Press release

Business Insurance Market Analysis and Forecast to 2028: COVID-19 and Post-COVID Impact, Opportunities and Trends

According to a report from Evolve Business Intelligence, the global Business Insurance market is set to grow at CAGR of XX% from 2022 to 2030. The study covers insights regarding growth leveraging factors and investment strategies for each of the reader's analysts. The reader will gain valuable insights regarding key players and their developmental outlook for 2019, 2020 and 2021. This latest report on Pre-COVID-19 and Post-COVID-19 impact analysis will help investors with keeping up-to-date with current market activity and plan future investments accordingly.To request a free sample, Go To: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008687

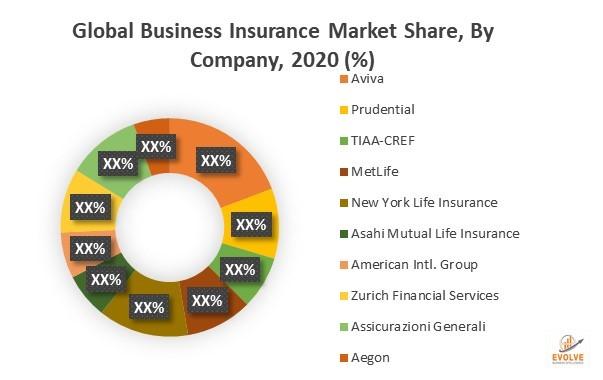

The report includes 10 key players in the Business Insurance market ecosystem that have been strategically profiled, along with the market ranking/share for major players. The key players profiled in the report are:

• Aviva

• Prudential

• TIAA-CREF

• MetLife

• New York Life Insurance

• Asahi Mutual Life Insurance

• American Intl. Group

• Zurich Financial Services

• Assicurazioni Generali

• Aegon

• Allstate

• Prudential Financial

• Nippon Life Insurance

• Meiji Life Insurance

• Cardinal Health

• Royal & Sun Alliance

• Sumitomo Life Insurance

• Dai-ichi Mutual Life Insurance

• AXA

• Swiss Reinsurance

• Allianz

• State Farm Insurance

• China Life Insurance Company

• CNP Assurances

• Munich Re Group

• Mitsui Mutual Life Insurance

• Ping An Insurance

• Aetna

• China Pacific Insurance

The research team has conducted a study of the BUSINESS INSURANCE market. This study indicated an optimistic outlook for the future based on recent trends, hurdles, and opportunities. Based on our findings, our research team determined specific opportunities for growth for BUSINESS INSURANCE Market, including some key areas that we believe could help bolster this innovative project's performance in terms of financial results (which have thus far been quite positive). This report on the BUSINESS INSURANCE market shows the industry's historic development, including its evolution and latest developments. The report contains a comprehensive market stat of leading players in this industry. It also provides some important findings on this industry, like the consumption (sales), revenue, market share and growth rate analysis with respect to some major countries of this industry from 2020-2030.

Impact of COVID-19 & Post Covid Scenario

The COVID-19 pandemic has been hitting the market for several months and the repercussions have been felt across several countries and continents. There have been outbreaks of this virus that have amassed and bred among financial markets over a long period of time, disrupting trade and personal profit as well because they were frozen to avoid further spread. We at Evolve Business Intelligence have interviewed hundreds of people in similar geographical regions to help eliminate these risks.

In terms of COVID 19 impact, the Business Insurance market report also includes the following data points:

• Impact of COVID-19

• Government Aids and Policies for Industry Revival

• Companies Recent Developments to Tackle Negative Impact

• Opportunity Window & Post COVID Trend

For any customization, contact us through - https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008687

Market Segment By types with focus on market share, consumption trend, and growth rate of Business Insurance Market:

• Commercial Property Insurance

• Commercial Health Insurance

• Others

Market Segment By applications with focus on market share, consumption trend, and growth rate of Business Insurance Market:

• Large Corporations

• Small and Medium-Sized Companies

Global Business Insurance Geographic Coverage:

• North America

o US

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Rest of Asia Pacific

• Latin America

o Mexico

o Brazil

o Argentina

o Rest of Latin America

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of MEA

For any customization, contact us through - https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008687

Key Matrix

• Base Year: 2021

• Estimated Year: 2022

• CAGR: 2022 to 2030

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Contact: +1 773 644 5507 / +91 635 396 3987

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Insurance Market Analysis and Forecast to 2028: COVID-19 and Post-COVID Impact, Opportunities and Trends here

News-ID: 2587730 • Views: …

More Releases from Evolve Business Intelligence

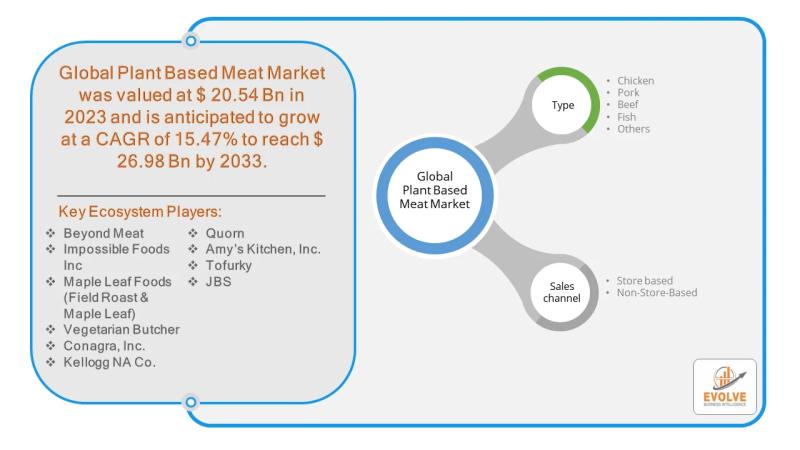

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

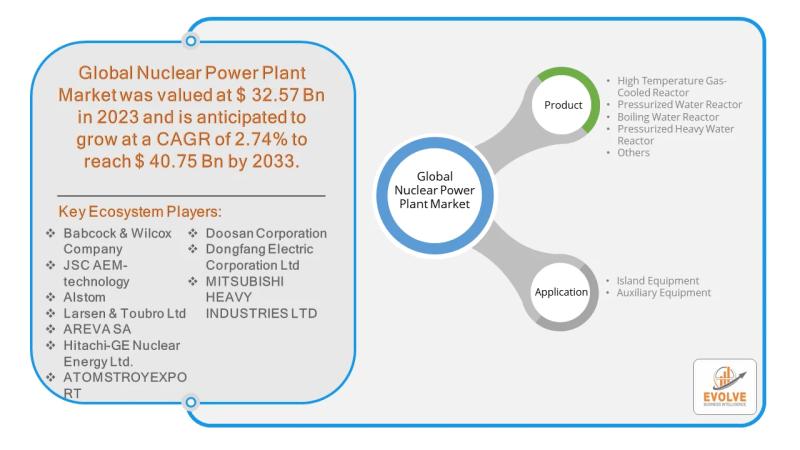

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

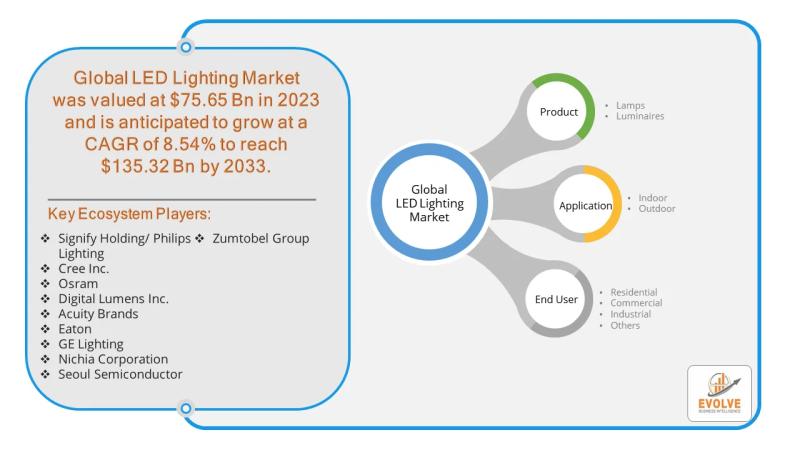

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…