Press release

Insurance Third Party Administrator Market 2021 Growth Drivers, Regional Outlook, Competitive Strategies and Forecast up to 2027 | Charles Taylor, CORVEL, CRAWFORD & COMPANY

Allied Market Research published a new report, titled, "Insurance Third Party Administrator Market by Service Type (Claims Management, Policy Management, Commission Management, and Others), End User (Life & Health Insurance [Diseases Insurance and Medical Insurance] and Property & Casualty (P&C) Insurance), and Enterprise Size (Large Enterprises and Small & Medium-sized Enterprises): Global Opportunity Analysis and Industry Forecast, 2021–2030:"The latest study on the Global insurance third party administrator Market covers a broad range of organizations from different regions. It offers an extensive information based on market growths, competitions, and challenges confronted by the industry players. With this, the report also involves the major market strategies followed by the market players, key market determinants, and recent trends that helps the industry to expand furthermore. The report offers comprehensive data from 2014 to 2021 and forecasted data till 2027 along with product outline and other growth factors.

Download Research Sample with Industry Insights (200+ Pages PDF Report) @ https://www.alliedmarketresearch.com/request-sample/12907

Insurance third party administrator Market Competitive Analysis

Leading market players profiled in the market report include Charles Taylor, CORVEL, CRAWFORD & COMPANY, ESIS, ExlService Holdings, Inc., GALLAGHER BASSETT SERVICES, INC., Helmsman Management Services LLC, Meritain Health, SEDGWICK, and United HealthCare Services, Inc. These players have adopted various strategies including expansions, mergers & acquisitions, joint ventures, new product launches, and collaborations to reinforce their position in the industry.

Covid-19 Impact on the Global Insurance third party administrator Market

Insurance third party administrator Market Research Report includes an outline of the industry based on major parameters including market size, sales, sales analysis and key drivers. The market size is expected to grow on a large scale during the forecast period (2021-2027). This report also offers the latest impacts of COVID-19 on the market. The outbreak of the pandemic has affected numerous aspects of life across the globe. This, in turn, has urged the markets to adopt new norms, trends, and strategies. Essentially, the research report intends to provide a view of initial and future assessments of the market.

Get detailed COVID-19 impact analysis on the Insurance third party administrator Market @ https://www.alliedmarketresearch.com/request-for-customization/12907?reqfor=covid

Insurance third party administrator Market Segmentation

By Service Type

• Claims Management

• Policy Management

• Commission Management

• Others

By End User

• Life & Health Insurance

• Diseases Insurance

• Medical Insurance

• Senior Citizens

• Adult

• Minors

• Property & Casualty (P&C) Insurance

By Enterprise Size

• Large Enterprises

• Small & Medium-sized Enterprises

Our Report Provides

• Thorough inquiry of market assessments for all the segments

• Detailed market examination from the viewpoint of the frontrunners in the industry

• Tactical slants and approaches incorporated by new entrants

• Insurance third party administrator Market forecasts on regional base for the next few years

• Competitive exploration of the present market trends

• Profiling of companies along with their exclusive strategies

Insurance third party administrator Market Regional Analysis

The market is studied across different regions including North America (United States, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, and Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa). The report includes competitive scenarios in the regions. These insights help the market players to improve strategies and create new opportunities to accomplish exceptional results.

Key Benefits For Stakeholders

• This study consists analytical representation of the present trends and forthcoming estimations of the insurance third party administrator Market to exhibit the imminent investment pockets.

• The report offers overall potential to recognise the lucrative trends to achieve a stronger base in the insurance third party administrator Market.

• The insurance third party administrator Market analysis report provides statistics based on drivers, restrains, and opportunities along with a detailed impact analysis.

• The current market forecast is quantitatively examined from 2021 to 2027 to target the financial capability.

• Porter’s five forces analysis demonstrates the strength of the consumers and suppliers in the industry.

Get Up to 25% Discount on Purchase: https://www.alliedmarketresearch.com/purchase-enquiry/12907

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web:https://www.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Third Party Administrator Market 2021 Growth Drivers, Regional Outlook, Competitive Strategies and Forecast up to 2027 | Charles Taylor, CORVEL, CRAWFORD & COMPANY here

News-ID: 2400760 • Views: …

More Releases from Allied Market Research

Renal Denervation Market to Exceed USD $4.5 Billion by 2030 | Allied Market Rese …

Renal denervation is a medical procedure that uses radiofrequency ablation or other methods to disrupt the activity of nerves that surround the kidneys. These nerves are part of the sympathetic nervous system, which controls various bodily functions, including blood pressure regulation. During renal denervation, upper chamber and lower chamber of the heart beat irregularly, chaotically, and out of sync, which can cause shortness of breath, chest pain, weakness, lightheadedness, or…

The Booming Surgical Equipment Market Is Projected to Reach $59 Billion by 2032

Allied Market Research recently said the surgical equipment industry has been growing steadily in recent years, driven by advances in technology, increasing demand for minimally invasive surgeries, and rising healthcare expenditures. The global surgical equipment market size was valued at $35.6 billion in 2022, and is projected to reach $59 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. Surgical equipment refers to the various tools,…

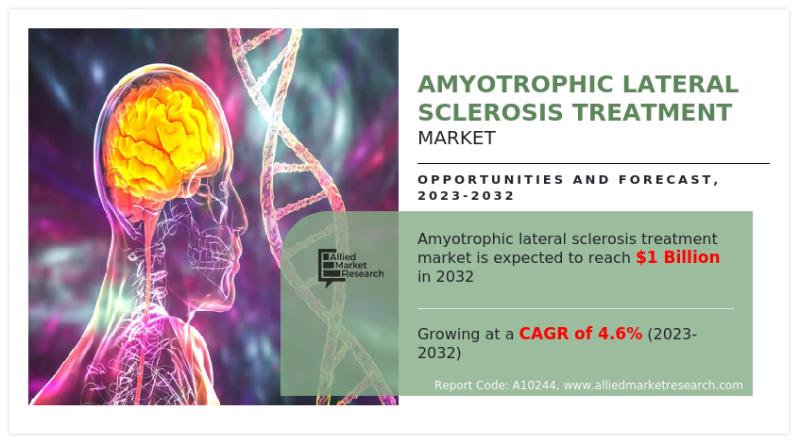

ALS Treatment Market to Reach US$ 1.04 Billion by 2032, Growing at 4.6% CAGR

The global amyotrophic lateral sclerosis (ALS) treatment market is entering a critical phase of growth as unmet therapeutic needs and research momentum converge. Current figures indicate a market value of US$ 662.3 million in 2022, with a projected increase to US$ 1,038.94 million by 2032, which equates to a CAGR of 4.6% from 2023 to 2032. ALS is a severe neurodegenerative disease affecting nerve cells in the brain and spinal…

Aircraft Engine Forging Market to Garner $5 Billion, Globally, By 2032 At 6.9% C …

Aircraft engine forging industry size was valued at $2.6 billion in 2022, and is estimated to garner $5 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

The demand for lightweight materials, such as titanium, aluminum, and advanced alloys, aimed at improving fuel efficiency and overall performance of aircraft engines. Moreover, there is surge in air travel demand that led airlines to expand their fleets, necessitating the…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…