Press release

Business Loan Market May See a Big Move : Major Giants Citibank, Barclays Bank, Deutsche Bank

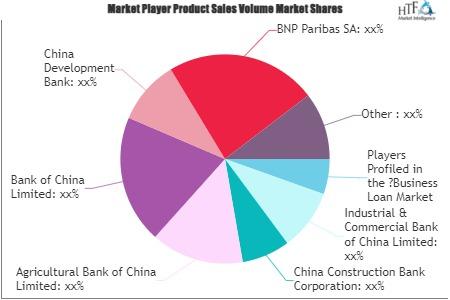

The Latest research study released by HTF MI “Global Business Loan Market” with 100+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint and status. Understanding the segments helps in identifying the importance of different factors that aid the market growth. Some of the Major Companies covered in this Research are Industrial & Commercial Bank of China Limited, China Construction Bank Corporation, Agricultural Bank of China Limited, Bank of China Limited, China Development Bank, BNP Paribas SA, JPMorgan Chase Bank National Association, MUFG Bank Ltd., JAPAN POST BANK Co Ltd, Credit Agricole SA, Bank of America National Association, Sumitomo Mitsui Banking Corporation, Wells Fargo Bank National Association, Banco Santander SA, Mizuho Bank Ltd, Deutsche Bank AG, Societe Generale, BPCE, Citibank NA, Bank of Communications Co Ltd, Postal Savings Bank of China Co Ltd, Barclays Bank PLC, The Hongkong and Shanghai Banking Corporation Limited, The Toronto-Dominion Bank, Royal Bank of Canada, ING Bank NV, China Merchants Bank Co Ltd, Industrial Bank Co Ltd, UBS AG & The Norinchukin Bank etc.Click here for free sample + related graphs of the report @: https://www.htfmarketreport.com/sample-report/3762639-global-business-loan-market-1

Browse market information, tables and figures extent in-depth TOC on “Business Loan Market by Application (BFSI Industry, Retail Industry, IT & Telecom Industry, Healthcare Industry, Food Industry, Channel, Market Data Breakdown by Channels & Direct Sales, Distribution Channel), by Product Type (, Market Data Breakdown by Type, Short-term Loan, Medium term Loan & Long-term Loan), Business scope, Manufacturing and Outlook – Estimate to 2025”.

for more information or any query mail at sales@htfmarketreport.com

At last, all parts of the Global Business Loan Market are quantitatively also subjectively valued to think about the Global just as regional market equally. This market study presents basic data and true figures about the market giving a deep analysis of this market based on market trends, market drivers, constraints and its future prospects. The report supplies the worldwide monetary challenge with the help of Porter's Five Forces Analysis and SWOT Analysis.

If you have any Enquiry please click here @: https://www.htfmarketreport.com/enquiry-before-buy/3762639-global-business-loan-market-1

Customization of the Report: The report can be customized as per your needs for added data up to 3 businesses or countries or 2 analyst hours.

On the basis of report- titled segments and sub-segment of the market are highlighted below:

Global Business Loan Market By Application/End-User (Value and Volume from 2021 to 2026) : BFSI Industry, Retail Industry, IT & Telecom Industry, Healthcare Industry, Food Industry, Channel, Market Data Breakdown by Channels & Direct Sales, Distribution Channel

Market By Type (Value and Volume from 2021 to 2026) : , Market Data Breakdown by Type, Short-term Loan, Medium term Loan & Long-term Loan

Global Business Loan Market by Key Players: Industrial & Commercial Bank of China Limited, China Construction Bank Corporation, Agricultural Bank of China Limited, Bank of China Limited, China Development Bank, BNP Paribas SA, JPMorgan Chase Bank National Association, MUFG Bank Ltd., JAPAN POST BANK Co Ltd, Credit Agricole SA, Bank of America National Association, Sumitomo Mitsui Banking Corporation, Wells Fargo Bank National Association, Banco Santander SA, Mizuho Bank Ltd, Deutsche Bank AG, Societe Generale, BPCE, Citibank NA, Bank of Communications Co Ltd, Postal Savings Bank of China Co Ltd, Barclays Bank PLC, The Hongkong and Shanghai Banking Corporation Limited, The Toronto-Dominion Bank, Royal Bank of Canada, ING Bank NV, China Merchants Bank Co Ltd, Industrial Bank Co Ltd, UBS AG & The Norinchukin Bank

Geographically, this report is segmented into some key Regions, with manufacture, depletion, revenue (million USD), and market share and growth rate of Business Loan in these regions, from 2015 to 2026 (forecast), covering China, USA, Europe, Japan, Korea, India, Southeast Asia & South America and its Share (%) and CAGR for the forecasted period 2021 to 2026.

Informational Takeaways from the Market Study: The report Business Loan matches the completely examined and evaluated data of the noticeable companies and their situation in the market considering impact of Coronavirus. The measured tools including SWOT analysis, Porter's five powers analysis, and assumption return debt were utilized while separating the improvement of the key players performing in the market.

Key Development’s in the Market: This segment of the Business Loan report fuses the major developments of the market that contains confirmations, composed endeavors, R&D, new thing dispatch, joint endeavours, and relationship of driving members working in the market.

To get this report buy full copy @: https://www.htfmarketreport.com/buy-now?format=1&report=3762639

Some of the important question for stakeholders and business professional for expanding their position in the Global Business Loan Market :

Q 1. Which Region offers the most rewarding open doors for the market Ahead of 2021?

Q 2. What are the business threats and Impact of latest scenario Over the market Growth and Estimation?

Q 3. What are probably the most encouraging, high-development scenarios for Business Loan movement showcase by applications, types and regions?

Q 4.What segments grab most noteworthy attention in Business Loan Market in 2020 and beyond?

Q 5. Who are the significant players confronting and developing in Business Loan Market?

For More Information Read Table of Content @: https://www.htfmarketreport.com/reports/3762639-global-business-loan-market-1

Key poles of the TOC:

Chapter 1 Global Business Loan Market Business Overview

Chapter 2 Major Breakdown by Type [, Market Data Breakdown by Type, Short-term Loan, Medium term Loan & Long-term Loan]

Chapter 3 Major Application Wise Breakdown (Revenue & Volume)

Chapter 4 Manufacture Market Breakdown

Chapter 5 Sales & Estimates Market Study

Chapter 6 Key Manufacturers Production and Sales Market Comparison Breakdown

…………………..

Chapter 8 Manufacturers, Deals and Closings Market Evaluation & Aggressiveness

Chapter 9 Key Companies Breakdown by Overall Market Size & Revenue by Type

………………..

Chapter 11 Business / Industry Chain (Value & Supply Chain Analysis)

Chapter 12 Conclusions & Appendix

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, LATAM, Europe or Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Loan Market May See a Big Move : Major Giants Citibank, Barclays Bank, Deutsche Bank here

News-ID: 2517210 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Education Finance Software Market: Regaining Its Glory | PowerSchool Finance, Ty …

The latest analysis of the worldwide education finance software market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The education finance software market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as competitors.

Key Players in This Report Include:

Blackbaud, Ellucian,…

Digital Parcel Mapping Systems Market Is Booming Worldwide | Major Giants Hexago …

The latest analysis of the worldwide digital parcel mapping systems market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The Digital Parcel Mapping Systems market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as competitors' positions.

Key Players in This…

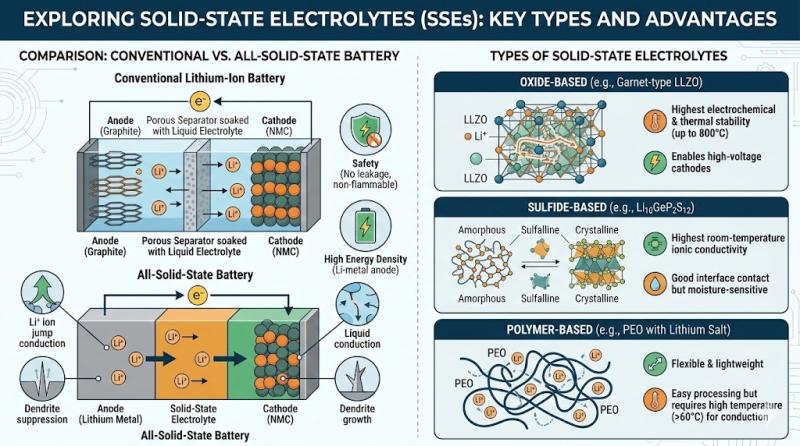

Solid-State Electrolytes Market Likely to Boost Future Growth by 2033 | QuantumS …

HTF Market Intelligence published a new research document of 150+pages on Solid-State Electrolytes Market Insights, to 2033" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Solid-State Electrolytes market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic slowdown have…

Marine Mining Technology Market Current Status and Future Prospects | Odyssey Ma …

The latest study released on the Global Marine Mining Technology Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Marine Mining Technology study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…