Press release

Identity Theft Insurance Market Size, Share, Growth Analysis and Forecast by 2027 By Key Players Aura, Chubb, Experian

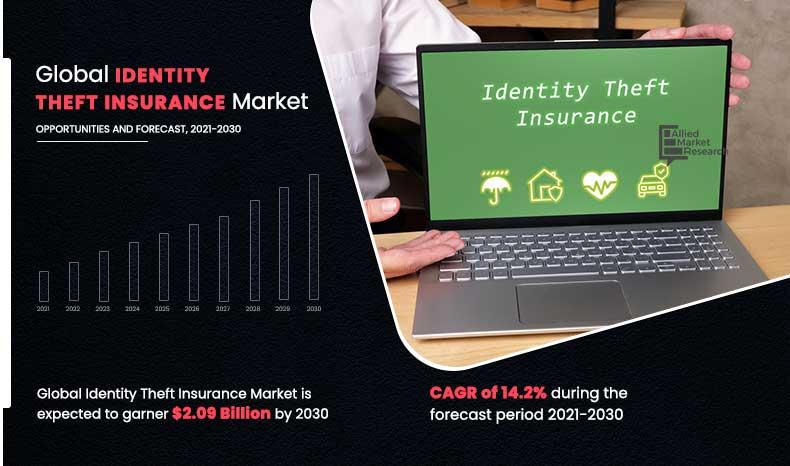

As per the report published by Allied Market Research Titled "Identity Theft Insurance Market By Type (Credit Card Fraud, Employment Or Tax-Related Fraud, Phone Or Utilities Fraud, Bank Fraud and Others) and Application (Individuals and Business): Global Opportunity Analysis and Industry Forecast, 2021-2030", the global identity theft insurance market is estimated to showcase significant growth from 2020 to 2027.As per AMR, the recent developments in technology have an instrumental effect on the growth of the identity theft insurance market. The study offers a comprehensive analysis of the driving and restraining factors, lucrative opportunities, market segmentation, and study of major market players. The report includes a detailed analysis of the impact of the Covid-19 pandemic on the global identity theft insurance market.

Download Sample Report with Full TOC @ https://www.alliedmarketresearch.com/request-sample/12352

The global identity theft insurance market report includes an overview of the market and highlights market definition and scope along with major factors that shape the identity theft insurance market. The study outlines the major market trends and driving factors that boost the growth of the identity theft insurance market. The report includes an in-depth study of sales, market size, sales analysis, and prime drivers, challenges, and opportunities.

The report offers a comprehensive study of market trends, major market players, and top investment pockets that help make strategic and informed decisions. The study includes a detailed analysis of the top impacting factors and investment pockets that affect the market growth and influence new opportunities in the future.

Request For Customization @ https://www.alliedmarketresearch.com/request-for-customization/12352?reqfor=covid

The report includes an in-depth analysis of the impact of the Covid-19 outbreak on the market. The prolonged lockdown and restriction on international trade have a significant impact on the global identity theft insurance market. The Covid-19 pandemic has resulted in a disrupted supply chain and shortage of raw materials, which has affected the market growth. The report includes consumer trends, preferences, and budget impact on the market due to the pandemic. Moreover, the report highlights the opportunity window and key strategic decisions taken by the market players during such unprecedented times.

The global identity theft insurance market is segmented on the basis of geography. The regions analyzed in the report are North America (United States, Canada, and Mexico), Europe (Germany, France, UK, Russia, and Italy), Asia-Pacific (China, Japan, Korea, India, and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa). This market study aids to formulate business strategies and understand lucrative opportunities.

Pre-Book Now with 10% Discount @ https://www.alliedmarketresearch.com/purchase-enquiry/12352

The global identity theft insurance market report provides an in-depth segmentation of the market. The report provides a study of sales, revenue, growth rate, and market shares of each segment during the historic as well as forecast period. The global identity theft insurance market report provides a detailed study of drivers, challenges, restraints, and opportunities in the market. The comprehensive analysis of the major drivers helps new market entrants to understand the current market scenario. The challenges and restraints are essential to comprehend the growth of the market during the forecast period and formulate strategic business plans accordingly. The analysis of the recent and upcoming market trends helps understand the market demand and futuristic opportunities in the market.

Key Market Segments Includes:

• By Type

o Credit Card Fraud

o Employment or Tax-Related Fraud

o Phone or Utilities Fraud

o Bank Fraud

o Others

• By Application

o Individuals

o Business

The technological advancements and advent of novel technologies such as artificial intelligence, cloud computing, big data, and cryptocurrency have an instrumental effect on the global identity theft insurance market growth. The report helps understand the role of such technologies in the market growth during the forecast period.

The market growth is formulated with the help of several methods and tools. The SWOT analysis offers in-depth knowledge of the major determinants of the market growth. Furthermore, these tools are essential for understanding the lucrative opportunities in the market.

Access Full Summary @ https://www.alliedmarketresearch.com/identity-theft-insurance-market-A11987

Key offering of the Report:

1. Major driving factors: A detailed study of determinants of the market factors, forthcoming opportunities, and challenges.

2. Current market trends & forecasts: An in-depth analysis of the market including recent market trends and forecasts for the next few years that help to make an informed decision.

3. Segmental Analysis: A detailed study of each segment along with driving factors and growth rate analysis of each segment.

4. Geographical analysis: Insightful study of the market across various regions that enable market players to benefit from the market opportunities.

5. Competitive landscape: A detailed study of major market players that are active in the identity theft insurance market.

The global identity theft insurance market report offers a detailed study of the top 10 market players present in the industry. The report includes production, sales, and revenue analysis of the market players. The major market players that are currently active in the market are Allstate Insurance Company, Aura, Chubb, Experian, GEICO, IdentityForce, Inc., IDShield, McAfee, LLC, NortonLifeLock Inc., and Nationwide Mutual Insurance Company. These market players have adopted various business strategies including mergers & acquisitions, new product launches, partnerships, and collaborations to maintain their foothold in the market. The market report includes statistics, tables, and charts to offer a detailed study of the identity theft insurance industry.

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web:https://www.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Identity Theft Insurance Market Size, Share, Growth Analysis and Forecast by 2027 By Key Players Aura, Chubb, Experian here

News-ID: 2585596 • Views: …

More Releases from Allied Market Research

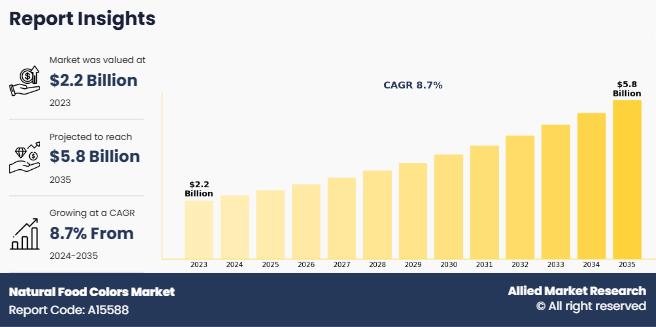

Natural Food Colors Market Size Worth USD 5.58 Billion By 2035 | Growth Rate (CA …

The natural food colors market was valued at $2.2 billion in 2023, and is estimated to reach $5.8 billion by 2035, growing at a CAGR of 8.7% from 2024 to 2035.

The rising demand for functional and nutraceutical foods is significantly driving the natural food colors, as consumers increasingly seek products that offer both health benefits and visual appeal. Natural colors derived from ingredients like turmeric, beetroot, spirulina, and blueberry not…

Combat Self-Defense Management Systems Market Rapidly Growing Dynamics with Indu …

Combat management system is a computer system which integrates the ship sensors, radars, weapons, data links, and other equipment into a single system. The combat management system provides situational awareness & intelligence to the crew and enables them to perform combat missions effectively. A combat management system comprises the central command & decision-making element of vessel combat system. The combat management system is used in combat missions for several purposes…

Ice Cream Coating Market Research Overview, Share, Size, Analysis, and Forecast …

Ice cream is a sweetened frozen product with either an artificial sweetener or natural sugar. Ice cream is eaten as a desert or snack. Increase in consumption of ice cream is highest in summer. Ice cream coating is made from coconut, cashew, almond milk, dairy milk or cream, soy, and is flavored with sugar. Ice cream coating contains thin layers that are manufactured from inexpensive fats such as hydrogenated palm…

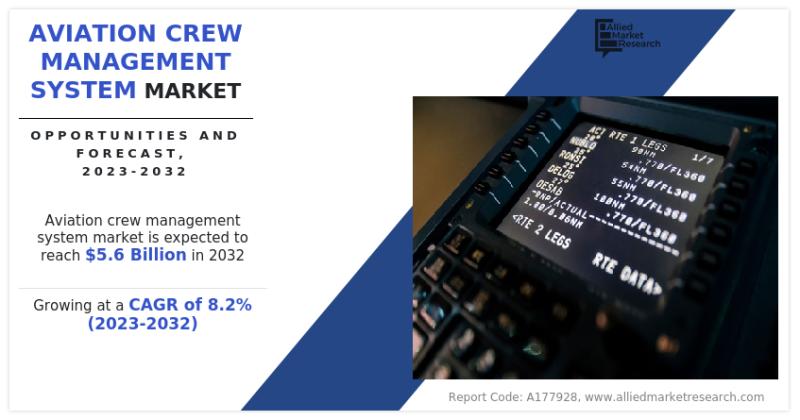

Aviation Crew Management System Market Size Worth $5.61 Billion by 2032 With CAG …

According to the report, the global aviation crew management system market size was valued at $2.61 billion in 2022 and is projected to reach $5.61 billion by 2032, registering a CAGR of 8.16% from 2023 to 2032.

The growing demand for sophisticated software designed to improve crew operations across a range of aviation industries will experience significant growth.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/A177928

The global aviation crew management system market is driven by factors…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…