Press release

Usage-Based Insurance Market Analysis, Trends, Growth and Forecast to 2026

The Usage-Based Insurance Market is projected to reach USD 66.8 billion by 2026 from an estimated USD 19.6 billion in 2021, growing at a CAGR of 27.7% during the forecast period. The increasing adoption of telematics and connected car services is expected to drive the usage-based insurance market. The rolling out of various UBI packages in countries such as India, South Africa is expected to further drive its popularity.UBI providers can work directly with OEMs to capitalize on the increasing trend of connected cars in developed as well as developing regions. UBI service providers can also provide customized plans for embedded systems that can give incentives to connected car owners to choose UBI policies.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=154621760

Manage-how-you-drive or MHYD is estimated to be the fastest-growing usage-based insurance market. MHYD is an extended version of PHYD, which provides feedback to drivers on improvement areas besides just ranking them on driving behavior. This model is ideal for young drivers aged between 18 and 25 as they are new drivers. The MHYD system collects various driving behavior information such as harsh braking, sharp cornering, and overspeeding to rate the driver. The system also suggests improvements to the driver to help improve the driver's behavior and reduce insurance premiums for the driver. UBI companies can work together with telematics device manufactures, insurance companies, and OEMs to develop MHYD plans that suit the requirements of different customers.

Smartphone is projected to be the fastest-growing segment of the usage-based insurance market, by technology. Using a smartphone for UBI services offers multiple advantages such as flexibility, accurate driver drive behavior information, etc. Smartphones are now equipped with an array of sensors that can collect data for telematics analysis. A smartphone is a cost-effective option for UBI services as the user is not required to purchase an external hardware device, and no vehicle installation is required. Hence, the system can be implemented quickly without any additional hardware requirements. Thus, smartphone technology is expected to witness a strong boost.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=154621760

According to MarketsandMarkets, Asia Pacific is estimated to be the fastest-growing market for usage-based insurance during the forecast period. Market growth in this region can be attributed to the increasing adoption of telematics and the rising trend of car-sharing and ride-hailing in developing countries such as India, Malaysia, Australia, and Japan. Japan dominates the market in 2020 and is anticipated to continue its dominance during the forecast period owing to significant developments in connected and autonomous vehicles and increasing adoption of telematics services.

Thus, the growing adoption of telematics in LDVs and HDVs, growing awareness about UBI packages is expected to be the major reasons for UBI growth. COVID-19 gave a boost to the adoption of UBI in several countries. The growing popularity of mobile telematics, OBD-II is also expected to propel the market.

Key Market Players:

The usage-based insurance market is dominated by globally established players such as UnipolSai Assicurazioni S.p.A (Italy), Progressive Casualty Insurance Company (US), Allstate Insurance Company (US), State Farm Automobile Mutual Insurance Company (US), and Liberty Mutual Insurance Company (US).

View Detail TOC @ https://www.marketsandmarkets.com/Market-Reports/usage-based-insurance-market-154621760.html

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: newsletter@marketsandmarkets.com

Phone: 18886006441

Address: 630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

One stop solution for all Market Research & Consulting needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-Based Insurance Market Analysis, Trends, Growth and Forecast to 2026 here

News-ID: 2546945 • Views: …

More Releases from MarketsandMarkets™ INC.

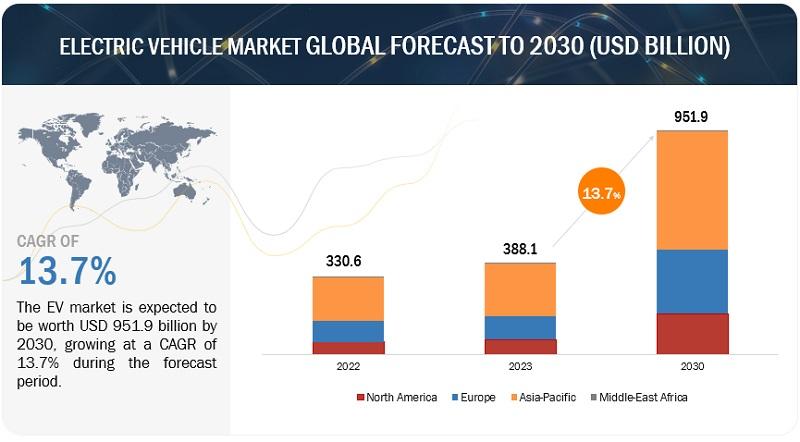

Electric Vehicle Market Size, Share, Trends & Analysis by 2030

The global EV market is projected to grow from USD 388.1 billion in 2023 to USD 951.9 billion by 2030, registering a CAGR of 13.7%. The electric vehicle (EV) market is currently experiencing a transformative phase of rapid growth and innovation. With increasing global concern over climate change and air pollution, coupled with advancements in technology and supportive government policies, the adoption of EVs has gained tremendous momentum. Consumers are…

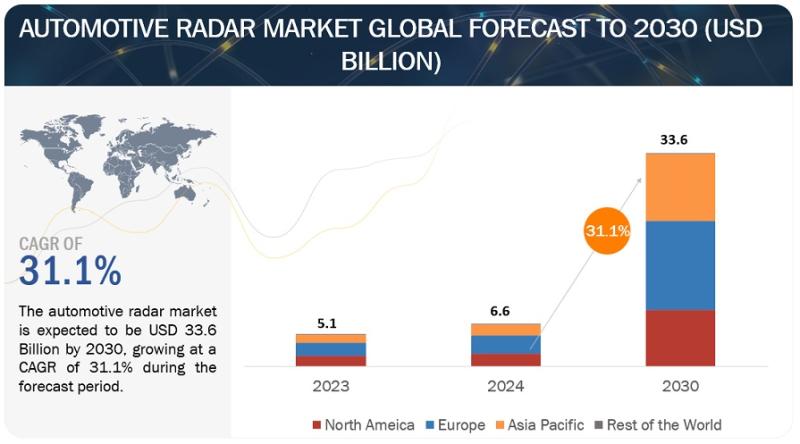

Automotive Radar Market Valued at $33.6 billion by 2030

The global automotive radar market is projected to grow from USD 6.6 billion in 2024 to USD 33.6 billion by 2030, registering a CAGR of 31.1%.

The automotive radar market is flourishing due to a confluence of factors. The primary driver is the surging demand for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. These technologies heavily rely on radar for object detection and measurement, making it an essential component. Furthermore, stricter…

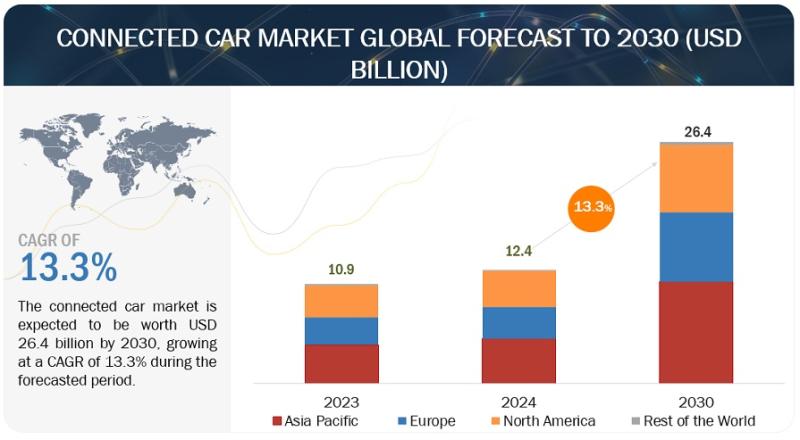

Connected Car Market Poised to Reach $26.4 billion by 2030

The globally connected car market is estimated to grow from USD 12.4 billion in 2024 to USD 26.4 billion by 2030, at a CAGR of 13.3%.

Government initiatives towards developing intelligent transportation networks and the growing trend of in-vehicle connectivity solutions are two factors influencing the growth of the worldwide connected car market. Also, the consumer demand for a safer, more convenient, and entertaining driving experience is a significant driver. This…

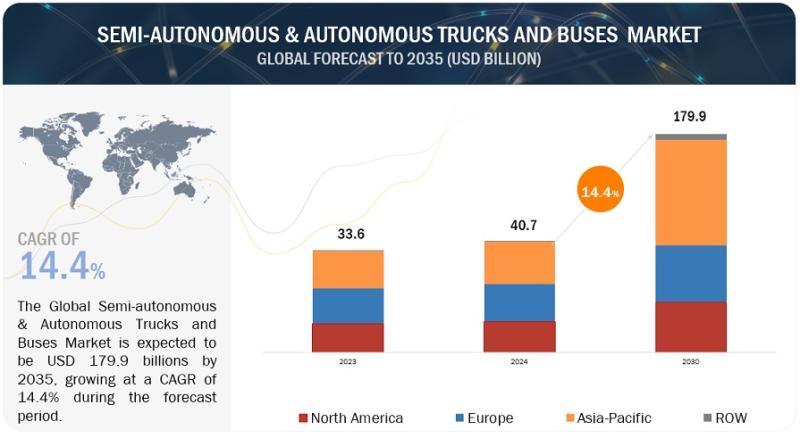

Semi-Autonomous & Autonomous Trucks and Buses Market worth $179.9 billion by 203 …

The Semi-autonomous & autonomous Trucks and Buses market size is projected to grow from USD 40.7 Billion in 2024 to USD 179.9 Billion by 2035, at a CAGR of 14.4%. The increasing demand for electric and autonomous vehicle and government regulation regarding safety is expected to increase the demand for Semi-autonomous & autonomous Trucks and Buses. Additionally, continuos innovation in advance driving technologies and components will boost the demand…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…