Press release

Insurance Protection Products Market Analysis By Key Players, SWOT Analysis, Growth Factors and Forecast till 2028

As per the study initiated by Evolve Business Intelligence, the global Insurance Protection Products Market is expected to reach $XX Billion by 2028 growing at a CAGR of 10.21% from 2021 to 2028.Get Free Exclusive Sample PDF of the report: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=005581

COVID-19 scenario:

• The temporary lockdown and restriction have led to supply chain disruption, presenting import and export challenges across different sectors.

• The companies operating in the Insurance Protection Products market have been positively impacted due to the COVID-19 pandemic resulted in an increase in the growth of the market for 2020 and 2021.

The major factor that have impacted the growth of the market includes Increasing insurance policy benefit and Chronic diseases are becoming more common, among others.

Insurance firms have indeed begun to provide insurance in other areas such as individual health insurance, private health insurance, maternity, and personal accident insurance cover, which is projected to fuel market expansion.

Regional Analysis

The United States holds the largest share in the global market in insurance products. The growth of the regional market will be driven by an increase in chronic disease prevalence and governmental insurance policy regulations. During the forecast period, Latin America is expected to see significant market growth.

IMP NOTE: All our reports will be updated considering the impact of the COVID-19 scenario before delivery.

The global Insurance Protection Products market provides an in-depth analysis of key players which includes:

• Allianz

• Aviva

• Prudential

• AXA

• Covea Insurance

• Metlife Inc

• China Life Insurance Company

• United Health Group Incorporated

• Aegon Life Insurance Company

• Sun Life Financial

The global Insurance Protection Products Market is segmented based on Type, and Distribution Channel. Based on type, the market is segmented as life insurance, critical issues insurance, income protection insurance, term insurance, long term care insurance, others and based on the distribution channel, the market is analyzed on Direct And Indirect.

For Any Query or Customization, Ask Our Industry Experts@ https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=005581

Key Region/ Countries Covered

• North America (US, Canada, Mexico)

• Europe (Germany, U.K., France, Italy, Russia, Rest of Europe)

• Asia-Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

• Rest of the World (the Middle East & Africa and South America)

Key Questioned Answered Through The Report:

• The Impact of COVID-19 on the global market

• What are the potential opportunities for new entrants in the global market

• What is the market Size and Forecast from 2020 to 2028?

• Key Players associated with the global Insurance Protection Products Market

• Value Chain Analysis of Global Insurance Protection Products Market

• What is the CAGR of the global Insurance Protection Products Market from 2021 to 2028

• Major Growth Factor, Challenges, Trends, and Opportunities in the global market

• Key outcomes of SWOT Analysis

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

NH 48, Balitha, Gujarat,

India

Contact: +1 773 644 5507 / +91 635 396 3987

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging the pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool – EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune’s global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Protection Products Market Analysis By Key Players, SWOT Analysis, Growth Factors and Forecast till 2028 here

News-ID: 2458572 • Views: …

More Releases from Evolve Business Intelligence

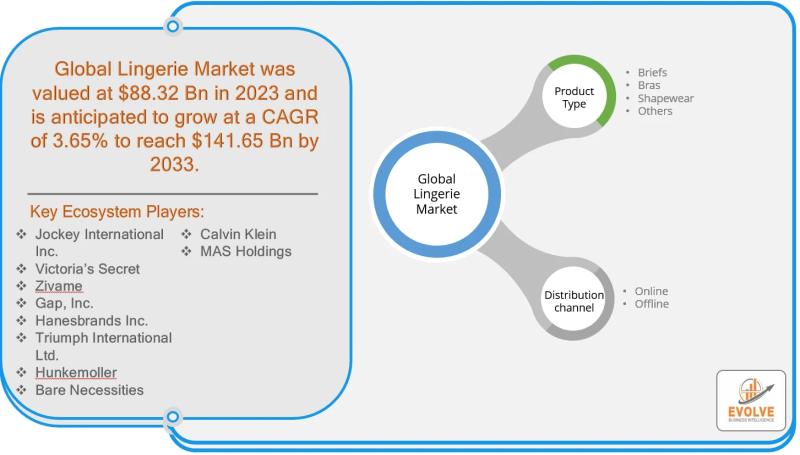

Lingerie Market Forecast to Reach USD 141.65 Billion by 2033

The global lingerie market is an expansive and dynamic industry, projected to reach a value of USD 141.65 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 6.14% from 2023 to 2033. Within this market, the shapewear segment presents a significant opportunity for growth and innovation.

Driven by a growing emphasis on body positivity and inclusivity, consumers are increasingly seeking out products that offer comfort, style, and confidence.…

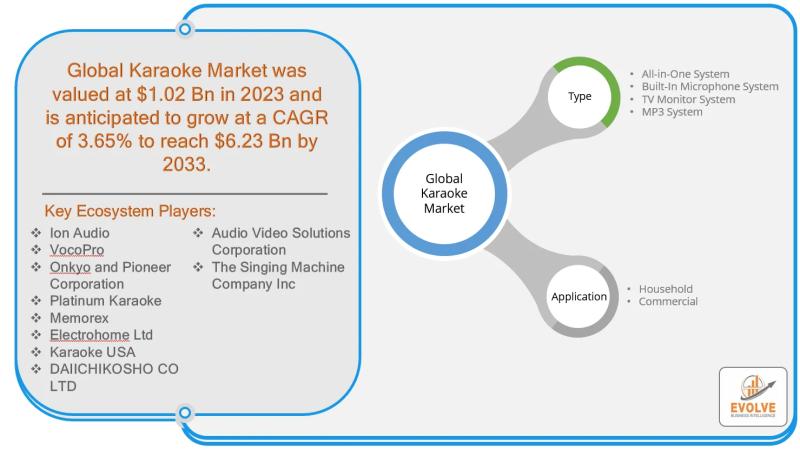

Karaoke Market Forecast to Reach USD 6.23 Billion by 2033

The global karaoke market is on a trajectory of significant growth, with projections from Evolve Business Intelligence indicating it will reach a valuation of USD 6.23 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 3.65% from 2023. This growth is driven by a combination of factors, including increasing disposable income, a strong cultural presence in regions like North America and Asia-Pacific, and an ever-evolving market that…

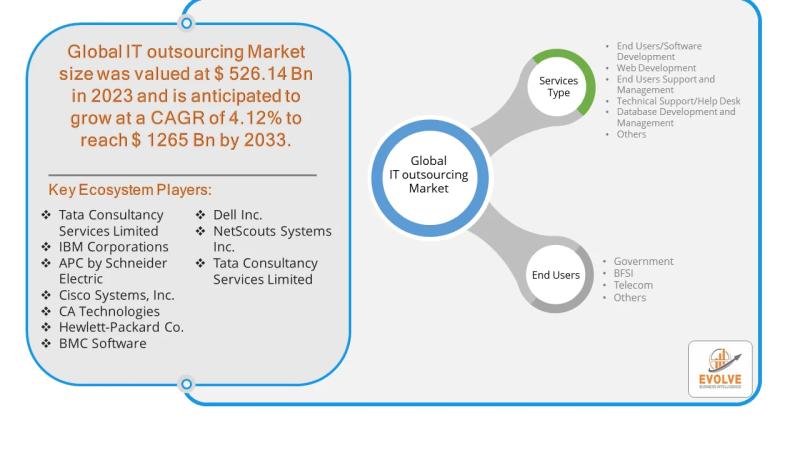

IT Outsourcing Market Forecast to Reach USD 1,265 Billion by 2033

The global IT outsourcing market is a significant and growing sector, driven by businesses seeking to cut costs, access specialized talent, and improve efficiency. Amid this growth, web development stands out as a high-opportunity area for several reasons. The demand for digital transformation, including the creation of new websites, e-commerce platforms, and web applications, is a constant for companies across all industries. This creates a continuous need for skilled developers,…

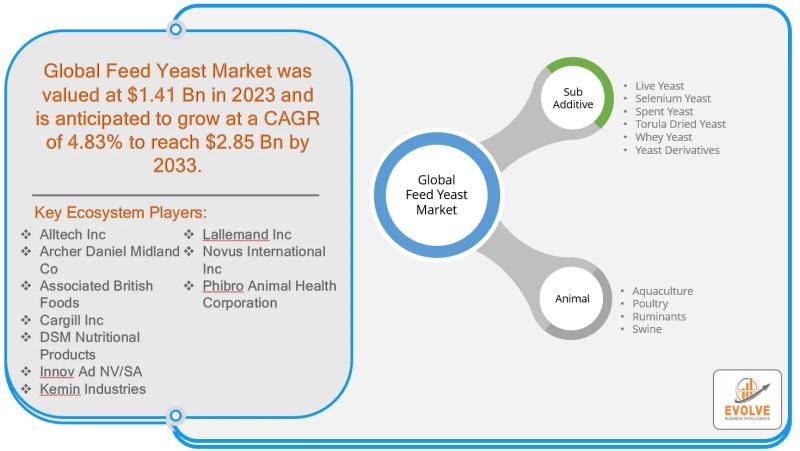

Feed Yeast Market Forecast to Reach USD 2.85 Billion by 2033

The Feed Yeast Market is experiencing significant growth, with a forecast to reach USD 2.85 Billion by 2033, a substantial increase from USD 1.41 Billion in 2023, at a Compound Annual Growth Rate (CAGR) of 4.83%. This expansion is largely fueled by the rising global demand for animal protein, which in turn drives the need for high-quality, nutritious feed additives like feed yeast. Yeast derivatives, as a key sub-additive, stand…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…