Press release

Insurance for HNWIs Market To Witness Spectacular Growth By 2026 | AIG, M Financial, Lloyd's

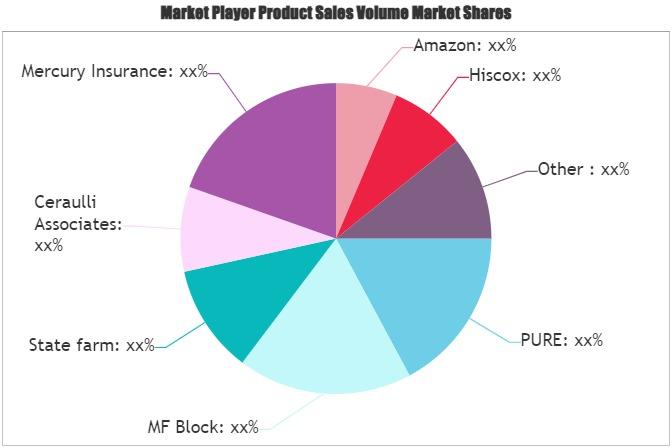

The latest report released on Global Insurance for HNWIs Market analyses areas where there is still room for improvement. Irrespective of industry, organization size or geographic location, the Insurance for HNWIs Market study suggests that advanced technologies are playing a bigger role than ever before. The assessment provides trend, growth factors and estimates for Global Insurance for HNWIs Market forecasted till 2026. Some of the key players profiled are PURE, MF Block, State farm, Ceraulli Associates, Mercury Insurance, Amazon, Hiscox, Axa, IronShore, Prudential, Google Compare, ACE Private Risk Services, Sun Life, SwissLife, GSRP, New York Life, Walmart, Morgan Stanley, Limra, Aspen Specialty, Chubb Group of Insurance Cos., AIG, M Financial Group, Lloyd's, Zurich Private Clients, Prudential, Aon, Life Insurance Corporation of India, MetLife, XL Catlin, SulAmerica, Berkley, Reinsurance Group of America, Inc., Richard Thompson Insurance Brokers & Wink Inc. etc.Keep yourself up-to-date with latest Global Insurance for HNWIs market trends to maintain a competitive edge by sizing up with open business opportunity in Insurance for HNWIs Market segments and emerging territory.

Get Access to Insurance for HNWIs Market Sample Pages https://www.htfmarketreport.com/sample-report/3280113-global-insurance-for-hnwis-market-1

The Insurance for HNWIs Market research compliments and examines the disrupting forces and its role, structure in competitive environment for financial institutions and the markets. The Insurance for HNWIs transformation on consumers engagement with financial services is mirrored from the supply side. To provide further guidance on how these trends are factored into the market trajectory; the Insurance for HNWIs scope provides market size & estimates as

Product Type: , Life Insurance & Non-life Insurance

Major End-use Applications: Ultra HNWIs, Mid-Tier Millionaires & Millionaires Next Door

Regional Breakdown Covers Market Size by following Country in Global Outlook:

North America (USA, Canada and Mexico)

Europe (Germany, France, the United Kingdom, Netherlands, Russia, Italy, Spain and Rest of Europe)

Asia-Pacific (China, Japan, Australia, New Zealand, South Korea, India, Southeast Asia and Others)

South America (Brazil, Argentina, Colombia, Others)

MEA (Saudi Arabia, United Arab Emirates (UAE), Israel, Egypt, Nigeria, South Africa & Rest of MEA)

Have any Query or Customizations; Make an Enquiry Now @ https://www.htfmarketreport.com/enquiry-before-buy/3280113-global-insurance-for-hnwis-market-1

New entrant in Insurance for HNWIs are mainly focusing on the online-only model to reach millennials and increasingly other sub-segments like , Life Insurance & Non-life Insurance or technology. Meanwhile, traditional players are also employing same approach to reduce their operational costs significantly. Many players from profiled list PURE, MF Block, State farm, Ceraulli Associates, Mercury Insurance, Amazon, Hiscox, Axa, IronShore, Prudential, Google Compare, ACE Private Risk Services, Sun Life, SwissLife, GSRP, New York Life, Walmart, Morgan Stanley, Limra, Aspen Specialty, Chubb Group of Insurance Cos., AIG, M Financial Group, Lloyd's, Zurich Private Clients, Prudential, Aon, Life Insurance Corporation of India, MetLife, XL Catlin, SulAmerica, Berkley, Reinsurance Group of America, Inc., Richard Thompson Insurance Brokers & Wink Inc. are designing and targeting services that focus on the value chain of Insurance for HNWIs, or a particular subset of customers as consumers are getting more smarter about their options.

Furthermore, the years considered in the Insurance for HNWIs Market study are as follows:

Historical year – 2016-2020

Base year – 2020

Forecast period** – 2021 to 2026 [** unless otherwise stated]

What to expect from Global Insurance for HNWIs Market report:

- Focused Study on "Niche" Strategy, R&D, patent Analysis

- Insights on technology trends

- Implications for customer segments

- Analysis of M&As, Joint Ventures & Technological Tie-ups in Insurance for HNWIs Market

- Top 10 Insurance for HNWIs Companies Market Share (2019-2021E) by Region (APAC, Europe, North America, LATAM, MEA)

- Identify growth in emerging economies and business strategies to overcome Insurance for HNWIs Market Competition

and many more ..........

Get full access to Global Insurance for HNWIs Market Report; Buy Latest Edition Now @: https://www.htfmarketreport.com/buy-now?format=1&report=3280113

Thanks for reading Insurance for HNWIs Industry research publication; All of the findings, data, and information provided in the report are validated and revalidated with the help of trustworthy sources. The analysts who have authored the report took a unique and industry-best research and analysis approach for an in-depth study of the Global Insurance for HNWIs market.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance for HNWIs Market To Witness Spectacular Growth By 2026 | AIG, M Financial, Lloyd's here

News-ID: 2545567 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Generative Robotics Market Hits New High | Major Giants Sanctuary AI, Figure AI, …

HTF MI recently introduced Global Generative Robotics Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market size (2025-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

Major Companies in Generative Robotics Market are: Boston Dynamics, NVIDIA, ABB, Fanuc, KUKA, Yaskawa, Siemens, Universal Robots, OpenAI, Google DeepMind, Tesla, Sanctuary…

Holistic Skincare Market Hits New High | Major Giants Shiseido, Beiersdorf, Amor …

HTF MI recently introduced Global Holistic Skincare Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market size (2025-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

Major Companies in Holistic Skincare Market are: L'Oréal, Estée Lauder, Unilever, Procter & Gamble, Shiseido, Beiersdorf, Amorepacific, Natura &Co, The Body Shop,…

Pet Taxidermy Service Market to See Drastic Growth - Post 2025 | Forever Pets, E …

The latest study released on the Global Pet Taxidermy Service Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Pet Taxidermy Service market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the…

Recreation Clubs Market Growth Prospects Are Still Attractive | Northwood Club, …

The latest study released on the Global Recreation Clubs Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Recreation Clubs market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…