Press release

Insurance Automation Market: Industry Outlook, Growth Prospects and Key Opportunities 2031| TMR

The insurance automation market is estimated to observe extensive growth during the forecast period of 2021-2031. The expanding popularity of technologies like artificial intelligence (AI), machine learning (ML), and others will present a plethora of opportunities for the insurance automation market during the forecast period.The need for automation has increased extensively in every industry and sector. The banking and insurance sector is no exception to this change. Many companies in the insurance sector are implementing automation to increase their efficiency in various processes like claims and renewals. Thus, based on these aspects, the demand for insurance automation is expected to increase in the upcoming period.

The report on the insurance automation market by Transparency Market Research (TMR) has various points and factors that make the stakeholder aware of the existing competitive scenario. Furthermore, the report includes the demographic landscape, industrial insights, and the latest trends that prove to be of great help to the CXOs and stakeholders. The COVID-19 pandemic effect has also been included in the report.

Get More Information at – https://www.transparencymarketresearch.com/insurance-automation-market.html

How is the Competitive Scenario of Insurance Automation Market?

The insurance automation market is highly fragmented. The players indulge in new launches and constantly strive for upgrading their platforms. The players invest in research and development activities. These activities help in discovering insights that help develop new features which are convenient for the players. Thus, these factors eventually increase the growth rate of the insurance automation market.

The players are involved in mergers, acquisitions, joint ventures, and partnerships. These activities help in increasing the influence of the players in the insurance automation market, ultimately contributing to the growth structure.

Some well-established players in the insurance automation market are Acko General Insurance, IBM Corporation, Microsoft Corporation, Shift Technology, Zurich Insurance Group, Lemonade, Cape Analytics LLC, Trov, Quantemplate, and ZhongAn.

Request For Brochure- https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=83841

What are Key Trends in Insurance Automation Market?

Emergence of Digitalization Bringing Considerable Growth for Insurance Automation Market

Digitalization has captured almost every sector and field. The insurance sector is no stranger to this change. With the evolving customer preferences and the rising popularity of digitalization, the demand for insurance automation is bound to increase. Many benefits are attached with the automation of processes. One of the prominent benefits is the ease and convenience to the consumers. Thus, many consumers prefer insurance companies with automation processes for efficient and hassle-free process. Based on all these factors, the demand for insurance automation is estimated to rise.

Use of Technologies like Robotic Process Automation (RPA) in Insurance Automation to Add Value to Growth Trajectory

Latest technologies are penetrating the insurance automation market will full force. The players in the insurance automation market are trying to expand their consumer base through making use of numerous technologies. One of the prominent technologies is the Robotic Automation Process (RPA). The growing influence of RPA among insurance automation platforms will have a profound impact on the growth of the insurance automation market. Many insurance companies have started implementing RPA for automating certain mechanical and tedious procedures while claiming insurance. Thus, these factors will have a large influence on the growth of the insurance automation market.

PreBook Our Premium Research Report at – https://www.transparencymarketresearch.com/checkout.php?rep_id=83841<ype=S

What are Regional Dimensions of Insurance Automation Market?

North America is expected to observe a dominating stance in terms of region for the insurance automation market during the forecast period. The growing focus on research and development activities in the insurance automation sector, especially in the U.S. will serve as a vital growth factor for the insurance automation market. The Asia Pacific is also expected to emerge as a rapid growth-generating region for the insurance automation market. The rising awareness about the automation in the insurance sector is extrapolated to serve as a beneficial factor for the growth of the insurance automation market.

Contact

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com/

About Us

Transparency Market Research is a global market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants, use proprietary data sources and various tools and techniques to gather, and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Automation Market: Industry Outlook, Growth Prospects and Key Opportunities 2031| TMR here

News-ID: 2477816 • Views: …

More Releases from Transparency Market Research

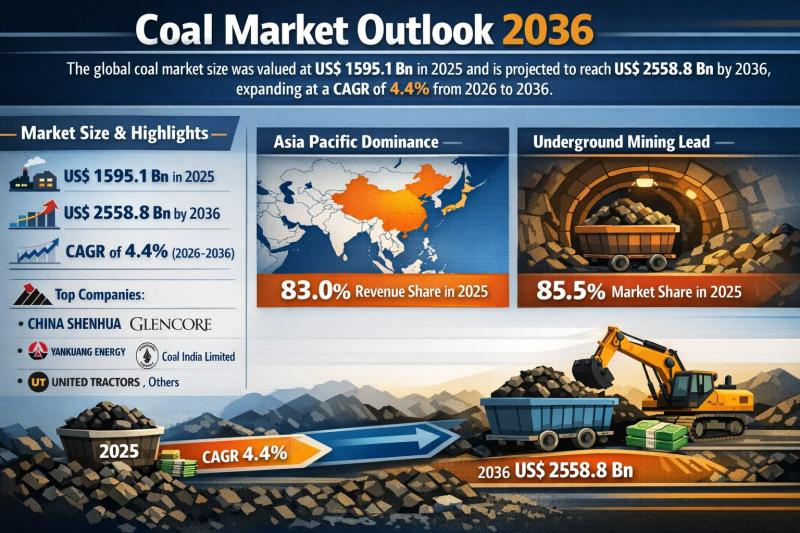

Global Coal Market Outlook 2036: Industry to Reach US$ 2,558.8 Billion by 2036 D …

The global coal market was valued at US$ 1,595.1 Bn in 2025 and is projected to reach US$ 2,558.8 Bn by 2036, expanding at a CAGR of 4.4% from 2026 to 2036. The industry continues to remain a cornerstone of global energy systems, particularly in emerging economies where coal-fired power generation supports industrialization and infrastructure growth.

Asia Pacific dominated the global coal market in 2025, accounting for 83.0% of total revenue…

Metalworking Fluids Market Expanding at 3.7% CAGR Through 2036 - By Type / By Ap …

The global metalworking fluids market was valued at US$ 11.8 Bn in 2025 and is projected to reach US$ 17.6 Bn by 2036, expanding at a steady CAGR of 3.7% during the forecast period from 2026 to 2036. The market's moderate yet stable growth trajectory reflects its strong integration into essential industrial operations across automotive, aerospace, construction, marine, medical, and heavy engineering sectors.

Get a concise overview of key insights from…

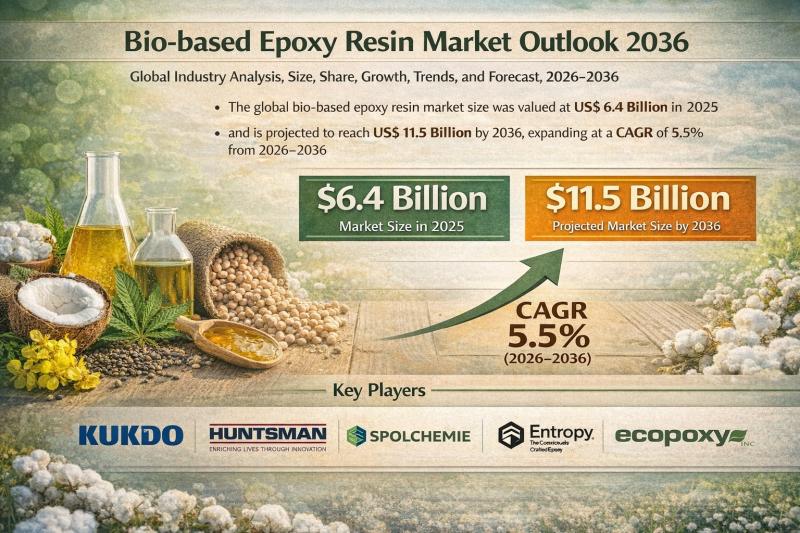

Bio-based Epoxy Resin Market to Reach US$ 11.5 Billion by 2036 Amid Sustainabili …

The global bio-based epoxy resin market is entering a transformative growth phase as industries shift toward sustainable and low-carbon material solutions. Valued at US$ 6.4 billion in 2025, the market is projected to reach US$ 11.5 billion by 2036, expanding at a CAGR of 5.5% from 2026 to 2036. Increasing regulatory pressure, evolving sustainability mandates, and the growing adoption of renewable raw materials are accelerating demand across multiple end-use industries.

Bio-based…

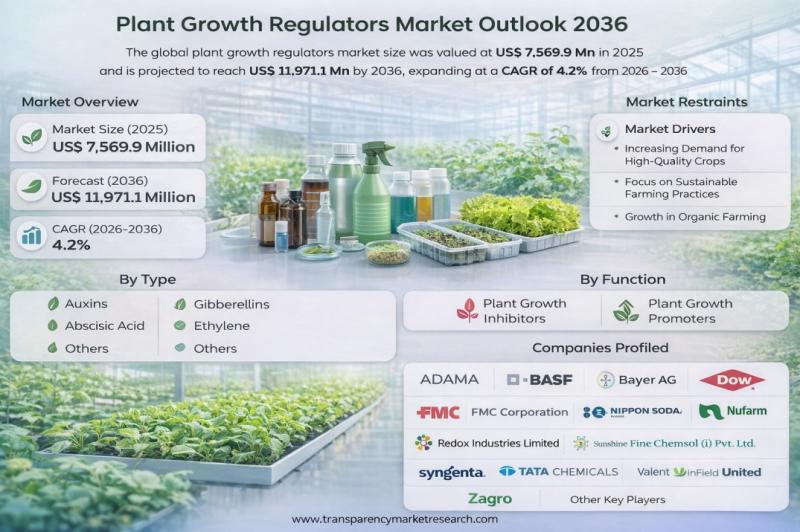

Plant Growth Regulators Market to Reach US$ 11.97 Billion by 2036, Driven by Ris …

The global plant growth regulators market was valued at US$ 7,569.9 Mn in 2025 and is projected to reach US$ 11,971.1 Mn by 2036, expanding at a compound annual growth rate (CAGR) of 4.2% from 2026 to 2036. Market growth is primarily driven by rising pressure to improve agricultural productivity and the rapid expansion of high-value crops and protected cultivation systems worldwide.

Access key findings and insights from our Report in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…