Press release

Brazil P2P Payments Market to Witness Significant Growth at a CAGR of 15.1% through 2026

According to a new study by MarkNtel Advisors, the Brazil P2P Payments Market is expected to grow at a CAGR of 15.1% during the forecast period, i.e., 2021-26. Various technological changes are driving rapid transformation in the payment industry. The rising adoption of mobile payments & digital innovations is the key factor likely to boost the market in the coming years.Further, the rising popularity of smartphones & tablets for everyday applications like bill payments, online shopping, & banking entwined with an increase in the young and tech-savvy population shall also propel the overall market growth in the forecast timeframe, further states the research report, “Brazil P2P Payments Market Analysis, 2021.”

Get the report sample: https://www.marknteladvisors.com/query/request-sample/brazil-p2p-payments-market.html

Key Questions Answered in the Study

1. What are the current and future trends in the Brazil P2P Payments market?

2. How has the industry been evolving in terms of geography and services adoption?

3. How has the competition been shaping across the Brazil, followed by their comparative factorial indexing?

4. What are the key growth drivers and challenges for the Brazil P2P Payments market?

5. What are the customer orientation, purchase behavior, and expectations from the P2P Payment service providers across Brazil?

Money Transfers & Payments Accounted for the Largest Share of Brazil P2P Payments Market

Based on the Type of Purchase, the market bifurcates into Airtime Transfer & Top-Ups, Money Transfers & Payments, Merchandise & Coupons, and Travel & Ticketing. Among these segments, Money Transfer & Payment captured the largest share of the P2P Market during 2016-2019 and is projected to grow at the highest CAGR during the forecast period.

For detailed analysis: https://www.marknteladvisors.com/research-library/brazil-p2p-payments-market.html

Money transfers & payments via mobile apps, SMS, or smartcards have increased significantly due to the launch of various instant payment solutions and an increasing number of mobile payments through debit & credit cards. Besides, during the pandemic, a rapid surge in online payments was observed due to consumers' augmenting inclination toward online purchases, such as grocery shopping, money transfer, etc.

“Brazil P2P Payments Market Analysis, 2021” highlights insights on the market potential & opportunities, along with business strategies to enhance the overall market growth. The report offers an overview of leading market players and their recent developments. Moreover, the report provides incredible market opportunities & emerging trends to help stakeholders make appropriate decisions before investing.

Short Message Service to Witness Significant Growth in the Brazil P2P Payments Market

Based on the Transaction Mode, the market bifurcates into Short Message Service (SMS), Mobile Apps, and Smartcard/NFC (Near Field Communication). Of these segments, Short Message Service (SMS) is rapidly gaining popularity in the Brazil P2P Payment Market. The payment link method had become very popular during the COVID-19 as this enables customers to pay remotely to the retailers for the goods & services they purchase. Moreover, Brazil witnessed around a 33% increase in transactions via a payment link between Oct-Nov, 2020. Hence, these aspects indicate the rapid growth of the Short Message Service (SMS) segment in the Brazil P2P Payments Market during 2021-26.

Share your requirements: https://www.marknteladvisors.com/query/request-customization/brazil-p2p-payments-market.html

Key Market Competitors:

According to MarkNtel Advisors, the leading industry players in the Brazil P2P Payments Market are Boleto Bancario, Boleto Flash, PagBrasil PIX, PEC Flash, Samsung Pay, Google Pay, and WhatsApp Pay.

Market Segmentation:

1. By Transaction Mode (Short Message Service (SMS), Mobile Apps, Smartcard/NFC (Near field communication))

2. By Location (Remote Payment, Proximity Payment)

3. By Type of Purchase (Airtime Transfer & Top-Ups, Money Transfers & Payments, Merchandise & Coupons, Travel & Ticketing)

4. By Application (Retail Payments, Travels and Hospitality Payments, Transportation and Logistics Payments, Others)

5. By Region (North, Northeast, South, Southeast, Central west)

6. By Competitors (Boleto Bancario, Boleto Flash, PagBrasil PIX, PEC Flash, Samsung Pay, Google Pay, WhatsApp Pay)

MarkNtel Advisors

1147 88AVE, Delta, British Columbia, BC,V4C,3B8, CANADA

Email: sales@marknteladvisors.com

Tel: +1 604 800 2671

Website: https://www.marknteladvisors.com

About us:

MarkNtel Advisors is a leading research, consulting and data analytics firm that provides a wide range of strategic reports on diverse industry verticals to a substantial and varied client base that includes multinational corporations, financial institutions, governments, and individuals.

We specialize in niche industries and emerging geographies to support our clients in the formulation of strategies viz. Go to Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, trend analysis, etc. in around 15 industry verticals to enable our clients in identifying attractive investment opportunities and maximizing ROI through an early mover advantage.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Brazil P2P Payments Market to Witness Significant Growth at a CAGR of 15.1% through 2026 here

News-ID: 2377784 • Views: …

More Releases from MarkNtel Advisors LLP

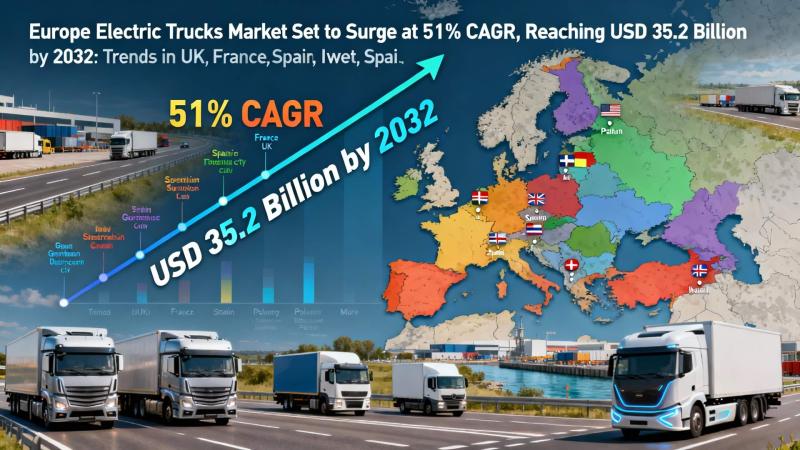

Europe Electric Trucks Market Set to Surge at 51% CAGR, Reaching USD 35.2 Billio …

Latest Research Report of European Electric Trucks Market Size and CAGR

According to MarkNtel Advisors latest market research report data, the Europe Electric Trucks Market is projected to grow from USD 1.96 billion in 2025 to USD 35.2 billion by 2032, registering a remarkable CAGR of 51.07%. Growth is primarily driven by stringent EU emission standards, expansion of high-capacity charging networks, and fleet electrification by major OEMs like Volvo Trucks and…

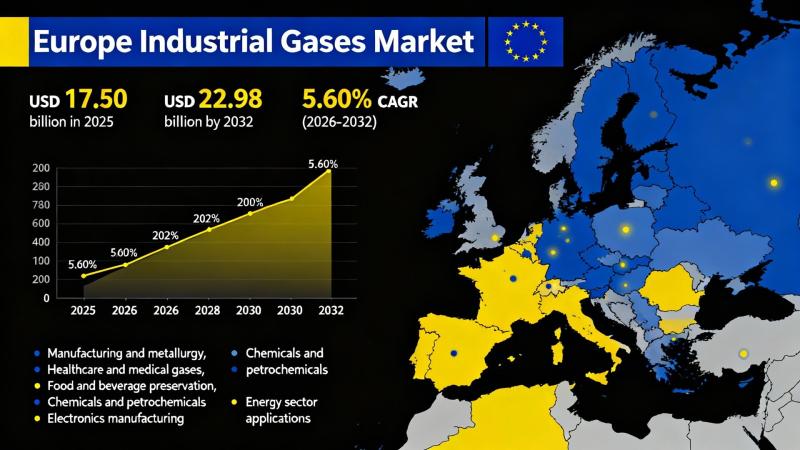

Europe Industrial Gases Market Expected to Reach Nearly $22.98 Billion by 2032: …

Europe Industrial Gases Market: Trends, Insights, and Future Outlook

The Europe Industrial Gases Market is seeing robust growth, driven by increasing demand across key sectors such as petrochemicals, healthcare, and steelmaking. Innovations in hydrogen production and carbon capture technologies are prominent factors influencing market dynamics. A shift towards renewable and low-carbon sources presents significant opportunities amid growing environmental regulations. Additionally, the rise in energy costs is reshaping the landscape for industrial…

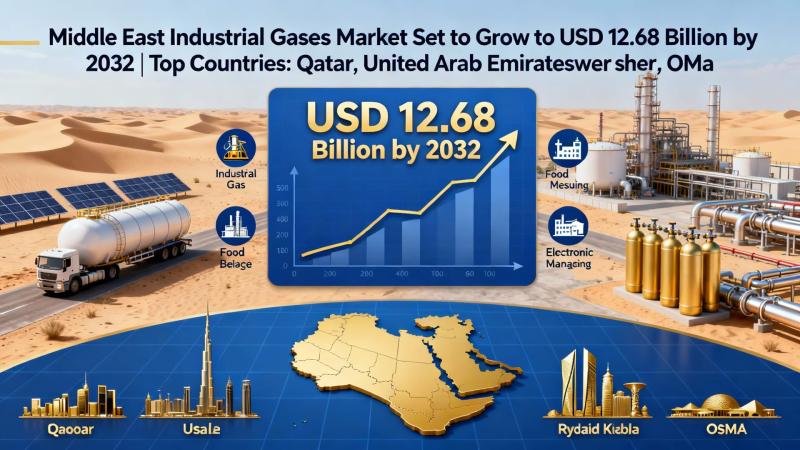

Middle East Industrial Gases Market Set to Grow to USD 12.68 Billion by 2032 | T …

The Middle East Industrial Gases Market is forecasted to expand from USD 10.06 billion in 2025 to USD 12.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.72% during the period of 2026 to 2032. The primary drivers fueling this growth are the increasing demand for hydrogen and the robust expansion of the petrochemical industry, which necessitates high-purity gases for various applications such as chemical synthesis and…

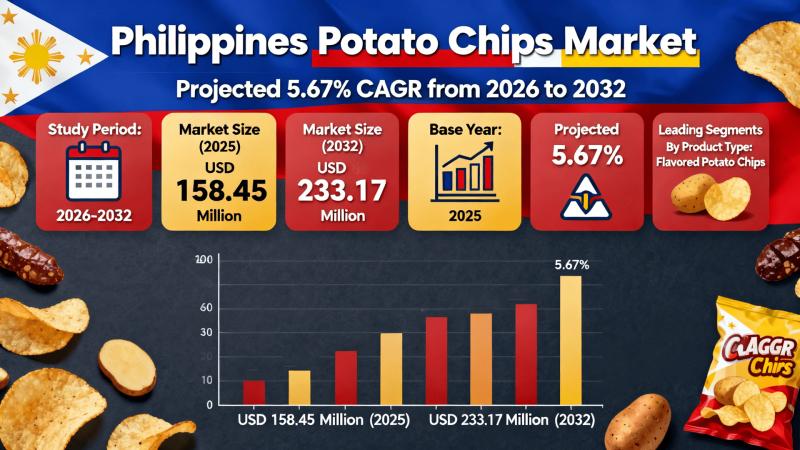

Potato Chips Market in Philippines Set to Grow to USD 233.17 Million by 2032 as …

The Philippines Potato Chips Market is entering a significant growth phase, projected to expand from USD 158.45 million in 2025 to USD 233.17 million by 2032, with a robust compound annual growth rate (CAGR) of 5.67%. Key growth drivers include government initiatives aimed at bolstering local potato production and the rising popularity of flavored varieties among consumers.

Philippines Potato Chips Market Growth Outlook:

As snack food preferences evolve, the Philippines Potato Chips…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…