Press release

Digital transformation in Banking, Financial Services, and Insurance Market Analysis and Forecast to 2028: COVID-19 and Post-COVID Impact, Opportunities and Trends

According to a report from Evolve Business Intelligence, the global DIGITAL TRANSFORMATION IN BANKING, FINANCIAL SERVICES, AND INSURANCE market is set to grow at CAGR of XX% from 2022 to 2030. The study covers insights regarding growth leveraging factors and investment strategies for each of the reader's analysts. The reader will gain valuable insights regarding key players and their developmental outlook for 2019, 2020 and 2021. This latest report on Pre-COVID-19 and Post-COVID-19 impact analysis will help investors with keeping up-to-date with current market activity and plan future investments accordingly.To request a free sample, Go To: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008100

The report includes 10 key players in the Digital transformation in Banking, Financial Services, and Insurance market ecosystem that have been strategically profiled, along with the market ranking/share for major players. The key players profiled in the report are:

• IBM

• Microsoft

• SAP

• Oracle

• Coinbase

• Fujitsu

• Cross Match Technologies

• HID Global

• AlphaSense Inc.

The research team has conducted a study of the Digital transformation in Banking, Financial Services, and Insurance market. This study has indicated a positive outlook for the future based on current and past data as well as an in-depth examination of key trends that could impact the long-term performance of this sector. Based on our findings, we see opportunities for growth in some key specific areas that we believe are ripe for new applications. To determine the amounts of these opportunities, we closely investigated factors such as how accessible the required raw materials were and how easily accessible sources could be to those who would be potentially interested in knowing more about these materials and their unique qualities so that they could consider incorporating them into their manufacturing process or commercializing them.

The study discusses the growth potential of the Digital transformation in Banking, Financial Services, and Insurance market on a global scale, by region and by country. The report analyzes how and why market trends affect the market in different parts of the world. Then, it sheds light on opportunities available for companies looking to get involved in this industry irrespective of the product or service they are offering.

Impact of COVID-19 & Post Covid Scenerio

The COVID-19 pandemic has been impacting the industry for the past year. Several financial impacts including disruptions have been felt over a long period of time across diverse markets. Our research has interviewed hundreds of people in the same geographical markets to collect information.

In terms of COVID 19 impact, the Digital transformation in Banking, Financial Services, and Insurance market report also includes the following data points:

• Impact of COVID-19

• Government Aids and Policies for Industry Revival

• Companies Recent Developments to Tackle Negative Impact

• Opportunity Window & Post COVID Trend

For any customization, contact us through - https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008100

Market Segment By Product Type with focus on market share, consumption trend, and growth rate of Digital transformation in Banking, Financial Services, and Insurance Market:

• Cloud Computing

• Blockchain

• Artificial Intelligence

• Biometrics

• Big Data

Market Segment By Application with focus on market share, consumption trend, and growth rate of Digital transformation in Banking, Financial Services, and Insurance Market:

• Banking

• Financial Services

• Insurance

Global Digital transformation in Banking, Financial Services, and Insurance Geographic Coverage:

• North America

o US

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Rest of Asia Pacific

• Latin America

o Mexico

o Brazil

o Argentina

o Rest of Latin America

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of MEA

For any customization, contact us through - https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008100

Key Matrix

• Base Year: 2021

• Estimated Year: 2022

• CAGR: 2022 to 2030

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Contact: +1 773 644 5507 / +91 635 396 3987

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital transformation in Banking, Financial Services, and Insurance Market Analysis and Forecast to 2028: COVID-19 and Post-COVID Impact, Opportunities and Trends here

News-ID: 2579366 • Views: …

More Releases from Evolve Business Intelligence

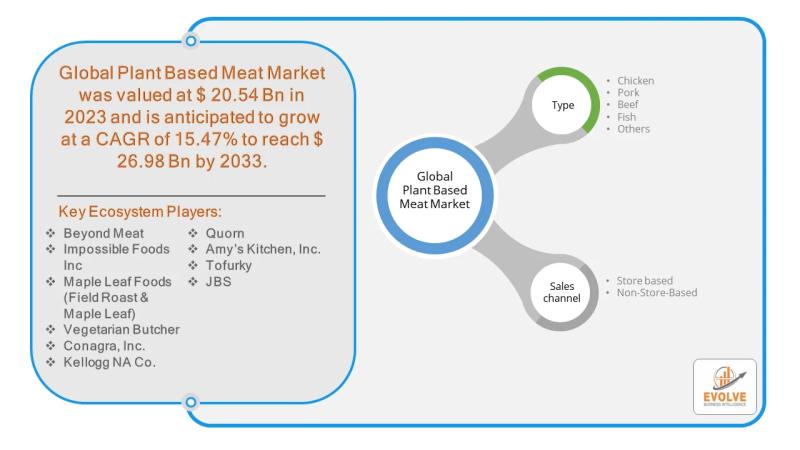

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

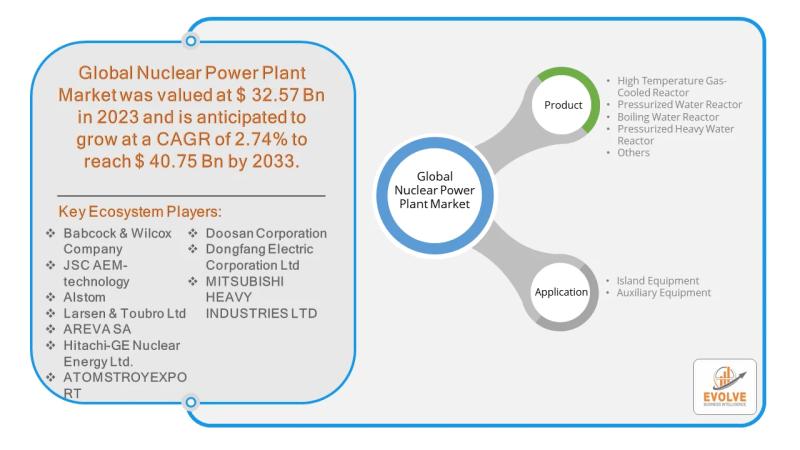

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

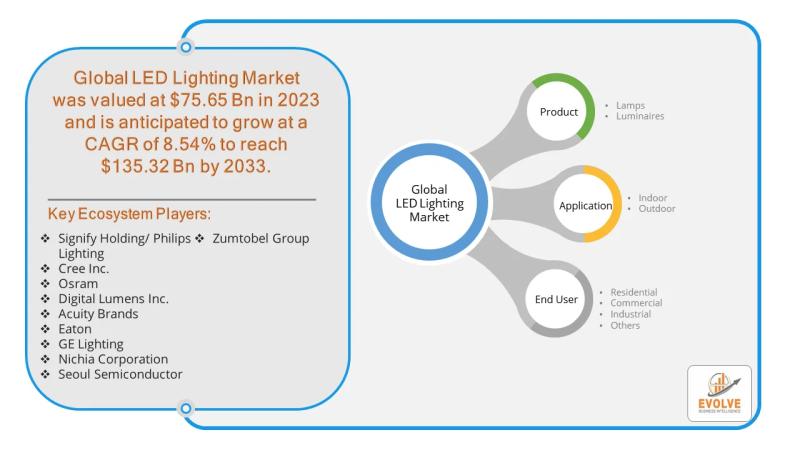

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…