Press release

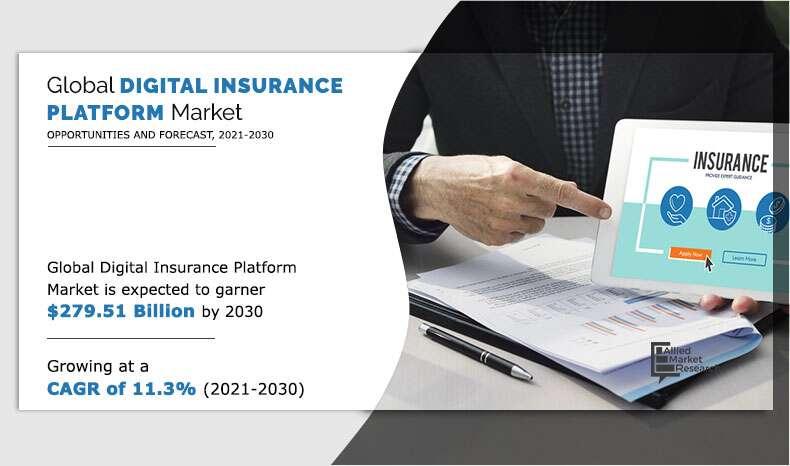

Digital Insurance Platform Market Statistics 2021 - Top Impacting Factors that Can Win the Industry Globally

Digital Insurance Platform Market Statistics: Major Factors that Can Increase the Global Demand, Business Growth Analysis by Top Countries Data and Segments InsightsACCESS COMPLETE REPORT: https://www.alliedmarketresearch.com/digital-insurance-platform-market

The market study incorporates an in-depth analysis of the Digital Insurance Platform Market based on the key parameters that take in the drives, sales inquiry, market extents & share. Moreover, the report provides a detailed measurements about the drivers, growth, and opportunities that have a direct influence on the market. The report, further, focuses on assessing the market size of four major regions, namely North America, Europe, Asia-Pacific, and LAMEA. The research study is designed to help the readers with an exhaustive valuation of the current industry trends and analysis.

The report spans the Digital Insurance Platform research data of various companies, benefits, gross margin, strategic decisions of the worldwide market, and more through tables, charts, and infographics.

DOWNLOAD FREE SAMPLE REPORT: https://www.alliedmarketresearch.com/request-sample/5594

Other important factors studied in this report include demand and supply dynamics, industry processes, import & export scenarios, R&D development activities, and cost structures. Besides, consumption demand and supply figures, cost of production, and selling price of products are also estimated in this report.

The Study Will Help the Readers:

1. Acknowledge the complete market dynamics.

2. Inspect the competitive scenario along with the future market landscape with the help of different strictures such as Porter's five forces and parent/peer market.

3. Understand the impact of government regulations during the Covid-19 pandemic and evaluate the market throughout the global health crisis.

4. Consider the portfolios of the major market players operational in the market coupled with the comprehensive study of the products and services they offer.

Main Offerings:

1. The report crafted by AMR on the Digital Insurance Platform Market doles out a wide-ranging study of global market share, key determinants of the growth, country-level stance, segmental assessment, market prospects, and the major trends.

2. Porter's five forces model, on the other hand, cites the efficacy of buyers & sellers, which is important to help the market players implement fruitful stratagems. Furthermore, the research study includes,

- Threat of new competitors

- Threat of new stand-ins

- Bargaining clout of suppliers as well as consumers

- Rivalry among key players

3. An explicit analysis of the driving and restraining factors of the global Digital Insurance Platform Market is also provided in the report.

GET EXCLUSIVE DISCOUNT: https://www.alliedmarketresearch.com/purchase-enquiry/5594

Key Market Players:

The Digital Insurance Platform Market also focuses on the key players operating in the sector. Their product portfolio, business tactics, company profiles, and revenue share are also perfectly delineated in the report. Finally, the study delineates the strategies such as partnership, expansion, collaboration, joint ventures, and others implemented by the frontrunners to heighten their status in the sector.

Top Market Players Change the View of the Global Face of Digital Insurance Platform Industry: DXC Technology Company, EIS Software Limited, Lemonade Insurance Company, Majesco, Oscar Insurance, OutSystems, Quantemplate, Shift Technology, Wipro Limited, and Zhongan Insurance.

COVID-19 Scenario:

The research study showcases the thorough impact analysis of COVID-19 on the global Digital Insurance Platform Market. The unprecedented situation had distressed the global economy and the Digital Insurance Platform Market was impacted badly, especially during the initial phase. The report also takes in the details about the market extents during this pandemic. Moreover, the study provides a large-scale study of the policies & plans executed by the key players all over this term. At the same time, it also cites the post-pandemic scenario, since the majority of government bodies have come up with slackening measures on the existing rules, when major vaccination drives have also been initiated across the world. With this drift on board, the global Digital Insurance Platform Market is projected get back on track very soon.

COVID-19 IMPACT ANALYSIS/CUSTOMIZATION: https://www.alliedmarketresearch.com/request-for-customization/5594?reqfor=covid

Key Market Segments:

• By Component

o Solution

o Service

o Professional

o Managed

• By Deployment Model

o On-premise

o Cloud

• By Enterprise Size

o Large Enterprises

o Small & Medium-sized Enterprises (SMEs)

• By Application

o Automotive Transportation & Logistics

o Life & Health

o Commercial & Residential Buildings

o Business & Enterprise

o Agriculture

o Others

• By End User

o Insurance Companies

o Aggregators

o Third Party Administrators & Brokers

Top Trending Reports:

1) Home Insurance Market- https://www.alliedmarketresearch.com/home-insurance-market-A06947

2) BFSI Security Market- https://www.alliedmarketresearch.com/bfsi-security-market-A10561

3) Neo and Challenger Bank Market- https://www.alliedmarketresearch.com/neo-and-challenger-bank-market

Pre-Book Now With 10% Discount:

1) Premium Finance Market- https://www.alliedmarketresearch.com/premium-finance-market-A15358

2) Neobanking Market- https://www.alliedmarketresearch.com/neobanking-market

3) Supply Chain Finance Market- https://www.alliedmarketresearch.com/supply-chain-finance-market-A08187

Contact:

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on LinkedIn: https://www.linkedin.com/company/allied-market-research

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Insurance Platform Market Statistics 2021 - Top Impacting Factors that Can Win the Industry Globally here

News-ID: 2609102 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

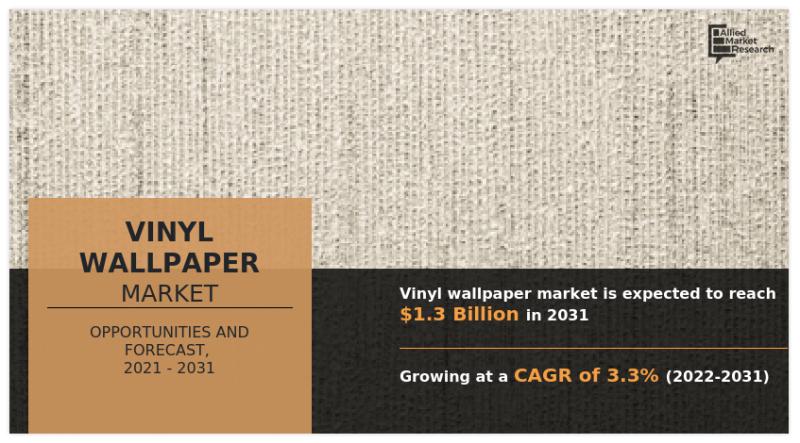

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

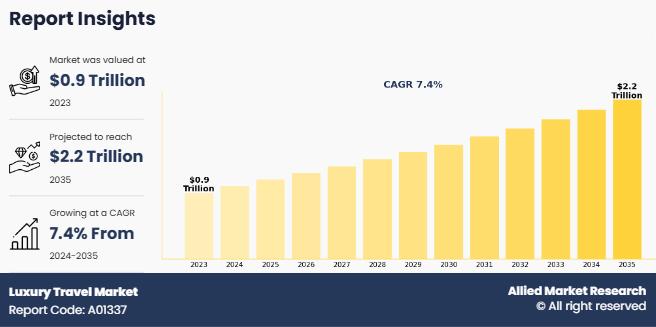

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…