Press release

Fraudulent Fund Recovery Schemes Attack Online Trading Victims

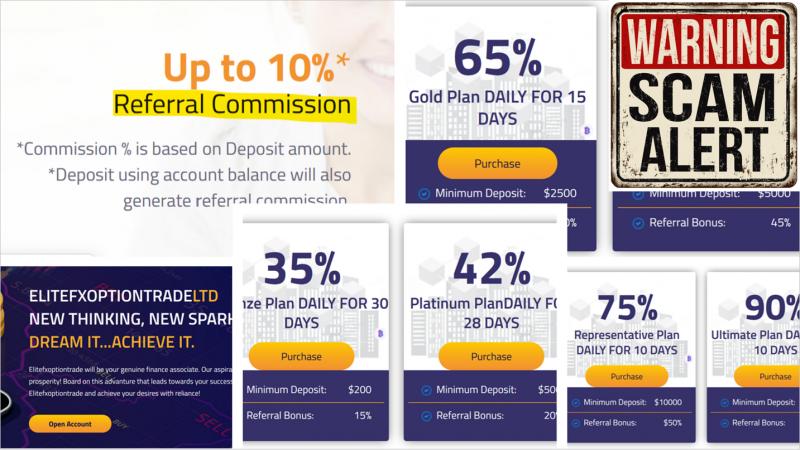

CyberFinance - It is a well-known fact that the permanent threat of online fraud schemes also characterizes the CyberFinance era. Especially in the online trading space, a vast fraud industry has developed over the last decade, operating mainly in the now-banned binary options, forex, CFD, and cryptocurrencies. Based on our information, we assume that more than 95% of the active online trading platforms are either operating illegally without regulatory permission and/or are straight fraud schemes in the first place.Hundreds of thousands of victims worldwide lose hundreds of millions of dollars every year to these illegal online brokers searching for quick and easy profit, which is promised to them online and via phone calls by the boiler room agents. At the end of the day, the clients of these illegal brokers always lose their money and turn into devastated victims.

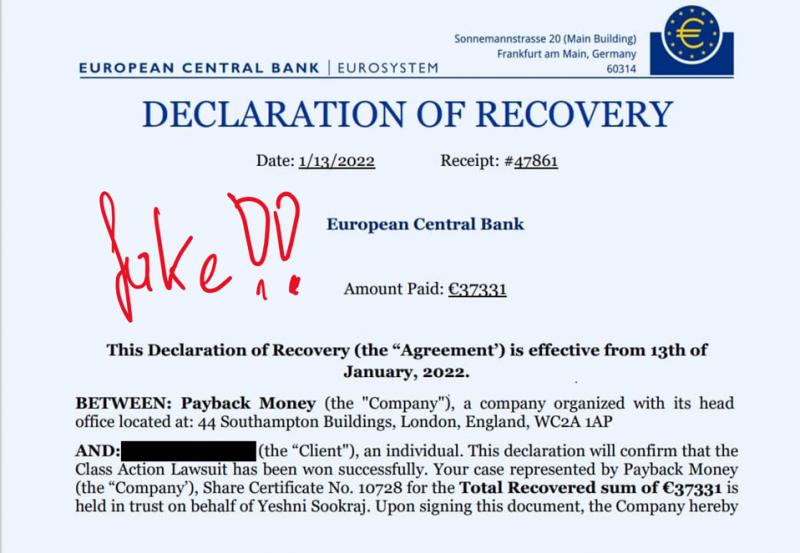

The desperate victims seek help from the numerous fund recovery providers that advertise massively on Google. Most of these providers are also fraud schemes. They promise the victims the quick recovery of their lost funds. Sometimes these fund recovery schemes work with fake certificates that are supposed to be issued by financial market supervisory authorities or banks. These fund recovery operators are impostors who pose as employees or partners of regulators and banks.

These fund recovery schemes fool victims into believing they are entitled to funds using these fake certificates. However, they argue, the victims would have to deposit money again to cover the costs of withdrawal or taxes. Only after depositing the funds could be paid out to them. The reality is that no money is ever paid out.

Stay far away from fraudulent fund recovery schemes. Please read more about the fraudulent activities of fund recovery providers on www.fintelegram.com.

132-134 Great Ancoats Street

Advantage Business Center

Manchester, M4 6DE

Ben Givon

reporter@fintelegram.com

Active since 2018, FinTelegram (www.fintelegram.com) is a cyber financial intelligence and whistleblower platform with the mission of protecting and educating investors. FinTelegram regularly produces reports on financial service providers and issues warnings about schemes and fraudulent activities.

For more information on fund recovery schemes, please visit www.fintelegram.com.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraudulent Fund Recovery Schemes Attack Online Trading Victims here

News-ID: 2527169 • Views: …

More Releases from FinTelegram News

Payvision Founder Rudolf Booker Attacks Investors Protection Organisation EFRI

Victims of binary options and forex broker schemes started to bring legal claims against ING subsidiary Payvision before the courts in different jurisdictions. They made their now lost deposits via the Dutch fintech, founded by Rudolf Booker. The victims, members of the European Fund Recovery Initiative (EFRI), claim that Payvision knowingly and intentionally facilitated these fraudulent broker schemes.

However, instead of dealing with these claims, Payvision and its founder and former…

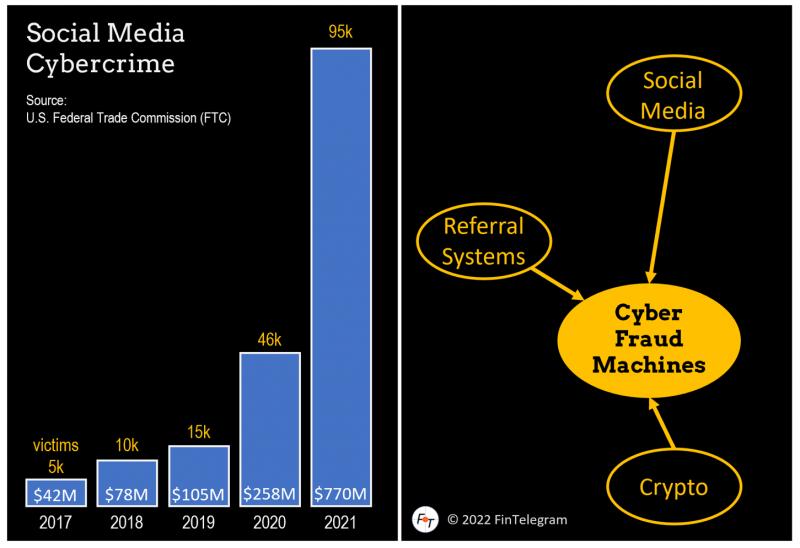

Financial Cybercrime facilitated by Cryptocurrencies and Social Media Gold Mine …

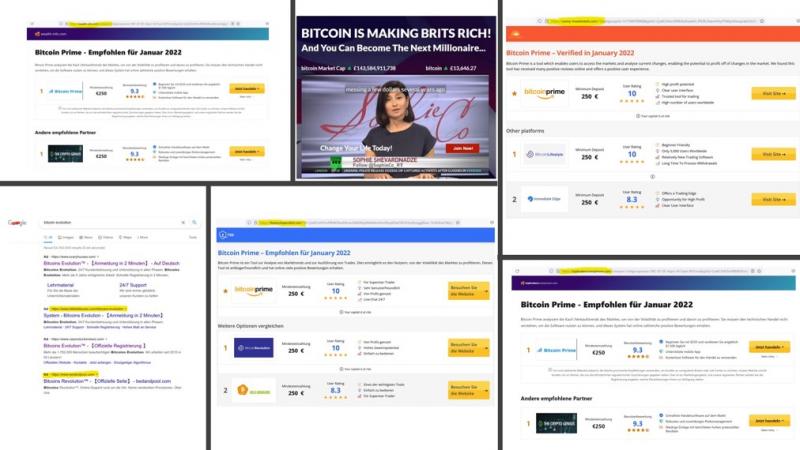

FinTelegram has warned many times against fraud marketing campaigns chasing victims for their investment schemes on Google and social media platforms. Our research findings show that online attackers find victims for their investment schemes primarily through fraudulent crypto campaigns on Google and social media platforms. Cybercrime organizations combine the power of social media with the new capabilities of cryptocurrencies to build super-efficient cyber fraud machines.

Fraudulent crypto campaigns such as Bitcoin…

FinTelegram Exposed Vast Crypto Investment Scheme Attacking European Consumers

CyberFinance - Financial market regulators, most notably the UK FCA as well as the Spanish CNMV, have placed a strategic focus on the crypto segment in recent months. In the first weeks of 2022, dozens of warnings have already been issued against crypto trading and crypto investment schemes attacking European consumers. It is no exaggeration to say that we are in the middle of a global crypto fraud tsunami.

In its…

FinTelegram Warns Against Fake Crypto Review Platforms Chasing Consumers for Bro …

As a cyber financial intelligence and whistleblower platform, FinTelegram targets online fraud schemes and their facilitator. Digital marketing agencies are among essential fraud-facilitators. Scheme operators task them with chasing after victims deploying fraudulent marketing campaigns on Google and social media. Over the last couple of months, the number of warnings from financial market regulators such as the UK FCA or the Spanish CNMV against illegal crypto platforms has literally been…

More Releases for Fund

Broad-Based Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong F …

The Broad-Based Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Broad-Based Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E Fund, …

The Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Exchange-Traded Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fun …

The Exchange-Traded Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Exchange-Traded Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Equity Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Equity Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Equity Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Bond Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E …

The Bond Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Bond Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Money Market Funds Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Money Market Funds research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Money Market Funds market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…