Press release

Global Insurance Third Party Administrator Market Study Analysis: The is created by TPA for insurance companies is presumed to uplift the market of Third Party Administrators.

The global Insurance Third Party Administrator market is expected to grow at a CAGR of more than 7%. Third-party administrators are separate entities that act as a mediator between the insurance company and policyholders. The main purpose of these administrators is to process and settle claims.To request a free sample, Go To: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=007011

Global Insurance Third Party Administrator Drivers:

The growing need for efficiency and productivity in the insurance business processes is the major driver for Third Party Administrator market. In addition to this, outsourcing the services of a TPA is less expensive compared to having an in-house claims department, this paves in more demand for Third Party Administrator.

Covid-19 Scenario:

● Impact on Market Size

● End-User Trend, Preferences, and Budget Impact

● Regulatory Framework/Government Policies

● Key Players Strategy to Tackle Negative Impact

● Opportunity Window

Global Insurance Third Party Administrator Market Segments:

The global Insurance Third Party Administrator market is further segmented into Service Type, End-User, Enterprise Size, and geography.

● By Service Type: Claims Management, Policy Management, Commission Management, and Others

● By End-User: Life & Health Insurance [Diseases Insurance and Medical Insurance] and Property & Casualty (P&C) Insurance

● By Enterprise Size: Large Enterprises and Small & Medium-sized Enterprises

Key Region/ Countries Covered

● North America (US, Canada, Mexico)

● Europe (Germany, U.K., France, Italy, Russia, Rest of Europe)

● Asia-Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

● Rest of the World (the Middle East & Africa and South America)

The North American region dominates the Insurance Third-Party Administrator market, owing to the fact that most of the key players are based in the region. Moreover, the increasing disposable income of the population in the region increases the demand for high premium insurances thus leading to further growth of the market in the region.

Key Players of Global Insurance Third Party Administrator Market:

● Charles Taylor

● CORVEL

● CRAWFORD & COMPANY

● ESIS

● ExlService Holdings, Inc.

● GALLAGHER BASSETT SERVICES, INC.

● Helmsman Management Services LLC

● Meritain Health

● SEDGWICK

● United HealthCare Services, Inc.

For Any Query or Customization, Ask Our Industry Experts@https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=007011

Key Questions Answered Through The Report:

● The Impact of COVID-19 on the global market

● What are the potential opportunities for new entrants in the global market

● What is the market Size and Forecast from 2020 to 2028?

● Key Players associated with the global Insurance Third Party Administrator Market

● Value Chain Analysis of Global Insurance Third Party Administrator Market

● What is the CAGR of the global Insurance Third Party Administrator Market from 2021 to 2028

● Major Growth Factor, Challenges, Trends, and Opportunities in the global market

● Key outcomes of SWOT Analysis

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Contact: +1 773 644 5507 / +91 635 396 3987

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is market research, business intelligence, and advising service that offers creative solutions to a company's problems. Our market research studies can find data beneficial to micro, small, medium, and large-scale businesses. We offer a wide range of services, from data collection to business consulting.

Evolve Business Intelligence is built on account of technology advancement and our in-house AI-modelled data analysis and forecast tool - EvolveBI - provides extremely accurate data. This application tracks real-time statistics from Fortune's Global 2000 firms, including quarterly performance, annual performance, and recent changes.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Third Party Administrator Market Study Analysis: The is created by TPA for insurance companies is presumed to uplift the market of Third Party Administrators. here

News-ID: 2553553 • Views: …

More Releases from Evolve Business Intelligence

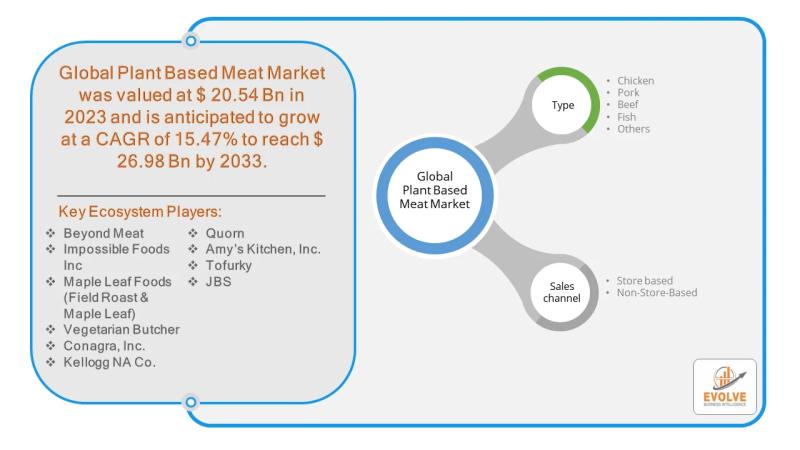

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

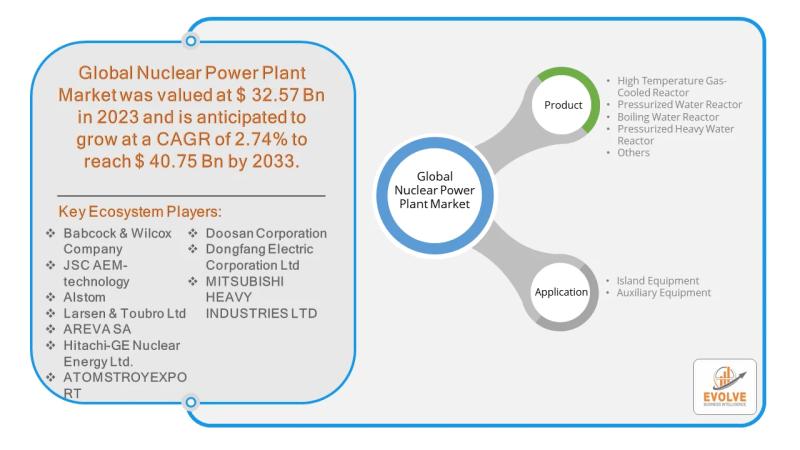

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

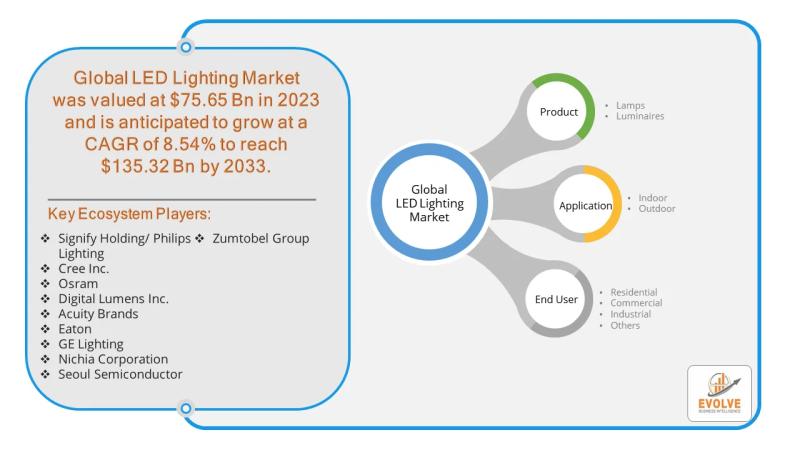

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…