Press release

Usage-based Insurance Market Competitive Analysis with Growth Forecast Till 2025

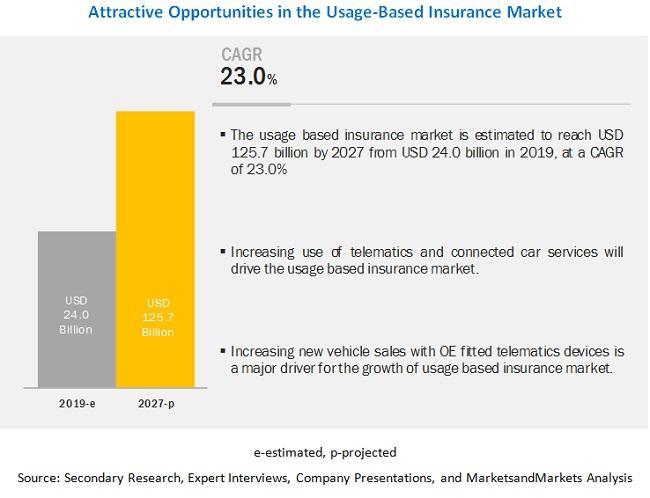

The report “Usage-Based Insurance Market for Automotive by Package type, Technology type (OBD-II, Blackbox, Smartphone, Embedded, and Other technologies), Vehicle type, Vehicle age, Device Offering, Electric & Hybrid vehicles, and Region – Global forecast to 2027″, is projected to reach USD 125.7 billion by 2027 from an estimated USD 24.0 billion in 2019, at a CAGR of 23.0% during the forecast period. The growth of the usage-based insurance market is influenced by factors such as the increasing sales of telematics-equipped vehicles and government regulations on safety and telematics services. In addition, the anticipated increase in demand for connected cars and lower insurance premiums compared to regular insurance are expected to boost the market growth. Therefore, the usage-based insurance market is expected to witness significant growth in the future.Light-Duty Vehicle (LDV) is expected to lead the market during the forecast period

Light-duty vehicles constitute of passenger cars and light commercial vehicles. In 2018, these vehicles accounted for almost 95% of the total global vehicle sales, as per OICA. The adoption rate of UBI is higher in LDVs than HDVs. Light-duty vehicles can be easily fitted with OBD-II, black box, or other devices to access usage-based insurance plans. Additionally, as LDVs are generally driven by a single person, UBI plans based on driver behavior are ideal for this vehicle segment. The same is not true for HDVs as they have multiple drivers. Also, leading companies are developing various products and solutions for LDVs such as ride sharing and autonomous vehicles. For instance, in March 2018, Allstate partnered with Uber to protect drivers and passengers by offering commercial auto coverage. The partnership enabled Allstate to expand its leadership in personal transportation solutions into the commercial insurance market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=154621760

Embedded system segment is expected to be the fastest growing market

According to MarketsandMarkets analysis, embedded system is the fastest growing segment, by technology, of the usage-based insurance market owing to the increasing number of vehicles with embedded connectivity. In the current market scenario, OBD-II is widely used as OBD-II devices offer reliable data collection and have gained high customer acceptance. The market for embedded system-based UBI is directly related to the market for connected cars with built-in telematics. The market for connected cars is proliferating. However, the major market is concentrated in North America and Europe owing to their higher adoption rate of embedded systems.

North America is expected to lead the market during the forecast period

North America is estimated to be the largest market for usage-based insurance owing to the high adoption rate of usage-based insurance in new and on-road vehicles equipped with telematics units. In 2017, according to the National Association of Insurance Commissioners (NAIC), about 80 percent of new car sales in the US were equipped with on-board telematics. In 2020, 70% of all auto insurers are expected to use telematics. Most of the cars sold in the US and Canada belong to the premium segment. The dominance of premium cars increases the adoption rate of usage-based insurance as their regular insurance is very high. With the help of usage-based insurance, vehicle owners can save up to 30% on insurance. In addition, the increasing number of companies offering hardware to avail usage-based insurance has also contributed to the growth of the market.

Request Free Sample @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=154621760

Key Players:

The usage-based insurance market is dominated by globally established players such as UnipolSai Assicurazioni S.p.A (Italy), Progressive Casualty Insurance Company (US), Allstate Insurance Company (US), State Farm Automobile Mutual Insurance Company (US), and Liberty Mutual Insurance Company (US).

Critical Questions:

• Many companies are operating in the usage-based insurance market space across the globe. Who, according to you, are the frontrunners, and what strategies have they adopted?

• Fast-paced developments in usage-based insurance technologies such as embedded systems and smartphones are expected to change the dynamics of usage-based insurance market. How will this impact the overall market?

• The report includes an analysis of your competition that includes major players in the usage-based insurance ecosystem. The major players are UnipolSai Assicurazioni S.p.A (Italy), Progressive Casualty Insurance Company (US), Allstate Insurance Company (US), State Farm Automobile Mutual Insurance Company (US), and Liberty Mutual Insurance Company (US) among others.

• Discussion on your client’s imperatives based on our existing research on the usage-based insurance market and its ecosystems.

View Detail TOC @ https://www.marketsandmarkets.com/Market-Reports/usage-based-insurance-market-154621760.html

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: newsletter@marketsandmarkets.com

Phone: 18886006441

Address: 630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth emerging opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of globalFortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions. Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve. MarketsandMarkets's™ flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-based Insurance Market Competitive Analysis with Growth Forecast Till 2025 here

News-ID: 2288904 • Views: …

More Releases from MarketsandMarkets™ INC.

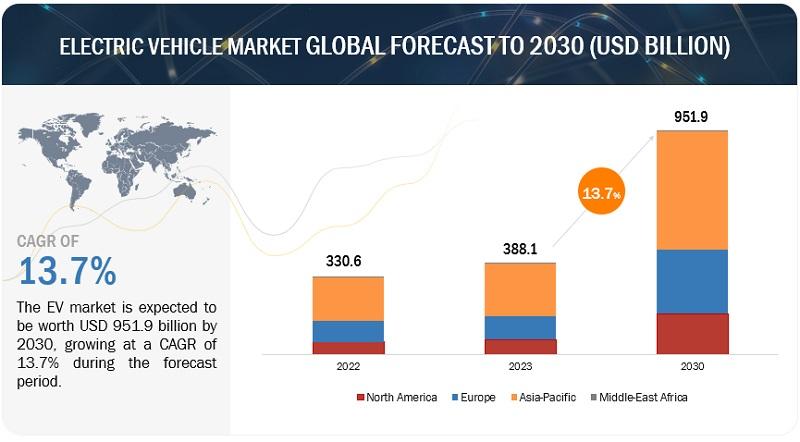

Electric Vehicle Market Size, Share, Trends & Analysis by 2030

The global EV market is projected to grow from USD 388.1 billion in 2023 to USD 951.9 billion by 2030, registering a CAGR of 13.7%. The electric vehicle (EV) market is currently experiencing a transformative phase of rapid growth and innovation. With increasing global concern over climate change and air pollution, coupled with advancements in technology and supportive government policies, the adoption of EVs has gained tremendous momentum. Consumers are…

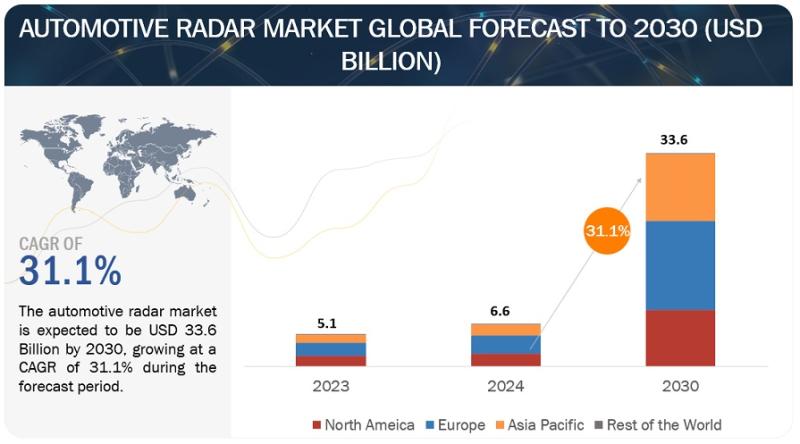

Automotive Radar Market Valued at $33.6 billion by 2030

The global automotive radar market is projected to grow from USD 6.6 billion in 2024 to USD 33.6 billion by 2030, registering a CAGR of 31.1%.

The automotive radar market is flourishing due to a confluence of factors. The primary driver is the surging demand for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. These technologies heavily rely on radar for object detection and measurement, making it an essential component. Furthermore, stricter…

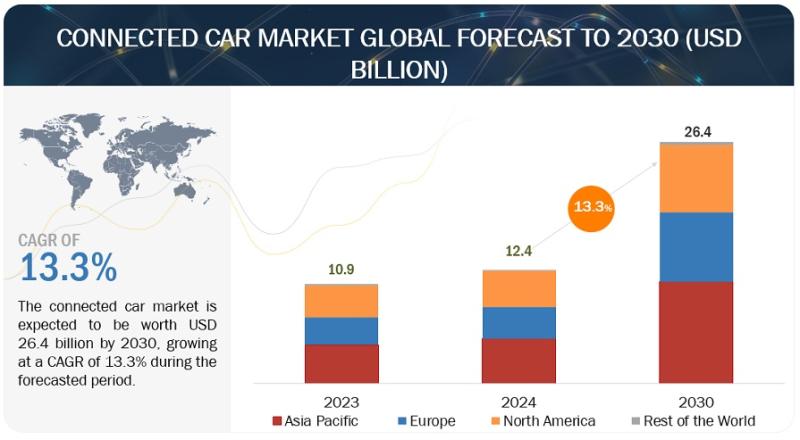

Connected Car Market Poised to Reach $26.4 billion by 2030

The globally connected car market is estimated to grow from USD 12.4 billion in 2024 to USD 26.4 billion by 2030, at a CAGR of 13.3%.

Government initiatives towards developing intelligent transportation networks and the growing trend of in-vehicle connectivity solutions are two factors influencing the growth of the worldwide connected car market. Also, the consumer demand for a safer, more convenient, and entertaining driving experience is a significant driver. This…

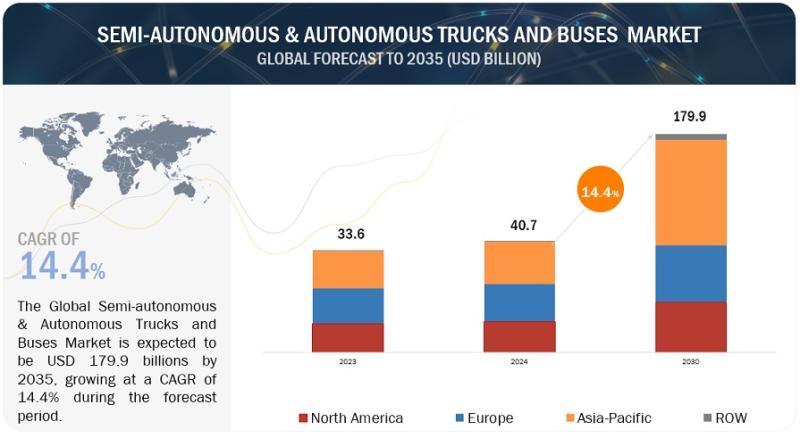

Semi-Autonomous & Autonomous Trucks and Buses Market worth $179.9 billion by 203 …

The Semi-autonomous & autonomous Trucks and Buses market size is projected to grow from USD 40.7 Billion in 2024 to USD 179.9 Billion by 2035, at a CAGR of 14.4%. The increasing demand for electric and autonomous vehicle and government regulation regarding safety is expected to increase the demand for Semi-autonomous & autonomous Trucks and Buses. Additionally, continuos innovation in advance driving technologies and components will boost the demand…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…