Press release

Takaful Insurance Market Size, Growth, Sales Value and Forecast 2021-2027 By bu Dhabi National Takaful Co

Allied Market Research published an exclusive report, titled, “Takaful Insurance Market By Distribution Channel (Agents & Brokers, Banks, Direct Response and Others), Type (Family Takaful and General Takaful), and Application (Personal and Commercial): Global Opportunity Analysis and Industry Forecast, 2021–2030”.The takaful insurance market report offers a detailed analysis of prime factors that impact the market growth such as key market players, current market developments, and pivotal trends. The report includes an in-depth study of key determinants of the global market including drivers, challenges, restraints, and upcoming opportunities.

Download Sample Report with Full TOC @ https://www.alliedmarketresearch.com/request-sample/12200

The takaful insurance market report encompasses driving factors of the market coupled with prime obstacles and restraining factors that hamper the market growth. The report helps existing manufacturers and entry-level companies devise strategies to battle challenges and leverage lucrative opportunities to gain a foothold in the global takaful insurance market.

The takaful insurance market is analyzed across the globe and highlight several factors that affect the performance of the market across the various region including North America (United States, Canada, and Mexico), Europe (Germany, France, UK, Russia, and Italy), Asia-Pacific (China, Japan, Korea, India, and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa).

Pre-Book Now with 10% Discount @ https://www.alliedmarketresearch.com/purchase-enquiry/12200

The takaful insurance market report offers an in-depth analysis of the 10 prime market players that are active in the market. Moreover, it provides their thorough financial analysis, business strategies, SWOT profile, business overview, and recently launched products & services. In addition, the report offers recent market developments such as market expansion, mergers & acquisitions, and partnerships & collaborations. The prime market players studied in the report are Abu Dhabi National Takaful Co., Allianz, AMAN Insurance, Islamic Insurance, Prudential BSN Takaful Berhad, Qatar Islamic Insurance, SALAMA Islamic Arab Insurance Company, Syarikat Takaful Brunei Darussalam, Takaful International, and Zurich Malaysia.

The takaful insurance market report provides thorough information about prime end-users and annual forecast during the period from 2020 to 2027. Moreover, it offers revenue forecast for every year coupled with sales growth of the takaful insurance market. The forecasts are provided by skilled analysts in the takaful insurance market and after an in-depth analysis of the geography of the market. These forecasts are essential for gaining insight into the future prospects of the takaful insurance industry.

Request For Customization @ https://www.alliedmarketresearch.com/request-for-customization/12200?reqfor=covid

Takaful insurance Market Key Segments

By Distribution Channel

• Agents & Brokers

• Banks

• Direct Response

• Others

By Type

• Family Takaful

• General Takaful

o Motor Takaful

Personal

Third Party Liability Coverage

Comprehensive & Optional Coverage

Commercial

o Property & Fire

o Medical & Health Takaful

o Marine, Aviation & Transport

o Others

By Application

• Personal

• Commercial

Prime Benefits:

1. The report offers Porter’s Five Forces analysis to recognize the ability of buyers and suppliers, which allows business investors to formulate strategic decisions.

2. The report includes an in-depth study of the current market trends and market size along with a forecast of the takaful insurance market from 2020-2027.

3. The study provides the potential of the industry across several regions coupled with revenue contribution.

4. The report offers a thorough study of the key market players that are active in the takaful insurance market.

Avail for full summary @ https://www.alliedmarketresearch.com/connect-to-analyst/12200

COVID-19 Scenario Analysis:

1. To subdue the spread of COVID–19, respective governments have shutdown day-to-day business operations by implementing a full-scale lockdown. Labour shortages and delays in project completion are a few factors hindering the takaful insurance industry, resulting in a decline in production.

2. Takaful insurance market forecast has been significantly impacted by the outbreak. New projects throughout the world have stalled, which have significant demand for takaful insurance market.

3. The factories have struggled to manufacture and assemble new devices as workers have stayed in their homes while the already available devices in various warehouses cannot be transported due to current rules & regulations, which disrupted the supply chains.

4. The impact of COVID-19 on takaful insurance market is temporary as just the production and supply chain is stalled. Once the situation improves, production, supply chains, and demand for these products are gradually going to increase. This is expected to provide opportunities for companies operating in the market to think about ways of increasing production, research about technologies, and improve current products.

Key offering of the Report:

1. Major driving factors: A detailed study of determinants of the market factors, forthcoming opportunities, and challenges.

2. Current market trends & forecasts: An in-depth analysis of the market including recent market trends and forecasts for the next few years that help to make an informed decision.

3. Segmental Analysis: A detailed study of each segment along with driving factors and growth rate analysis of each segment.

4. Geographical analysis: Insightful study of the market across various regions that enable market players to benefit from the market opportunities.

5. Competitive landscape: A detailed study of major market players that are active in the takaful insurance market.

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web:https://www.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Insurance Market Size, Growth, Sales Value and Forecast 2021-2027 By bu Dhabi National Takaful Co here

News-ID: 2352142 • Views: …

More Releases from Allied Market Research

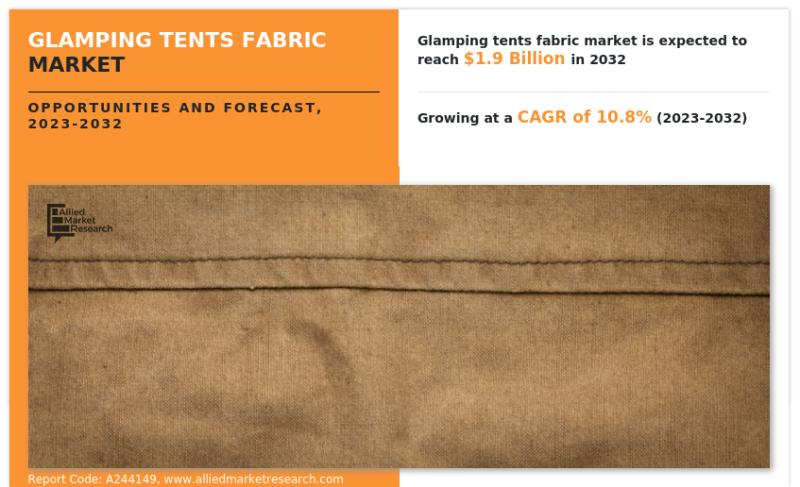

A Comprehensive Look at Glamping Tents Fabric Market Size 2026 and Growth Foreca …

Allied Market Research published a report, titled, "Glamping Tents Fabric Market by Fabric (Cotton, Polycotton, PVC, Polyester, Others), and Application (1 Person Glamping Tents, 2 Person Glamping Tents, Family Sized Glamping Tents, Others): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the glamping tents fabric market was valued at $0.6 billion in 2022 and is estimated to reach $1.9 billion by 2032, exhibiting a CAGR of 10.8%…

Expert View: Special Steel in India Market Growing at Exponential CAGR of 10.9% …

According to the report published by Allied Market Research, the India special steel market was estimated at $7.0 billion in 2020 and is expected to hit $38.8 billion by 2035, registering a CAGR of 10.9% from 2021 to 2035. The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and evolving market trends.

Download Sample PDF (173…

Wheeled Multiple Rocket Systems Marke Share, Size, Trends, Growth, Analysis, Res …

Multiple rocket system is a type of rocket artillery system with advance capabilities. In multiple rocket system, rockets are of larger size and can carry heavier payloads, compared to artillery systems. Although rocket systems were highly inaccurate & slow when compared to artillery. Such issue has been resolved with the emergence of guided multiple rocket systems. Guided multiple rocket system uses GPS or internal guidance to improve its accuracy while…

Thai Cuisine Market Size to See Massive Growth by 2032 With High CAGR

Thai cuisine is the national cuisine of Thailand. Traditional Thai cuisine is categorized into four types- tom (boiled dishes), yam (spicy salads), tam (pounded foods) and, gaeng (curries). Thai food has a blend of sweet, salty, sour, and bitter flavors mix together. The Thai platter can be plain or fancy and it varies from region to region. The cuisine is influenced by Chinese dishes, Indian cuisine and other…

More Releases for Takaful

Islamic Insurance (Takaful) Market Hits New High | Major Giants Takaful Malaysia …

HTF MI recently introduced Global Islamic Insurance (Takaful) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Takaful Malaysia, Syarikat Takaful Malaysia, Abu Dhabi Islamic Insurance.

Download Sample Report PDF…

Takaful Market Is Going To Boom | Etiqa, SALAMA, Takaful Emarat

According to HTF Market Intelligence, the Global Takaful market is expected to grow from USD 35 Billion in 2023 to USD 65 Billion by 2032, with a CAGR of 9.10% from 2025 to 2032.

HTF MI recently introduced Global Takaful Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Taka …

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.

Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth…