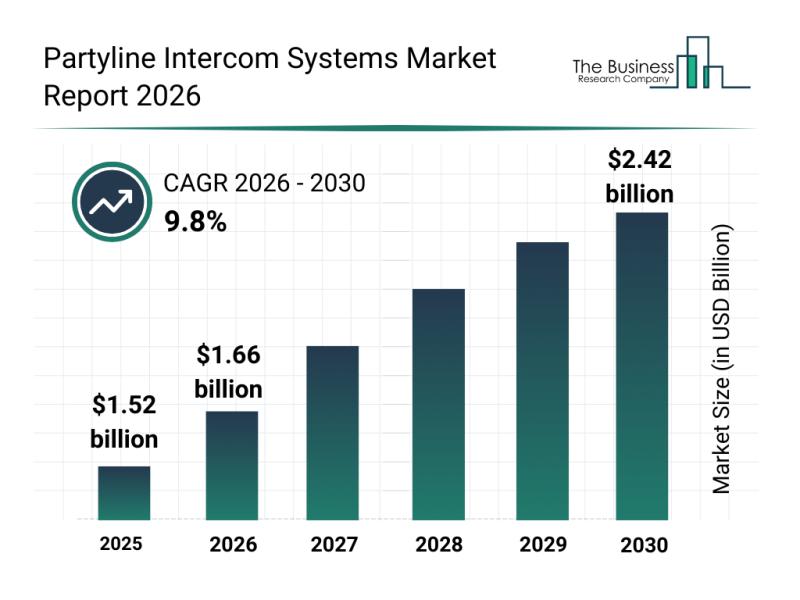

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…