Press release

Financial Cards and Payments Market 2021 Projection By Key Players – MasterCard, Amazon Payments, Apple Pay, Visa– Analysis and Forecast to 2025

Financial Cards and Payments Market 2021-2025New Study Reports " Financial Cards and Payments Market 2021 Global Opportunities, Challenges, Strategies and Forecasts 2025" has been Added on PersistenceMarketResearch.

Report Details:

Electronic payment through financial cards and payment systems is on the rise across the world. On account of the convenience and higher availability offered, financial cards and payment systems have witnessed higher penetration in numerous economies across the world. Traditional payment systems such as cash payments, demand drafts and other payment certificates have become obsolete due to technological advancements in financial cards and payment systems.

Through financial cards and payment systems, numerous financial transactions can be executed between entities located anywhere in the world. Financial cards including debit cards, credit cards, charge cards, ATM cards, fleet cards and stored value cards are widely used for different types of financial transactions. Other types of financial cards including Scrip, gift cards and electronic purse have gained popularity and serve to a very niche market. Financial cards are deployed using numerous technologies such as embossing, magnetic stripe cards, smart cards, proximity cards and re-programmable magnetic stripe cards.

Request for Free Sample Report of “Financial Cards and Payments” Market @https://www.persistencemarketresearch.com/samples/10882

Key Players:

The report has profiled some of the Important players prevalent in the global like – MasterCard, Amazon Payments, Apple Pay, Visa, PayPal,and RuPay and more.

This report covers the sales volume, price, revenue, gross margin, manufacturers, suppliers, distributors, intermediaries, customers, historical growth and future perspectives in the Financial Cards and Payments.

Magnetic stripe were highly adopted in the global credit and debit cards due to inefficiencies in the embossing technology. However, due to factors such as magnetic interference and possibility of damage to the magnetic stripe, the magnetic stripe cards were replaced by other technologies such as smart cards and proximity cards.

The smart card technology uses an integrated circuit chip (ICC) which can process financial transactions with higher efficiency as compared to magnetic stripe cards. Proximity cards are contactless integrated circuit devices which make use of Radio Frequency Identification (RFID) technology and are powered by resonant energy transfer.

Proximity cards are gaining immense popularity in private payment systems and public transit payments. Financial payment systems include various types of payment methods such as bank transfers, E-wallets, direct debit and other mobile payment solutions. Users across the world make use of such payment systems to electronically transfer cash directly to merchant’s account. Unlike financial cards where the payments takes place through point of sale (PoS) systems, payment systems enable users to authenticate and execute financial transactions over the internet.

One of the major factors driving the growth of financial cards and payments market is the rise of ecommerce. Increasing penetration of online stores for numerous products and services has offered higher accessibility and availability of market places to consumers. Such factors have driven the growth of financial cards and payments systems across the world.

Moreover, benefits such as convenience, security and privacy have further driven the growth of financial cards and payments market. In addition, ongoing collaboration between numerous payment industry participants including merchants’ banks, card issuers and card association network providers has led to development of comprehensive financial payment and transfer solutions.

Increasing penetration of ecommerce and mobile phones across the world has made the financial cards and payment systems lucrative in recent years. Numerous players in these markets seek to reap maximum profits in the developing economies especially in countries such as Brazil, Russia, India and China (BRIC).

Free analysis

The electronic payment from financial cards and payment systems is gaining popularity across the globe owing to high convenience. Different types of financial cards gaining rapid traction in the market are debit cards, fleet cards, ATM cards, and credit cards. Various highly demanded technologies in the market are magnetic stripe cards, re-programmable magnetic stripe cards, and proximity cards.

Presence of different payment methods in the market that include bank transfers, mobile payments, and e-wallets are propelling the growth of the market ahead. Growing penetration of e-commerce acts as a major growth lever in the market, creating new growth prospects for the service providers.

The increase in the numerous offers provided by the online stores has enhanced the accessibility and availability of various market places which is drawing the consumers towards it. Attributes such as security and privacy are further boosting the market growth rate.

View Table of Contents, Figures, and Tables@https://www.persistencemarketresearch.com/toc/10882

Region Coverage (Regional Production, Demand & Forecast by Countries etc.):

North America (U.S., Canada, Mexico)

Europe (Germany, U.K., France, Italy, Russia, Spain etc.)

Asia-Pacific (China, India, Japan, Southeast Asia etc.)

South America (Brazil, Argentina etc.)

Middle East & Africa (Saudi Araia, South Africa etc.)

Key Stakeholders

Financial Cards and Payments Market Manufacturers

Financial Cards and Payments Market Distributors/Traders/Wholesalers

Financial Cards and Payments Market Subcomponent Manufacturers

Industry Association

Downstream Vendors

If you have any special requirements, please let us know and we will offer you the report as you want.

Major Highlights of the Financial Cards and Payments Market Report:

The Financial Cards and Payments Market analysis report offers an in-depth study of the potential market growth opportunities and challenges.

The report dives deeper into the market and explains the dynamic factors bolstering market growth.

The report deeply assesses the current, historical market size, market share, and revenue growth rates to offer accurate market projections for the forecast period.

The report analyzes the Financial Cards and Payments Market presence across major regions of the world.

It determines the production & consumption capacities and demand & supply dynamics of each regional market.

The report further illustrates the intense competition among the key market players and highlights their effective business expansion plans and strategies.

It provides company overview and SWOT analysis of each of the market players.

Key Questions Answered in This Report.

What will the Market growth rate in Future?

What are the key factors driving the global Market?

Who are the key manufacturers in Market space?

What are the opportunities and threats faced by the vendors in the global industry?

What are sales, revenue, and price analysis by regions of industry?

If you have any special requirements, please let us know and we will offer you the report as you want and also We Provide you Table of Content.

Click Here to Buy/Pre-Book this Report@https://www.persistencemarketresearch.com/checkout/10882

Media Contact:

Persistence Market Research

305 Broadway,7th Floor New York City, NY 10007 United States

Call +1-646-568-7751

Call +1 800-961-0353

sales@persistencemarketresearch.com

About PersistenceMarketResearch:

PersistenceMarketResearch is an esteemed company with a reputation of serving clients across domains of information technology (IT), healthcare, and chemicals. Our analysts undertake painstaking primary and secondary research to provide a seamless report with a 360 degree perspective. Data is compared against reputed organizations, trustworthy databases, and international surveys for producing impeccable reports backed with graphical and statistical information.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Cards and Payments Market 2021 Projection By Key Players – MasterCard, Amazon Payments, Apple Pay, Visa– Analysis and Forecast to 2025 here

News-ID: 2502382 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

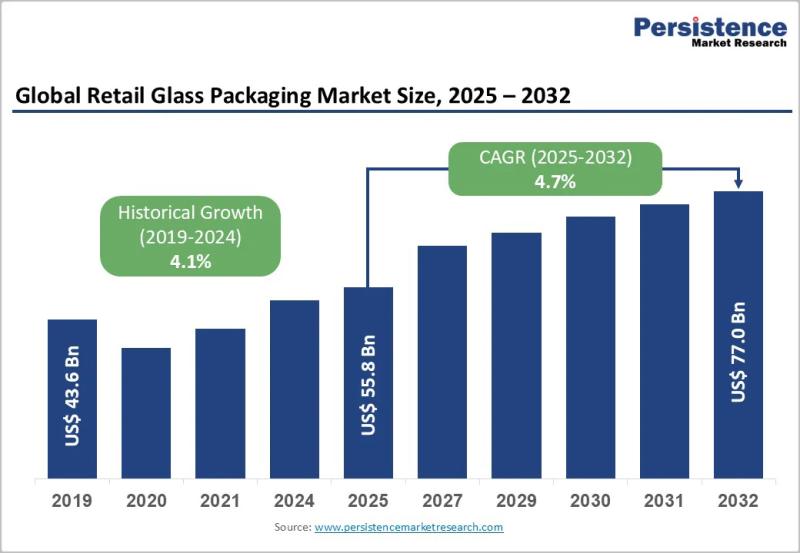

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…