Press release

Payday Loans Market Size, Share, Demand And Forecasts Report Till 2027 | Cashfloat, CashNetUSA

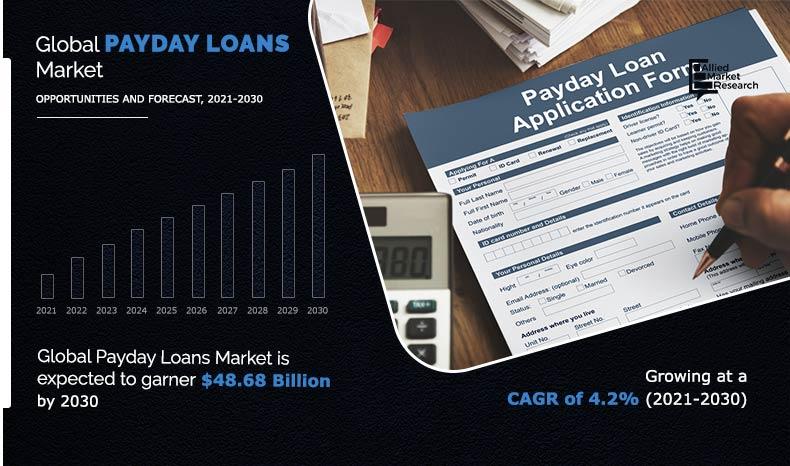

Allied Market Research recently published a report, "Payday Loans Market By Type (Storefront Payday Loans and Online Payday Loans), Marital Status (Married, Single and Others), and Customer Age (Less than 21, 21-30, 31-40, 41-50 and More than 50): Global Opportunity Analysis and Industry Forecast, 2021-2030".Download Sample Report (200+ Pages PDF Report) @ https://www.alliedmarketresearch.com/request-sample/10377

The market report presents a systematic and methodical description of the global payday loans market along with the recent drifts, future estimates, and competitive landscape. At the same time, it also emphasizes on the study of the payday loans market on the basis of regional heights. It doles out in-depth information associated with the frontrunners operational in the payday loans market and portrays the competitive strength and approaches incorporated by the market players for thriving their shares and heightening their status in the industry.

The payday loans market report also offers an explicit study of different market segments, including type, application, and end user. Each market segment is properly scrutinized with respect to the revenue generation in the major regional provinces such as Asia Pacific, North America, Europe, and LAMEA. The comprehensive study of the global payday loans market helps to figure out multi-region exploration.

Furthermore, the report offers a comprehensive breakdown of market undercurrents such as drivers, challenges, and opportunities. A brief estimation of Porter's five forces is also portrayed in the report to get through the prospects of the buyers and suppliers. In terms of the competitive market scenario, the report also depicts the major market players along with their brief synopsis, major entrants, and their budding potential in the industry. It also sketches the strategies adopted by them so as to dilate their position in the global payday loans market.

Request For Customization @ https://www.alliedmarketresearch.com/request-for-customization/10377?reqfor=covid

Key Market Segments

• By Type

o Storefront Payday Loans

o Online Payday Loans

• By Marital Status

o Married

o Single

o Others

• By Customer Age

o Less Than 21

o 21 To 30

o 31 To 40

o 41 To 50

o More Than 50

Finally, by region, the market is evaluated across Europe, LAMEA, Asia-Pacific, and North America. The province across North America is broken down into the United States, Mexico, and Canada. Europe indexes countries such as the United Kingdom, Italy, France, Spain, Germany, and rest of Europe. Concurrently, Asia-Pacific consists of countries such as South Korea, India, Japan, China, and rest of Asia-Pacific. Finally, LAMEA is classified into Africa, the Middle East, and Latin America,

Research Methodology

Both, bottom-up and top-down approaches are used to collaborate and estimate the extent of the global payday loans market. All percentage shares and itemizations are bent on through secondary sources and substantiated through primary bases. Moreover, all possible margins & precincts that affect the market covered in this research study have been descried in detail, confirmed through primary research, and explored & examined to get to the final quantitative & qualitative data.

The Interested Potential Key Market Players Can Enquire for the Report Purchase at: https://www.alliedmarketresearch.com/purchase-enquiry/10377

Covid-19 Impact Analysis

The payday loans market report provides a perfect overview of the upshots of the pandemic and takes in a brief outline of its development along with the macro & micro impacts on the market. It contains the impacts on demand, sales, and on the supply chain management. The report further puts a light on the market share and extent based on the very impact of the Covid-19 pandemic. Additionally, it presents the strategies undertaken by the major market players to deal with the impact caused by the global health crisis. Last but not the least; the report provides a little overview of the pre as well as post Covid impacts coupled with the growth of the payday loans market.

The payday loans market report includes an analysis of the top 10 market players that are active in the market. The study includes sales, revenue analysis, and production of these companies. The prime market players are Cashfloat, CashNetUSA, Creditstar, Lending Stream, Myjar, Silver Cloud Financial, Inc., Speedy Cash, THL Direct, Titlemax, and TMG Loan Processing.

The Main Points Covered in the Payday loans Market

• The payday loans market study offers a wide-ranging study with regard to the major industry participants.

• Porter's five forces analysis aids in defining the potential suppliers & buyers and the viable picture of the shareholders for strategy development.

• A lot of developing as well as developed countries have been outlined in line with their individual revenue support to the regional market.

• The report, finally, focuses on the recent market trends of the global payday loans market to get into the dominant opportunities and prospective investment pockets.

• The major drivers, restraints, and opportunities and their thorough impact study are also included in the report.

Full Summary @ https://www.alliedmarketresearch.com/payday-loans-market-A10012

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web:https://www.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payday Loans Market Size, Share, Demand And Forecasts Report Till 2027 | Cashfloat, CashNetUSA here

News-ID: 2611154 • Views: …

More Releases from Allied Market Research

Global Smart Waste Management Market to Hit $8.3 Billion by 2032 | Transforming …

One of the key factors fueling the growth of the smart waste management market is the increasing volume of waste generated worldwide. With rapid urbanization and expanding industrial activities, traditional waste management methods are struggling to keep up with the rising waste output. Smart waste management systems provide an effective solution by optimizing collection schedules, enhancing sorting accuracy, and streamlining disposal processes, making them vital for handling large-scale waste efficiently.

In…

Construction Equipment Market to Hit New Heights by 2031, Rising at 4.8% CAGR wi …

Construction equipment refers to specially engineered machinery designed to perform or support various construction activities. These machines include wheel bulldozers, front loaders, dump trucks, backhoe loaders, graders, crawler dozers, compactors, excavators, forklifts, concrete mixer trucks, and more. Each type of equipment serves distinct functions such as drilling, hauling, excavating, paving, grading, and lifting. Beyond construction and infrastructure projects, construction equipment also finds applications across industries like manufacturing and oil &…

Industrial Robotics Market to Soar at 12.6% CAGR Through 2032 | Powering Industr …

Industrial robotics is a sector that deals with the development, manufacture, and implementation of automated systems and robotic solutions in a variety of industries. These advanced robots are designed to perform a variety of tasks with remarkable accuracy, velocity, and productivity, and are employed in a variety of industrial settings to replace or assist human workers. These robots are employed to improve productivity, reduce safety, and streamline processes in a…

Modular Construction Industry on Track for $234.7 Billion by 2031, Growing at 6. …

According to the report published by Allied Market Research, the global modular construction market generated $131.1 billion in 2021, and is estimated to reach $234.7 billion by 2031, witnessing a CAGR of 6.1% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market…

More Releases for Payday

$500 Google Payday Review - Legit or Another Hype?

$500 Google Payday Review - Legit or Another Hype?

With so many online money-making systems launching every day, it's hard to separate real opportunities from overhyped products. One of the latest entries is "$500 Google Payday" by Glynn Kosky, a WarriorPlus product promising a plug-and-play system that leverages Google's algorithm to generate commissions without selling, ads, or tech skills. But does it really work, or is it just another rehashed system?…

Payday Loans Market Outlook 2023-2030

A payday credit is a transient unstable advance, frequently described by exorbitant loan costs. The expression "payday" in payday credit alludes to when a borrower composes a postdated check to the moneylender for the payday pay, yet gets some portion of that payday total in prompt money from the loan specialist. Likewise, payday loans have little credit limits, ordinarily up to $500, and don't need a credit check. Moreover, the…

Payday Loans Service Market Astonishing Growth with Top Influencing Key Players …

Report Description

The Payday Loans Service Market is expected to register a CAGR of around 4.1%, during the forecast period 2022 to 2027.

The Global Payday Loans Service Market Report provides Insightful information to the clients enhancing their basic leadership capacity identified with the global Payday Loans Service Market business, including market dynamics, segmentation, competition, and regional growth. The strategy of expansion has been adopted by key players who are increasing their…

Payday Loans Rise in Public interest

PaydayLoanSolutions believes that the personal payday loan is becoming a necessary element of the modern consumers way of life. The company offers insight with regard to the near cultural necessity of the payday loan for significant parts of the general population.

Location—PaydayLoanSolutions allows consumers to organise a quick and small sized loan based upon the stability and reliability of their employment history and that is paid back to the company automatically…

Enjoy Financial Freedom with Payday Loan Solutions

Payday Loan Solutions is an online lender of the loans for American citizens at any hour of the day. It is the most trustworthy site to get payday loan of any amount within few hours.

“Fast cash delivery and other exciting features that our website offers to loan seekers make us the best choice,” says a company spokesperson.

The website operates 365 days a year and 24 hours a day,…

Payday Loan Consolidation Company "Payday Freedom" Announces Lender Scam Still T …

There has been a massive increase of fraudulent payday loan debt collectors trying to collect fake payday loan debts. Most of the callers have very strong Indian accents from the client reports coming in. It's been ongoing for many months now with no end in sight.

Unfortunately, so many people are falling for this trap and the main problem is the operators of this scam are working out of the country.…