Press release

Neurogine rolls out mobile app to address liquidity and financial access issues

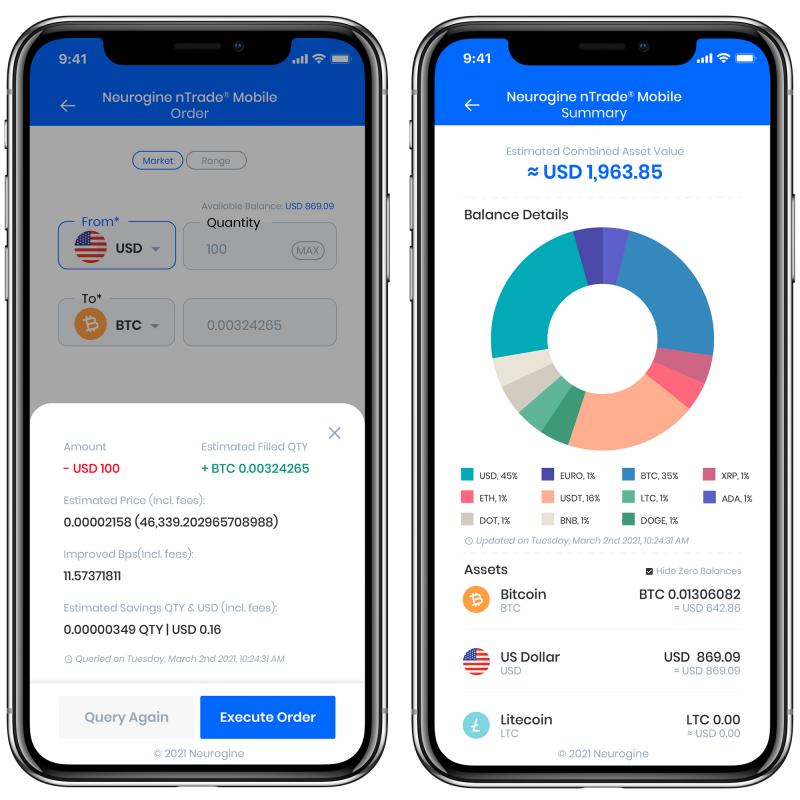

Petaling Jaya, Malaysia, September 28, 2021 – Neurogine Sdn Bhd, the operator of an exciting group of techfins providing mobile banking platform, mobile payment platforms, artificial intelligence (AI)-driven money broking platform and more, has released Neurogine nTrade® Mobile for its corporate and retail users to solve liquidity and financial access issues plaguing the industry.According Neurogine chief executive officer Owen Chen, the Neurogine nTrade® platform is currently experiencing approximately RM2 million per week of transactions. “With the release of a dedicated mobile version of Neurogine nTrade® which offers access anywhere, anytime from any smart device or smartphone, we anticipate both the value and volume of transactions will increase significantly and potentially exceed RM10 million per week,” he said adding Neurogine nTrade® Mobile is now available on Google Play Store and Apple App Store.

”We understand that while the Forex and Securities financial markets are highly established and streamlined, fiat/ digital fiat pairing and transactions are highly fragmented. Furthermore, there are massive price disparities across exchanges, which is caused by existing limitations where every exchange operate in a silo. This effectively limits their offerings and subsequently, rates,” he explained.

A direct route pairing of USD/ETH in Exchange A can have a different value in Exchange B. Subsequently, a multi route, multi pairing approach across multiple exchanges can lead to extremely significant price improvements. Such efforts are resource intensive but a main differentiator in Neurogine nTrade® Mobile lies in its Artificial Intelligence (AI) engine and unique algorithms, which is fully capable to ascertain and mine multiple rates from multiple exchanges at a fraction of a time, then depending on the authority from the user, to lock in those rates or release it.

“It has taken Neurogine two years to refine the platform and about six months to completely develop Neurogine nTrade® Mobile, which is fully engineered and designed by Malaysian talent, unlike others. This is indeed a significant milestone for us and reflect Malaysia’s focus to be an innovation-driven nation,” he said, adding a two-factor authentication (2FA) to verify user identities are used to strengthen access security.

The commercial roll-out of Neurogine nTrade® Mobile has been tasked to Neurogine Capital (L) Ltd, which is fully licensed and regulated by Labuan Financial Services Authority (LFSA) to operate a Labuan Money Broking Business and recently approved to operate a Labuan Payment System Operator (PSO) Business. This offers greater transparency and user protection as two versions are now available.

The corporate version of Neurogine nTrade® Mobile is positioned as a white-label solution for Banks, Financial Institutions and Licensed Money Services Businesses, who can have the application customised and rebranded as their own, with minimal capital expenditure. “We can complete the customised version within three months to help accelerate their digitalisation plans and retain their account holders, while still complying with Know-Your-Customer processes, Customer Due Diligence procedures, anti-money laundering and counter finance terrorism requirements.”

Meanwhile, the retail version of Neurogine nTrade® Mobile is being rolled out to its current users of whom the majority are from USA, UK, Singapore, Cambodia, Thailand and Albania. “We have two new features; micro transactions and price alerts. The first is that the minimal amount for any transaction now starts at USD25 or MYR104. Our micro transactions feature offers a low-risk starter point and responds to numerous requests that we have received. There are no commission or hidden fees and this is very reassuring and attractive to retail users who are beginning their journey in this market. We hope this will contribute towards democratising accessibility to global markets for millions in this region.”

The second is Price Alert. “Users can configure targeted rates for a specific digital asset and receive active alerts when the market reaches the configured targeted rate. The market has been volatile in past months and getting good rates means having to lengthy time monitoring. Many of our users have requested for Price Alert so they can enjoy the rates they seek without having to dedicate so much time to monitoring the markets. This feature gives our users a peace of mind and offers plenty of convenience.”

Neurogine is expanding its direct accessibility from four exchanges to eight exchanges by next March. “The increase in the number of exchanges translates to greater access to a much deeper liquidity pool. We are in the midst of integrating our platform to a fifth exchange and such a direct access will benefit every user on our platform,” he said adding the new exchanges are Huobi, ErisX, Coinbase and BinanceUS. The Neurogine nTrade® platform already has direct access to OKCoin, Liquid, Kraken and Binance since 2019.

“We have also recently introduced the availability of four new digital fiats; ADA, BNB, DOGE and DOT, in addition to BTC, ETH, XRP, LTC and USDT and two fiats; USD and EUR, which cumulatively is the world’s top 10 most attractive across multiple global exchanges. We think it is important and fully support financial innovations and access to new financial services. It moves us closer towards our goal of democratising financial access in this region and in our own way, help ensure a shared digital economy prosperity,” he said.

ADDRESS

Neurogine Capital (L) Ltd

Business Suite 1620, Level 16 (A), Main Office Tower, Labuan Financial Park Complex, Jalan Merdeka, 87000 FT Labuan, Malaysia.

www.ntrade.com.my

ABOUT US

Neurogine Sdn Bhd operates an exciting group of techfins and develops technology for mobile banking, mobile payment, money broking and more to Banks, Financial Institutions, Licensed Money Services Businesses, Corporations and retail users. Neurogine’s flagship technology includes nPay®, a fully integrated mobile payment solution with geo-location conveniences and payment options, nBank®, a full suite of mobile banking platform, nCard®, a Near Field Communication (NFC) and token service payment technology, nTrade®, an AI-driven, multi-routing, multi-pairing money broking platform and more. The Group includes two Labuan licensed companies operating in the domicile of Labuan International Business and Financial Centre with Labuan Financial Services Authority as the regulator. The two are Neurogine Capital (L) Ltd, a licensed Money Broking business and approved Payment System Operator (PSO) and Neurogine DX (L) Ltd, a licensed credit token operator.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neurogine rolls out mobile app to address liquidity and financial access issues here

News-ID: 2408939 • Views: …

More Releases from Neurogine Capital (L) Ltd

High court victory for Neurogine Capital in legal suit against Emas Fintech

Labuan, Malaysia, September 28, 2022: Neurogine Capital (L) Ltd, the developer and operator of Neurogine nTrade®, a money broking platform, has met with success in civil proceedings against Emas Fintech Inc. (Emas Fintech).

According to Neurogine Group Managing Director Chen Chee Peng, the suit (WA-23CY-4-01/2021) was filed in January last year and brought before Judicial Commissioner of the High Court of Kuala Lumpur His Lordship Dr. John Lee Kien How…

Neurogine Capital Takes Legal Action Against Emas Fintech

Labuan, Malaysia, Jan 29, 2021 – Neurogine Capital (L) Ltd, the developer and operator of Neurogine nTrade®, a money broking platform, has commenced civil proceedings against Emas Fintech Inc. (Emas Fintech). According Neurogine Capital managing director Chen Chee Peng, the suit was filed in the High Court of Malaysia in Shah Alam, Selangor earlier this week. Neurogine Capital is represented by its legal counsel, Messrs Anton & Chen.

“Earlier this…

Neurogine terminates relationship with Emas Fintech

Labuan, Malaysia, Dec 16, 2020: Neurogine Capital (L) Ltd, the developer and operator of Neurogine nTrade®, a money broking and trading platform serving financial institutions (FIs) and corporation, has announced terminating relationship with Manila-based Emas Fintech Inc. (EFI), its first corporate customer from Asia.

The termination of relationship took effect December 4, 2020 following a two-week suspension. “We are a Business–to-Business technology service provider to FIs and corporations providing money broking…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…