Press release

Asia Pacific Automotive Usage-Based Insurance (UBI) Market 2020 Recovering From Covid-19 Outbreak | By Allianz SE, Assicurazioni Generali S.p.A., AXA SA, Liberty Mutual Insurance Company

Automotive UBI market in the Asia Pacific is expected to grow from US$ 1.71 Bn in 2018 to US$ 13.57 Bn by the year 2027 with a CAGR of 25.9% from the year 2019 to 2027.The Business Market Insights provides you regional research analysis on “Asia Pacific Automotive Usage-Based Insurance (UBI) Market” and forecast to 2027. The research report provides deep insights into the regional market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Asia Pacific Automotive Usage-Based Insurance (UBI) market during the forecast period, i.e., 2020–2027.

Browse Full Report URL: https://www.businessmarketinsights.com/reports/asia-pacific-automotive-usage-based-insurance-ubi-market?utm_source=OpenPR&utm_medium=10466

Major Key players covered in this report:

• Allianz SE

• Assicurazioni Generali S.p.A.

• AXA SA

• Liberty Mutual Insurance Company

• MS&AD Insurance Group Holdings, Inc.

• Octo Telematics S.p.A

• Sierra Wireless, Inc.

• TomTom Telematics BV

• Unipolsai Assicurazioni S.p.A.

• Vodafone Automotive S.P.A

The increasing demand for mobility-as-a-service (MaaS) and various type of insurance premium policies are boosting the growth of the automotive UBI market. Moreover, the strategic partnerships among insurance companies and telematics companies are anticipated to propel automotive UBI market growth in the forecast period. In the last few years, the consumer behavior towards intercity and intracity transit has been transformed to a newer level. A significant percentage of travelers across the globe are no more willing to drive their own vehicles with an objective to avoid traffic. This has given rise to various other transit practices such as car sharing and ride-hailing in developed countries and developing countries. These practices are known as mobility as a service as the consumer avails the vehicle and the driver from a third party service provider.

Get Sample Copy of this Asia Pacific Automotive Usage-Based Insurance (UBI) Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00005461?utm_source=OpenPR&utm_medium=10466

The growth of the Asia Pacific Automotive Usage-Based Insurance (UBI) market is attributed to the increasing demand for tumor modelling and biobanking, increasing adoption of personalized drugs and growing focus on developing alternatives for animal testing models. However, issues related to the incorporation of organoids into existing workflows. leading to restraining the growth of the market.

ASIA PACIFIC AUTOMOTIVE UBI MARKET SEGMENTATION

By Technology Fitted

• Smartphones

• Black Box

• Dongles

• Others

By Policy Type

• Pay-As-You-Drive (PAYD)

• Pay-How-You-Drive (PHYD)

Order a Copy of this Asia Pacific Automotive Usage-Based Insurance (UBI) Market research report at – https://www.businessmarketinsights.com/buy/single/TIPRE00005461?utm_source=OpenPR&utm_medium=10466

The report profiles the key players in the industry, along with a detailed analysis of their individual positions against the regional landscape. The study conducts SWOT analysis to evaluate strengths and weaknesses of the key players in the Asia Pacific Automotive Usage-Based Insurance (UBI) market. The researcher provides an extensive analysis of the Asia Pacific Automotive Usage-Based Insurance (UBI) market size, share, trends, overall earnings, gross revenue, and profit margin to accurately draw a forecast and provide expert insights to investors to keep them updated with the trends in the market.

Contact US:

Business Market Insights

Phone: +442081254005

E-Mail ID: sales@businessmarketinsights.com

Web URL: https://www.businessmarketinsights.com/

LinkedIn URL: https://www.linkedin.com/company/business-market-insights/

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asia Pacific Automotive Usage-Based Insurance (UBI) Market 2020 Recovering From Covid-19 Outbreak | By Allianz SE, Assicurazioni Generali S.p.A., AXA SA, Liberty Mutual Insurance Company here

News-ID: 2519163 • Views: …

More Releases from Business Market Insights

Laser Hair Removal Market Accelerates as Innovation, Consumer Awareness, and Aes …

The laser hair removal market is undergoing a transformative phase as evolving beauty standards, rapid technological innovation, and increasing preference for non-invasive aesthetic treatments continue to reshape the global personal care and dermatology landscape. Once considered a premium cosmetic procedure, laser hair removal is now becoming an integral part of modern grooming routines across diverse age groups and demographics.

Driven by continuous improvements in laser technology, treatment comfort, and customization capabilities,…

Veterinary Imaging Market Poised for Sustainable Growth Amid Rising Pet Humaniza …

The Global Veterinary Imaging Market continues its trajectory of steady, innovation-led expansion, fueled by rising adoption of advanced diagnostic solutions, deepening pet humanization trends, and escalating veterinary healthcare awareness worldwide. With significant developments reported in both technology adoption and service delivery, the veterinary imaging landscape is advancing to meet growing demand for higher diagnostic precision, faster clinical decision-making, and improved animal patient outcomes.

Veterinary imaging solutions - spanning X-ray, ultrasound,…

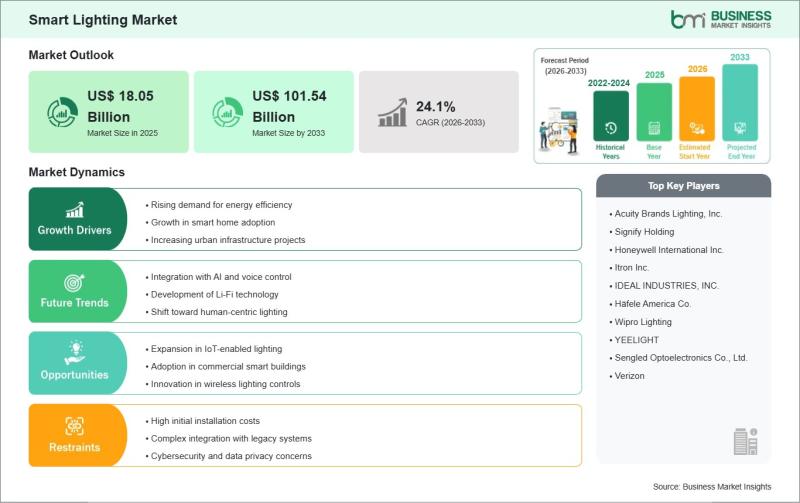

Smart Lighting Market to Skyrocket to US$101.54 Billion by 2033 from US$18.05 Bi …

The Smart Lighting Market is transforming everyday spaces into energy-efficient havens, powered by IoT, AI, and wireless controls that adapt to user needs and environments. Homeowners and businesses alike are discovering how connected bulbs and fixtures enhance ambiance while slashing energy use. The Smart Lighting Market size is expected to reach US$ 101.54 billion by 2033 from US$ 18.05 billion in 2025. The market is estimated to record a CAGR…

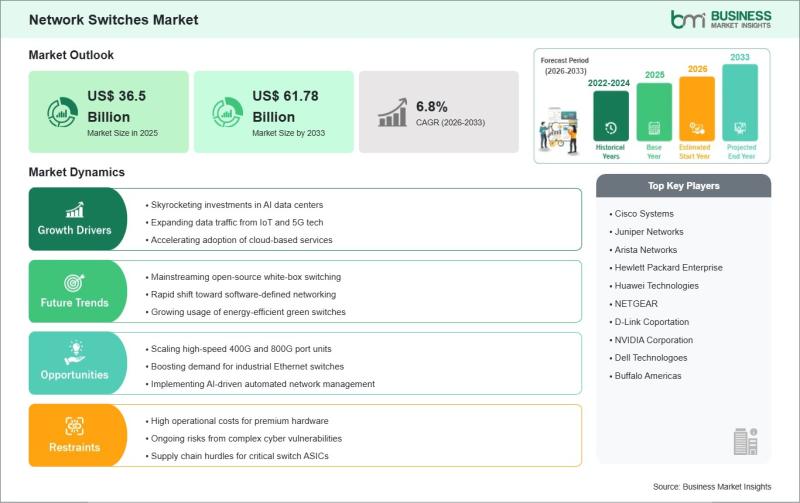

Network Switches Market Analysis: US$ 61.78 Billion Projection by 2033 at 6.8% G …

The Network Switches Market stands at the heart of digital transformation, powering seamless connectivity for enterprises embracing cloud computing, 5G, and IoT ecosystems. As businesses worldwide prioritize agile, secure networks, innovations in software-defined networking and high-speed Ethernet drive the evolution of this vital infrastructure.

Check valuable insights in the Network Switches Market report. You can easily get a sample PDF of the report - https://www.businessmarketinsights.com/sample/BMIPUB00032458?utm_source=OpenPr&utm_medium=10457

Executive Summary and Global Market Analysis:

Network…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…