Press release

Global Fire Insurance Market Future Prospects 2027 | Standard Life Assurance, Yasuda Mutual Life Insurance, Swiss Reinsurance, Royal and Sun Alliance

Fire InsuranceThe report on the Global Fire Insurance Market Research Report Covers, Future Trends, Size, Share, Past, Present Data and Deep Analysis, And Forecast, 2021-2027 market documented by Zion Market Research (ZMR) means to offer a coordinated and orderly methodology for the major aspects that have influenced the market in the past and the forthcoming market prospects on which the organizations can depend upon before investing. It furnishes with a reasonable examination of the market for better decision-making and assessment to put resources into it. The report analyses the elements and a complete detailed outlook of the main players that are probably going to add to the demand in the global Fire Insurance market in the upcoming years.

The top Major Competitive Players are : Standard Life Assurance, Yasuda Mutual Life Insurance, Swiss Reinsurance, Royal and Sun Alliance, Mitsui Mutual Life Insurance, TIAA-CREF, CPIC, PingAn, CNP Assurances, Aetna, Meiji Life Insurance, New York Life Insurance, Prudential Financial, Aegon, Allstate, MetLife, Sumitomo Life Insurance, Prudential, Zurich Financial Services, Munich Re Group, Dai-ichi Mutual Life Insurance, State Farm Insurance, Cardinal Health, Assicurazioni Generali, Aviva, American Intl. Group, Nippon Life Insurance, AXA, and Allianz.

FREE : Request Sample is Available @ https://www.zionmarketresearch.com/sample/fire-insurance-market#utm_source=Rahul&utm_medium=JulyO

The market report additionally gives a to-the-point evaluation of the techniques and plans of action that are being executed by the players and companies to contribute to the global Fire Insurance market growth. Some of the most conspicuous measures taken by the organizations are partnerships, mergers & acquisitions, and collaborations to extend their overall reach. The players are likewise presenting newer product varieties in the market to improve the product portfolio by embracing the new innovation and carrying out it in their business.

Global Fire Insurance Market: Regional Analysis

North America ( United States)

Europe ( Germany, France, UK)

Asia-Pacific ( China, Japan, India)

Latin America ( Brazil)

The Middle East & Africa

The report on the global Fire Insurance market utilizes diverse methods to examine the market data and present it in an organized manner to the readers. It provides the market research on the various segmentation based on the aspects like region, end-user, application, types, and other important categories. It further gives a detailed report on the leading sub-segment among each of them.

Download Free PDF Report Brochure @ https://www.zionmarketresearch.com/requestbrochure/fire-insurance-market#utm_source=Rahul&utm_medium=JulyO

Moving to the drivers and restraints, one will be given all factors that are indirectly or directly helping the development of the global Fire Insurance market. To get to know the market's development measurements, it is important to evaluate the drivers of the market. Furthermore, the report likewise analyzes the current patterns alongside new and plausible growth openings for the global market. Additionally, the report incorporates the components that can restrict the market growth during the forecast period. Understanding these elements is also mandatory as they help in grasping the market's shortcomings.

Primary and secondary methodologies are being utilized by the research analysts to gather the information. Along these lines, this global Fire Insurance market report is planned at guiding the readers to a superior, clearer viewpoint and information about the global market.

COVID-19 impact: Since the pandemic has adversely affected almost every market in the world, it has become even more important to analyze the market situation before investing. Thus, the report comprises a separate section of all the data influencing the market growth. The analysts also suggest the measures that are likely to uplift the market after the downfall, bettering the current situation.

The study objectives of this report are:

To study and analyze the global Keyword size (value and volume) by the company, key regions/countries, products and application, history data from 2020 to 2027, and forecast to 2027.

To understand the structure of Keyword by identifying its various sub-segments.

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

Focuses on the key global Keyword manufacturers, to define, describe and analyze the sales volume, value, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

To analyze the Keyword with respect to individual growth trends, future prospects, and their contribution to the total market.

To project the value and volume of Keyword submarkets, with respect to key regions (along with their respective key countries).

To analyze competitive developments such as expansions, agreements, new product launches, and acquisitions in the market.

To strategically profile the key players and comprehensively analyze their growth strategies

Inquire more about this report @ https://www.zionmarketresearch.com/inquiry/fire-insurance-market#utm_source=Rahul&utm_medium=JulyO

Frequently Asked Questions

What are the key factors driving Fire Insurance Market expansion?

What will be the value of Fire Insurance Market during 2021- 2027?

Which region will make notable contributions towards global Fire Insurance Market revenue?

What are the key players leveraging Fire Insurance Market growth?

Also, Research Report Examines:

Competitive companies and manufacturers in global market

By Product Type, Applications & Growth Factors

Industry Status and Outlook for Major Applications / End Users / Usage Area

Thanks for reading this article ; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll Free No.1-855-465-4651

Email - sales@zionmarketresearch.com

Web - http://www.zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Fire Insurance Market Future Prospects 2027 | Standard Life Assurance, Yasuda Mutual Life Insurance, Swiss Reinsurance, Royal and Sun Alliance here

News-ID: 2319600 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

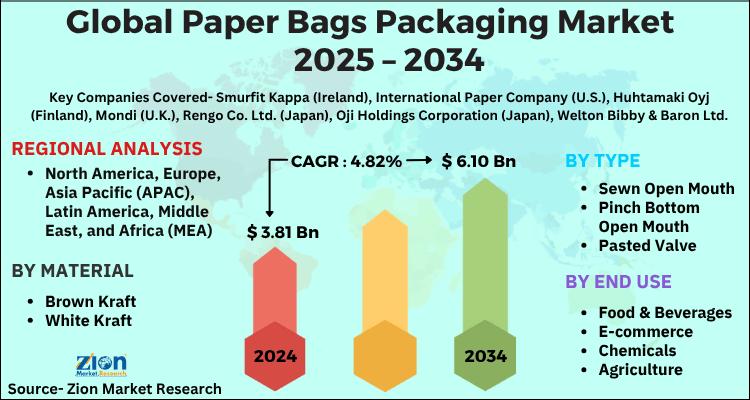

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

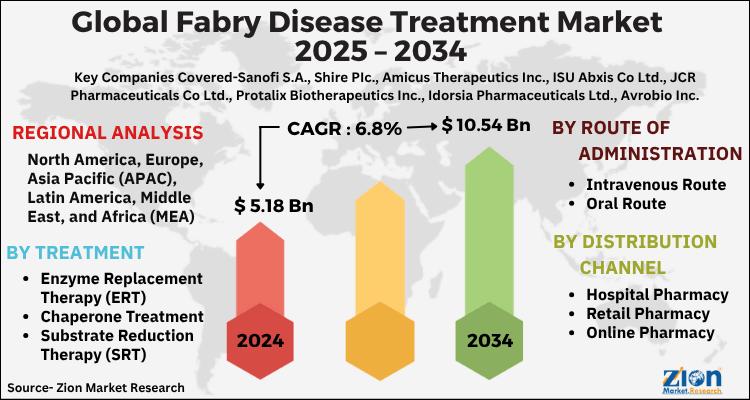

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…