Press release

Florida Digital Lending Market Size Detailed Analysis of Current Industry Figures with Forecasts Growth By 2030

As per the report published by Allied Market Research Titled “Florida Digital Lending Market By Loan Type (Payday Loans, Personal Loans, and SME-focused Loans), Provider Type (Banks, Credit Unions, FinTech Institutions, and Others), Loan Amount (Less than USD 500, USD 500-USD4,999, USD 5000-USD10,000, and More than 10,000), End User (Individuals, Entrepreneurs, and SMEs) : Opportunity Analysis and Industry Forecast, 2020–2027”, the Florida digital lending market is estimated to showcase significant growth from 2020 to 2027. As per AMR, the recent developments in technology have an instrumental effect on the growth of the Florida digital lending market. The study offers a comprehensive analysis of the driving and restraining factors, lucrative opportunities, market segmentation, and study of major market players. The report includes a detailed analysis of the impact of the Covid-19 pandemic on the Florida digital lending market.Download Sample Report with Full TOC @ https://www.alliedmarketresearch.com/request-sample/11457

The Florida digital lending market report includes an overview of the market and highlights market definition and scope along with major factors that shape the Florida digital lending market. The study outlines the major market trends and driving factors that boost the growth of the Florida digital lending market. The report includes an in-depth study of sales, market size, sales analysis, and prime drivers, challenges, and opportunities.

The report offers a comprehensive study of market trends, major market players, and top investment pockets that help make strategic and informed decisions. The study includes a detailed analysis of the top impacting factors and investment pockets that affect the market growth and influence new opportunities in the future.

Request For Customization @ https://www.alliedmarketresearch.com/request-for-customization/11457?reqfor=covid

The report includes an in-depth analysis of the impact of the Covid-19 outbreak on the market. The prolonged lockdown and restriction on international trade have a significant impact on the Florida digital lending market. The Covid-19 pandemic has resulted in a disrupted supply chain and shortage of raw materials, which has affected the market growth. The report includes consumer trends, preferences, and budget impact on the market due to the pandemic. Moreover, the report highlights the opportunity window and key strategic decisions taken by the market players during such unprecedented times.

Pre-Book Now with 10% Discount @ https://www.alliedmarketresearch.com/purchase-enquiry/11457

The Florida digital lending market report provides an in-depth segmentation of the market. The report provides a study of sales, revenue, growth rate, and market shares of each segment during the historic as well as forecast period. The Florida digital lending market report provides a detailed study of drivers, challenges, restraints, and opportunities in the market. The comprehensive analysis of the major drivers helps new market entrants to understand the current market scenario. The challenges and restraints are essential to comprehend the growth of the market during the forecast period and formulate strategic business plans accordingly. The analysis of the recent and upcoming market trends helps understand the market demand and futuristic opportunities in the market.

Key Market Segments Includes:

By Loan Type

• Payday Loans

• Personal Loans

• SME-focused Loans

By Provider Type

• Banks

• Credit Unions

• FinTech Institutions

• Others

By Loan Amount

• Less than USD 500

• USD 500-USD4,999

• USD 5000-USD10,000

• More than 10,000

By End User

• Individuals

• Entrepreneurs

• SMEs

The technological advancements and advent of novel technologies such as artificial intelligence, cloud computing, big data, and cryptocurrency have an instrumental effect on the Florida digital lending market growth. The report helps understand the role of such technologies in the market growth during the forecast period.

The market growth is formulated with the help of several methods and tools. The SWOT analysis offers in-depth knowledge of the major determinants of the market growth. Furthermore, these tools are essential for understanding the lucrative opportunities in the market.

Schedule a Call with Our Analysts for Free Consultation: https://www.alliedmarketresearch.com/connect-to-analyst/11457

Key offering of the Report:

1. Major driving factors: A detailed study of determinants of the market factors, forthcoming opportunities, and challenges.

2. Current market trends & forecasts: An in-depth analysis of the market including recent market trends and forecasts for the next few years that help to make an informed decision.

3. Segmental Analysis: A detailed study of each segment along with driving factors and growth rate analysis of each segment.

4. Geographical analysis: Insightful study of the market across various regions that enable market players to benefit from the market opportunities.

5. Competitive landscape: A detailed study of major market players that are active in the Florida digital lending market.

The Florida digital lending market report offers a detailed study of the top 10 market players present in the industry. The report includes production, sales, and revenue analysis of the market players. The major market players that are currently active in the market are lly Financial Inc., Credible, Florida Credit Union, LendingPoint LLC, Navy Federal Credit Union, Social Finance, Inc., Suncoast Credit Union, TD Bank, N.A., VyStar Credit Union, and WELLS FARGO. These market players have adopted various business strategies including mergers & acquisitions, new product launches, partnerships, and collaborations to maintain their foothold in the market. The market report includes statistics, tables, and charts to offer a detailed study of the Florida digital lending industry.

David Correa

Portland, OR, United States

USA/Canada (Toll Free): +1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web:https://www.alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Florida Digital Lending Market Size Detailed Analysis of Current Industry Figures with Forecasts Growth By 2030 here

News-ID: 2294044 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

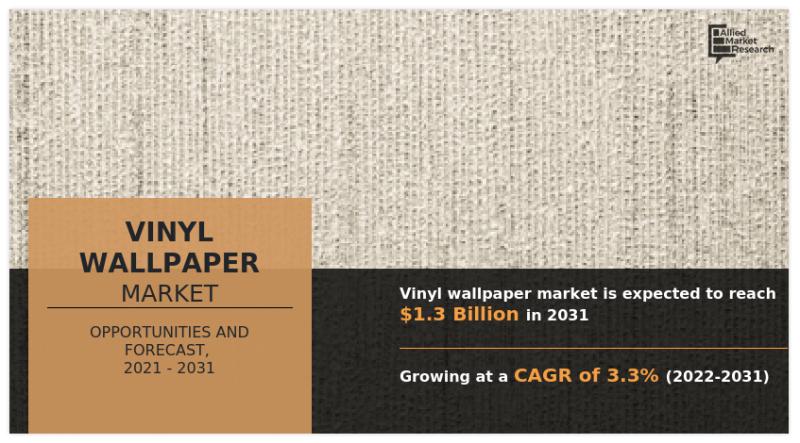

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

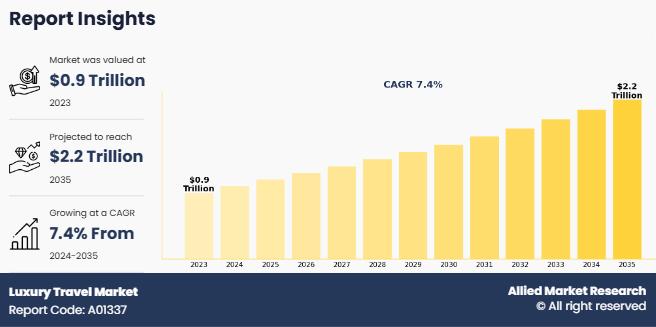

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Florida

Florida Roof Bros Strengthens Its Commitment to Quality Roofing Across Florida

Image: https://www.globalnewslines.com/uploads/2025/12/1764763768.jpg

Palm Bay, FL - Florida Roof Bros has announced an expanded range of professional roofing services designed to meet the needs of both residential and commercial clients throughout the state of Florida. Built on a foundation of integrity, expertise, and dedication to quality, the company continues to be a leading force in the roofing industry, known for exceptional craftsmanship and dependable service.

The company's residential roofing division focuses on providing…

Estimate Florida Consulting Delivers Trusted Estimating Solutions Across the Flo …

Estimate Florida Consulting is a recognized leader in construction estimating services, delivering accurate, timely, and detailed solutions to contractors, developers, and property owners across the United States. The firm specializes in construction estimates, material takeoffs, and budget planning for residential, commercial, and industrial projects of all sizes.

With a commitment to precision and professionalism, Estimate Florida Consulting helps clients reduce financial risk, improve bidding accuracy, and maintain tighter control over construction…

Online Florida Apostille LLC Revolutionizes Apostille Processing Across Florida

Image: https://www.globalnewslines.com/uploads/2025/07/1752125246.jpg

July 10, 2025 - Florida, USA - Online Florida Apostille LLC is transforming the way residents and businesses obtain document authentication, offering the most efficient, secure, and user-friendly Florida Apostille service available today. As of July 7, 2025, the company has become the go-to solution for individuals seeking fast and reliable online apostille Florida [https://onlinefloridaapostille.com/] processing-streamlining a process that was once slow, confusing, and burdensome.

Founded with a mission to…

Estimate Florida Consulting Delivers Accurate Construction Estimates Across Flor …

Orlando, Florida - June 2025

Estimate Florida Consulting, a professional estimating company based in Florida, is now providing detailed construction cost estimating services for projects across the entire state-including Orlando, Tampa, Miami, Jacksonville, Fort Lauderdale, West Palm Beach, and other surrounding areas.

With years of experience working closely with general contractors, subcontractors, developers, material suppliers, and homeowners, the company supports all types of residential and commercial construction projects. Their services include roofing,…

South Florida Van Lines Expands Local Moving Services in Miami, Florida

As the demand for professional, reliable, and efficient moving services continues to rise throughout South Florida, South Florida Van Lines proudly announces the expansion of its local moving services in Miami, Florida. With over two decades of experience in the industry, the company is strengthening its commitment to helping families and businesses transition seamlessly to new spaces-whether it's down the street or across the city.

Serving communities throughout Miami-Dade County, South…

Florida Commissioner Nikki Fried Proclaims October “Florida Native Plant Month …

Tallahassee, Fla., Oct. 24, 2019 – In a ceremony held in Tallahassee at Native Nurseries, Florida Department of Agriculture and Consumer Services Commissioner Nicole “Nikki” Fried proclaimed October to be Florida Native Plant Month. The proclamation was presented to the Florida Native Plant Society to highlight the role of native plants in conserving and protecting Florida’s natural environment.

“This is a significant step in our efforts to publicize the benefits of…