Press release

Digital Mortgage Software Market Next Big Thing | Major Giants- Roostify, Ellie Mae, RapidValue, WebMax

Latest Study on Industrial Growth of Digital Mortgage Software Market 2021-2027. A detailed study accumulated to offer Latest insights about acute features of the Digital Mortgage Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of the market. It also examines the role of the leading market players involved in the industry including their corporate overview, financial summary and SWOT analysis.The Major Players Covered in this Report: Roostify, Ellie Mae, Blend, Streamloan, Maxwell, SimpleNexus, Salesforce, Cloudvirga, Blue Sage Solutions, RapidValue, WebMax, Preclose, Kofax, RealKey & Newgen Software

Digital Mortgage Software Market Study guarantees you to remain / stay advised higher than your competition. With Structured tables and figures examining the Digital Mortgage Software, the research document provides you a leading product, submarkets, revenue size and forecast to 2027. Comparatively is also classifies emerging as well as leaders in the industry. Click To get SAMPLE PDF of Digital Mortgage Software Market (Including Full TOC, Table & Figures) @ https://www.htfmarketreport.com/sample-report/3821169-digital-mortgage-software-market-1

This study also covers company profiling, specifications and product picture, sales, market share and contact information of various regional, international and local vendors of Digital Mortgage Software Market. The market proposition is frequently developing ahead with the rise in scientific innovation and M&A activities in the industry. Additionally, many local and regional vendors are offering specific application products for varied end-users. The new merchant applicants in the market are finding it hard to compete with the international vendors based on reliability, quality and modernism in technology.

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/3821169-digital-mortgage-software-market-1

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Digital Mortgage Software market segments by Types: Cloud-Based & On-Premises

Detailed analysis of Digital Mortgage Software market segments by Applications: Retail Lending, Residential Mortgage, Trade Finance & Others

Major Key Players of the Market: Roostify, Ellie Mae, Blend, Streamloan, Maxwell, SimpleNexus, Salesforce, Cloudvirga, Blue Sage Solutions, RapidValue, WebMax, Preclose, Kofax, RealKey & Newgen Software

Regional Analysis for Digital Mortgage Software Market:

• APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)

Furthermore, the years considered for the study are as follows:

Historical year – 2015-2020

Base year – 2020

Forecast period** – 2021 to 2027 [** unless otherwise stated]

**Moreover, it will also include the opportunities available in micro markets for stakeholders to invest, detailed analysis of competitive landscape and product services of key players.

Buy Latest Edition of Market Study Now @ https://www.htfmarketreport.com/buy-now?format=1&report=3821169

Key takeaways from the Digital Mortgage Software market report:

– Detailed considerate of Digital Mortgage Software market-particular drivers, Trends, constraints, Restraints, Opportunities and major micro markets.

– Comprehensive valuation of all prospects and threat in the

– In depth study of industry strategies for growth of the Digital Mortgage Software market-leading players.

– Digital Mortgage Software market latest innovations and major procedures.

– Favorable dip inside Vigorous high-tech and market latest trends remarkable the Market.

– Conclusive study about the growth conspiracy of Digital Mortgage Software market for forthcoming years.

What to Expect from this Report On Digital Mortgage Software Market:

1. A comprehensive summary of several area distributions and the summary types of popular products in the Digital Mortgage Software Market.

2. You can fix up the growing databases for your industry when you have info on the cost of the production, cost of the products, and cost of the production for the next future years.

3. Thorough Evaluation the break-in for new companies who want to enter the Digital Mortgage Software Market.

4. Exactly how do the most important companies and mid-level companies make income within the Market?

5. Complete research on the overall development within the Digital Mortgage Software Market that helps you elect the product launch and overhaul growths.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/3821169-digital-mortgage-software-market-1

Detailed TOC of Digital Mortgage Software Market Research Report-

– Digital Mortgage Software Introduction and Market Overview

– Digital Mortgage Software Market, by Application [Retail Lending, Residential Mortgage, Trade Finance & Others]

– Digital Mortgage Software Industry Chain Analysis

– Digital Mortgage Software Market, by Type [Cloud-Based & On-Premises]

– Industry Manufacture, Consumption, Export, Import by Regions (2015-2020)

– Industry Value ($) by Region (2015-2020)

– Digital Mortgage Software Market Status and SWOT Analysis by Regions

– Major Region of Digital Mortgage Software Market

i) Digital Mortgage Software Sales

ii) Digital Mortgage Software Revenue & market share

– Major Companies List

– Conclusion

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, MINT, BRICS, G7, Western / Eastern Europe or Southeast Asia. Also, we can serve you with customize research services as HTF MI holds a database repository that includes public organizations and Millions of Privately held companies with expertise across various Industry domains.

Contact US:

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Mortgage Software Market Next Big Thing | Major Giants- Roostify, Ellie Mae, RapidValue, WebMax here

News-ID: 2535477 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Fashion Backpack Market Future Growth & Size Projection

The latest study released on the Global Fashion Backpack Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fashion Backpack study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Ecommerce Platform Market - Global Growth Opportunities 2020-2033

The latest study released on the Global Ecommerce Platform Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Ecommerce Platform study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

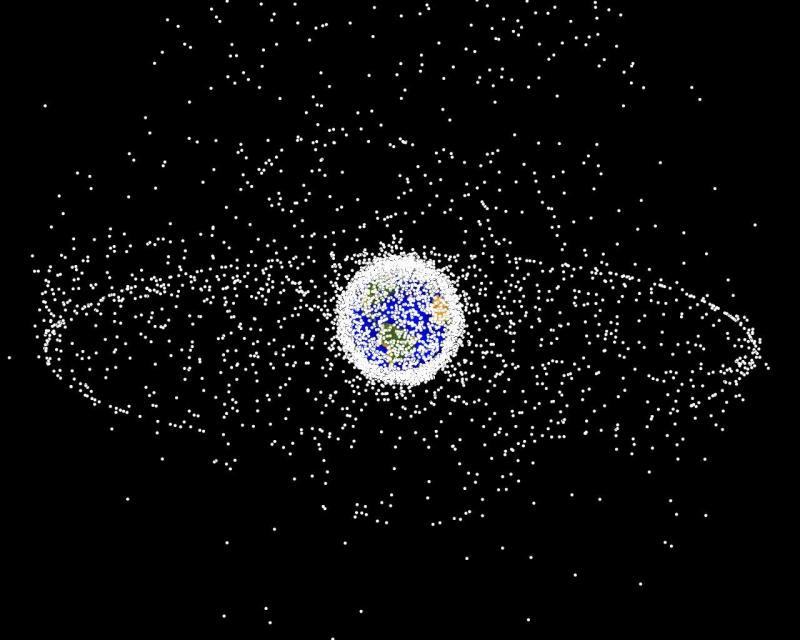

Space Debris Solutions Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Space Debris Solutions Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Space Debris Solutions study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Baby Buggy Market to Witness Unprecedented Growth by 2033

The latest analysis of the worldwide Baby Buggy market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Baby Buggy market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report Include:

Graco, Chicco, Britax, UPPAbaby,…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…