Press release

Australia Bank Guarantee Market is Projected to Reach $645.71 Million By 2030 | BNP Paribas, Citigroup, Inc., DBS Bank, Deutsche Bank AG

According to a new report published by Allied Market Research, titled, "Australia Bank Guarantee Market by Type (Financial Guarantee and Performance Guarantee), Application (International and Domestic), End User (Exporters and Importers), and Enterprise Size (Small Enterprise, Medium Enterprise, and Large Enterprise): Opportunity Analysis and Industry Forecast, 2021–2030." The report has offered an all-inclusive analysis of the global Australia Bank Guarantee Market taking into consideration all the crucial aspects like growth factors, constraints, market developments, top investment pockets, future prospects, and trends. At the start, the report lays emphasis on the key trends and opportunities that may emerge in the near future and positively impact the overall industry growth.>>Get Complete Report for Better Understanding @ https://www.alliedmarketresearch.com/australia-bank-guarantee-market-A13110

Key drivers that are propelling the growth of the market included in the report. Additionally, challenges and restraining factors that are likely to curb the growth of the market are put forth by the analysts to prepare the manufacturers for future challenges in advance.

The report presents in-depth insights into each of the leading Australia Bank Guarantee end user verticals along with annual forecasts to 2030. The report provides revenue forecast with sales, and sales growth rate of the global Australia Bank Guarantee market. The forecasts are also provided with respect to the product, application, and regional segments of the market. The forecasts are issued to understand the future outlook and prospects of the industry.

>>Download Free [PDF] Sample Copy of This Report @ https://www.alliedmarketresearch.com/request-sample/13475

The market is evaluated based on its regional penetration, explaining the performance of the market in each regional market covering provinces such as North America (United States, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Top 10 leading companies in the global Australia Bank Guarantee market are analyzed in the report along with their business overview, operations, financial analysis, SWOT profile and Australia Bank Guarantee products and services. The key players operating in the global Australia Bank Guarantee industry include Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, Citigroup, Inc., DBS Bank, Deutsche Bank AG, HSBC Holdings PLC, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., Standard Chartered PLC, and United Overseas Bank Limited (UOB).

Latest news and industry developments in terms of market expansions, acquisitions, growth strategies, joint ventures and collaborations, product launches, market expansions etc. are included in the report.

>>Get Detailed COVID-19 Impact Analysis on the Australia Bank Guarantee Market @ https://www.alliedmarketresearch.com/request-for-customization/13475?reqfor=covid

Key Benefits:

♦ The report provides a qualitative and quantitative analysis of the current Australia Bank Guarantee market trends, forecasts, and market size from 2021-2030 determine the prevailing opportunities.

♦ Porter’s Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make strategic business decisions and determine the level of competition in the industry.

♦ Top impacting factors & major investment pockets are highlighted in the research.

♦ The major countries in each region are analyzed and their revenue contribution is mentioned.

♦ The market report also provides an understanding of the current position of the market players active in the Australia Bank Guarantee industry.

>>If You Have Any Query or Customization of Australia Bank Guarantee Market Report, Visit @ https://www.alliedmarketresearch.com/connect-to-analyst/13475

Highlights of the Report:

♦ Competitive landscape of the Australia Bank Guarantee Market.

♦ Revenue generated by each segment of the Australia Bank Guarantee market by 2030.

♦ Factors expected to drive and create new opportunities in the Australia Bank Guarantee industry.

♦ Strategies to gain sustainable growth of the market.

♦ Region that would create lucrative business opportunities during the forecast period.

♦ Top impacting factors of the Australia Bank Guarantee market.

Australia Bank Guarantee Market Key Segments

By Type

➢ Financial Guarantee

➢ Performance Guarantee

By Application

➢ International

➢ Domestic

By End User

➢ Exporters

➢ Importers

By Enterprise Size

➢ Small Enterprises

➢ Medium Enterprises

➢ Large Enterprises

Contact:

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on LinkedIn: https://www.linkedin.com/company/allied-market-research

About Us

Allied Market Research (AMR) is a market research and business-consulting firm of Allied Analytics LLP, based in Portland, Oregon. AMR offers market research reports, business solutions, consulting services, and insights on markets across 11 industry verticals. Adopting extensive research methodologies, AMR is instrumental in helping its clients to make strategic business decisions and achieve sustainable growth in their market domains. We are equipped with skilled analysts and experts, and have a wide experience of working with many Fortune 500 companies and small & medium enterprises.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Bank Guarantee Market is Projected to Reach $645.71 Million By 2030 | BNP Paribas, Citigroup, Inc., DBS Bank, Deutsche Bank AG here

News-ID: 2403211 • Views: …

More Releases from Allied Market Research

Mortar Ammunition Market Demand, Growth Opportunities, Analysis by Top Key Playe …

Mortar ammunitions are stealth, robust and modern devices that can launch to a counter at short and low nearing activities. Modern-age mortars are light in weight and portable in nature. These ammunitions generally come in two types: fin-stabilized and spin-stabilized. Fin-Stabilized projectiles obtain stability through use of fins located at the aft of projectile. Spin-stabilized projectile technology has been used for aerodynamic stabilization. Glided path is auto-tracked and spinning creates…

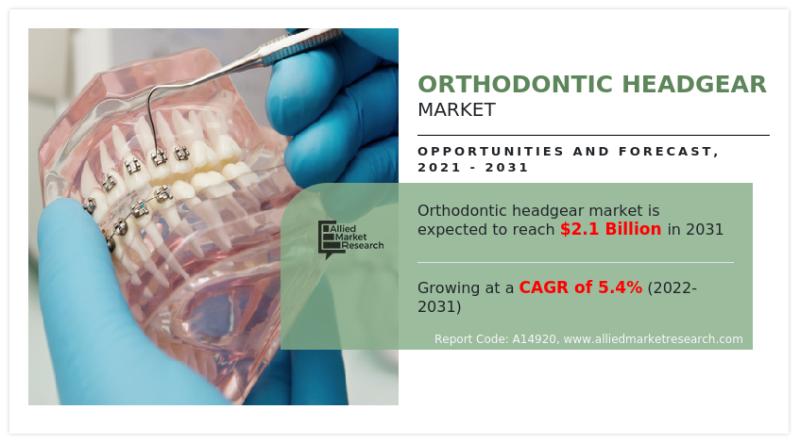

Orthodontic Headgear Market is Projected to Reach $2,094.00 Million by 2031, Gro …

The Orthodontic Headgear Market is a dynamic and integral segment of the orthodontic industry, playing a pivotal role in the correction of malocclusions and the alignment of teeth. Orthodontic headgear is a crucial orthodontic appliance used to address a wide range of dental and skeletal irregularities, such as overbites, underbites, and spacing issues. This market is witnessing substantial growth as orthodontic treatments become increasingly popular for both functional and cosmetic…

Olive Oil Market Analysis, Size, Growth, Trends, Segmentation, Opportunity and F …

The global olive oil industry was valued at $18,552.6 million in 2022, and is projected to reach $30,196.4 million by 2032, registering a CAGR of 5.2% from 2023 to 2032.

The olive oil market has experienced significant growth driven by several prime determinants. The increase in awareness and adoption of healthier lifestyles have led consumers to seek alternatives to traditional cooking oils, with olive oil being recognized for its numerous health…

Hotel Toiletries Market Revenue is expected to Surpass $50.5 billion by 2031

The hotel toiletries market was valued at $17.9 billion in 2021, and is estimated to reach $50.5 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/75060

There is a greater demand for hotel toiletries with the growth of the tourism industry and the rise in international travel. Improved transportation, economic growth, globalization, technology advancements, and other initiatives have…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…