Press release

Peer to Peer (P2P) Lending Market Latest Updates, SWOT Analysis, Top Key Players, and Business Opportunities By 2028 | Avant, Kabbage, Lending Club, Funding Circle, LendingTree LLC, On Deck Capital and Prosper Marketplace

Peer to peer (P2P) lending, also referred to as market place lending, is a method of online debt financing, which allows creditors to lend varying sums of money to small business and individual borrowers. P2P lending transactions are not only economical for borrowers but also a profitable investment opportunity for retail lenders. Moreover, it allows individuals to give loans to other individuals or participate in pools of loans, thus limiting the market risk. Although P2P companies do not lend their own funds, they act as mediators to both borrower and lender.Allied Market Research published a new report, titled, "Peer to Peer (P2P) Lending Market By Business Model (Alternate Marketplace Lending and Traditional Lending), Type (Consumer Lending and Business Lending), and End User (Consumer Credit Loans, Small Business Loans, Student Loans, and Real Estate Loans): Global Opportunity Analysis and Industry Forecast, 2020-2028".

The market report provides an all-inclusive analysis of the present market aspects, estimations, assessments, revolving scenarios, and dynamic forces of the industry from 2019 to 2028. An extensive study of the aspects that drive and curtail the market growth is also demonstrated. The wide-ranging assessment of the market size and its proper breakdown help determine the dominant market opportunities.

Absolutely Free | Get Sample Report (Full Insights in PDF - 300+ Pages) @ https://www.alliedmarketresearch.com/request-sample/1948

The major countries in each region are portrayed according to the chunk of revenue they have. The major market players in the industry are outlined, and their plans & strategies are examined thoroughly, that ideate the competitive outlook of the peer to peer lending (P2P) market.

The market report covers regions that take in North America (United States, Canada and Mexico), South America (Brazil, Argentina, and Colombia), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa). The report also presents a comprehensive scenario of the market in each jurisdiction.

The frontrunners in the global peer to peer lending market are studied in this report. These market players have incorporated different strategies including partnership, expansion, collaboration, joint ventures, and others to prop up their stand in the industry. The key players operating in the global peer to peer lending industry include Avant Inc., Funding Circle Limited, Kabbage Inc., Lending Club Corporation, LendingTree LLC, On Deck Capital Inc., Prosper Marketplace Inc., RateSetter, Social Finance Inc., and Zopa Limited.

The market report covers an array of growth factors of the industry along with severe challenges and impeding factors that might deter the growth of the market. This study helps new market entrants and manufacturers concoct proper plans for potential challenges and look for opportunities to build up their market stance.

Get Extensive Analysis of COVID-19 Impact on Peer to Peer (P2P) Lending Market @ https://www.alliedmarketresearch.com/purchase-enquiry/1948

The report offers detailed information regarding major end-users and annual forecasts from 2019 to 2028. In addition, it presents revenue forecasts for each year along with sales and sales growth of the market. The forecasts are offered by a thorough study of the market by proficient analysts concerning geographical assessment of the market. These forecasts are beneficial to gain deep insight on the future prospects of the industry.

Key Benefits of the Report:

1. This study gives out an edifying illustration of the global peer to peer (P2P) lending market along with the contemporary trends and future assessments to support the investment takes.

2. The market report, furthermore, presents statistics in regards to key drivers, restraining factors, and opportunities coupled with an all-inclusive analysis of the market revenue.

3. The current market is thoroughly assessed from 2019 to 2028 to accentuate the global peer to peer lending market growth scenario. This analytical pattern displays the assertiveness of the market by analyzing several parameters including pressures from alternatives, power of the suppliers, and choice of the buyers operating in the industry.

4. The report doles out an explicit market study based on economic strength and how the global competition will take proper form in the near future.

Access Full Summary @ https://www.alliedmarketresearch.com/peer-to-peer-lending-market

Major Offering of the Report:

1. Top impacting factors: An extensive study of the driving factors, imminent opportunities, and challenges.

2. Current drifts & trends: A thorough analysis of the recent market trends and forecasts for the next few years to lay hold of a tactical, premeditated decision.

3. Segmental inquiry: A pervasive analysis of each segment and growth factors along with growth rate estimation.

4. Geographical analysis: Detailed discernments on the market potential across each province to allow the market players to make the most out of the market opportunities.

5. Competitive scenario: An extensive analysis of frontrunners active in the industry.

Questions Answered in the Peer to peer lending Market Research Report:

1. Which are the leading players active in the global peer to peer (P2P) lending market?

2. What would be the detailed impact of COVID-19 on the global peer to peer lending market size?

3. How the current peer to peer lending market trends that would influence the industry in the next few years?

4. What are the driving factors, restraints, and opportunities in the global market?

5. What are the projections for the future that would help in taking further strategic steps?

Schedule a Call with Our Analysts/Industry Experts to Find a Solution For Your Business @ https://www.alliedmarketresearch.com/connect-to-analyst/1948

Peer to Peer Lending Market Key Segments:

By Business Model:

1. Alternate Marketplace Lending

2. Traditional Lending

By Type:

1. Consumer Lending

2. Business Lending

By End User:

1. Consumer Credit Loans

2. Small Business Loans

3. Student Loans

4. Real Estate Loans

By Region:

1. North America

2. Europe

3. Asia-Pacific

4. LAMEA

CHAPTERS DISCUSSED IN THE REPORT: [Total 250 Pages]

Chapter 1: Introduction

Chapter 2: Executive Summary

Chapter 3: Market Overview

Chapter 4: Peer To Peer Lending Market By End-Users

Chapter 5: Peer To Peer Lending Market By Business Model

Chapter 6: Peer To Peer Lending Market By Geography

Chapter 7: Company Profile

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer to Peer (P2P) Lending Market Latest Updates, SWOT Analysis, Top Key Players, and Business Opportunities By 2028 | Avant, Kabbage, Lending Club, Funding Circle, LendingTree LLC, On Deck Capital and Prosper Marketplace here

News-ID: 2284563 • Views: …

More Releases from Allied Market Research

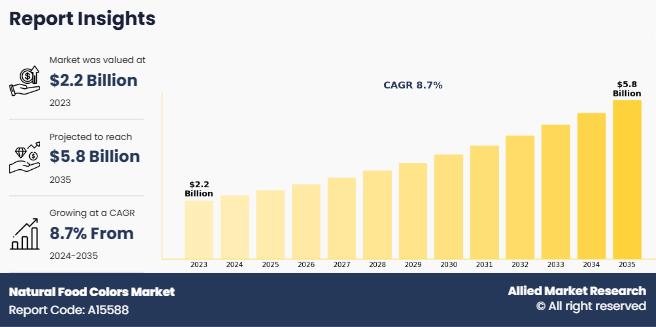

Natural Food Colors Market Size Worth USD 5.58 Billion By 2035 | Growth Rate (CA …

The natural food colors market was valued at $2.2 billion in 2023, and is estimated to reach $5.8 billion by 2035, growing at a CAGR of 8.7% from 2024 to 2035.

The rising demand for functional and nutraceutical foods is significantly driving the natural food colors, as consumers increasingly seek products that offer both health benefits and visual appeal. Natural colors derived from ingredients like turmeric, beetroot, spirulina, and blueberry not…

Combat Self-Defense Management Systems Market Rapidly Growing Dynamics with Indu …

Combat management system is a computer system which integrates the ship sensors, radars, weapons, data links, and other equipment into a single system. The combat management system provides situational awareness & intelligence to the crew and enables them to perform combat missions effectively. A combat management system comprises the central command & decision-making element of vessel combat system. The combat management system is used in combat missions for several purposes…

Ice Cream Coating Market Research Overview, Share, Size, Analysis, and Forecast …

Ice cream is a sweetened frozen product with either an artificial sweetener or natural sugar. Ice cream is eaten as a desert or snack. Increase in consumption of ice cream is highest in summer. Ice cream coating is made from coconut, cashew, almond milk, dairy milk or cream, soy, and is flavored with sugar. Ice cream coating contains thin layers that are manufactured from inexpensive fats such as hydrogenated palm…

Aviation Crew Management System Market Size Worth $5.61 Billion by 2032 With CAG …

According to the report, the global aviation crew management system market size was valued at $2.61 billion in 2022 and is projected to reach $5.61 billion by 2032, registering a CAGR of 8.16% from 2023 to 2032.

The growing demand for sophisticated software designed to improve crew operations across a range of aviation industries will experience significant growth.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/A177928

The global aviation crew management system market is driven by factors…

More Releases for Peer

Peer To Peer Network Patent Enforcement and Industry Consolidation

Peer To Peer Network ($PTOP) formally retained patent infringement counsel to enforce two specific U.S. utility patents, signaling their intent to consolidate control over the projected $300 billion market.

A Pivotal Moment for Digital Networking

The digital business card market, a rapidly growing sector fueled by the global shift to remote and hybrid work, has reached a pivotal moment. The industry is on the cusp of a fundamental transformation, initiated not by…

Evolving Market Trends In The Peer-To-Peer Dining Industry: Affordable And Custo …

The Peer-To-Peer Dining Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Peer-To-Peer Dining Market Size During the Forecast Period?

The peer-to-peer dining market size is expected to grow from $6.36 billion in 2024 to $6.64 billion in 2025 at a CAGR of…

Transforming the Peer-To-Peer Dining Market in 2025: Home Cooking Growth Propels …

What Is the Expected Size and Growth Rate of the Peer-To-Peer Dining Market?

In the past few years, the peer-to-peer dining market size has exhibited consistent growth. The current projection indicates an increase from $6.36 billion in 2024 to $6.64 billion in 2025, maintaining a compound annual growth rate (CAGR) of 4.3%. The expansion during the historic period is believed to stem from factors such as growing internet usage, widespread influence…

What is Peer-to-Peer Networks: Full Guide

In today's fast-paced digital age, the very fabric of how we connect and share information is transforming. At the forefront of this revolution stands peer-to-peer (P2P) technology, a game-changer that offers unprecedented levels of control, security, and efficiency. By enabling devices to communicate directly without a central server, peer-to-peer networks are redefining the way we think about data exchange and resource sharing.

Image: https://revbit.net/wp-content/uploads/2024/11/peer-to-peer-networks-1024x640.png

Understanding Peer-to-Peer Technology

Peer-to-peer technology is redefining connectivity by…

Global Peer-to-peer Network Market Size & Trends

According to a new market research report published by Global Market Estimates, the global peer-to-peer network market is expected to grow at a CAGR of 15.5% from 2023 to 2028.

Global peer-to-peer network market growth is driven by the rise in demand for scalability of the network and efficiency in terms of communication and file sharing.

Browse 147 Market Data Tables and 115 Figures spread through 163 Pages and in-depth TOC on…

CCE’s revolutionary peer-to-peer CAD collaboration technology

FOR IMMEDIATE RELEASE

Debankan Chattopadhyay

+1 (248) 932-5295

debankan@cadcam-e.com

CCE’s revolutionary peer-to-peer CAD collaboration technology

No need to store proprietary data in the cloud/server to view or collaborate

FARMINGTON HILLS, Mich. – (November 10, 2020) – CCE, a leading provider of advanced CAD interoperability technology, will launch Review Room, an exciting update to its EnSuite-Cloud product to enable people working remotely use its unique secure peer-to-peer technology for CAD collaboration.

EnSuite-Cloud is a phenomenally successful…