Press release

Usage-Based Insurance Market Analysis, Trends, Growth and Forecast 2021 to 2026

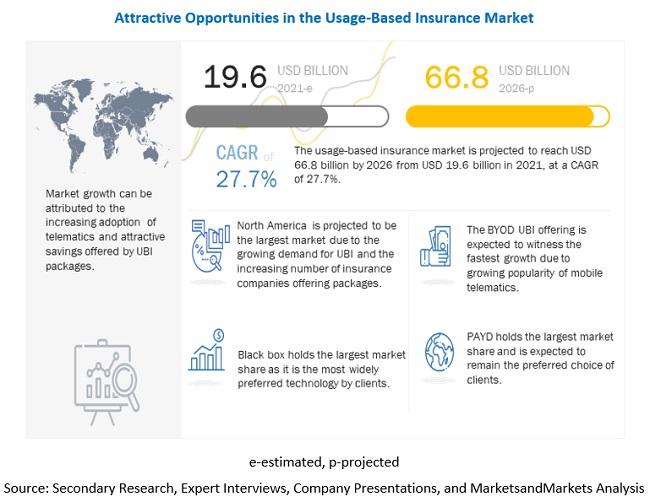

The Usage-Based Insurance Market is projected to reach USD 66.8 billion by 2026 from an estimated USD 19.6 billion in 2021, growing at a CAGR of 27.7% during the forecast period. The increasing adoption of telematics and connected car services is expected to drive the usage-based insurance market. The rolling out of various UBI packages in countries such as India, South Africa is expected to further drive its popularity.Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=154621760

UBI providers can work directly with OEMs to capitalize on the increasing trend of connected cars in developed as well as developing regions. UBI service providers can also provide customized plans for embedded systems that can give incentives to connected car owners to choose UBI policies.

Manage-how-you-drive or MHYD is estimated to be the fastest-growing usage-based insurance market. MHYD is an extended version of PHYD, which provides feedback to drivers on improvement areas besides just ranking them on driving behavior. This model is ideal for young drivers aged between 18 and 25 as they are new drivers. The MHYD system collects various driving behavior information such as harsh braking, sharp cornering, and overspeeding to rate the driver. The system also suggests improvements to the driver to help improve the driver's behavior and reduce insurance premiums for the driver. UBI companies can work together with telematics device manufactures, insurance companies, and OEMs to develop MHYD plans that suit the requirements of different customers.

Smartphone is projected to be the fastest-growing segment of the usage-based insurance market, by technology. Using a smartphone for UBI services offers multiple advantages such as flexibility, accurate driver drive behavior information, etc. Smartphones are now equipped with an array of sensors that can collect data for telematics analysis. A smartphone is a cost-effective option for UBI services as the user is not required to purchase an external hardware device, and no vehicle installation is required. Hence, the system can be implemented quickly without any additional hardware requirements. Thus, smartphone technology is expected to witness a strong boost.

According to MarketsandMarkets, Asia Pacific is estimated to be the fastest-growing market for usage-based insurance during the forecast period. Market growth in this region can be attributed to the increasing adoption of telematics and the rising trend of car-sharing and ride-hailing in developing countries such as India, Malaysia, Australia, and Japan. Japan dominates the market in 2020 and is anticipated to continue its dominance during the forecast period owing to significant developments in connected and autonomous vehicles and increasing adoption of telematics services.

Thus, the growing adoption of telematics in LDVs and HDVs, growing awareness about UBI packages is expected to be the major reasons for UBI growth. COVID-19 gave a boost to the adoption of UBI in several countries. The growing popularity of mobile telematics, OBD-II is also expected to propel the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=154621760

Key Market Players:

The usage-based insurance market is dominated by globally established players such as UnipolSai Assicurazioni S.p.A (Italy), Progressive Casualty Insurance Company (US), Allstate Insurance Company (US), State Farm Automobile Mutual Insurance Company (US), and Liberty Mutual Insurance Company (US).

Impact of Covid-19 on Usage-based Insurance Market

The automotive industry plays a crucial role in building the global economy. However, the COVID-19 outbreak disrupted the entire automotive supply chain on a global scale during the second and third quarters of 2020, impacting the new vehicle sales in FY 2020. According to OICA and MarketsandMarkets analysis, the new vehicle sales (including LDV and HDV) witnessed a decline of 14% in 2020. However, according to various insurance organizations/institutes, the COVID-19 pandemic gave a boost to the UBI industry. For instance, according to Insurance Information Institute (iii), US witnessed a strong boost as vehicle owners did not want to pay full automotive insurance premiums.

View Detail TOC @ https://www.marketsandmarkets.com/Market-Reports/usage-based-insurance-market-154621760.html

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: newsletter@marketsandmarkets.com

Phone: 18886006441

Address: 630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth emerging opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of globalFortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions. Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve. MarketsandMarkets's™ flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-Based Insurance Market Analysis, Trends, Growth and Forecast 2021 to 2026 here

News-ID: 2313130 • Views: …

More Releases from MarketsandMarkets™ INC.

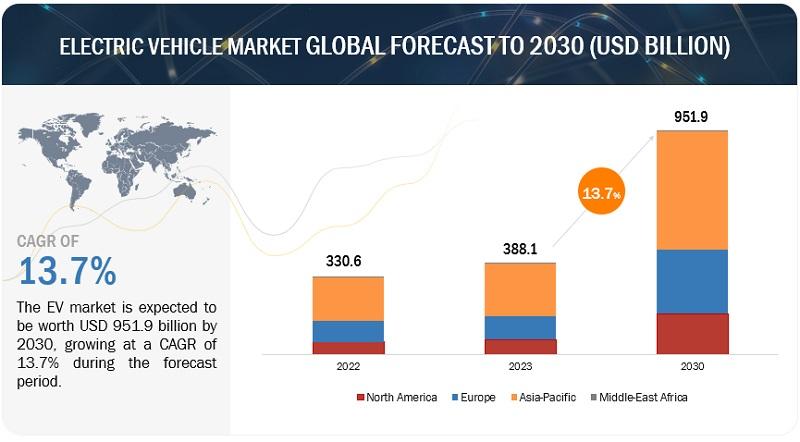

Electric Vehicle Market Size, Share, Trends & Analysis by 2030

The global EV market is projected to grow from USD 388.1 billion in 2023 to USD 951.9 billion by 2030, registering a CAGR of 13.7%. The electric vehicle (EV) market is currently experiencing a transformative phase of rapid growth and innovation. With increasing global concern over climate change and air pollution, coupled with advancements in technology and supportive government policies, the adoption of EVs has gained tremendous momentum. Consumers are…

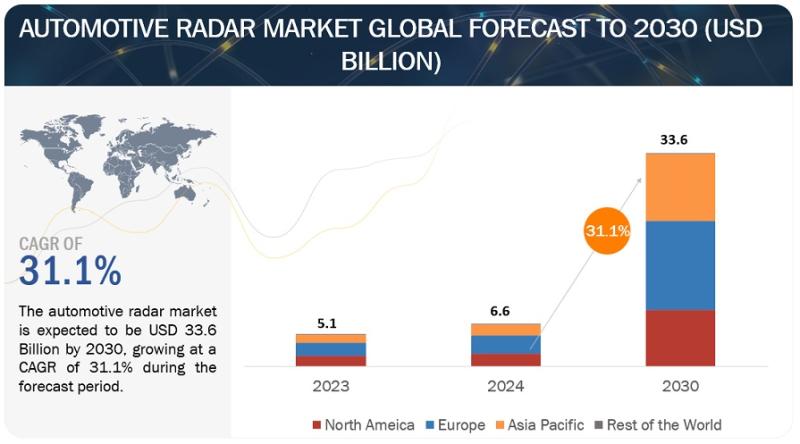

Automotive Radar Market Valued at $33.6 billion by 2030

The global automotive radar market is projected to grow from USD 6.6 billion in 2024 to USD 33.6 billion by 2030, registering a CAGR of 31.1%.

The automotive radar market is flourishing due to a confluence of factors. The primary driver is the surging demand for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. These technologies heavily rely on radar for object detection and measurement, making it an essential component. Furthermore, stricter…

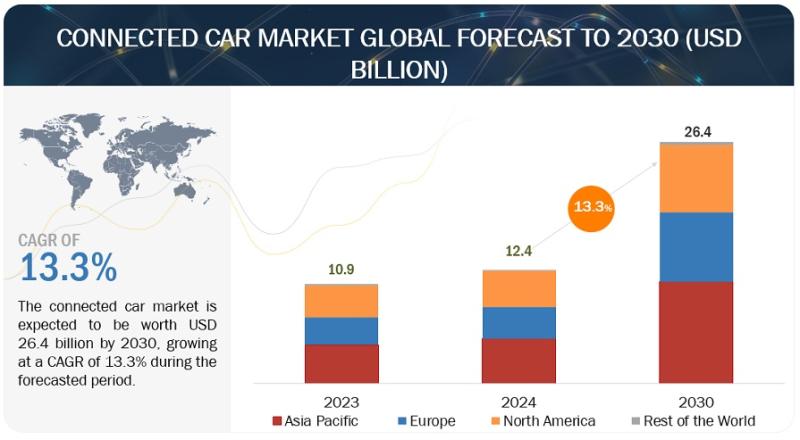

Connected Car Market Poised to Reach $26.4 billion by 2030

The globally connected car market is estimated to grow from USD 12.4 billion in 2024 to USD 26.4 billion by 2030, at a CAGR of 13.3%.

Government initiatives towards developing intelligent transportation networks and the growing trend of in-vehicle connectivity solutions are two factors influencing the growth of the worldwide connected car market. Also, the consumer demand for a safer, more convenient, and entertaining driving experience is a significant driver. This…

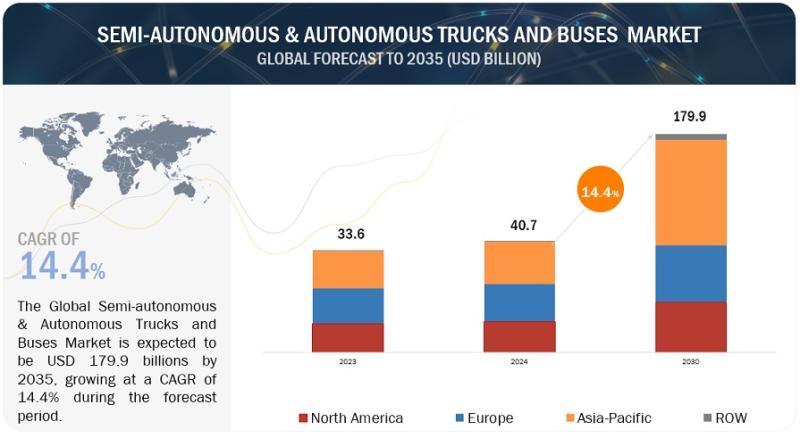

Semi-Autonomous & Autonomous Trucks and Buses Market worth $179.9 billion by 203 …

The Semi-autonomous & autonomous Trucks and Buses market size is projected to grow from USD 40.7 Billion in 2024 to USD 179.9 Billion by 2035, at a CAGR of 14.4%. The increasing demand for electric and autonomous vehicle and government regulation regarding safety is expected to increase the demand for Semi-autonomous & autonomous Trucks and Buses. Additionally, continuos innovation in advance driving technologies and components will boost the demand…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…