Press release

Self-Directed Investors Implications for Wealth Managers Market Development Trends, Key Players, Competitive Landscape and Key Regions

Self-Directed Investors Implications for Wealth Managers Market research report arrangement investigation showcases player profiles and methodologies. The report offers a complete understanding of the improvement approaches, procedures, cost structures, and future growth.For this study, the global Self-Directed Investors Implications for Wealth Managers Market based upon the components, usage, application, the main participant, and the region, has Prepared by ReportsnReports Industry Research Firm.

COVID-19 Impact Analysis:

Due to the effects of COVID-19, the implementation of Self-Directed Investors Implications for Wealth Managers Marketis expected to witness a rapid advance, thereby resulting in the fast growth of the Self-Directed Investors Implications for Wealth Managers Market. This is mainly due to the rapid adoption of the technology to map the spread of the disease and implement preventive measures. Hence, various government organizations are utilizing the Self-Directed Investors Implications for Wealth Managers Market technology for varied applications during the pandemic.

Download a FREE Sample Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=4476490

This report elaborates the market size, market characteristics, and market growth of the Self-Directed Investors Implications for Wealth Managers industry, and breaks down according to the type, application, and consumption area of Self-Directed Investors Implications for Wealth Managers. The report also conducted a PESTEL analysis of the industry to study the main influencing factors and entry barriers of the industry.

In Chapter 3.4 of the report, the impact of the COVID-19 outbreak on the industry was fully assessed. Fully risk assessment and industry recommendations were made for Self-Directed Investors Implications for Wealth Managers in a special period. This chapter also compares the markets of Pre COVID-19 and Post COVID-19.

In addition, chapters 8-12 consider the impact of COVID-19 on the regional economy.

Key players in the global Self-Directed Investors Implications for Wealth Managers market covered in Chapter 13:

Hargreaves Lansdown

Charles Schwab

National Australia Bank

Betterment

Interactive Investor

TD Ameritrade

UBS

Merrill Edge

Scottrade

Charles Stanley

Wealth front

Barclays

America Merrill Lynch

Fidelity

Wells Fargo

In Chapter 6, on the basis of types, the Self-Directed Investors Implications for Wealth Managers market from 2015 to 2025 is primarily split into:

Self-Directed Investors

Wealth Managers

In Chapter 7, on the basis of applications, the Self-Directed Investors Implications for Wealth Managers market from 2015 to 2025 covers:

HNW Clients under 35 Years Old

HNW Clients above 35 Years Old

Geographically, the detailed analysis of production, trade of the following countries is covered in Chapter 4.2, 5:

United States

Europe

China

Japan

India

Geographically, the detailed analysis of consumption, revenue, market share and growth rate of the following regions are covered in Chapter 8, 9, 10, 11, 12:

North America (Covered in Chapter 8)

United States

Canada

Mexico

Europe (Covered in Chapter 9)

Germany

UK

France

Italy

Spain

Others

Asia-Pacific (Covered in Chapter 10)

China

Japan

India

South Korea

Southeast Asia

Others

Middle East and Africa (Covered in Chapter 11)

Saudi Arabia

UAE

South Africa

Others

South America (Covered in Chapter 12)

Brazil

Others

Years considered for this report:

Historical Years: 2015-2019

Base Year: 2019

Estimated Year: 2020

Forecast Period: 2020-2025

Get a 20% Discount on this Report at https://www.reportsnreports.com/contacts/discount.aspx?name=4476490

The Goal of Self-Directed Investors Implications for Wealth Managers Market Report is to provide a complete market evaluation which includes insightful observations, information, actual data, market data verified by the industry, and forecasts with a proper set of hypotheses and methodologies. The study also analyzes global companies, including patterns in growth, opportunities for industry, investment strategies, and conclusions from experts. The study focuses on globally performing key players to clarify, identify and analyze the multiple aspects of the demand for Self-Directed Investors Implications for Wealth Managers Market.

About Us: ReportsnReports.com is your single source for all market research needs. Our database includes 500,000+ market research reports from over 95 leading global publishers & in-depth market research studies of over 5000 micro markets.

We provide 24/7 online and offline support to our customers.

E-mail: sales@reportsandreports.com

Phone: +1 888 391 5441

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Self-Directed Investors Implications for Wealth Managers Market Development Trends, Key Players, Competitive Landscape and Key Regions here

News-ID: 2302885 • Views: …

More Releases from ReportsnReports

DeviceCon Series 2024 - UK Edition | MarketsandMarkets

Future Forward: Redefining Healthcare with Cutting-Edge Devices

Welcome to DeviceCon Series 2024 - Where Innovation Meets Impact!

Join us on March 21-22 at Millennium Gloucester Hotel, 4-18 Harrington Gardens, London SW7 4LH for a groundbreaking convergence of knowledge, ideas, and technology. MarketsandMarkets proudly presents the DeviceCon Series, an extraordinary blend of four conferences that promise to redefine the landscape of innovation in medical and diagnostic devices.

Register Now @ https://events.marketsandmarkets.com/devicecon-series-uk-edition-2024/register

MarketsandMarkets presents…

5th Annual MarketsandMarkets Infectious Disease and Molecular Diagnostics Confer …

London, March 7, 2024 - MarketsandMarkets is thrilled to announce the eagerly awaited 5th Annual Infectious Disease and Molecular Diagnostics Conference, scheduled to take place on March 21st - 22nd, 2024, at the prestigious Millennium Gloucester Hotel, located at 4-18 Harrington Gardens, London SW7 4LH.

This conference promises to be a groundbreaking event, showcasing the latest trends and insights in diagnosis, as well as unveiling cutting-edge technologies that are revolutionizing the…

Infection Control, Sterilization & Decontamination Conference |21st - 22nd March …

MarketsandMarkets is pleased to announce its 8th Annual Infection Control, Sterilisation, and Decontamination in Healthcare Conference, which will take place March 21-22, 2024, in London, UK. With the increased risk of infection due to improper sterilisation and decontamination practices, the safety of patients and healthcare workers is of paramount importance nowadays.

Enquire Now @ https://events.marketsandmarkets.com/infection-control-sterilization-and-decontamination-conference/

This conference aims to bring together all the stakeholders to discuss the obstacles in achieving…

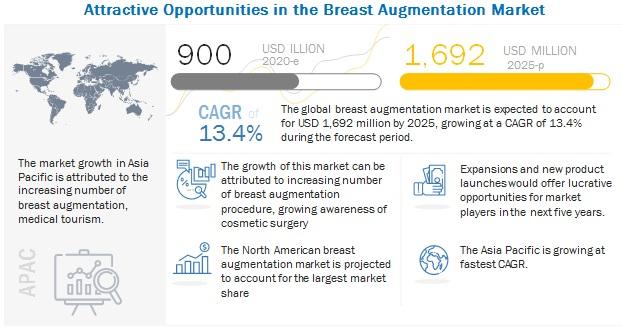

Breast Augmentation Market Key Players, Demands, Cost, Size, Procedure, Shape, S …

The global Breast Augmentation Market in terms of revenue was estimated to be worth $900 million in 2020 and is poised to reach $1,692 million by 2025, growing at a CAGR of 13.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…