Press release

Global IoT in Banking & Financial Services Market : Industry Analysis and Forecast (2021-2027)– by Type, Application, and Region

IoT in Banking & Financial ServicesThe report by Zion Market Research on the Global IoT in Banking & Financial Services Market Research Report Covers, Future Trends, Size, Share, Past, Present Data and Deep Analysis, And Forecast, 2021-2027 market is an indispensable guide for positioning one's business in a highly competitive market landscape. The report is tailored according to our client’s needs and their current foothold in the market. The report is the compilation of analysis and deep assessment of industry experts and associated participants across the value chain.

The top Leading Market Players Covered in this Report are : American Express, Apple Inc., Amazon.com inc., Bank of America, Citibank, Citrus Payment Solutions, Dwolla, MasterCard, Visa, AT&T, Sprint, First Data, BlackBerry, Samsung, Google, Paytm.

FREE : Request Sample is Available @ https://www.zionmarketresearch.com/sample/iot-in-banking-financial-services-market?utm_source=OpenPR-Rahul&utm_medium=Sep

The report extensively details the overview and core working of the parent market. It accurately proposes the present and future market size andvolume. Our analysts well equip the clients with all the vital data required to build strategic growth plans and policies during the forecast period. A holistic study of the global IoT in Banking & Financial Services market unveils the business cycles and paradigm pattern shift due to the outbreak of Covid-19. The report offers a thorough investigation on the post-Covid market, alongside sheddinglight on expected upcoming trends that can play a vital role further in market development.

Apart from historical, current, and forecasted market value, the report is an in-depth guide on market segmentation. The report clearly mentions the potential segment anticipated to exhibit exceptional growth during the forecast period. Furthermore, the report maps the critical assessment of the customer journey to help the decision-makers of the organization in framing an effective strategy to convert more prospects into customers.

Global IoT in Banking & Financial Services Market: Regional Analysis

North America ( United States)

Europe ( Germany, France, UK)

Asia-Pacific ( China, Japan, India)

Latin America ( Brazil)

The Middle East & Africa

Download Free PDF Report Brochure @ https://www.zionmarketresearch.com/requestbrochure/iot-in-banking-financial-services-market?utm_source=OpenPR-Rahul&utm_medium=Sep

The report entails the growth and restraining factors of the global IoT in Banking & Financial Services market. Our data repository is updated continuously to reflect precise and real-time data analysis. Our analysts have adopted a wide array of methodologies to extract accurate data for stating growth factors in the global IoT in Banking & Financial Services market. The report deliberates recent case studies to help our clients understand how to overcome the underlying challenges in the market. The section will help our clients to identify the opportunity along with possible barriers to leverage their business position in the global market.

The regional analysis section reveals the potential region that can credit the business revenue manifolds. Also, it entails the regional market value and volume to let clients map promising regions for their business operations during the forecast period. The report is very handy for guiding on investing choices, whether in a product or service array.

Our analysts are experts in thisfield with years of experience. We at Zion Market Research maintain the highest level of accuracy and transparency in the report. The primary and secondary resources used in the report are taken from reliable and high authority sources to deliver 100% accurate and trusted data.

The study objectives of this report are:

To study and analyze the global Keyword size (value and volume) by the company, key regions/countries, products and application, history data from 2020 to 2027, and forecast to 2027.

To understand the structure of Keyword by identifying its various sub-segments.

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

Focuses on the key global Keyword manufacturers, to define, describe and analyze the sales volume, value, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

To analyze the Keyword with respect to individual growth trends, future prospects, and their contribution to the total market.

To project the value and volume of Keyword sub-markets, with respect to key regions (along with their respective key countries).

To analyze competitive developments such as expansions, agreements, new product launches, and acquisitions in the market.

To strategically profile the key players and comprehensively analyze their growth strategies

Inquire more about this report @ https://www.zionmarketresearch.com/inquiry/iot-in-banking-financial-services-market?utm_source=OpenPR-Rahul&utm_medium=Sep

Frequently Asked Questions

What are the key factors driving IoT in Banking & Financial Services Market expansion?

What will be the value of IoT in Banking & Financial Services Market during 2021- 2027?

Which region will make notable contributions towards global IoT in Banking & Financial Services Market revenue?

What are the key players leveraging IoT in Banking & Financial Services Market growth?

Also, Research Report Examines:

Competitive companies and manufacturers in global market

By Product Type, Applications & Growth Factors

Industry Status and Outlook for Major Applications / End Users / Usage Area

Thanks for reading this article ; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

Also Read, Global Digital Genome Market Report

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll Free No.1-855-465-4651

Email - sales@zionmarketresearch.com

Web - http://www.zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global IoT in Banking & Financial Services Market : Industry Analysis and Forecast (2021-2027)– by Type, Application, and Region here

News-ID: 2384709 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

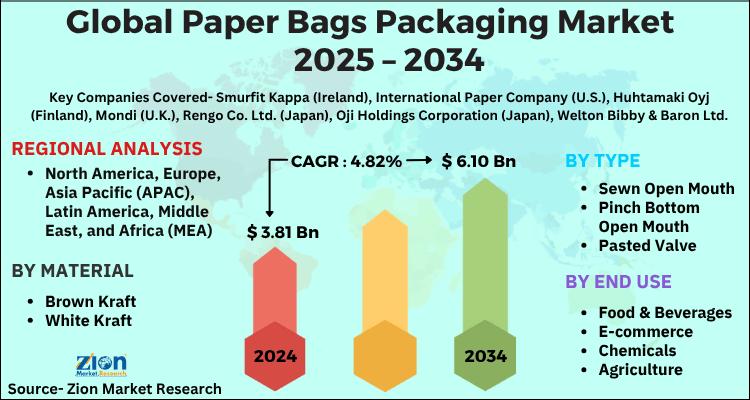

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

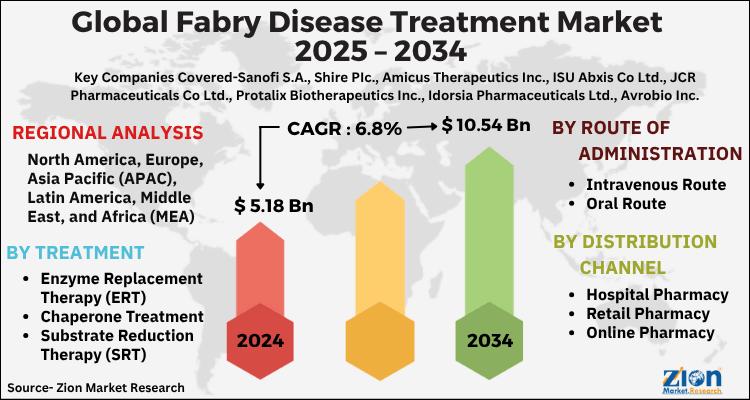

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…