Press release

Loan Origination Tools: Market 2021 | Industry overview, supply and demand analysis and forecast 2026 | Pegasystems, ISGN Corp, Mortgage Cadence (Accenture), Turnkey Lender

Qurate’s most recent research report on Loan Origination Tools was performed by extremely qualified research professionals and business experts in order to provide an in-depth assessment on the market. The study on Loan Origination Tools is extensive and consist of over 120 pages. The research analysis on Loan Origination Tools is the proper mix of qualitative and quantitative information with an emphasis on crucial characteristics of the Loan Origination Tools. These involve –- Significant market development

- Challenges faced by the industry and its players under gap analysis

- New opportunities

- Detailed Covid – 19 impact analysis on the Loan Origination Tools

The several market players and emerging companies that are profiled in the Loan Origination Tools research study consist of –

Pegasystems

ISGN Corp

Mortgage Cadence (Accenture)

Turnkey Lender

FICS

Mortgage Builder Software

VSC

Axcess Consulting Group

PCLender

DH Corp

LLC

Wipro

Lending QB

Tavant Tech

Ellie Mae

Calyx Software

Juris Technologies

Fiserv

SPARK

Byte Software

Black Knight

GET a FREE Sample Report + All Related Graphs & Charts NOW! https://www.qurateresearch.com/report/sample/BnF/global-loan-origination-tools-market/QBI-MR-BnF-1092265

The free sample PDF of the research report is readily accessible on request and consist of the following –

- A comprehensive introduction of the research report

- Graphical representation of the regional analysis

- Key players along with their profile analysis including financial data

- Selected sections of market insights and trends

- A blueprint of the final research report

Strategic research techniques applied to compile the information in the Loan Origination Tools report is as under –

We follow a supply-side assessment to track market revenue, in which, we track revenue produced by companies offering corresponding products and services to their respective end-users.

Market Sizing Approach (Bottom-Up Approach):

- Track prominent products and services providers (In India)

- Understand their respective business segment, product portfolio, distribution channel, regional presence, and recent developments

- Track the revenue generated by the players

- Add the revenue generated by all the players

Data Collection Technique (Market Size):

Desk Research:

Refer to authentic literature available on open sources including company annual reports, press releases, white papers, industry magazine, government websites, and blogs.

Primary Research:

This market size was further validated during interviews with C-level and D-level executives, managers, key opinion leaders and mainly through our channel partners.

Paid Sources:

Apart from our in-house repository of industry reports, we had referred to various paid databases such as Trademap, Hoover’s, Factiva, and Marklines.

on the basis of types, the Loan Origination Tools market from 2015 to 2025 is primarily split into:

On-demand (Cloud)

On-premise

on the basis of applications, the Loan Origination Tools market from 2015 to 2025 covers:

Banks

Credit Unions

Mortgage Lenders & Brokers

Others

Quantitative data point incorporated in the Loan Origination Tools research analysis includes –

- Market data breakdown by key regions, product type, application, end user

- By Type – Historic and Forecasted data

- Specific Application / End User Sales and Growth Rates - Historic and Forecasted data

- Revenue and growth rate by market - Historic and Forecasted data

- Market size and growth rate, application/end-user and type - Historic and Forecasted data

- Sales revenue, volume, and Y-O-Y growth rate of the base year of Loan Origination Tools

Qualitative data in the Loan Origination Tools research study encompasses –

- Market overview and trends

- Growth drivers and factors

- Detailed Covid – 19 impact analysis

- Market opportunity windows

- SWOT analysis

- PESTLE analysis

- Demand – Supply analysis

- Competitor landscape

Purchase FULL Report Now! https://www.qurateresearch.com/report/buy/BnF/global-loan-origination-tools-market/QBI-MR-BnF-1092265

Regions Covered under the Loan Origination Tools include:

- Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia)

- North America (The United States, Mexico, Canada, etc.)

- South America (Brazil, Colombia, etc.)

- Europe (France, Germany, Russia, UK, Italy, etc.)

- Rest of the World (GCC and African Countries, Turkey, Egypt, etc.)

Years Studied to Estimate the Loan Origination Tools Market Size are as under:

- History Year: 2015-2019

- Base Year: 2020

- Estimated Year: 2021

- Forecast Year: 2021-2026

(*If you have any special requirements, please let us know and we will offer you the report as you want.)

Note - In order to provide more accurate market forecast, all our reports will be updated before delivery by considering the impact of COVID-19.

Contact Us:

Nehal Chinoy

Runwal Platinum,

Ramnagar Colony, Bavdhan,

Pune, Maharashtra, India-411021

IN +919881074592

info@qurateresearch.com

https://www.qurateresearch.com/

We at Qurate Business Intelligence Pvt. Ltd. offer a wide range of market research reports and consulting services with an in-depth expertise of various industries. Our aim is to provide our clients with the most accurate and qualitied oriented market information so that they can compete and stay competitive with the changing times and dynamic market situations. We at Qurate deliver comprehensive market peripheral research documents equipped with historic data, recent developments, key trends, company investigations, and industry performance forecast.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Origination Tools: Market 2021 | Industry overview, supply and demand analysis and forecast 2026 | Pegasystems, ISGN Corp, Mortgage Cadence (Accenture), Turnkey Lender here

News-ID: 2499759 • Views: …

More Releases from Qurate Business Intelligence

Ayurvedic Service Market (COVID-19 Impact Analysis) Share, Size, Revenue and Bus …

Ayurvedic Service Market Report research report is a wide-ranging analysis and Impact of COVID19 in the global market and the in-detail information with segmentation has been added in this intelligence report. In this report a comprehensive analysis of current global Global Ayurvedic Service Market market in terms of demand and supply environment is provided, as well as price trend currently and in the next few years. Global leading players are…

Cash Management System Market Outlook, Size, Share, Revenue, Regions & Forecast …

Cash Management System Market Report research report is a wide-ranging analysis and Impact of COVID19 in the global market and the in-detail information with segmentation has been added in this intelligence report. In this report a comprehensive analysis of current global Global Cash Management System Market market in terms of demand and supply environment is provided, as well as price trend currently and in the next few years. Global leading…

Poultry Processing Product Market 2023 Outlook, Business Strategies, Challenges …

Poultry Processing Product Market Report research report is a wide-ranging analysis and Impact of COVID19 in the global market and the in-detail information with segmentation has been added in this intelligence report. In this report a comprehensive analysis of current global Global Poultry Processing Product Market market in terms of demand and supply environment is provided, as well as price trend currently and in the next few years. Global leading…

Smart Greenhouse Market is Booming Growth by Top Key Players - Venlo, Palram, RB …

Smart Greenhouse Market Report research report is a wide-ranging analysis and Impact of COVID19 in the global market and the in-detail information with segmentation has been added in this intelligence report. In this report a comprehensive analysis of current global Global Smart Greenhouse Market market in terms of demand and supply environment is provided, as well as price trend currently and in the next few years. Global leading players are…

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

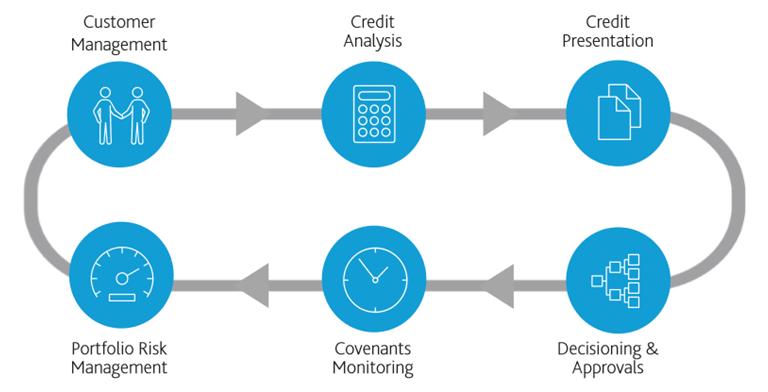

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…