Press release

Digital Banking Platforms Market Growth Projections 2020-2027 by Component, Deployment Model, Banking Mode, Regional Scope and Top Players Analysis | Appway, COR Financial Solution Ltd., Edgeverve, FIS Global, Fiserv, Inc, nCino, Oracle Corp

The Digital Banking Platforms Market would portray a significant CAGR by 2027, as per the latest report published by Allied Market Research.Allied Market Research recently published a report, titled, “Digital Banking Platform Market by Component (Solution and Service), Deployment Model (On-Premise and Cloud), Type (Retail Banking and Corporate Banking), and Banking Mode (Online Banking and Mobile Banking): Global Opportunity Analysis and Industry Forecast, 2020–2027”.

The report offers a detailed analysis of the market including dynamic growth factors, constraints, challenges, and opportunities. Moreover, it provides a study of major market players and their recent market strategies to aid new market entrants, stakeholders, and shareholders to devise profitable business strategies. The report offers a detailed study of various strategies adopted by market players to maintain their foothold in the market.

Download Sample Report (Get Full Insights in PDF – 250+ Pages) @ https://www.alliedmarketresearch.com/request-sample/5539

The Digital Banking Platforms Market report includes an overview of the market, SWOT analysis of the major market players along with financial analysis, portfolio analysis of services and products, and business overview. Moreover, the report includes the latest market developments such as market expansion, joint ventures, product launches for stakeholders to better understand the long-term profitability of the market.

Major segmentation:

The report includes segmentation of the Digital Banking Platforms Market on the basis of type, application, and geography. The study offers an in-depth study on each segment in the market that makes it advantageous to stakeholders and market players to gain a competitive understanding.

The market is analyzed based on geographical penetration along with a study of market performance in each region such as across several regions such as North America (United States, Canada, and Mexico), Europe (Germany, France, UK, Russia, and Italy), Asia-Pacific (China, Japan, Korea, India, and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa).

Interested? Do Purchase Inquiry Now @ https://www.alliedmarketresearch.com/purchase-enquiry/5539

Covid-19 scenario:

The Digital Banking Platforms Market has been significantly affected by the Covid-19 pandemic. The government restrictions and guidelines issued by World Health Organization (WHO) have temporarily suspended the manufacturing facilities. Moreover, the prolonged lockdown across several countries resulted in disruption of the supply chain and increased the raw material prices. This negatively affected the market growth.

Major market players

The report includes a detailed analysis of top players in the Digital Banking Platforms Market including Appway, COR Financial Solution Ltd., Edgeverve, FIS Global, Fiserv, Inc, nCino, Oracle Corporation, SAP SE, Temenos, and Vsoft Corporation.

The competitive analysis of these companies offers a detailed business overview, portfolio analysis of services and products. These companies have adopted various strategies such as partnership, joint ventures, new product launches, mergers & acquisitions, and collaboration to maintain a foothold in the market and help stakeholders understand the market.

Key benefits of the report:

• This report offers a comprehensive analysis of the Digital Banking Platforms Market along with a detailed summary, ongoing market trends, and future estimations to formulate profitable business strategies.

• The study includes a detailed analysis of major determinants of the market such as drivers, restraints, challenges, and opportunities in the Digital Banking Platforms Market.

• The market size is offered to determine the profitable trends to gain a strong foothold in the market.

• The Digital Banking Platforms Market report offers a qualitative and quantitative analysis of the historic and forecast period.

• The report includes Porter’s five forces analysis to understand the influence of the buyers and suppliers in the Digital Banking Platforms Market.

• The report includes the Digital Banking Platforms Market trends and share of major market players.

Get Detailed Analysis of COVID-19 Impact on Digital Banking Platforms Market @ https://www.alliedmarketresearch.com/request-for-customization/5539?reqfor=covid

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key forces shaping Global digital banking platform market

3.3.Market dynamics

3.3.1.Case Studies

3.3.1.1.Case Study 1

3.3.1.2.Case Study 02

3.3.2.Drivers

3.3.2.1.Increase in number of internet users

3.3.2.2.Growth in shift from traditional banking to digital banking

3.3.2.3.Increase in focus of organizations on digitalizing their financial services

3.3.3.Restraint

3.3.3.1.Security and compliance issues

3.3.4.Opportunities

3.3.4.1.Growth in usage of machine learning and artificial intelligence in digital banking platform

3.3.4.2.Increased market for cloud-based integrated products

3.4.COVID-19 impact analysis on digital banking platform market

3.4.1.Impact on digital banking platform market size

3.4.2.Chane in end user trends, budgets, and preferences

3.4.3.Regulatory framework solving market challenges faced by digital banking provider vendors

3.4.4.Economic impact on digital banking platform providers

3.4.5.Strategies to tackle negative impact in the industry

3.4.6.Opportunity window

Ask to Analyst: https://www.alliedmarketresearch.com/connect-to-analyst/5539

CONTACT US

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on LinkedIn: https://www.linkedin.com/company/allied-market-research

ABOUT US

Allied Market Research (AMR) is a market research and business-consulting firm of Allied Analytics LLP, based in Portland, Oregon. AMR offers market research reports, business solutions, consulting services, and insights on markets across 11 industry verticals. Adopting extensive research methodologies, AMR is instrumental in helping its clients to make strategic business decisions and achieve sustainable growth in their market domains. We are equipped with skilled analysts and experts and have a wide experience of working with many Fortune 500 companies and small & medium enterprises.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platforms Market Growth Projections 2020-2027 by Component, Deployment Model, Banking Mode, Regional Scope and Top Players Analysis | Appway, COR Financial Solution Ltd., Edgeverve, FIS Global, Fiserv, Inc, nCino, Oracle Corp here

News-ID: 2300143 • Views: …

More Releases from Allied Market Research

Renal Denervation Market to Exceed USD $4.5 Billion by 2030 | Allied Market Rese …

Renal denervation is a medical procedure that uses radiofrequency ablation or other methods to disrupt the activity of nerves that surround the kidneys. These nerves are part of the sympathetic nervous system, which controls various bodily functions, including blood pressure regulation. During renal denervation, upper chamber and lower chamber of the heart beat irregularly, chaotically, and out of sync, which can cause shortness of breath, chest pain, weakness, lightheadedness, or…

The Booming Surgical Equipment Market Is Projected to Reach $59 Billion by 2032

Allied Market Research recently said the surgical equipment industry has been growing steadily in recent years, driven by advances in technology, increasing demand for minimally invasive surgeries, and rising healthcare expenditures. The global surgical equipment market size was valued at $35.6 billion in 2022, and is projected to reach $59 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. Surgical equipment refers to the various tools,…

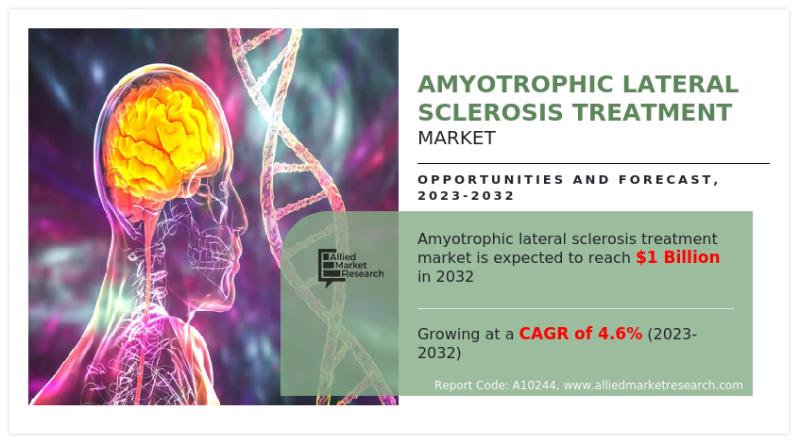

ALS Treatment Market to Reach US$ 1.04 Billion by 2032, Growing at 4.6% CAGR

The global amyotrophic lateral sclerosis (ALS) treatment market is entering a critical phase of growth as unmet therapeutic needs and research momentum converge. Current figures indicate a market value of US$ 662.3 million in 2022, with a projected increase to US$ 1,038.94 million by 2032, which equates to a CAGR of 4.6% from 2023 to 2032. ALS is a severe neurodegenerative disease affecting nerve cells in the brain and spinal…

Aircraft Engine Forging Market to Garner $5 Billion, Globally, By 2032 At 6.9% C …

Aircraft engine forging industry size was valued at $2.6 billion in 2022, and is estimated to garner $5 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

The demand for lightweight materials, such as titanium, aluminum, and advanced alloys, aimed at improving fuel efficiency and overall performance of aircraft engines. Moreover, there is surge in air travel demand that led airlines to expand their fleets, necessitating the…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…