Press release

Usage-Based Insurance Market Size, Share, Growth, Trends, Investment Opportunities, Revenue Projections, Sales Channels. Industry Segments, and Business Development Strategies by Key Players 2020-2027

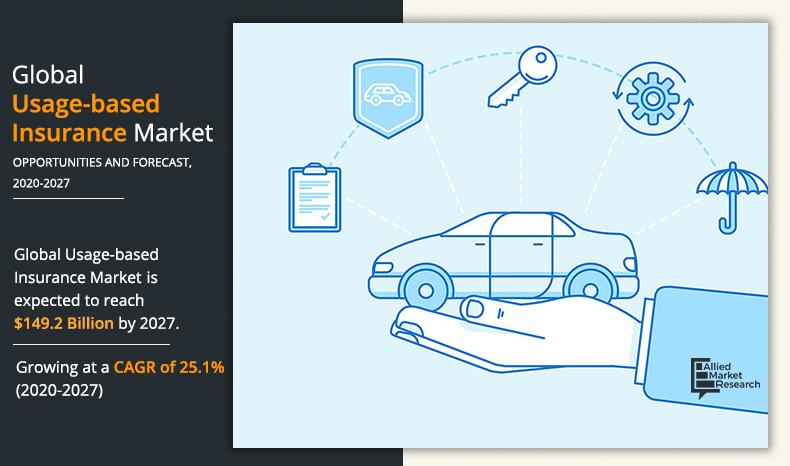

The Usage-Based Insurance Market would portray a significant CAGR by 2027, as per the latest report published by Allied Market Research.Allied Market Research recently published a report, titled, “Usage-Based Insurance Market by Policy Type [Pay-As-You-Drive Insurance (PAYD), Pay-How-You-Drive Insurance (PHYD), and Manage-How-You-Drive Insurance (MHYD)], Technology (OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs), Vehicle Age (New Vehicles and Used Vehicles), Vehicle Type (Light-Duty Vehicle (LDV) and Heavy-Duty Vehicle (HDV)): Global Opportunity Analysis and Industry Forecast, 2020–2027”.

The report offers a detailed analysis of the market including dynamic growth factors, constraints, challenges, and opportunities. Moreover, it provides a study of major market players and their recent market strategies to aid new market entrants, stakeholders, and shareholders to devise profitable business strategies. The report offers a detailed study of various strategies adopted by market players to maintain their foothold in the market.

Download Sample Report (Get Full Insights in PDF – 250+ Pages) @ https://www.alliedmarketresearch.com/request-sample/1742

The Usage-Based Insurance Market report includes an overview of the market, SWOT analysis of the major market players along with financial analysis, portfolio analysis of services and products, and business overview. Moreover, the report includes the latest market developments such as market expansion, joint ventures, product launches for stakeholders to better understand the long-term profitability of the market.

Major segmentation:

The report includes segmentation of the Usage-Based Insurance Market on the basis of type, application, and geography. The study offers an in-depth study on each segment in the market that makes it advantageous to stakeholders and market players to gain a competitive understanding.

The market is analyzed based on geographical penetration along with a study of market performance in each region such as across several regions such as North America (United States, Canada, and Mexico), Europe (Germany, France, UK, Russia, and Italy), Asia-Pacific (China, Japan, Korea, India, and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa).

Interested? Do Purchase Inquiry Now @ https://www.alliedmarketresearch.com/purchase-enquiry/1742

Covid-19 scenario:

The Usage-Based Insurance Market has been significantly affected by the Covid-19 pandemic. The government restrictions and guidelines issued by World Health Organization (WHO) have temporarily suspended the manufacturing facilities. Moreover, the prolonged lockdown across several countries resulted in disruption of the supply chain and increased the raw material prices. This negatively affected the market growth.

Major market players

The report includes a detailed analysis of top players in the Usage-Based Insurance Market including Allianz SE, Allstate Corporation, Aviva, AXA, Insurethebox, Liberty Mutual Insurance, Mapfre S.A., Nationwide Mutual Insurance Company, Progressive Corporation and UNIPOLSAI ASSICURAZIONI S.P.A.

The competitive analysis of these companies offers a detailed business overview, portfolio analysis of services and products. These companies have adopted various strategies such as partnership, joint ventures, new product launches, mergers & acquisitions, and collaboration to maintain a foothold in the market and help stakeholders understand the market.

Key benefits of the report:

• This report offers a comprehensive analysis of the Usage-Based Insurance Market along with a detailed summary, ongoing market trends, and future estimations to formulate profitable business strategies.

• The study includes a detailed analysis of major determinants of the market such as drivers, restraints, challenges, and opportunities in the Usage-Based Insurance Market.

• The market size is offered to determine the profitable trends to gain a strong foothold in the market.

• The Usage-Based Insurance Market report offers a qualitative and quantitative analysis of the historic and forecast period.

• The report includes Porter’s five forces analysis to understand the influence of the buyers and suppliers in the Usage-Based Insurance Market.

• The report includes the Usage-Based Insurance Market trends and share of major market players.

Get Detailed Analysis of COVID-19 Impact on Usage-Based Insurance Market @ https://www.alliedmarketresearch.com/request-for-customization/1742?reqfor=covid

Key Market Segments

By Type

• Pay-as-you-drive (PAYD)

• Pay-how-you-drive (PHYD)

• Manage-how-you-drive (MHYD)

By Technology

• OBD-II-based UBI programs

• Smartphone-based UBI programs

• Hybrid-based UBI programs

• Black-box-based UBI programs

By Vehicle Age

• New Vehicles

• Used Vehicles

By Vehicle Type

• Light-Duty Vehicle (LDV)

• Heavy-Duty Vehicle (HDV)

By Region

• North America

o U.S.

o Canada

• Europe

o Germany

o France

o UK

o Italy

o Spain

o Belgium

o Rest of Europe

• Asia-Pacific

o China

o Japan

o Australia

o Singapore

o Thailand

o Rest of Asia-Pacific

• LAMEA

o Latin America

o Middle East

o Africa

Key Market Players

• Allianz SE

• Allstate Corporation

• Aviva

• AXA

• Insurethebox

• Liberty Mutual Insurance

• Mapfre S.A.

• Nationwide Mutual Insurance Company

• Progressive Corporation

• UNIPOLSAI ASSICURAZIONI S.P.A

Ask to Analyst: https://www.alliedmarketresearch.com/connect-to-analyst/1742

CONTACT US

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on LinkedIn: https://www.linkedin.com/company/allied-market-research

ABOUT US

Allied Market Research (AMR) is a market research and business-consulting firm of Allied Analytics LLP, based in Portland, Oregon. AMR offers market research reports, business solutions, consulting services, and insights on markets across 11 industry verticals. Adopting extensive research methodologies, AMR is instrumental in helping its clients to make strategic business decisions and achieve sustainable growth in their market domains. We are equipped with skilled analysts and experts and have a wide experience of working with many Fortune 500 companies and small & medium enterprises.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-Based Insurance Market Size, Share, Growth, Trends, Investment Opportunities, Revenue Projections, Sales Channels. Industry Segments, and Business Development Strategies by Key Players 2020-2027 here

News-ID: 2300124 • Views: …

More Releases from Allied Market Research

Warehouse Automation Market Expected to Reach $90,725.7 Million by 2034

According to a new report published by Allied Market Research, titled, "Warehouse Automation Market,by Solution (Automated Storage and Retrieval Systems, Conveyors and Sortation Systems, Robotics Systems, Picking and Packing Equipment, Palletizing and Depalletizing Systems, Sensors and Scanners, Others Hardware, Warehouse Management System, Warehouse Control System, Warehouse Execution System, Others Software's), by Application (Automotive, Food and beverage, E-Commerce, Pharmaceutical, Fashion and Apparel, Cosmetics, Others), by End User Industry (Retailers, Manufacturers and…

($243.26 million) U.S. Insurance Third-Party Administrator Market Poised for Exp …

According to the report published by Allied Market Research, the U.S. Insurance Third Party Administrator market generated $156.08 million in 2020, and is projected to reach $243.26 million by 2030, witnessing a CAGR of 4.6% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, top segments, value chain, key investment pockets, regional scenario, and competitive landscape.

Claim Your Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/14904

Third-party administrator acts…

Medical Professional Liability Insurance Market to Hit $33.7 Billion by 2031 at …

According to the report published by Allied Market Research, the global medical professional liability insurance market generated $12.5 billion in 2021, and is projected to reach $33.7 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

➡️Download Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A30183

The adoption of medical liability insurance solutions or malpractice insurance has increased over the years to help organizations to cover liability of the doctors…

Crowdfunding Market on the Rise, Growing at 14.3% CAGR Through 2031

According to the report published by Allied Market Research, the global crowdfunding market generated $1.9 billion in 2021, and is estimated to reach $6.8 billion by 2031, witnessing a CAGR of 14.3% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market players,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…