Press release

Banking Encryption Software Market to Expand with Significant CAGR during 2031

Banking Encryption Software Market:• Banking encryption software is a data security platform that enables banks and financial institutions to securely exchange transaction document details with their customers while also protecting their data from cyber-attacks. Banking encryption software services provide a number of advantages, including easy data transactions and high security. Furthermore, banks benefit from encryption software in a variety of ways, including real-time notifications on fraudulent actions, improved database efficiency, and increased security of user financial information. Banking encryption software encrypts and decrypts confidential information for bank customers as required, and as a result, most fintech organizations and banks are using this software across their premises. Furthermore, to protect client information such as customer emails, banker notes, call center transcripts, and survey responses, the financial & banking industry employs encryption technology, which aids in the improvement of business operations.

• The COVID-19 pandemic has positively impacted the banking encryption software market. Since the outbreak of the pandemic, businesses have been increasing their investment in encryption software due to a variety of factors, including increased use of digital financial services and adoption of online payment services. Furthermore, banking encryption software is likely to have a lucrative growth rate during the forecast period due to numerous norms imposed as a result of the pandemic, such as social distancing, digital transformation of the payment industry, and work from home. This, in turn, is anticipated to create significant opportunities for the banking encryption software market during the forecast period.

Read More @ https://www.transparencymarketresearch.com/banking-encryption-software-market.html

Global Banking Encryption Software Market: Dynamics

Global Banking Encryption Software Market: Key Drivers

• Increasing use of digital payment technologies such as credit cards, debit cards, and mobile banking by customers is propelling the banking encryption software market. Banking encryption software offers several advantages, including a reduction in fraudulent activities in various banking processes, increased payment security, and enhanced payment transaction services due to the integration of encryption software in electronic payment methods. Financial institutions and banks have been in charge of a large amount of their customers’ personal and financial data. As a result, fintech companies and banks are implementing banking encryption software to improve the security of various critical documents and to protect large volumes of customer financial records. Furthermore, many businesses are implementing this software to generate more insights and better data management, which is expected to boost the banking encryption software market.

North America to Account for Major Share of Global Banking Encryption Software Market

• In terms of region, the global banking encryption software market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

• North America dominated the global banking encryption software market and is expected to maintain the leading position over the forecast period. This growth is attributed to an increase in government backing for data security technologies and an increase in demand for encryption software by public and private banks to safeguard and secure data privacy. In addition, one of the primary factors driving demand for banking encryption software in the region is the increasing number of cyber-attacks and risks to information affecting businesses.

Get PDF brochure for Industrial Insights and business Intelligence @ https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=84153

Global Banking Encryption Software Market: Competitive Landscape

Key Players Operating in the Global Banking Encryption Software Market

Providers of banking encryption software are implementing development strategies to enhance their presence and consolidate their share in the market. Banking encryption software providers have adopted major growth strategies such as product acquisitions, partnerships and launches, and forming regional and global distribution networks in order to expand their presence in the market.

Key players operating in the global banking encryption software market include:

• IBM Corporation

• Intel Corporation

• Microsoft Corporation

• McAfee, LLC

• Sophos Group Plc

• Thales Group

• Trend Micro Inc.

• WinMagic, Inc.

• Broadcom, Inc.

• Eset, Spol, S.r.o

Request for Discount – https://www.transparencymarketresearch.com/sample/sample.php?flag=D&rep_id=84153

Global Banking Encryption Software Market: Research Scope

Global Banking Encryption Software Market, by Component

• Software

• Service

Global Banking Encryption Software Market, by Deployment

• On-premise

• Cloud-based

Global Banking Encryption Software Market, by Enterprise Size

• Small and Medium Enterprises

• Large Enterprises

Global Banking Encryption Software Market, by Function

• Disk Encryption

• Communication Encryption

• File/Folder Encryption

• Cloud Encryption

• Others

Purchase our Premium Research Report at: https://www.transparencymarketresearch.com/checkout.php?rep_id=84153<ype=S

TMR Latest News Publication: https://www.prnewswire.co.uk/news-releases/barcode-readers-market-to-gain-largely-from-healthcare-industry-north-america-to-record-promising-growth-between-2020-and-2030-tmr-861501793.html

About Us

Transparency Market Research is a global market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants, use proprietary data sources and various tools and techniques to gather, and analyse information. Now avail flexible Research Subscriptions, and access Research multi-format through downloadable databooks, infographics, charts, interactive playbook for data visualization and full reports through MarketNgage, the unified market intelligence engine. Sign Up for a 7 day free trial!

Contact

Rohit Bhisey

Transparency Market Research

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Blog: https://tmrblog.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking Encryption Software Market to Expand with Significant CAGR during 2031 here

News-ID: 2552573 • Views: …

More Releases from Transparency Market Research

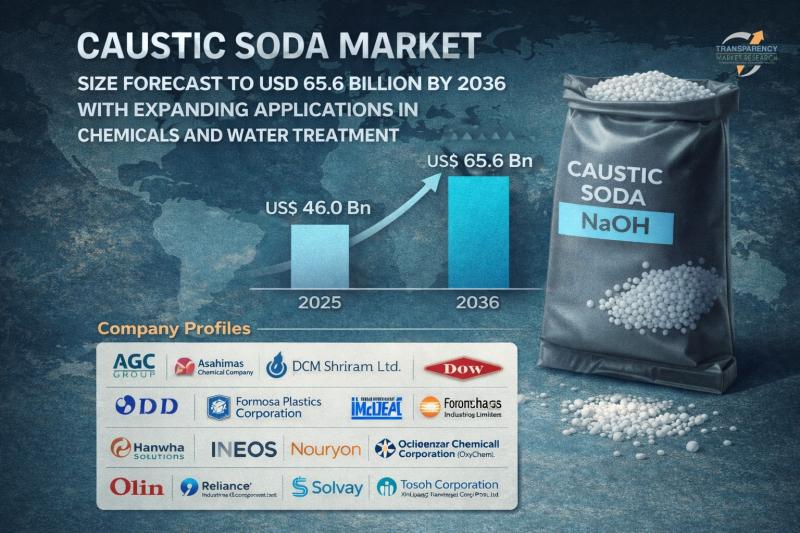

Caustic Soda Market Size Forecast to USD 65.6 Billion by 2036 with Expanding App …

Caustic Soda Market Outlook 2036

The global caustic soda market was valued at US$ 46.0 Billion in 2025 and is projected to reach US$ 65.6 Billion by 2036, expanding at a steady CAGR of 3.2% from 2026 to 2036. Market growth is driven by increasing demand from the pulp & paper industry, rising alumina production, expanding chemical manufacturing activities, and growing applications in water treatment and textiles.

👉 Get your sample market…

Global Baby Diaper Market Outlook 2036: Industry to Reach US$ 75.1 Billion by 20 …

The global baby diaper market was valued at US$ 44.5 Bn in 2025 and is projected to reach US$ 75.1 Bn by 2036, expanding at a steady CAGR of 4.9% from 2026 to 2036. This consistent upward trajectory reflects the essential nature of diapers in infant hygiene and the growing consumer preference for high-performance and convenient baby care products.

In 2025, North America accounted for 42.1% of the global revenue share,…

Rare Earth Metals Market to be Worth USD 30.9 Bn by 2036 - By Metal Type / By Ap …

The rare earth metals market has evolved from a niche industrial segment into a strategically critical global industry. In 2025, the market stood at US$ 14.1 Billion, driven primarily by increasing deployment of electric vehicles (EVs), renewable energy systems, defense electronics, and advanced industrial machinery.

Review critical insights and findings from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=823

By 2036, the market is expected to nearly double to US$ 30.9 Billion, supported by…

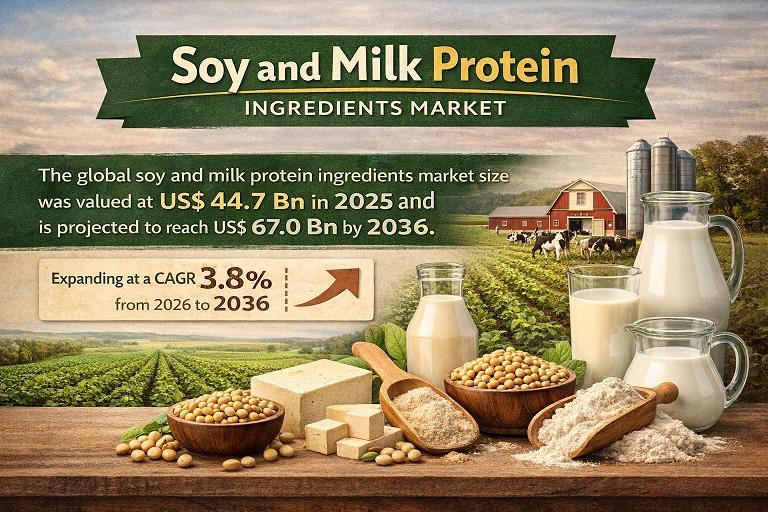

Soy and Milk Protein Ingredients Market to Reach USD 67.0 Billion by 2036 Amid R …

The global Soy and Milk Protein Ingredients Market is witnessing significant momentum as consumers increasingly prioritize high-protein diets, functional nutrition, and clean-label ingredients. With the surge in plant-based alternatives, sports nutrition products, and fortified food offerings, soy and milk protein ingredients have become critical components across multiple industries including food & beverages, pharmaceuticals, animal nutrition, and personal care.

The global Soy and Milk Protein Ingredients Market is projected to reach US$…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…