Press release

Critical Illness Insurance Market is Predicted to See Lucrative Gains Over 2022-2028 Covid-19 Analysis

The Critical Illness Insurance market research report provides an in depth examination of the key factors stimulating market expansion. It also sheds light on the challenges or restraining factors that are poised to hinder industry growth over the forecast timeframe. Growth rate, market share captured, and valuation estimates for each region, segment, and company are documented as well.Critical illness insurance or critical illness cover is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list as part of an insurance policy. Also, the system may be structured to pay out regular income, and the payout may also be on the policyholder undergoing a surgical procedure, for example, having a heart bypass operation.

Get Sample PDF Copy of Critical Illness Insurance Market at: https://www.theinsightpartners.com/sample/TIPRE00011932/?utm_source=OpenPR&utm_medium=10352

The report makes inclusion of vital information such as market size, growth rate, and valuation of each segmental, regional and country level market, and growth opportunities in related niche market segments. This information has been incorporated after a thorough study of primary and secondary sources.

List of Companies operating in this report are:

1. Aegon N.V.

2. Allianz SE

3. Aviva plc

4. Axa S.A.

5. China Life Insurance

6. China Pacific Insurance Co., Ltd.

7. Legal & General Group plc,

8. New China Life Insurance Co., Ltd.

9. Ping An Insurance

10. Prudential plc

Furthermore, the Critical Illness Insurance Market is segmented based on Type, Application and region in order to study it exhaustively and provide the data in a systematic manner. Speaking of competitive landscape, the study includes a list of leading companies along with their product and service offerings, strategic decisions, SWOT analysis, latest developments, market share captured, growth rate, and valuation. The challenges faced by these companies are analyzed and solutions for them are given as well.

The critical illness insurance market is segmented on the basis of type, and application. Based on type, the market is segmented as disease insurance, medical insurance and income protection insurance. On the basis of application, the market is categorized as cancer, heart attack and stroke.

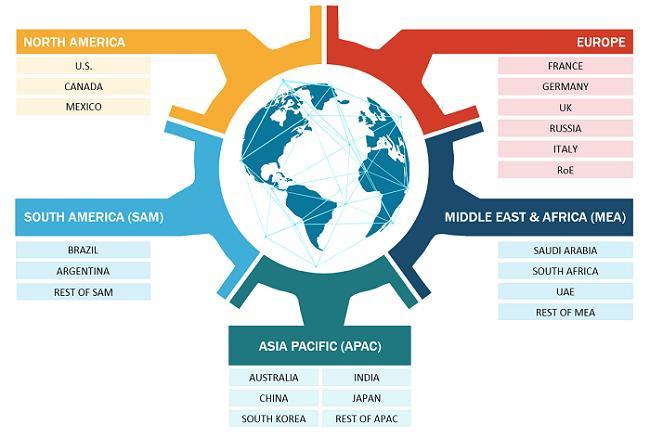

The report provides a detailed overview of the industry including both qualitative and quantitative information. It provides overview and forecast of the critical illness insurance market based on various segments. It also provides market size and forecast estimates from year 2020 to 2028 with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. The critical illness insurance market by each region is later sub-segmented by respective countries and segments. The report covers analysis and forecast of 18 countries globally along with current trend and opportunities prevailing in the region.

COVID-19 first began in Wuhan (China) during December 2019 and since then it has spread at a fast pace across the globe. The US, India, Brazil, Russia, France, the UK, Turkey, Italy, and Spain are some of the worst affected countries in terms confirmed cases and reported deaths. The COVID-19 has been affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. Shutdown of various plants and factories has affected the global supply chains and negatively impacted the manufacturing, delivery schedules, and sales of products in global market. Few companies have already announced possible delays in product deliveries and slump in future sales of their products. According to the current market situation, the report further assesses the present and future effects of the COVID-19 pandemic on the overall market, giving more reliable and authentic projections In addition to this, the global travel bans imposed by countries in Europe, Asia-Pacific, and North America are affecting the business collaborations and partnerships opportunities.

Have Question? Speak to Analyst at: https://www.theinsightpartners.com/speak-to-analyst/TIPRE00011932?utm_source=OpenPR&utm_medium=10352

Several market forces such as drivers and restraints and political, social, economic and technological advancements help shape up the industry in specific manner. All such forces are studied in detail to arrive at a market forecast which can help build the investment strategies in Critical Illness Insurance market.

Essential points covered in Critical Illness Insurance market report are:-

1 What will the market size and the growth rate be in 2028?

2 What are the key growth stimulants of Critical Illness Insurance market?

3 What are the key market trends impacting Critical Illness Insurance market valuation?

4 What are the challenges to market proliferation?

5 Who are the key vendors in the Critical Illness Insurance market?

6 Which are the leading companies contributing to Critical Illness Insurance market valuation?

7 What was the market share held by each region in 2028?

8 What is the estimated growth rate and valuation of Critical Illness Insurance market in 2028?

Order a Copy of Critical Illness Insurance Market Share, Strategies and Forecasts to 2028 Research Report at:

https://www.theinsightpartners.com/buy/TIPRE00011932/?utm_source=OpenPR&utm_medium=10352

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market is Predicted to See Lucrative Gains Over 2022-2028 Covid-19 Analysis here

News-ID: 2572027 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…