Press release

In-Vehicle Infotainment Market Growth Factors, Opportunities, Ongoing Trends and Key Players 2027

The In-Vehicle Infotainment Market is projected to grow from USD 20.8 billion in 2021 to USD 38.4 billion by 2027, at a CAGR of 10.8%. Government mandates on telematics and e-call services, Emergence of various technologies such as 5G and AI, and ADAS and other autonomous solutions are expected to offer promising growth opportunities in the In-vehicle infotainment market.Asia Pacific holds the largest share of the in-vehicle infotainment market during the forecast period. It witnessed higher growth in vehicle production than Europe and North America due to the availability of labor at lower wages, reduced production costs, lenient vehicle safety norms, and government initiatives for FDIs in the region in both pre-and post-COVID-19. Vehicle production is mostly driven by countries such as China, South Korea, India, and Japan, which contributes ~88% of the total production of vehicles, and these countries within the region contributed ~55% of the global vehicle production in 2021. Thus, increasing vehicle production, along with changing consumer preferences and growing per capita income of the middle-class population, is driving the vehicle demand and encouraging automotive OEMs to increase production capacity and offer infotainment systems in the lower-range cars as well

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=538

Growing consumer focus on passenger safety and availability of entertainment services such as music, video streaming, navigation features are major factors driving the in-vehicle infotainment market in developed and developing countries. This demand is primarily driving the front row infotainment system demand globally.

Additionally, growing luxury vehicle sales and demand for screens for rear passengers to offer a more personalized experience and comfort are factors expected to fuel the rear row in-vehicle infotainment system market during the forecast period. The emergence of 5G is also expected to contribute to the development of the in-vehicle infotainment market. In 2021, with the BMW iX, BMW Group became the first premium manufacturer to integrate 5G mobile radio standard into a globally available production vehicle, and Vodafone is offering the first 5G mobile radio contract to BMW Group for such vehicles. Thus, considering the abovementioned factors, the in-vehicle infotainment system market is expected to grow significantly in the future.

By form type, the embedded segment is estimated to account for the largest market share of ~48-50% in 2021. The integrated segment is estimated to be the second-largest form segment with a ~32% market share in 2021. The growth in embedded technology is mainly driven by regulatory mandates in the EU, which mandated that all new car models in member states must have embedded technology as part of its European eCall system. The embedded form type is prevalent in Europe and North America, while the integrated form type is growing in popularity in Asia Pacific and RoW. The major driver for this trend is the cost-sensitive nature of the regions (Asia Pacific and RoW), which prefer integrated connectivity as it is more economical than the embedded form. The market for the integrated form type, whose adoption is growing rapidly in the aforementioned regions, is projected to register a CAGR of 12.4% globally.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=538

The operating system segment of the in-vehicle infotainment market is driven by Linux OS at present. However, Android Automotive OS is an open-source platform that reduces the cost of using it to zero, and it is cheaper to install than most other systems. Presently, it provides access to a series of services already having millions of users across the world and is expected to register the highest growth in the OS segment during the forecast period. Moreover, many automotive suppliers and OEMs are working on the development and commercialization of Android Automotive OS; for instance, in August 2021, Renault announced to install Android Automotive in some of the models launched by its brands, and Renault Megane E-Tech would be the first to be introduced. Audi and Volvo have partnered with Google to use upgraded versions of infotainment systems. General Motors and Stellantis announced that they would use Google's new Android operating system to power infotainment systems in all their vehicles by the end of 2023. Hence, Android Automotive OS is expected to emerge as key OS for in-vehicle infotainment companies and register the highest growth rate of 36.4% during the forecast period.

The infotainment market for electric vehicles is growing at a significant rate over ICE cars. Due to the introduced stringent emission regulations around the world, unstable oil prices, and shifting focus toward an environment-friendly ecosystem have fueled the demand for electric vehicles globally. Further, the penetration of advanced and connected technologies in EVs is higher, and demand for luxury and premium electric cars is on the rise. Luxury brands such as Mercedes-Benz, Tesla, and Audi are gaining their market share in luxury EV sales and are adding other luxury EV models in their product lineups. Multiple OEMs have announced to launch several EV models in the coming years. Growing electric vehicle sales, including premium vehicles, would consequently push the demand for in-vehicle infotainment in this segment.

The passenger car retrofitting of infotainment systems leads the market during the forecast period. Along with increase in vehicle production at the global level, growing technological advancements, introduction of sophisticated systems, improved connectivity infrastructure (4G/5G), rising disposable income, and changing preferences have shifted consumer focus on retrofitting of infotainment systems in newly sold cars. Lower to mid-range cars hold the dominant share in vehicle production, especially in developing countries of Asia Pacific and RoW, and most of these cars are not offered with infotainment systems or are installed with normal systems without touchscreen and other functionalities. On the other side, OEMs have also started offering embedded devices in lower-end cars from mid-range trims to sustain the competition, and the trend is expected to remain the same in the future as well. All these factors would keep the demand for retrofitted infotainment systems in the coming years.

View Detail TOC @ https://www.marketsandmarkets.com/Market-Reports/in-car-vehicle-infotainment-ici-systems-market-538.html

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: newsletter@marketsandmarkets.com

Phone: 18886006441

Address: 630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

One stop solution for all Market Research & Consulting needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release In-Vehicle Infotainment Market Growth Factors, Opportunities, Ongoing Trends and Key Players 2027 here

News-ID: 2606637 • Views: …

More Releases from MarketsandMarkets™ INC.

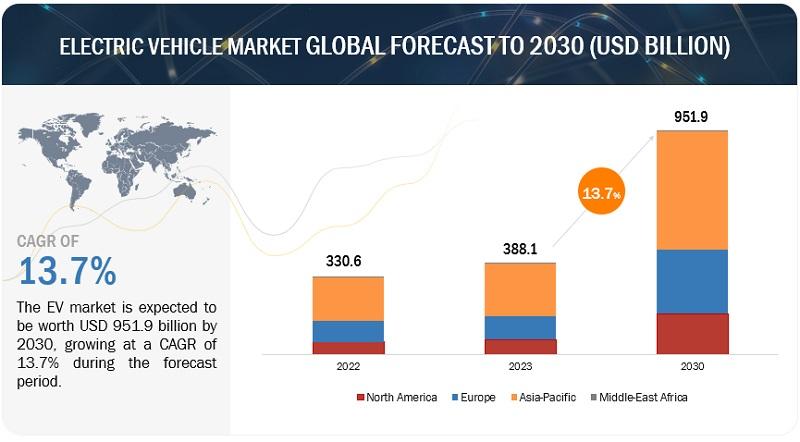

Electric Vehicle Market Size, Share, Trends & Analysis by 2030

The global EV market is projected to grow from USD 388.1 billion in 2023 to USD 951.9 billion by 2030, registering a CAGR of 13.7%. The electric vehicle (EV) market is currently experiencing a transformative phase of rapid growth and innovation. With increasing global concern over climate change and air pollution, coupled with advancements in technology and supportive government policies, the adoption of EVs has gained tremendous momentum. Consumers are…

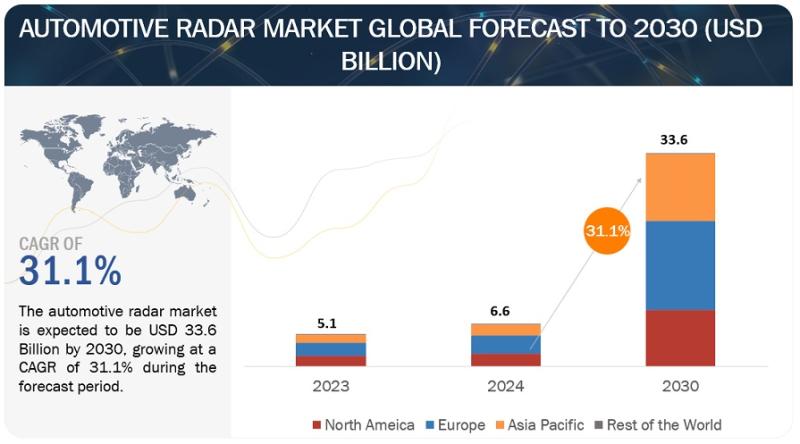

Automotive Radar Market Valued at $33.6 billion by 2030

The global automotive radar market is projected to grow from USD 6.6 billion in 2024 to USD 33.6 billion by 2030, registering a CAGR of 31.1%.

The automotive radar market is flourishing due to a confluence of factors. The primary driver is the surging demand for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. These technologies heavily rely on radar for object detection and measurement, making it an essential component. Furthermore, stricter…

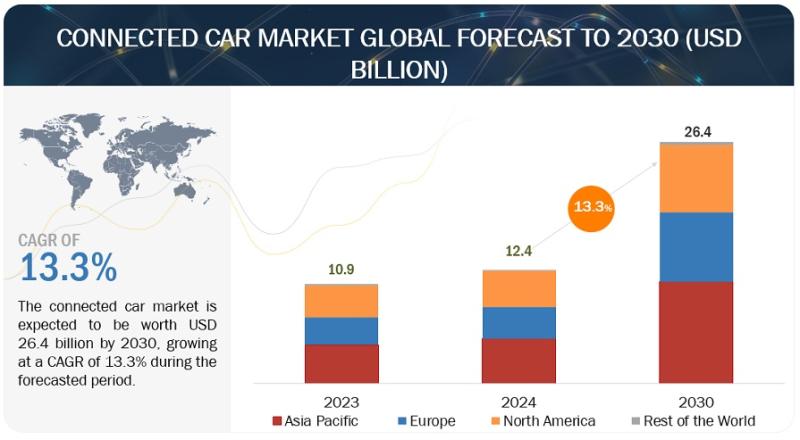

Connected Car Market Poised to Reach $26.4 billion by 2030

The globally connected car market is estimated to grow from USD 12.4 billion in 2024 to USD 26.4 billion by 2030, at a CAGR of 13.3%.

Government initiatives towards developing intelligent transportation networks and the growing trend of in-vehicle connectivity solutions are two factors influencing the growth of the worldwide connected car market. Also, the consumer demand for a safer, more convenient, and entertaining driving experience is a significant driver. This…

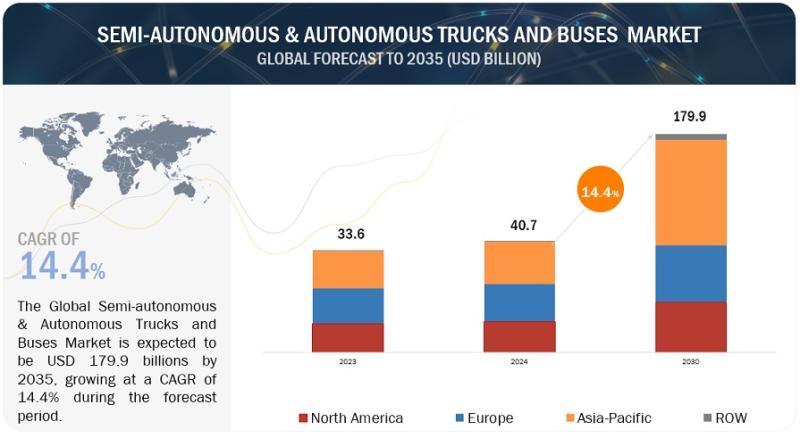

Semi-Autonomous & Autonomous Trucks and Buses Market worth $179.9 billion by 203 …

The Semi-autonomous & autonomous Trucks and Buses market size is projected to grow from USD 40.7 Billion in 2024 to USD 179.9 Billion by 2035, at a CAGR of 14.4%. The increasing demand for electric and autonomous vehicle and government regulation regarding safety is expected to increase the demand for Semi-autonomous & autonomous Trucks and Buses. Additionally, continuos innovation in advance driving technologies and components will boost the demand…

More Releases for Android

Android MDM: A Comprehensive Guide to Android Device Management

Android device management is a remote solution for the corporate sector that helps them efficiently monitor, manage, and control only Android devices. Mobile device management has gained more importance with the changing business trends from traditional office work to remote work. It helps enterprises remotely monitor and control employee devices, enforce policies, distribute applications, and use them as interactive kiosks.

Image: https://www.getnews.info/uploads/04b1373ad6e3e980cfac4d9c2f8bbeef.png

What kind of Android Devices Can You Manage with Android…

Systweak Android Cleaner Gets Upgraded For Android 9 & Above

Systweak Software, a well-known organization in the field of cleaning & optimization utilities, recently upgraded its popular app Systweak Android Cleaner for Android 9 and above. The performance booster app now comes with enhanced UI, faster scanning engine, advanced optimization & is even lighter on phone resources.

Using the application is extremely easy, a single tap is required to kill any unneeded ‘running processes’ & ‘background apps’ that occupy lots…

Android Automotive AVN 2017 offers a glimpse into a android future

bigmarketresearch.com include new market research report "Global Android Automotive AVN Sales Market Report 2017”

This report studies sales (consumption) of Android Automotive AVN in Global market, especially in United States, China, Europe and Japan, focuses on top players in these regionscountries, with sales, price, revenue and market share for each player in these regions, covering

Bosch

Denso

Pioneer

Alpine

Aisin

Continental

Kenwood

Sony

ADAYO

Desay SV

Catch a glimpse of complete report here @ http://www.bigmarketresearch.com/global-android-automotive-avn-sales-report-2017-market

Split by product Types, with sales, revenue,…

Systweak Android Cleaner functionality upgraded for Android M

Systweak Software, a well- known IT development and solutions company based out of India, recently upgraded its popular App Systweak Android Cleaner (SAC) to optimize app functionality for Android M. The performance boosting app now also comes with detailed listings of apps according to battery usage and enhanced auto-cleaning.

“Systweak Android Cleaner is one of the best rated apps for phone boosting and optimization on Play Store. It has performed…

eCard Express App for Android and Android Tablet - Personal & Business Greeting …

Mississauga, Canada - Announcing that Bartsoft Inc., a Canadian based company, have released the new festive greeting card application for Android and Android Tablet - eCard Express HD. This application enables users to create and customize greeting cards with high quality stickers, frames, and their own photos or images from the photo gallery. eCard Express HD is intuitive, very easy to use, and very efficient at producing Christmas and holiday…

Android Tablet PC Supplier Chinavasion Launches Its First Android Gingerbread Ta …

Shenzhen, China - July 28, 2011 - Android Tablet PC supplier Chinavasion unveils its latest Android Tablet, the Ingenium 2.3, a 7 inch magnificent tablet powered by Android 2.3 Gingerbread operating system, with features including WiFi, a 7 inch ultra responsive capacitive screen, 3.0 megapixel front facing camera and a 4GB internal memory.

According to Chinavasion's Rose Li, people have constantly come to Chinavasion for high quality, low priced Android…