Press release

Mobile Digital Banking Market to Eyewitness Massive Growth by 2026 | Kony, Backbase, Technisys

Global Mobile Digital Banking Market Status, Trends and COVID-19 Impact Report 2021 is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Mobile Digital Banking Market. Some of the key players profiled in the study are Kony, Backbase, Technisys, Infosys, Digiliti Money, Innofis, Mobilearth, D3 Banking Technology, Alkami, Q2, Misys, SAP & ?Mobile Digital BankingMarket Scope and Market Breakdown.Get free access to sample report @ https://www.htfmarketreport.com/sample-report/3567771-global-mobile-digital-banking-market-6

Mobile Digital Banking Market Overview:

The study provides comprehensive outlook vital to keep market knowledge up to date segmented by on, Retail Digital Banking, SME Digital Banking, Corporate Digital Banking, Channel, By Channels, Market has been segmented into, Direct Sales, Distribution Channel, Regional & Country Analysis, North America Country (United States, Canada), South America (Brazil, Argentina, Peru, Chile, Rest of South America), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, Malaysia, Indonesia, Philippines, Thailand, Vietnam, Others), Europe (Germany, United Kingdom, France, Italy, Spain, Switzerland, Netherlands, Austria, Sweden, Norway, Belgium, Rest of Europe) & Rest of World [United Arab Emirates, Saudi Arabia (KSA), South Africa, Egypt, Turkey, Israel, Others], , BaaS (Banking as a Service), BaaP (Banking as a Platform) & Cloud-Based and 18+ countries across the globe along with insights on emerging & major players. If you want to analyse different companies involved in the Mobile Digital Banking industry according to your targeted objective or geography we offer customization according to requirements.

Mobile Digital Banking Market: Demand Analysis & Opportunity Outlook 2026

Mobile Digital Banking research study defines market size of various segments & countries by historical years and forecast the values for next 6 years. The report is assembled to comprise qualitative and quantitative elements of Mobile Digital Banking industry including: market share, market size (value and volume 2015-2020, and forecast to 2026) that admires each country concerned in the competitive marketplace. Further, the study also caters and provides in-depth statistics about the crucial elements of Mobile Digital Banking which includes drivers & restraining factors that helps estimate future growth outlook of the market.

The segments and sub-section of Mobile Digital Banking market is shown below:

The Study is segmented by following Product/Service Type: , BaaS (Banking as a Service), BaaP (Banking as a Platform) & Cloud-Based

Major applications/end-users industry are as follows: on, Retail Digital Banking, SME Digital Banking, Corporate Digital Banking, Channel, By Channels, Market has been segmented into, Direct Sales, Distribution Channel, Regional & Country Analysis, North America Country (United States, Canada), South America (Brazil, Argentina, Peru, Chile, Rest of South America), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, Malaysia, Indonesia, Philippines, Thailand, Vietnam, Others), Europe (Germany, United Kingdom, France, Italy, Spain, Switzerland, Netherlands, Austria, Sweden, Norway, Belgium, Rest of Europe) & Rest of World [United Arab Emirates, Saudi Arabia (KSA), South Africa, Egypt, Turkey, Israel, Others]

Some of the key players involved in the Market are: Kony, Backbase, Technisys, Infosys, Digiliti Money, Innofis, Mobilearth, D3 Banking Technology, Alkami, Q2, Misys, SAP & ?Mobile Digital BankingMarket Scope and Market Breakdown

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/3567771-global-mobile-digital-banking-market-6

Important years considered in the Mobile Digital Banking study:

Historical year – 2015-2020; Base year – 2020; Forecast period** – 2021 to 2026 [** unless otherwise stated]

If opting for the Global version of Mobile Digital Banking Market; then below country analysis would be included:

• North America (USA, Canada and Mexico)

• Europe (Germany, France, the United Kingdom, Netherlands, Italy, Nordic Nations, Spain, Switzerland and Rest of Europe)

• Asia-Pacific (China, Japan, Australia, New Zealand, South Korea, India, Southeast Asia and Rest of APAC)

• South America (Brazil, Argentina, Chile, Colombia, Rest of countries etc.)

• Middle East and Africa (Saudi Arabia, United Arab Emirates, Israel, Egypt, Turkey, Nigeria, South Africa, Rest of MEA)

Buy Mobile Digital Banking research report @ https://www.htfmarketreport.com/buy-now?format=1&report=3567771

Key Questions Answered with this Study

1) What makes Mobile Digital Banking Market feasible for long term investment?

2) Know value chain areas where players can create value?

3) Teritorry that may see steep rise in CAGR & Y-O-Y growth?

4) What geographic region would have better demand for product/services?

5) What opportunity emerging territory would offer to established and new entrants in Mobile Digital Banking market?

6) Risk side analysis connected with service providers?

7) How influencing factors driving the demand of Mobile Digital Banking in next few years?

8) What is the impact analysis of various factors in the Global Mobile Digital Banking market growth?

9) What strategies of big players help them acquire share in mature market?

10) How Technology and Customer-Centric Innovation is bringing big Change in Mobile Digital Banking Market?

Browse Executive Summary and Complete Table of Content @ https://www.htfmarketreport.com/reports/3567771-global-mobile-digital-banking-market-6

There are 15 Chapters to display the Global Mobile Digital Banking Market

Chapter 1, Overview to describe Definition, Specifications and Classification of Global Mobile Digital Banking market, Applications [on, Retail Digital Banking, SME Digital Banking, Corporate Digital Banking, Channel, By Channels, Market has been segmented into, Direct Sales, Distribution Channel, Regional & Country Analysis, North America Country (United States, Canada), South America (Brazil, Argentina, Peru, Chile, Rest of South America), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, Malaysia, Indonesia, Philippines, Thailand, Vietnam, Others), Europe (Germany, United Kingdom, France, Italy, Spain, Switzerland, Netherlands, Austria, Sweden, Norway, Belgium, Rest of Europe) & Rest of World [United Arab Emirates, Saudi Arabia (KSA), South Africa, Egypt, Turkey, Israel, Others]], Market Segment by Types , BaaS (Banking as a Service), BaaP (Banking as a Platform) & Cloud-Based;

Chapter 2, objective of the study.

Chapter 3, Research methodology, measures, assumptions and analytical tools

Chapter 4 and 5, Global Mobile Digital Banking Market Trend Analysis, Drivers, Challenges by consumer behaviour, Marketing Channels, Value Chain Analysis

Chapter 6 and 7, to show the Mobile Digital Banking Market Analysis, segmentation analysis, characteristics;

Chapter 8 and 9, to show Five forces (bargaining Power of buyers/suppliers), Threats to new entrants and market condition;

Chapter 10 and 11, to show analysis by regional segmentation [North America, Europe, Asia-Pacific etc], comparison, leading countries and opportunities; Customer Behaviour

Chapter 12, to identify major decision framework accumulated through Industry experts and strategic decision makers;

Chapter 13 and 14, about competition landscape (classification and Market Ranking)

Chapter 15, deals with Global Mobile Digital Banking Market sales channel, research findings and conclusion, appendix and data source.

Thanks for showing interest in Mobile Digital Banking Industry Research Publication; you can also get individual chapter wise section or region wise report version like North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc

Contact US:

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Digital Banking Market to Eyewitness Massive Growth by 2026 | Kony, Backbase, Technisys here

News-ID: 2421697 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Fashion Backpack Market Future Growth & Size Projection

The latest study released on the Global Fashion Backpack Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fashion Backpack study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Ecommerce Platform Market - Global Growth Opportunities 2020-2033

The latest study released on the Global Ecommerce Platform Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Ecommerce Platform study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

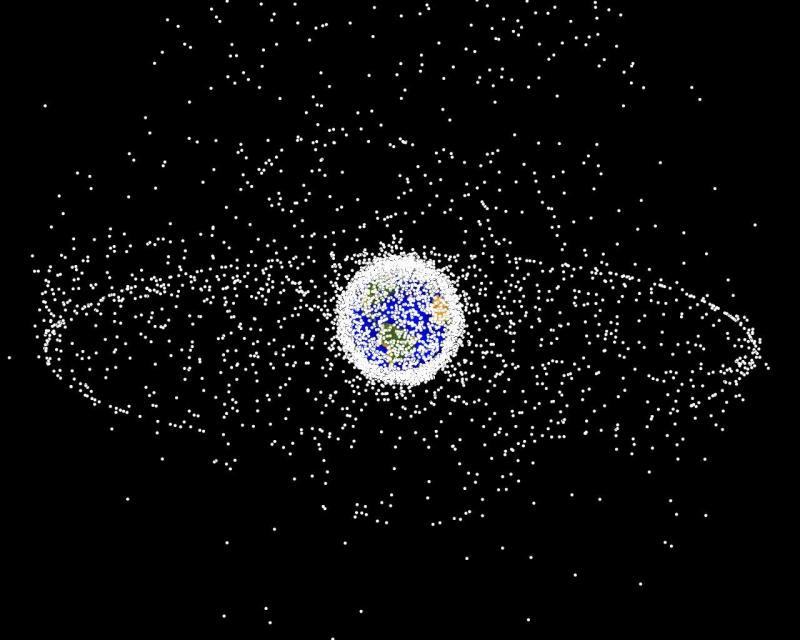

Space Debris Solutions Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Space Debris Solutions Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Space Debris Solutions study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Baby Buggy Market to Witness Unprecedented Growth by 2033

The latest analysis of the worldwide Baby Buggy market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Baby Buggy market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report Include:

Graco, Chicco, Britax, UPPAbaby,…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…