Press release

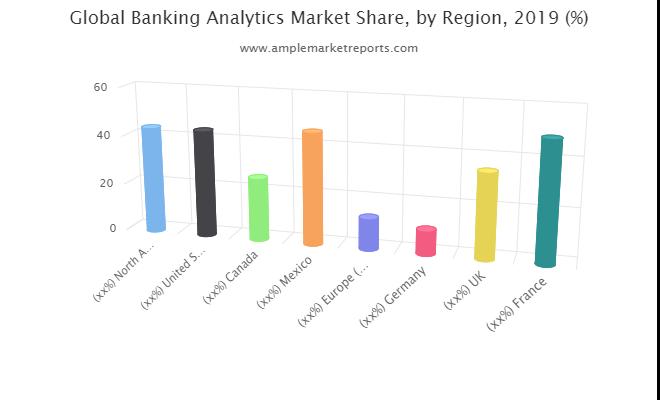

Banking Analytics Market May See Robust Growth By 2026: Aspire systems, IBM, ZestFinance

"SWOT Analysis of Banking Analytics, Professional Survey Report Including Top Most Global Players Analysis with CAGR and Stock Market Up and Down."The Banking Analytics Market research report presents an all-inclusive study of the Banking Analytics market. The report includes all the major trends and technologies performing a major role in the Banking Analytics market development during the forecast period. The key players in the market are Aspire systems, IBM Corporation, ZestFinance, PeerIQ, Microstrategy Inc., SAP SE, Oracle Corporation, Adobe Systems Incorporated, Hexanika, Alteryx Inc. An attractiveness study has been presented for each geographic area in the report to provide a comprehensive analysis of the overall competitive scenario of the Banking Analytics market globally.

https://www.amplemarketreports.com/sample-request/global-banking-analytics-market-2713585.html Apply here for the sample copy of the report

Furthermore, the report comprises an outline of the diverse tactics used by the key players in the market. It also details the competitive scenario of the Banking Analytics market, placing all the key players as per their geographic presence and previous major developments. SWOT analysis is used to evaluate the growth of the major players in the global market.

The report presents a detailed segmentation Local, Cloud based, Market Trend by Application Retail, B2B, B2C of the global market based on technology, product type, application, and various processes and systems. Geographically, the market is classified into. The report also includes the strategies and regulations according to the various regions stated above. Porter's five forces analysis describes the aspects that are presently affecting the Banking Analytics market. Moreover, the report covers the value chain analysis for the Banking Analytics market that describes the contributors of the value chain.

Impact Of COVID-19

The most recent report includes extensive coverage of the significant impact of the COVID-19 pandemic on the Heated Jacket division. The coronavirus epidemic is having an enormous impact on the global economic landscape and thus on this special line of business. Therefore, the report offers the reader a clear concept of the current scenario of this line of business and estimates the aftermath of COVID-19.

The report also puts forth the restraints, drivers, and opportunities expected to affect the market's growth in the forecast period. Further, it offers a holistic perspective on the Banking Analytics market's development within the stated period in terms of revenue [USD Million] and size [k.MT] across the globe.

The all-inclusive data presented in the report are the outcome of detailed primary and secondary research along with reviews from the experts and analysts from the industry. The report also evaluates the market's growth by taking into consideration the impact of technological and economic factors along with existing factors affecting the Banking Analytics market's growth.

Find out more information of Banking Analytics market at: https://www.amplemarketreports.com/report/global-banking-analytics-market-2713585.html

The additional geographical segments are also mentioned in the empirical report.

North America: U.S., Canada, Rest of North America

Europe: UK, Germany, France, Italy, Spain, Rest of Europe

Asia Pacific: China, Japan, India, Southeast Asia, North Korea, South Korea, Rest of Asia Pacific

Latin America: Brazil, Argentina, Rest of Latin America

The Middle East and Africa: GCC Countries, South Africa, Rest of Middle East & Africa

Chapters to display the Global Banking Analytics market

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Banking Analytics market

Chapter 2: Exclusive Summary - the basic information of the Banking Analytics Market.

Chapter 3: Introduction to Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Banking Analytics

Chapter 4: Presenting the Banking Analytics Market Factor Analysis, Post COVID Impact Analysis, Porter's Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: To show the by Type, End-User and Region/Country 2020-2026

Chapter 6: Evaluating the leading manufacturers of the Banking Analytics market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries, and by Manufacturers/Company/Players (Aspire systems, IBM Corporation, ZestFinance, PeerIQ, Microstrategy Inc., SAP SE, Oracle Corporation, Adobe Systems Incorporated, Hexanika, Alteryx Inc) with revenue share and sales by key countries in these various regions (2020-2026)

Chapter 8 & 9: Displaying the Appendix, Methodology, and Data Source

Customize Report and Inquiry for The Banking Analytics Market Report: https://www.amplemarketreports.com/enquiry-before-buy/global-banking-analytics-market-2713585.html

Reasons for Buying Banking Analytics market

- This report provides pin-point analysis for changing competitive dynamics

- It provides a forward-looking perspective on different factors driving or restraining market growth

- It provides a six-year forecast assessed on the basis of how the market is predicted to grow

- It helps in understanding the key product segments and their future

- It provides pin point analysis of changing competition dynamics and keeps you ahead of competitors

- It helps in making informed business decisions by having complete insights of market and by making in-depth analysis of market segments

Thanks for reading this article; you can also get individual chapter wise section or region wise report versions like North America, Europe, or Asia.

Contact Address:

William James

Media & Marketing Manager

Address: 3680 Wilshire Blvd, Ste P04 - 1387 Los Angeles, CA 90010

Call: +1 (530) 868 6979

Email: sales@amplemarketreports.com

https://www.amplemarketreports.com

About Author

Ample Market Research provides comprehensive market research services and solutions across various industry verticals and helps businesses perform exceptionally well. Our end goal is to provide quality market research and consulting services to customers and add maximum value to businesses worldwide. We desire to deliver reports that have the perfect concoction of useful data. Our mission is to capture every aspect of the market and offer businesses a document that makes solid grounds for crucial decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking Analytics Market May See Robust Growth By 2026: Aspire systems, IBM, ZestFinance here

News-ID: 2478527 • Views: …

More Releases from Ample Market Research & Consulting Private Limited

Family Camping Tent Market Future Profits to Reach New Heights with Market Size …

A research report added by Ample Market Research is a detailed examination of market segmentation, regional outlook, competitive scenarios, and Family Camping Tent market share. This study includes historical and forecast growth of industries based on geography. It also addresses industry constraints or challenges. The exam provides a detailed overview of the industry by product, type, application, and end user. This research provides accurate and accurate statistics on the industry,…

Higher Education Student CRM Systems Market Size Giants Spending Is Going To Boo …

A research report added by Ample Market Research is a detailed examination of market segmentation, regional outlook, competitive scenarios, and Higher Education Student CRM Systems market share. This study includes historical and forecast growth of industries based on geography. It also addresses industry constraints or challenges. The exam provides a detailed overview of the industry by product, type, application, and end user. This research provides accurate and accurate statistics on…

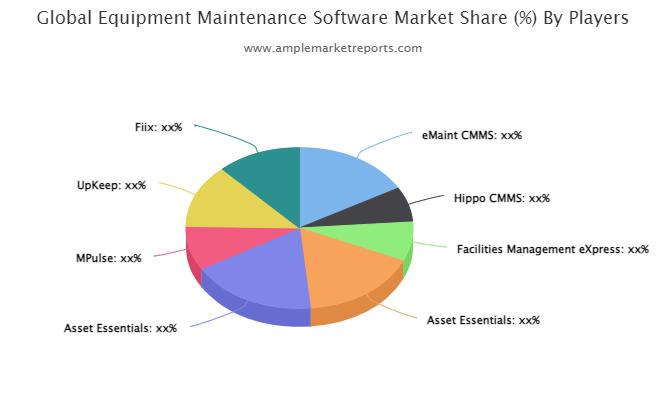

Equipment Maintenance Software Tracking Market 2023: Some Basic Influencing Fact …

A research report added by Ample Market Research is a detailed examination of market segmentation, regional outlook, competitive scenarios, and Equipment Maintenance Software market share. This study includes historical and forecast growth of industries based on geography. It also addresses industry constraints or challenges. The exam provides a detailed overview of the industry by product, type, application, and end user. This research provides accurate and accurate statistics on the industry,…

Lubricant Additives Market Strong Extension In Revenue Continues | Lubrizol, Inf …

A research report added by Ample Market Research is a detailed examination of market segmentation, regional outlook, competitive scenarios, and Lubricant Additives market share. This study includes historical and forecast growth of industries based on geography. It also addresses industry constraints or challenges. The exam provides a detailed overview of the industry by product, type, application, and end user. This research provides accurate and accurate statistics on the industry, including…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…