Press release

India Payment Services Market, Industry, Market Revenue, Market Sales, Market Shares, Market Major Players, Market Growth and Analysis, Market Forecast & Outlook: Ken Research

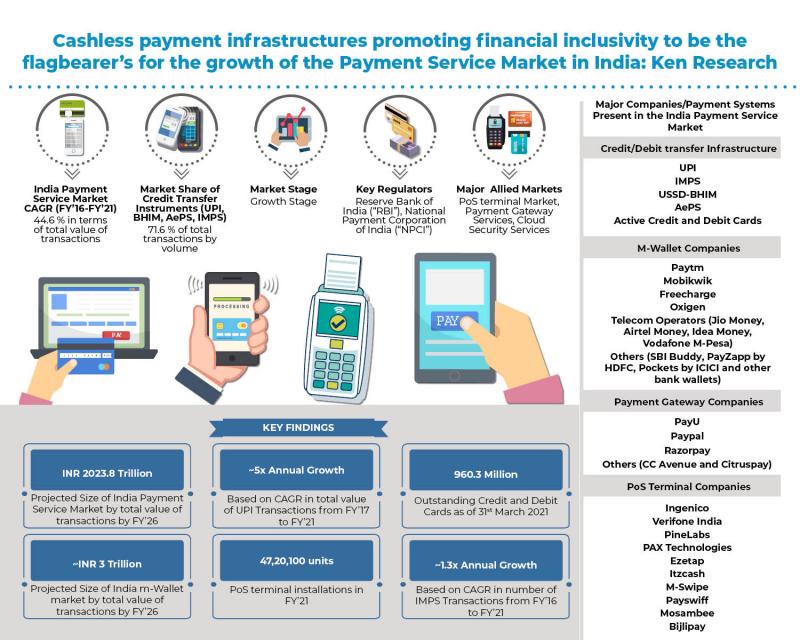

Overview of India Payment Service MarketIndia payment services market, which has traditionally been dominated by cash, witnessed advancement towards digital transactions both in terms of value and volume during the demonetization phase in India. The total market size for the India Payment service market has raised from INR ~ trillion in FY’16 to INR ~ trillion in FY21, during the review period. Regulatory authorities such as the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) play a major role in establishing guidelines for effective working within India’s payments landscape. In India, merchant payments were observed to be the central aspect of all payment services for large enterprises as well as MSMEs.

In addition to this, emergence of consumer mobile wallets in India, and UPI, especially for retail transactions has helped consumers with person-to-person funds transfer, therefore facilitating small value transactions. Surge in growth of electronic payments in India, along with rising E-commerce and M-commerce transactions are further expected to give a boost to numerous entities including payment gateway service providers and payment aggregators that facilitate online payments in the country. Besides all these advancements, cash still dominates the entire payment landscape in India and is further expected to hold a majority share in future.

India Payment Market Segmentation

The advent of innovative electronic payment systems that leverage on technology which can be used through internet and mobile, has led to electronic payment systems dominating the retail payment space with around ~% share in terms of volume and ~% share in terms of value during the FY’20. Increased mobile and internet penetration in the country has resulted in significant shift towards use of mobile / internet based payment systems for effecting payments for purchase of goods and services. Credit transfers from payment methods such as UPI, AePS, ABPS, IMPS have the highest share (~%) among modes of payment in India payment service market, followed by Card Payments, which constitute ~% of the total market.

Indian Payment Service Market Future Outlook and Projections, FY’21-FY’26

The India Payment Service Market is expected to grow at a CAGR of till 2026, reaching a market size of INR ~ Trillion. Growth in digital payments in India will be driven by multiple factors such as the launch of new and innovative payment products, increase demand for cashless transaction due to Covid19, increasing smartphone adoption, a growing need for faster payment modes, and a strong push from the Government and regulators towards adoption of digital channels.

For More Information, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-payment-services-market-outlook-to-2026/472829-93.html

The digital payment ecosystem will flourish with continuous efforts from the Government, regulators and payment companies to increase awareness and trust. We believe that the future success of digital payments will be driven mainly by the factors such as overlay services, contextual payments, offline payments, invisible payments, etc.

Role of Regulatory Authorities (RBI, NPCI) in the Indian Payment Service Market

Reserve Bank of India

The PSS Act along with the Payment and Settlement System Regulations, 2008 underlines the role of RBI as the sole regulator to oversee the payments market and no other person or entity can operate a payment system in India unless authorized by RBI. RBI has been instrumental in supporting the government's digitalization narrative, be it setting up of NPCI for managing digital payments in the retail sector or strengthening the bank's infrastructure for technological driven operations.

National Payment Corporation of India

NPCI, the brainchild of RBI and Indian Banks' Association (IBA), has revolutionized the retail payment system since its incorporation. By launching services and platforms to transform the Indian digital payment ecosystem, NPCI has proven to be one of the major organizations for the implementation of digital payments in Indian economy.

Snapshot of Credit Card And Debit Card Coverage In India

While the shift towards a more cashless economy is a threat to the credit/debit card market, it has maintained a healthy growth rate attributing to the fact that it is now a staple to opening a bank account in India. Plastic cards for instance, ATM cards, debit and credit cards are now being used by customers as an electronic payment tool, thereby helping in clearing and settling the payment process.

Increasing penetration of credit cards in metro areas coupled with rising usage of RuPay cards in tier 2 and tier 3 cities are some of the driving forces in India consumer payments landscape. In terms of total number of outstanding cards, credit cards were observed to grow at a five year CAGR of ~ % whereas; debit cards grew at a five year CAGR of ~ % during the review period FY’2016-FY’2021.

Unified Payments Interface (UPI) Consumer Payment Landscape

As of August 2021, UPI forms XX% of all retail payment in India. From financial year 2015-21, the domestic retail payment by value on UPI grew at XX% at compound annual growth rate while between 2017 and 2021, the collective payment on all forms of UPI grew at XX% CAGR. The year 2020 set a new record for Unified Payment Interface (UPI) transactions in India. The total UPI transactions in 2020 reached the figure of XX Billion in 2020. In comparison, the total amount of UPI transactions was XX Billion in 2019, a surge of XX% in transaction volume. As of 31st March 2021, there are XX banks available on UPI.

Immediate Payment Service (IMPS) Consumer Payment Landscape

IMPS are a multi-channel system that can be accessed using mobile, ATM, internet banking, bank branches, BCs, etc. Besides banks, the system allows non-bank entities such as PPI issuers to participate and facilitate remittances from wallets to the recipient bank accounts. From FY’14 to FY’21, IMPS transactions have seen a rise of CAGR XX% in terms of value. This has been primarily driven by wide-scale adoption of IMPS, with over XX banks live on IMPS in FY’21, along with the huge number of co-operative banks as the operators helping IMPS to be available to a large chunk of rural population.

Adhaar Enabled Payment System (AePS) Consumer Payment Landscape

Adhaar Enabled Payment System (“AePS”) has been operational since January 2011. It allows online interoperable transactions at Micro-ATM through the BCs of any bank using Adhaar authentication. While Mainline Commercial Banks have the largest share among the institutions live on AePS, Regional Rural banks and Co-operative banks have ~XX% share. This is a common theme among non-internet/non-smartphone payment methods, where rural banks see larger chunks of transactions in the rural and non-metro areas.

Unstructured Supplementary Service Data – Bharat Interface for Money (Ussd-Bhim) Consumer Payment Landscape

With growing mobile density, banks started offering mobile banking services to their customers using the USSD channel through bilateral tieups with individual telecom providers. The rise in USSD-BHIM transactions has been steady in the last few years, with a surge in usage in FY’21 (XX%), which can be attributed to the comparative recovery in FY’21 from the Covid pandemic. The usage of SMS rather than internet has allowed those without access to internet and smart-phones to have access to cashless payment alternative.

Key Segments Covered in India Payment Services Market:-

India Payment Services Market

By Payment Card Usage (Cash Payments and Cash Withdrawals)

By Number of Outstanding Debit Cards (PSU and Private Banks)

By Number of Outstanding Debit Cards: Market Share of Banks (State Bank of India, Bank of Baroda, Paytm Payments Bank, Punjab National Bank, Union Bank of India, Bank of India, Canara Bank, ICICI Bank and others)

By Number of Outstanding Credit Cards (PSU and Private Banks)

By Number of Outstanding Credit Cards: Market Share of Banks (HDFC Bank, State Bank of India, ICICI Bank, Axis Bank, Ratnakar Bank, Citi Bank, Kotak Mahindra Bank, American Express and others)

By Modes of Payment (RTGS, Credit Transfers, Debit Transfers, Direct Debits and Card Payments)

Credit and Debit Card Coverage

By Number of Credit Card Transactions (PoS and ATM)

By Credit Card Transaction Value (PoS and ATM)

By Number of Debit Card Transactions (PoS and ATM)

By Debit Card Transaction Value (PoS and ATM)

By Number of ATMs and PoS Terminals

By Number of Outstanding Cards (Credit and Debit Cards)

Immediate Payment Service (IMPS) Consumer Payment Landscape

By Type of Institution (Small Finance Bank, PSU, Private and Payments Bank, Public and Private Institutions, Regional Rural Bank and Co-operative Banks)

Aadhaar Enabled Payment System (AePS) Consumer Payment Landscape

By Types of Banks: Number of AePS Operator (Mainline Commercial Banks, Regional Rural Banks, Co-operative Banks, Payment Banks and Small Finance Banks)

India PoS Terminal Market

By Number of Terminals (Active and Inactive Terminals)

By Metro and Non-metro cities

By End User Industry (Large Enterprises, SME’s and Micro Merchants)

By Metro and Non-metro cities

Key Target Audience:-

Banks and Financial Institutions

Cash Reconciliation Companies

Payment Aggregators

Payment Network Companies

Payment Interface Companies

M-Wallet Companies

Payment Gateway Companies

PoS Terminal Companies

M-PoS Terminal Companies

Time Period Captured in the Report:-

Historical Period: FY’15-FY’21

Forecast Period: FY’21-FY’26E

Payment Service Companies in India:-

M-Wallet Companies

Paytm

Mobikwik

Freecharge

Oxigen

Telecom Operators (Jio Money, Airtel Money, Idea Money, Vodafone M-Pesa)

Others (SBI Buddy, PayZapp by HDFC, Pockets by ICICI and other bank wallets)

Payment Gateway Companies

PayU

Paypal

Razorpay

Others (CC Avenue and Citruspay)

PoS Terminal Companies

Ingenico

Verifone India

PineLabs

PAX Technologies

Ezetap

Itzcash

M-PoS Companies

M-Swipe

Payswiff

Mosambee

Bijlipay

Key Topics Covered in the Report:-

India Payment Services Market

Regulatory Framework in India Payment Services Market

India Payment Services Market Segmentation

India Payment Services Market Future Outlook and Projections

Credit and Debit Card Coverage

Immediate Payment Service (IMPS) Consumer Payment Landscape

Aadhaar Enabled Payment System (AePS) Consumer Payment Landscape

Unstructured Supplementary Service Data - Bharat Interface for Money (USSD-BHIM) Consumer Payment Landscape

Unified Payments Interface (UPI) Consumer Payment Landscape

Cross Comparison of Different Payment Modes (IMPS, AePS, USSD-BHIM and UPI) in India Payment Services Market

India Bill Payment Market

India Omni-Channel Payments Processing Market

India Bank Reconciliation Software Market

India Digital Payment Market

India Cloud Security Services Market

India Payment Security Services Market

India M-Wallet Market

Market Share of M-Wallet Players in India

Competitive Landscape of India M-Wallet Market

Trends and Developments in India M-Wallet Market

India Payment Gateway Market

India Point of Sale (PoS) Terminal Market

India Point of Sale (PoS) Terminal Competitive Landscape

India Point of Sale (PoS) Terminal Market Segmentation

India Point of Sale (PoS) Terminal Market Future Outlook and Projections

India m-PoS Market

CUG Cards / Prepaid Closed Loop Cards

Cloud / Security Outsourcing in Payments Technology

Government Regulations

Assessment of COVID Impact on Contactless Transactions and POS Terminals

Coverage on OMC Digital Space

For More Information, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-payment-services-market-outlook-to-2026/472829-93.html

Related Reports:-

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/asia-credit-cards-market-outlook/289128-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/global-payment-gateway-market-outlook/263650-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/india-atm-cash-management-market-forecast-2023-/154994-93.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Support@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a research based management consulting company. We provide strategic consultancy to aid clients on critical business perspective: strategy, marketing, organization, operations and technology transformation, advanced analytics, corporate finance, mergers & acquisitions and sustainability across all industries and geographies. We provide business intelligence and operational advisory across 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Some of top consulting companies and Market leaders seek our intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

We currently cater to 300+ sectors with 150,000+ research repository across 196+ countries serving 1000+ clients and have partnered with almost 25+ content aggregators.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Payment Services Market, Industry, Market Revenue, Market Sales, Market Shares, Market Major Players, Market Growth and Analysis, Market Forecast & Outlook: Ken Research here

News-ID: 2409036 • Views: …

More Releases from Ken Research Pvt Ltd

Ken Research Stated Saudi Arabia's Corporate Banking Market to Reach USD 33 Bill …

Comprehensive market analysis outlines growth opportunities, key trends, and strategic imperatives for corporate banking players in the Kingdom's evolving financial landscape.

Delhi, India - February 16, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Corporate Banking Market," revealing that the current market size is valued at USD 33 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven…

Egypt FinTech Micro-Lending Apps Market Surpasses USD 260 million Milestone - La …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in Egypt's rapidly evolving FinTech micro-lending ecosystem.

Delhi, India - January 22, 2026 - Ken Research released its strategic market analysis titled "Egypt FinTech Micro-Lending Apps Market", revealing that the current market size is valued at USD 260 million, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand,…

Increase in cybercrime results in India Digital Forensic Market to rise, with an …

With the rise in digital threats and cybercrimes, India Digital Forensic Market makes successive changes like integration of Artificial Intelligence, and marking its overall growth.

STORY OUTLINE

Using techniques like Data Recovery, Log Analysis and more, India Digital Forensic Market enhances its Computer Forensics.

Upgrades towards Network and Mobile Forensics are improving in cyber threats prevention, marking its increase in efficiency and security.

With the incorporation of Cloud Based services, advanced methods and easy…

Global Health Insurance market is expected to grow at a CAGR of ~6% by 2028: Ken …

Due to recent pandemic of Covid 19 health insurance market has grabbed growth ensuring economic help to comman man for better health care facilities with easy money handling and increasing awareness especially after COVID 19.

STORY OUTLINE

Launch of new policies, mergers, acquisitions and partnerships to propel growth in future

Covid 19 has a huge impact on the health insurance market on Global level.

Factors, which are responsible for the growth, are the higher…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…