Press release

Commercial Truck Insurance Market Size & Share to grow at a CAGR of 6.8% from 2022-2028 | Valuates Reports

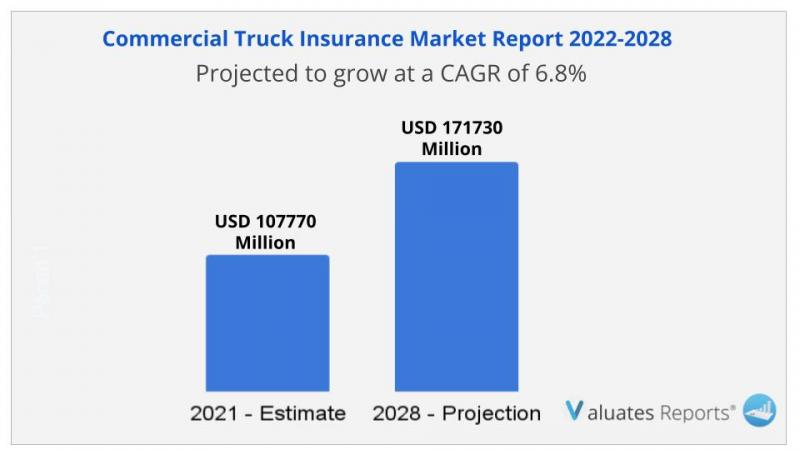

The global Commercial Truck Insurance market size is projected to reach US$ 171730 million by 2028, from US$ 107770 million in 2021, at a Compound Annual Growth Rate (CAGR) of 6.8% during 2022-2028.Commercial truck insurance provides coverage for vehicles used by businesses. These could be vehicles purchased for sole use of the business itself, or personal vehicles used for business purposes. Commercial truck insurance operates similarly to personal auto insurance, covering collision, property damage, medical payments, and other costs that could result either from driving mistakes or damages caused by sources outside one’s control. Personal insurance however, cannot usually be used for vehicles that are driven for business purposes. This is where commercial insurance steps in, since it can cover vehicles that regular auto insurance would not.

Get Detailed Analysis of COVID-19 Impact on Commercial Truck Insurance Market @ https://reports.valuates.com/request/sample/QYRE-Auto-21S9118/Global_Commercial_Truck_Insurance_Market

The Commercial Truck Insurance Liability Insurance and Physical Damage Insurance and Other. As of 2018, Physical Damage Insurance segment dominates the market contributing more than 66% of the total market share, reach to 30137 million dollars. The commercial truck Insurance market is fragment market; key players include PICC, Progressive Corporation, Ping An Insurance, AXA, Sompo Japan, Tokyo Marine, Travelers Group, Liberty Mutual Group, Zurich, CPIC, Nationwide, Mitsui Sumitomo Insurance, Aviva, Berkshire Hathaway, Old Republic International, Auto Owners Grp., Assicurazioni Generali, MAPFRE, Chubb, AmTrust NGH the premium of top ten manufacturers accounts about 20.76% of the total premium.

With industry-standard accuracy in analysis and high data integrity, the report makes a brilliant attempt to unveil key opportunities available in the global Commercial Truck Insurance market to help players in achieving a strong market position. Buyers of the report can access verified and reliable market forecasts, including those for the overall size of the global Commercial Truck Insurance market in terms of revenue.

Overall, the report proves to be an effective tool that players can use to gain a competitive edge over their competitors and ensure lasting success in the global Commercial Truck Insurance market. All of the findings, data, and information provided in the report are validated and revalidated with the help of trustworthy sources. The analysts who have authored the report took a unique and industry-best research and analysis approach for an in-depth study of the global Commercial Truck Insurance market.

View Full Report : https://reports.valuates.com/market-reports/QYRE-Auto-21S9118/global-commercial-truck-insurance

Commercial Truck Insurance market is segmented by players, region (country), by Type and by Application. Players, stakeholders, and other participants in the global Commercial Truck Insurance market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by Type and by Application for the period 2017-2028.

Segment by Type

➣Compulsory Insurance

➣Optional Insurance

Segment by Application

➣Semi-trailer Truck

➣Dump Truck

➣Tank Truck

➣Car Haulers

➣Others

BY COMPANY

➣PICC

➣Progressive Corporation

➣Ping An

➣Travelers Group

➣AXA

➣Sompo Japan

➣Liberty Mutual Group

➣Tokyo Marine

➣CPIC

➣Zurich

➣Old Republic International

➣Nationwide

➣Aviva

➣Mitsui Sumitomo Insurance

➣Assicurazioni Generali

➣Berkshire Hathaway

➣Auto Owners Grp

➣Chubb

➣AmTrust NGH

➣MAPFRE

by Regional and Country-level Analysis

➣North America

➣United States

➣Canada

➣Asia-Pacific

➣China

➣Japan

➣South Korea

➣India

➣Southeast Asia

➣Australia

➣Rest of Asia-Pacific

➣Europe

➣Germany

➣France

➣U.K.

➣Italy

➣Russia

➣Nordic Countries

➣Rest of Europe

➣Latin America

➣Mexico

➣Brazil

➣Rest of Latin America

➣Middle East & Africa

➣Turkey

➣Saudi Arabia

➣UAE

➣Rest of MEA

Similar Reports:

Semi-Trailer Market: https://reports.valuates.com/market-reports/QYRE-Auto-12Z2046/global-semitrailer

Automotive Trailer Market: https://reports.valuates.com/market-reports/QYRE-Auto-3B7040/global-and-japan-automotive-trailer

Dry Bulk Shipping Market: https://reports.valuates.com/market-reports/QYRE-Othe-4A274/dry-bulk-shipping

Freight Trucking Market: https://reports.valuates.com/reports/QYRE-Othe-1D493/freight-trucking

Valuates Reports

sales@valuates.com

For U.S. Toll Free Call +1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp : +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Linkedin - https://in.linkedin.com/company/valuatesreports

Facebook - https://www.facebook.com/valuatesreports/

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Truck Insurance Market Size & Share to grow at a CAGR of 6.8% from 2022-2028 | Valuates Reports here

News-ID: 2522316 • Views: …

More Releases from Valuates Reports

Textile Fabric Finishing Equipment Market Set to Surge - Key Insights You Must K …

Textile Fabric Finishing Equipment Market Size

The global market for Textile Fabric Finishing Equipment was valued at US$ 1980 million in the year 2024 and is projected to reach a revised size of US$ 3804 million by 2031, growing at a CAGR of 10.0% during the forecast period.

The 2025 U.S. tariff policies introduce profound uncertainty into the global economic landscape. This report critically examines the implications of recent tariff adjustments and…

Bamboo Fiber Textiles Market Set to Surge - Key Insights You Must Know

Bamboo Fiber Textiles Market

The global market for Bamboo Fiber Textiles was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-32A15722/Global_Bamboo_Fiber_Textiles_Market_Research_Report_2023

The development of bamboo fiber textiles is subject to some limiting factors, including the following:

High production cost: The production cost of bamboo fiber textiles is relatively high,…

Yarn Control Device Market Set to Surge - Key Insights You Must Know

Yarn Control Device Market Size

The global market for Yarn Control Device was valued at US$ 560 million in the year 2024 and is projected to reach a revised size of US$ 927 million by 2031, growing at a CAGR of 8.0% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-27H19571/Global_Yarn_Control_Device_Market_Research_Report_2025

Yarn Control Device Market

The 2025 U.S. tariff policies introduce profound uncertainty into the global economic landscape. This report critically examines the implications of…

Green Fibers Market Set to Surge - Key Insights You Must Know

Green Fibers Market

The global market for Green Fibers was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

Natural fibers are often termed as green fibers or organic fibers, as they are obtained from natural sources, i.e. mainly plants and animals.

The global green fibers market is mainly driven by the…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…