Press release

Digital Payment Market Revenue to Surpass $ 243,426.71 Mn by 2028| Industry Analysis by The Insight Partners

According to The Insight Partners' latest market study on "Digital Payment Market Forecast to 2028 - COVID-19 Impact and Global Analysis - by Component, Deployment, Organization Size, and Industry," the market was valued at US$ 89,045.67 million in 2021 and is projected to reach US$ 243,426.71 million by 2028; it is expected to grow at a CAGR of 15.4% from 2021 to 2028.Open Banking APIs boost a bank's attractiveness and enable it to meet the changing expectations of existing clients and attract new ones. The APIs may also be used as a one-of-a-kind solution to boost customer interaction and respond to consumer requirements in a safe, agile, and future-proof way. Open Banking APIs are significant assets for financial services organizations because they allow them to expand service offerings, boost client interaction, and create new digital income channels, which would offer a significant opportunity for the digital payment market to expand during the forecast period.

Get Sample PDF Brochure at https://www.theinsightpartners.com/sample/TIPRE00007577?utm_source=OpenPR&utm_medium=10051

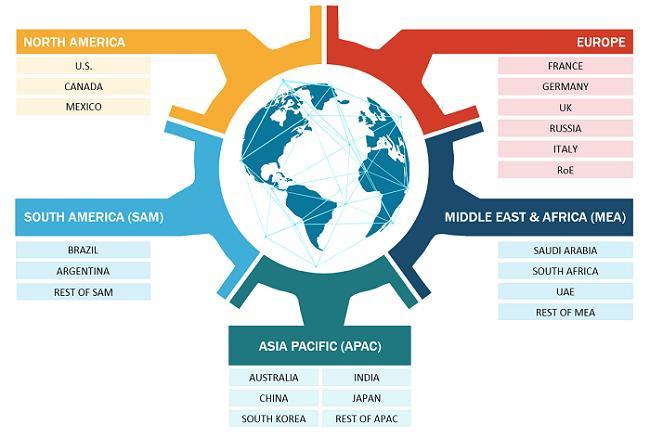

The overall digital payment market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. The process also serves the purpose of obtaining an overview and forecast for the digital payment market with respect to all the segments pertaining to the region. Also, multiple primary interviews have been conducted with industry participants and commentators to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the digital payment market.

Increasing Prevalence of Smartphones Enabling Expansion of mCommerce Boosts Demand for Digital Payment Market

The way people access the internet has a direct impact on the growth of mobile commerce. Users prefer smartphones over PCs for internet surfing as smartphones are more affordable, and high-speed internet is no longer a premium infrastructure in many countries. Retailers develop shopping applications that have easy-to-browse catalogs and a simple checkout experience. The fact that customers are intrinsically tied to their mobile phones is not missed by bankers and payment service providers. Banks provide banking apps that allow transactions to be completed on a mobile device's screen. Mobile commerce has also shifted the way brick-and-mortar businesses work, particularly in terms of accepting cashless payments. All these factors drive the growth of the digital payment market.

Speak to Analyst for more details: https://www.theinsightpartners.com/speak-to-analyst/TIPRE00007577?utm_source=OpenPR&utm_medium=10051

For instance, Apple Pay, Samsung Pay, and Google Pay are among the leading competitors in Europe, where they compete with the market leaders in their respective countries. In China, the rise of mobile payment has been inconsistent, with a few prominent payment services, such as AliPay, WeChat, and LinePAY, leading to the growth of the digital payment market.

The global digital payment market is expected to grow during the forecast period due to the increasing prevalence of smartphones enablingthe expansion of mCommerce. The way people access the internet has a direct impact on the growth of mobile commerce. Users prefer smartphones over PCs for internet surfing as smartphones are more affordable, and high-speed internet is no longer a premium infrastructure in many countries. Retailers develop shopping applications that have easy-to-browse catalogs and a simple checkout experience. The fact that customers are intrinsically tied to their mobile phones is not missed by bankers and payment service providers. Banks provide banking apps that allow transactions to be completed on a mobile device's screen. Mobile commerce has also shifted the way brick-and-mortar businesses work, particularly in terms of accepting cashless payments. Furthermore, difference between physical and digital commerce is dissolving, and channels are converging increasingly. The in-store purchase experience has shifted significantly closer to the online one due to the strong emphasis on contactless payments during the COVID-19 pandemic. Also, before the pandemic, contactless payments were already well-established in a few regions. Touchless payments and/or biometric identification are prevalent in the online purchase experience. The contactless card is the most prevalent kind of touch-free payment. Mobile payments, on the other hand, are gaining popularity due to easy use and the growing popularity of original equipment manufacturer (OEM) Pay solutions as a retail payment method. In a few countries, retailers and governments proactively request the customers to increase contactless payments and encourage retailers to make this possible. Many banks have increased their contactless payment limits to reduce the need for a touchpad or cash at the point of sale. All these factors drive the growth of the digital payment market.

Purchase a Copy of this Report @ https://www.theinsightpartners.com/buy/TIPRE00007577?utm_source=OpenPR&utm_medium=10051

The Insight Partners

533, 5th Floor,

Amanora Chambers, East Block, Amanora Township,

Kharadi Road, Hadapsar, Pune-411028

Email: sales@theinsightpartners.com

Phone : +1-646-491-9876

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market Revenue to Surpass $ 243,426.71 Mn by 2028| Industry Analysis by The Insight Partners here

News-ID: 2570464 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…