Press release

How Mutual Fund Assets Offers an Opportunity to Invest in a Professionally Managed & Diversified Portfolio! Market Scope and Demand Analysis 2021-2028

Allied Market Research has published a latest report titled, “Mutual Fund Assets Market by Fund Type (Equity Funds, Bond Funds, Money Market Funds, and Hybrid & Other Funds), Distribution Channel (Banks, Financial Advisors/Brokers, Direct Sellers, and Others), and Investor Type (Institutional and Individual): Global Opportunity Analysis and Industry Forecast, 2021–2028”, which says, the Mutual Fund Assets Market size is expected to grow at alarming pace by 2028.Mutual fund providers are looking forward to expanding their existing product portfolio and providing customized funding options for their investors. In addition, due to the COVID-19 outbreak, the mutual fund assets market has heightened volatility and led many investors to review their investments. Moreover, investors have largely switched to investment products protecting them from downside risk.

Download Research Sample with Industry Insights (250+ Pages PDF Report) @ https://www.alliedmarketresearch.com/request-sample/7297

The key players profiled in the Mutual Fund Assets Market research report are BlackRock, Inc., BNP Paribas Mutual Fund, Capital Group, Citigroup Inc., Goldman Sachs, JPMorgan Chase & Co., Morgan Stanley, PIMCO, State Street Corporation, and The Vanguard Group, Inc.

These players have adopted various strategies such as expansions, mergers & acquisitions, joint ventures, new product launches, and collaborations to gain a strong position in the industry.

Key Benefits for Stakeholders from this Research Report:

• This study comprises analytical depiction of the global Mutual Fund Assets Market outlook along with the current trends and future estimations to depict the imminent investment pockets.

• The overall Mutual Fund Assets Market analysis is determined to understand the profitable trends to gain a stronger foothold.

• The report presents information related to key drivers, restraints, and Mutual Fund Assets Market opportunities with a detailed impact analysis.

• The current Mutual Fund Assets Market forecast is quantitatively analyzed from 2020 to 2028 to benchmark the financial competency.

• Porter’s five forces analysis illustrates the potency of the buyers and the Mutual Fund Assets Market share of key vendors.

• The report includes the trends and the Mutual Fund Assets Market share of key vendors.

MUTUAL FUND ASSETS MARKET: Segment Analysis

The global Mutual Fund Assets Market share is segmented on the basis of fund type, distribution channel, investor type, and region.

Interested to Procure the Data? Inquire Here @ https://www.alliedmarketresearch.com/purchase-enquiry/7297

MUTUAL FUND ASSETS MARKET: Regional Scope and Demand Analysis for 2021-2028

Region wise, the Mutual Fund Assets Market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

North America is dominating the Mutual Fund Assets Market share, owing to growth of the high investment opportunities. However, Asia-Pacific is projected to register the significant growth rate during the forecast period. Furthermore, LAMEA holds the subsequent position, and is likely to increase its growth rate by the end of the forecast period, followed by Europe.

Covid-19 Impact on the Global Mutual Fund Assets Market:

Mutual Fund Assets Market Research Report provides an overview of the industry based on key parameters such as effect of COVID-19 on market size, sales, sales analysis and key drivers. The coronavirus pandemic (COVID-19) has affected all aspects of life around the world. This has changed some of the market situation. The main purpose of the research report is to provide users with a broad view of the market. Initial and future assessments of rapidly.

Get Detailed COVID-19 Impact Analysis on the Mutual Fund Assets Market @ https://www.alliedmarketresearch.com/request-for-customization/7297?reqfor=covid

Key Questions Answered in the Mutual Fund Assets Market Research Report:

Q1. At what CAGR, the Global Mutual Fund Assets Market will expand from 2021 – 2028?

Q2. What will be the revenue of Global industry by the end of 2028?

Q3. Which are the factors that drives global industry Growth?

Q4. Who are the leading players in Mutual Fund Assets Market?

Q5. What are the segments of Mutual Fund Assets Market?

Q6. What are the key growth strategies of Mutual Fund Assets Market Players?

Q7. By Application, which segment is expected to exhibit the highest CAGR during 2021 – 2028?

Q8. By Region, which segment holds a dominant position in 2020 and would maintain the lead over the forecast period?

Key market segments

By Fund Type

• Equity Funds

• Bond Funds

• Money Market Funds

• Hybrid & Other Funds

By Distribution Channel

• Banks

• Financial Advisors/Brokers

• Direct Sellers

• Others

By Investor Type

• Institutional

• Individual

By Region

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Ireland

o Netherlands

o Rest of Europe

• Asia-Pacific

o China

o Japan

o India

o South Korea

o Hong Kong

o Australia

o Rest of Asia-Pacific

• LAMEA

o Latin America

o Middle East

o Africa

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How Mutual Fund Assets Offers an Opportunity to Invest in a Professionally Managed & Diversified Portfolio! Market Scope and Demand Analysis 2021-2028 here

News-ID: 2381582 • Views: …

More Releases from Allied Market Research

Trends Shaping the Industrial Coatings Market: Applications, Type and Regional F …

According to the report, the "industrial coatings market" was valued at $61.2 billion in 2023, and is estimated to reach $89.8 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033.

Prime determinants of industrial coatings market growth

The global industrial coatings market is experiencing growth due to several factors such as expansion of construction and infrastructure projects, and application efficiency. However, raw…

Insights into the E-Coat Market Growth, Global Industry Forecast, 2032

The global E-coat market was valued at $2.3 billion in 2022, and is projected to reach $3.7 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

Allied Market Research published a report, titled, "E-coat Market by Type (Cathodic epoxy, cathodic acrylic, and anodic) by Application (passenger cars, commercial vehicles, automotive parts and accessories, heavy duty equipment, and others.): Global Opportunity Analysis and Industry Forecast, 2022-2032".…

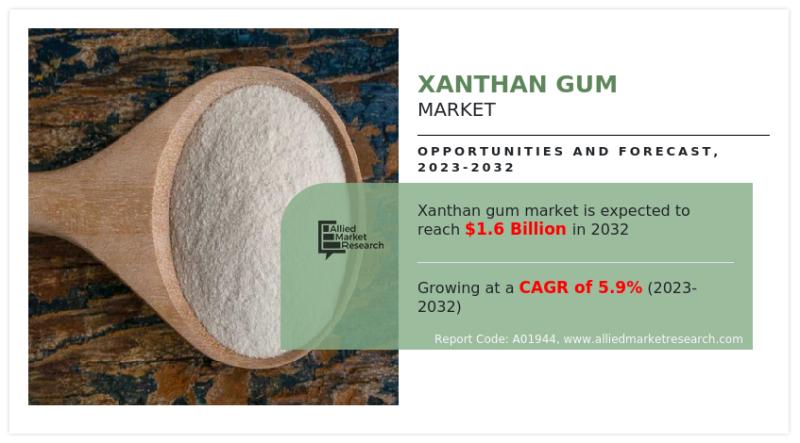

Xanthan Gum Market: Explore the Market Dynamics, Trends, and Advancements 2032

The global xanthan gum market was valued for $0.8 billion in 2018 and is estimated to reach $1.6 billion by 2032, exhibiting a CAGR of 5.9% from 2023 to 2032.

The xanthan gum market is expanding due to its versatile applications in food and beverage, pharmaceuticals, and cosmetics. Growing demand for gluten-free and processed foods is fueling market growth. Advances in production technology and increasing awareness of its functional…

Barley Flour Market Outlook, Top Key Players Analysis, Current Trends, Developme …

Barley flour market size was valued at $1.1 billion in 2022, and is projected to reach $2.4 billion by 2032, registering a CAGR of 5.5% from 2023 to 2032.

The barley flour market is experiencing steady growth, primarily driven by key determinants shaping consumer preferences and industry dynamics. Rise in awareness of the health benefits associated with barley flour, such as its high fibre content and potential to lower cholesterol levels,…

More Releases for Fund

Broad-Based Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong F …

The Broad-Based Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Broad-Based Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E Fund, …

The Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Exchange-Traded Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fun …

The Exchange-Traded Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Exchange-Traded Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Equity Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Equity Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Equity Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Bond Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E …

The Bond Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Bond Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Money Market Funds Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Money Market Funds research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Money Market Funds market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…