Press release

Growing Demand for Automotive Lubricants Aftermarket to Significantly Increase Revenues Through 2029

Automotive Lubricants Aftermarket : SnapshotA lubricant is a substance that is used to reduce friction and control wear between surfaces that are in contact with a relative motion. Automotive lubricants sold in the aftermarket are required for maintenance and smooth operation of vehicles after their purchase. Typically, a lubricant consists of approximately 80% to 90% base oil, and the rest is additives. However, these percentages vary according to application. Characteristics of a good lubricant include high boiling point, high viscosity index, corrosion retardation, thermal stability, low freezing point, and resistance to oxidation. Lubricants are used for their ability to increase the operating lifespan of mechanical parts. They can also eliminate any residue deposited over mechanical parts. Additives are added to the base oil to impart various properties to the lubricant and improve its performance. Lubricant additives are inorganic and organic compounds that are dissolved or suspended as solids in lubricants or base oils. in terms of type, the automotive lubricants aftermarket can be classified into engine oil, gear oil, transmission fluid, and others (including brake oil, greases, coolants, etc.). Aftermarket customers require lubricant suppliers to help them reduce their total operating cost. For instance, extended oil drain intervals help fleet owners to reduce their operating and maintenance cost, primarily by keeping cars and trucks on road for a longer duration of time. The type and quality of the lubricants used has a significant bearing on engine performance, fuel economy, and vehicle life. For instance, European cars and trucks have smaller, more fuel efficient and higher performance engines than vehicles in North America and Asia. Better fuel economy in cars can be achieved by reduced engine and gearbox friction, which is achieved by using lower viscosity and friction-modified lubricants.

Request A Sample-https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=41672

World Vehicle Usage

Increase in automotive vehicle fleet has been the main driver of the automotive lubricant aftermarket. The vehicles in operation all over the world require lubricants at frequent time intervals for smoother engine operation and fuel economy. The total global vehicle fleet, including passenger cars and commercial vehicles, stood at 1.28 billion in 2015 and is projected to cross the 2 billion mark by 2035 and 2.5 billion by 2050. Increasing vehicle fleet around the globe is a key indicator of increasing demand for aftermarket automotive lubricants in the near future.

Increasing Sales of New Vehicles

The total number of new vehicle sales stood at 96,804,390 units (including passenger cars and commercial vehicles) in 2017. The rapid increase in sales of vehicle in developing countries and development of infrastructure have created a strong demand for aftermarket automotive lubricants. Increase in manufacturing of vehicles is one of the major factors contributing to the expansion of the global automotive lubricants aftermarket. Rise in demand for low viscosity fluids in the automotive sector is expected to boost the automotive lubricants aftermarket during the forecast period. The engine oil segment dominated the market in 2017 and is expected to expand at a significant rate during the forecast period due to increasing number of vehicles. Engine oil has to be changed frequently after every 5,000 miles to 15,000 miles of vehicle usage depending upon the engine and base oil used. This is expected to boost demand for engine oil. A unique feature of the global automotive aftermarket lubricant industry is that there is no significant slowdown in the consumption of aftermarket lubricants during economic downturns or market slowdowns. For instance, when vehicle sales go up, there is more consumption of lubricants, whereas even if new vehicle sales go down, the running vehicle fleet requires lubricants at frequent time intervals for smoother operation. Oil changes in vehicles become more frequent as they grow old. Therefore, even during unfavorable market conditions, customers have to purchase lubricants in order to maintain the current fleet of vehicles.

REQUEST FOR COVID19 IMPACT ANALYSIS –https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=41672

Impact of Electric Vehicles on Lubricant Demand

In 2015, there were about 1.1 billion light passenger vehicles, of which 0.9% (9.9 million) vehicles were electric, while the rest were internal combustion engine (ICE) vehicles. Out of the total number of light electric vehicles (9.9 million), 0.1% were battery electric vehicles (BEV) and the rest were hybrid electric vehicles (HEV/PHEV). Despite the marginal penetration of electric vehicles, the move toward electrification of automotive vehicles is likely to gain further impetus as electric vehicles help reduce emissions to meet the CAFÉ norms and various emissions norms set across the world. Since battery electric vehicles do not have internal combustion engines, they do not require engine oil. They only consume small amounts of greases and other products. This is expected to hamper demand for light vehicle lubricants in the near future.

Synthetic and Semi-synthetic Oil Paving the Way for Future Automotive Lubricants

Currently, mineral engine oil dominates the global automotive lubricants aftermarket due to its reasonable price. However, the market share of semi-synthetic and synthetic engine oils is likely to increase in near future, due to increased product knowledge and higher awareness among consumers. As modern lightweight vehicle engines are put under enormous stress, automakers worldwide are shifting toward lubricant grades with less viscosity to support achieving higher mandated fuel economy standards and emission requirements. This has led to increasing consumption of synthetic and semi-synthetic lubricants in newer cars, and it presents a significant market opportunity for all the aftermarket service providers. Synthetic engine oils are made with a variety of performance additives and synthetic base oils. Unlike mineral base oils, synthetic base oils are engineered with molecules of uniform shape and size and are optimized to consistently perform better than mineral base oils. Synthetic oils offer many advantages for newer and advanced engines. They don’t break down as easily as mineral oils, which means they protect the engine longer from excessive metal-to-metal contact that causes wear. Synthetic engine oils also function better in extreme hot and cold temperature conditions. They are paving the way for next-generation engine technology. The inclination toward use of lower viscosity oils to achieve newer grades such as 0W-20, 0W-30, and still to come 0W-16 requires the use of synthetics. Automakers are demanding even lower viscosity grade lubricants, for example 0W-8, which is possible only with synthetic formulations.

Japanese cars have used 0W-20 grade lubricants for several years, and their U.S. and European counterparts are now following in their footsteps. When the new ILSAC GF-6 specification becomes active in near future, synthetics are expected to play a more prominent role.

Purchase A Report- https://www.transparencymarketresearch.com/checkout.php?rep_id=41672<ype=S

Market Bound by Emerging Economies in the Aftermath of Global Recession

Consumers in developed and developing regions have different mobility needs. Continued urbanization is likely to lead them toward car ownership. The global lubricants industry has seen a dramatic rebound since the global economic recession of 2008–2009. One of the key drivers of this rebound is higher demand for lubricants from developing economies. This can be ascribed to the surge in new vehicle sales and rise in number of on¬road vehicles in Asia Pacific, Latin America, and Middle East & Africa. Economies of rapidly expanding countries of the market such as China, India, and Brazil are expected to achieve significant growth rates in the near future. This is anticipated to drive the global automotive lubricants aftermarket.

Consolidated market with the top few players accounting for more than 60% of the market share

The global automotive lubricants aftermarket is a highly organized market with top players accounting for majority of market share. Key players operating in the Automotive Lubricants Aftermarket are Royal Dutch Shell plc, ExxonMobil Corporation, BP p.l.c., Chevron Corporation, Total S.A., Sinopec Corporation, Fuchs Lubricants Co., LUKOIL Oil Company, Valvoline, Phillips 66, Bharat Petroleum Corporation Limited, JX Nippon Oil & Energy Corporation, Repsol S.A., Petrobras, Petronas, and Indian Oil Corporation Limited.

Contact

Transparency Market Research

State Tower,

90 State Street,

Suite 700,

Albany NY - 12207

United States

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

bout Us

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through adhoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

TMR believes that unison of solutions for clients-specific problems with right methodology of research is the key to help enterprises reach right decision

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Growing Demand for Automotive Lubricants Aftermarket to Significantly Increase Revenues Through 2029 here

News-ID: 2390737 • Views: …

More Releases from Transparency Market Research

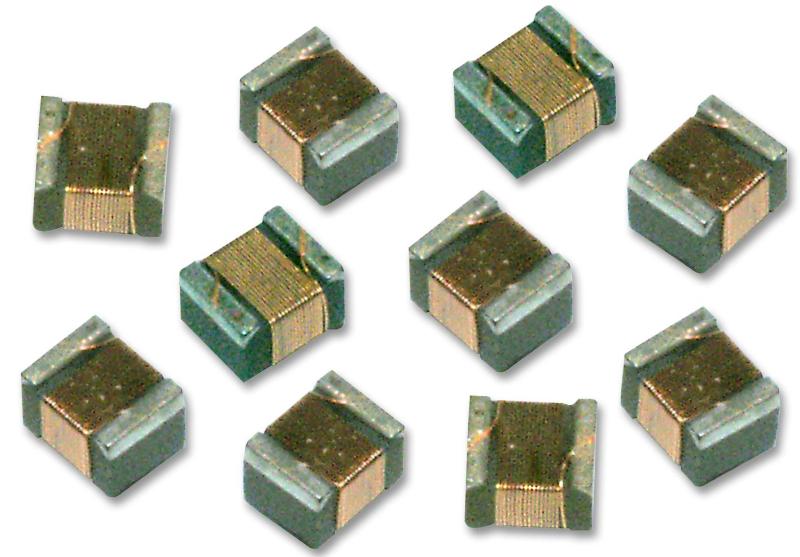

RF Chip Inductor Market Size to Reach over USD 1.8 billion by 2031 - Transparenc …

RF Chip Inductor Market are essential components in various electronic devices, providing inductance and functioning as filters, oscillators, and transformers. They play a crucial role in ensuring the efficiency and performance of RF circuits. With the rapid advancement in telecommunications, consumer electronics, and automotive industries, the demand for RF chip inductors has seen a significant rise. These components are integral in applications such as smartphones, IoT devices, and automotive electronics,…

Solid Tires Market Expected to Witness Impressive Growth at a 8.1% CAGR by 2031

The latest research study released by Transparency Market Research on "Solid Tires Market Forecast to 2023-2031 ″ research provides accurate economic, global, and country-level predictions and analyses.

Solid Tires market is estimated to attain a valuation of US$ 760.0 Mn by the end of 2031, states a study by Transparency Market Research (TMR). Besides, the report notes that the market is prognosticated to expand at a CAGR of 8.1% during…

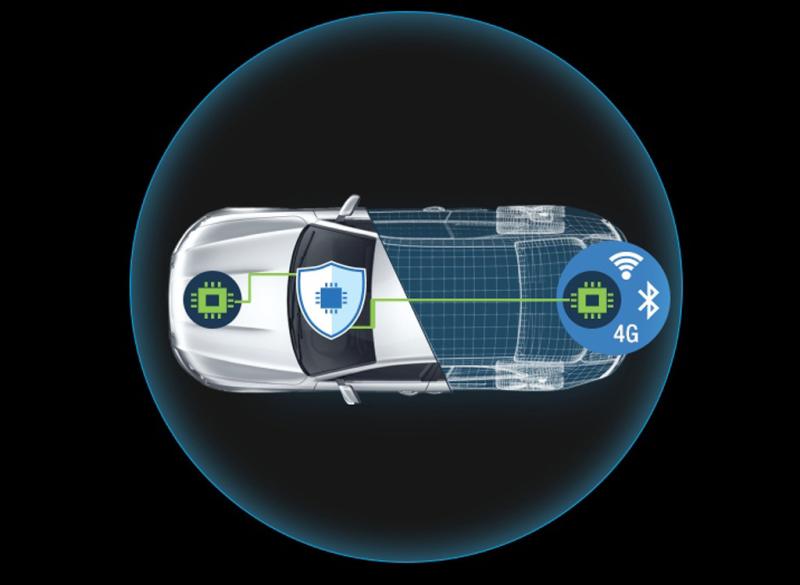

Automotive Cyber security Market Sales Estimated to Hit USD 10.5 Billion by 2031 …

The latest research study released by Transparency Market Research on "𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐂𝐲𝐛𝐞𝐫 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Automotive Cyber security industry, as…

Ready-mix Concrete Market to Witness Exponential Growth with a CAGR of 6.1% from …

The latest research study released by Transparency Market Research on "𝐑𝐞𝐚𝐝𝐲-𝐦𝐢𝐱 𝐂𝐨𝐧𝐜𝐫𝐞𝐭𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Ready-mix Concrete industry, as well as…

More Releases for Lubricant

Food Grade Machinery Lubricant

QY Research Inc. (Global Market Report Research Publisher) announces the release of 2025 latest report "Food Grade Machinery Lubricant- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031". Based on current situation and impact historical analysis (2020-2024) and forecast calculations (2025-2031), this report provides a comprehensive analysis of the global Wire Drawing Dies market, including market size, share, demand, industry development status, and forecasts for the next few…

Agricultural Lubricant Market Report Analysis, Research Studies | Pennine Lubric …

DataM Intelligence has published a new research report on "Agricultural Lubricant Market Size 2024". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Free Sample Research PDF -…

Aerospace Lubricant Market Growing Rapidly by - British Petroleum, Exxon Mobil, …

DataM Intelligence has published a new research report on "Aerospace Lubricant Market Size 2024". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Free Sample Research PDF -…

Agricultural Lubricant Market 2024 Size, Global Report till 2031 | Exxon Mobil C …

A new Report by DataM Intelligence, titled "Agricultural Lubricant Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2031,"" offers a comprehensive analysis of the industry, which comprises insights on the Agricultural Lubricant market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

This report has a complete table of contents, figures, tables, and charts, as well as insightful analysis. The Agricultural Lubricant market has…

Recycled Lubricant Market: Explosive Growth

The report comes out as an intelligent and thorough assessment tool as well as a great resource that will help you to secure a position of strength in the global Recycled Lubricant market. It includes Porter's Five Forces and PESTLE analysis to equip your business with critical information and comparative data about the Global Recycled Lubricant Market. We have provided deep analysis of the vendor landscape to give you a…

Malaysia Automotive Lubricant Market

Automotive Lubricants Market in Malaysia is driven by the Growth in Number of Passenger Vehicles on Road and the rapidly increasing demand for High Performing Lubricants Despite their premium pricing: Ken Research

Increase in income level generally in urban areas contributing towards increasing demand for Passenger Vehicles and a shift in preference to expensive synthetic and semi-synthetic lubricants have driven the market for Automotive Lubricants industry in recent years.

A Significant growth…