Press release

Carmaker Strategies In Shared & Smart Mobility Services Market 2021 Present Scenario on Growth Analysis and High Demand to 2030

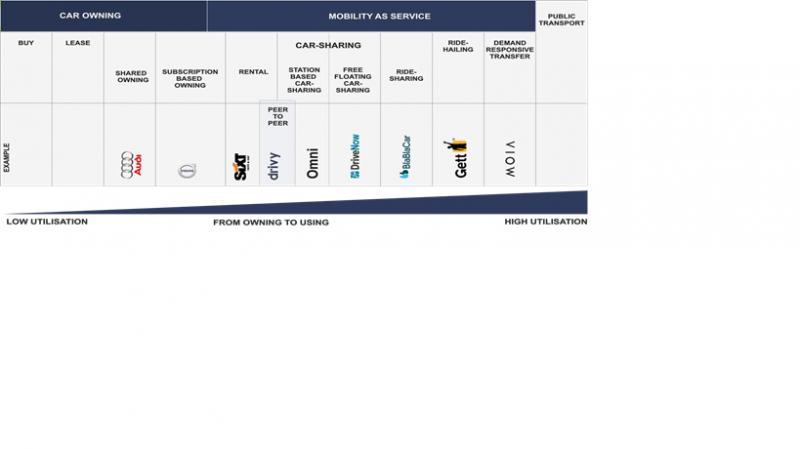

New Mobility patterns are emerging transforming mobility from a product to a service (MaaS) as people change the ways they move in cities, rethink their vehicle ownership criteria and continue adopting new technologies to access cheaper, faster, safer, emission-free and seamless mobility.At the same time, carmakers and automotive suppliers are transforming to Mobility providers and Tech players to respond to stricter emission regulation and road safety rules and address the new needs of mobility users.

MaaS promises not only better vehicle utilization rates but also the best mode of transportation depending on the use case. In the new era of Connected, Autonomous, Electrified and Shared Mobility, traditional automotive players now face additional competition from Tech leaders with strong expertise in AI, cloud connectivity and Big data.

To get a holistic SAMPLE of the report, please click @ https://www.supplydemandmarketresearch.com/home/contact/1589477?ref=Sample-and-Brochure&toccode=SDMRSM1589477

New technologies such as highly-automated driving, cloud, V2X, Virtual and Augmented Reality shape new experiences for mobility users. The Mobility landscape is changing fast, as competition for brand loyalty and new revenue pools is getting stronger.

Report Offerings

What This Report Delivers

Understand how carmakers are positioned in Smart and Shared Mobility across 10 business models:

B2C & P2P car-sharing, free-float and station- based

Taxi / P2P ride-hailing, incl. electrified fleets

AMOD / robo-taxis.

Micro-Mobility (e-bikes, e-scooters, other)

Multi-modal transport (e.g., Moovel)

Connected parking (e.g., Park Now)

Electric vehicle charging, such as VW’s Elli

Online car sales and subscription services

Urban Air Mobility investments & strategies

Other Aftersales services (e.g., predictive maintenance, battery swapping, etc.)

Learn about the strategies, investments, partnerships and roadmaps of leading carmakers in ride-hailing, car- sharing, micro-mobility, EV charging among other business models.

To get this report at a profitable rate @ https://www.supplydemandmarketresearch.com/home/contact/1589477?ref=Discount&toccode=SDMRSM1589477

Assess the techno-commercial readiness level of Mobility-as-a-Service will evolve by 2030 in China, Germany, California and India.

Table Of Contents:

THE STATE OF COMPETITION IN SHARED MOBILITY

1.1. Competitive Landscape & Carmaker Offerings in Shared & Smart Mobility Services

1.2. Carmaker Revenues from Financial Services & Mobility segments

1.3. $11+ billion of Investments by Carmakers in Mobility Start-up

1.4. Key Partnerships in Mobility in 2020-21: the Evolving Landscape

1.5. New battlefronts in Shared Mobility

1.5.1. Market growth in emerging markets

1.5.2. The crucial role of China

1.6. New Mobility, incl. Shared services, presents an additional $1.5 trillion opportunity

DRIVERS & TRENDS SHAPING THE FUTURE OF SHARED & SMART MOBILITY SERVICES

2.1. Segmentation and Definitions of Shared & Smart Mobility Services

2.2. Consumer demands are shifting driven by Digitalization, urbanization & sustainability

2.3. Carmakers rethink their Online Car Sales Strategies & Ditigal Sales Channels due to COVID-19

2.4. Enabling Technology for Smart Mobility

2.4.1. Digitalization: Connectivity, Big data, Cloud

2.4.2. The role of blockchain for Security & Privacy in Mobility Services

2.4.3. Autonomous Driving, Software & AI

Buy Complete Copy of this Report Avail 20% Discount Use Coupon [SDMR20] @ https://www.supplydemandmarketresearch.com/home/purchase?code=SDMRSM1589477

CARMAKERS’ STRATEGIES IN SHARED & SMART MOBILITY

3.1. Audi

3.1.1. Audi’s Car Sales 2015-2020 & Revenues 2019-2020

3.1.2. Audi’s Vision in Mobility, incl. Autonomous, Electric and Shared Mobility

3.1.3. Investments related to Smart Mobility & key partnerships

3.1.4. Assessment of Mobility Service Portfolio

3.2. BMW Group

3.2.1. BMW Group’s Car Sales & Revenues 2015-2020

3.2.2. Vision in Mobility, incl. Autonomous, Electric and Shared Mobility

3.2.3. Investments related to Smart Mobility from iVentures & key partnerships

3.2.4. Assessment of Mobility Service Portfolio

3.3. Daimler: Mercedes-Benz

3.3.1. Vision in Mobility

3.3.2. Investments related to Smart Mobility & key partnerships

3.3.3. Assessment of Mobility Service Portfolio

3.4. Ford

3.4.1. Vision in Mobility

3.4.2. Investments related to Smart Mobility & key partnerships

3.4.3. Assessment of Mobility Service Portfolio

3.5. General Motors

3.5.1. Vision in Mobility

3.5.2. Investments related to Smart Mobility & key partnerships

3.5.3. Assessment of Mobility Service Portfolio

3.6. Honda

3.6.1. Vision in Mobility

3.6.2. Investments related to Smart Mobility & key partnerships

3.6.3. Honda’s Mobility Service Portfolio

3.7. Hyundai-KIA

3.7.1. Vision in Mobility

3.7.2. Mobility Service Portfolio

3.8. Jaguar Land Rover

3.9. Porsche

3.10. Renault-Nissan-Mitsubishi Alliance

3.11. Stellantis: ex-FCA & PSA Group

3.12. Tesla Motors

3.13. Toyota Motors: Lexus and Toyota

3.13.1. Investments related to Smart Mobility & key partnerships

3.13.2. Toyota’s Mobility Service Portfolio

3.14. Volvo

3.14.1. Vision in Mobility: “Freedom to Move” & all electric by 2030

3.14.2. Assessment of Volvo’s Strategy & Mobility Service Portfolio

3.15. Volkswagen

3.15.1. Vision in Mobility: MOIA subsidiary

3.15.2. Investments related to Smart Mobility & key partnerships

3.15.3. Assessment of Mobility Service Portfolio

CONNECTED, AUTONOMOUS, SHARED & ELECTRIFIED MOBILITY IN CHINA, GERMANY, CALIFORNIA & INDIA

4.1. Summary of Maturity of MaaS across major geographies

4.2. Smart Mobility in China

4.2.1. Urbanization & environmental policy shape new Mobility Needs in China

4.2.2. MaaS Regulation in China: NEVs & ICVs at the centre of Gov.’s policy

4.2.3. DiDi “monopolizes” the booming Ride-hailing industry

4.2.4. Deployment of Lv.4 Autonomous Robotaxi accelerating in China in ‘21

4.2.5. Low adoption of Car-sharing in China

4.2.6. The limited EV charging network hinders MaaS adoption

4.2.7. Bike-Sharing popularity have slowed down recently

4.3. The Status & Outlook of Smart Mobility in Germany

4.3.1. Germany’s car-sharing market rebounded in 2021 driven by free-floating The Impact of Carsharing on Car Ownership in German Cities (2016)

4.3.2. Micro-mobility: Bike Sharing

4.3.3. Scooter sharing dominated by six major players

4.3.4. Germany’s EV Charging network doubled in 2020

4.3.5. Urban Air Mobility coming to Germany cities

4.4. The Status & Outlook of Smart Mobility in California, USA

4.4.1. Mobility Challenges in California

4.4.2. Ride-Sharing market in California: Uber & Lyft

4.4.3. Car-sharing/P2P car sharing projects

4.4.4. Car subscription models in California

4.4.5. Micro-mobility

4.4.6. Automated Driving & Autonomous Deliveries

4.4.7. EV charging infrastructure and business models in the USA

4.4.8. Three Key players in Smart Parking in California

4.5. Car sharing in North America vs. Europe

4.6. Shared Mobility in India

The customization research services cover the additional custom report features such as additional regional and country level analysis as per the client requirements.

Contact Us:

SUPPLY DEMAND MARKET RESEARCH

Mr. Charles Lee

302-20 Misssisauga Valley Blvd, Missisauga,

L5A 3S1, Toronto, Canada

Phone Number: +12764775910

Email- info@supplydemandmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carmaker Strategies In Shared & Smart Mobility Services Market 2021 Present Scenario on Growth Analysis and High Demand to 2030 here

News-ID: 2304432 • Views: …

More Releases from Supply Demand Market Research

Germany Waste Heat Recovery Systems is anticipated to reach USD 2150 Million by …

The Germany Waste Heat Recovery Systems (WHRS) is anticipated to reach USD 2150 million by 2030 growing at a CAGR of 5.7% from 2024-2030. Continued expansion post-2026 aligns with Germany's decarbonization trajectory, as operators increasingly prioritize heat-recovery to reduce fuel consumption and comply with tightening carbon-intensity expectations.

By technology, the exchange waste heat recovery boilers market size is anticipated to reach USD 710 million by 2030. Exchange/WH Boilers and SRC (Steam…

South Korea Flounder Market Anticipated to grow at a CAGR of 8% from 2023-2030

The South Korea flounder is anticipated to grow at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin B1 and B2, which is effective…

Global Flounder Market Anticipated to reach USD 56 Billion by 2030

The global flounder market is anticipated to reach USD 56 Billion by 2030, growing at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin…

Global Seafood Market Anticipated to reach USD 730 Billion by 2030

The global seafood market is anticipated to reach USD 730 Billion by 2030, growing at a CAGR% of 8.9% from 2022-2030. The factors contributing towards the high growth are increased disposable income, awareness of fish being used as an ingredient in healthy food is growing. USA the government plans to sanction illegal fishing activities, actively promote fair trade, and promote strategies to promote the fishing industry through detailed strategies such…

More Releases for Mobility

Indianapolis Mobility Retailer Rebrands from Mobility Plus Indianapolis West to …

Mobility Indy Emerges as a Locally Owned, Independent Provider of Stair Lifts, Scooters, and Lift Chairs for Central Indiana

Indianapolis, IN - May 2, 2025 - A well-known provider of mobility equipment in Indiana is taking an exciting step forward. Mobility Plus Indianapolis West, a top-rated showroom serving the Indianapolis area, is rebranding as Mobility Indy [https://www.mobilityindy.com/] effective immediately. Though the name is changing, customers can continue to expect the same…

Marc's Mobility Expands Fast Mobility Scooter Collection

Marc's Mobility (provider of new and used mobility devices) highlights the expansion of its fast mobility scooter collection: https://marcsmobility.com/new-scooters/fast-mobility-scooters.html. This move aims to meet the growing demand for speed and convenience in personal transportation for people with limited mobility.

Enhanced Mobility Solutions

The expanded collection features a range of fast mobility scooters designed to offer users quick and efficient transportation. These scooters are equipped with powerful motors capable of reaching speeds up…

Mobility Scooters Market Is Booming Worldwide | TGA Mobility, KYMCO, Amigo Mobil …

The Latest published a market study on Worldwide Mobility Scooters Market provides an overview of the current market dynamics in the Worldwide Mobility Scooters space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2028. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some…

Vehicles for Disabled Market to 2027 - Leading Key Players Advanced Mobility, Br …

The demand for vehicles for disabled has witnessed a symbolic increase in recent years. The development in mobility solutions and the need for equality in terms of accessibility has attracted the attention of auto manufacturers. Also, the scenario in developing countries is changing, and increased investments in the healthcare infrastructure are visible. The rising per capita income is also enabling disabled people to switch to these solutions.

The vehicles for disabled…

Clinical Mobility Aids Market Astonishing Growth| Magic Mobility, Karma Mobility …

A latest study released by HTF MI on Global Clinical Mobility Aids Market covering key business segments and wide scope geographies to get deep dive analysed market data. The study is a perfect balance bridging both qualitative and quantitative information of Clinical Mobility Aids market. The study provides historical data (i.e. Volume** & Value) from 2013 to 2018 and forecasted till 2025*. Some are the key & emerging players that…

Personal Mobility Devices Market 2025 - Carex Health Brands, Mobility+Designed, …

The Personal Mobility Devices Market report analyzes factors affecting Personal Mobility Devices Market from both demand and supply side and further evaluates market dynamics effecting the market during the forecast period i.e., drivers, restraints, opportunities, and future trend. The report also provides exhaustive PEST analysis for all five regions namely; North America, Europe, APAC, MEA and South & Central America after evaluating political, economic, social and technological factors effecting the…