Press release

Futures Trading Service Market Outlook 2021: Big Things are Happening

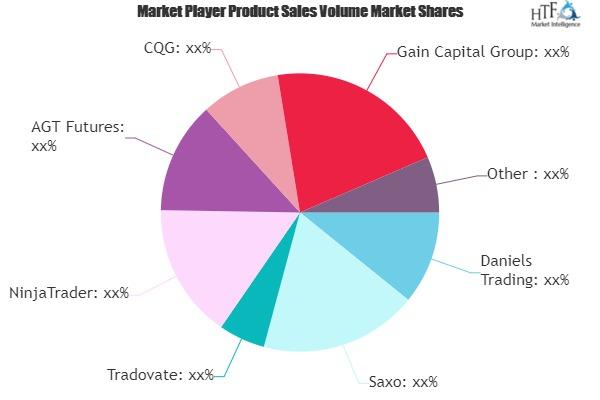

The latest update of Global Futures Trading Service Market study provides comprehensive information on the development activities by industry players, growth opportunities and market sizing for Futures Trading Service, complete with analysis by key segments, leading and emerging players, and geographies. The 91 page study covers the detailed business overview of each profiled players, its complete research and market development history with latest news and press releases. The study helps in identifying and tracking emerging players in the market and their portfolios, to enhance decision making capabilities and helps to create effective counter strategies to gain competitive advantage. Some of the players profiled/ part of study coverage are Daniels Trading, Saxo, Tradovate, NinjaTrader, AGT Futures, CQG, Gain Capital Group, ABLWSYS, SmartQuant, E-Futures, TransAct Futures, Trade Navigator & MultiCharts.Get free sample copy before purchase: https://www.htfmarketreport.com/sample-report/1925183-global-futures-trading-service-market

HTF Market Intelligence study explored over 15+ countries with detailed data layout spread from 2015 to 2026 and nearly 12+ regional indicators of Global Futures Trading Service Market. The study is built using data and information sourced from various primary and secondary sources, proprietary databases, company/university websites, regulators, conferences, SEC filings, investor presentations and featured press releases from company sites and industry-specific third party sources.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1925183-global-futures-trading-service-market

MARKET SCOPE & TARGET WITH KEY FINDINGS / OBJECTIVES

1. The Futures Trading Service Market Key Business Segments Growth & % Share

Share Price Index Futures & Commodity Futures are the segments analysed and sized in this study by application/end-users, displays the potential growth and various shift for period 2014 to 2026. The changing dynamics supporting the growth makes it critical for businesses in this space to keep abreast of the moving pulse of the market. Check which segment will bring in healthy gains adding significant momentum to overall growth., Software-based Futures Trading & Web-based Futures Trading have been considered for segmenting Futures Trading Service market by type.

Additionally, the study provides an in-depth overview of country level break-up classified as potentially high growth rate territory, countries with highest market share in past and current scenario. Some of the regional break-up classified in the study are United States, Europe, China, Japan, Southeast Asia, India & Central & South America.

2) How Study Have Considered the Impact of Economic Slowdown of 2020 ?

Analyst at HTF MI have conducted special survey and have connected with opinion leaders and Industry experts from various region to minutely understand impact on growth as well as local reforms to fight the situation. A special chapter in the study presents Impact Analysis of current scenario on Global Futures Trading Service Market along with tables and graphs related to various country and segments showcasing impact on growth trends.

3. Who is staying up in Competition

Due to pandemic, significant economic challenges confront China. Amid the growing push for decoupling and economic distancing, the changing relationship between China and the rest of the world will influence competition and opportunities in the Futures Trading Service market. Negotiations between the 2-largest global economies will continue in 2020, shaping all the uncertainty and worry-making still some emerging players are tapping highest growth rate and establishing its market share whereas reliable giants of Global Futures Trading Service Market still tuned with their strategic moves to challenge all competition.

How Key Players of the Global Futures Trading Service Market are Identified and What all Scenarios are considered while profiling players such as Daniels Trading, Saxo, Tradovate, NinjaTrader, AGT Futures, CQG, Gain Capital Group, ABLWSYS, SmartQuant, E-Futures, TransAct Futures, Trade Navigator & MultiCharts.

- Disruptive competition tops the list of industry challenges

- Customer experience, Revenue Monetization models and cost analysis.

- Top innovative Strategies, drivers, competitive moves etc.

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=1925183

Extracts from the TOC:

The exhaustive study has been prepared painstakingly by considering all important parameters. Some of these were

• Market sizing (value & volume) by Key Business Segments and Potential and Emerging Countries/Geographies

• Market driving trends

• Consumers options and preferences, Vendor and Supplier Landscape

• Regulatory Actions and Regional Policy Impacts

• Projected Growth Opportunities

• Industry challenges and constraints

• Technological environment and facilitators

• Consumer spending dynamics and trends

• other developments

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/1925183-global-futures-trading-service-market

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, MINT, BRICS, G7, Western / Eastern Europe or Southeast Asia.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Futures Trading Service Market Outlook 2021: Big Things are Happening here

News-ID: 2272213 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Hot Honey Drizzle Market Hits New High | Major Giants Nature Nate's, The Honey P …

The latest study released on the Global Hot Honey Drizzle Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Hot Honey Drizzle study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

AI Document Generator Market May See a Big Move | Major Giants Google (USA), SAP …

The latest study released on the Global AI Document Generator Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The AI Document Generator study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Frozen Okra Market is Booming Worldwide | Birds Eye (USA), Alasko Foods (Canada) …

The latest study released on the Global Frozen Okra Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Frozen Okra study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Notebooks & Journals Market Is Booming So Rapidly | Major Giants Moleskine, Leuc …

The latest analysis of the worldwide Notebooks & Journals market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The Notebooks & Journals market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges, as well as information about competitors.

Key Players in This Report…

More Releases for Futures

Trendspotting Futures

Co-authored by Point's strategy director, Carla Gontier, and Nkaroleng Matjie, Mid-Weight Strategist, this month's edition of "Fads & Futures" highlights some of the current trends that have the potential to impact brand-building and the brand-consumer relationship. The report also emphasises the importance of brands staying agile in negotiating these shifting tides.

In the same vein, for brands it's crucial to identify the markers that will determine which trends are likely…

TAIFEX Launches Mini Finance Futures

The Taiwan Futures Exchange (TAIFEX) has launched Mini Finance Sector Futures (ZFF) on 6 December 2021, in an effort to strengthen its small-sized product line-up, as well as adapting to surging demand from retail investors for managing their risk exposure in Taiwan’s finance industry.

Comprised of major banks, insurance and securities companies in Taiwan’s stock market, the financial sector is second only to Taiwan’s globally-critical electronics industry in terms of market…

Futures Trading Service Market Is Booming Worldwide: Daniels Trading, Saxo, TD A …

The latest research on “Global Futures Trading Service Report 2021” offered by HTF MI provides a comprehensive investigation into the geographical landscape, industry size along with the revenue estimation of the business. Additionally, the report also highlights the challenges impeding market growth and expansion strategies employed by leading companies in the “Market”.

Get Free Sample PDF including full TOC, Tables and Figures and Available customizations) in Global Futures Trading Service: https://www.htfmarketreport.com/sample-report/3343505-2020-2025-global-futures-trading-service-market-report-production-and-consumption-professional-analysis

Proceeding…

Latest Research of Futures Trading Service Market In-Depth Assessment of Industr …

Futures Trading Service Market research report contains an introduction on new trends that can guide the businesses performing in the Futures Trading Service industry to understand the market and make the strategies for their business growth accordingly. The research report study the market size, share, key drivers for growth, major segments, and CAGR.

Get Sample Copy of this Report - https://www.orianresearch.com/request-sample/1057743

Additionally, the report enables a market player not only to…

Global Futures Trading Service Market Study | Forecast 2019 to 2025 | Top key pl …

Report Description

Global Futures Trading Service Market Size, Status and Forecast 2019-2025

In finance, a futures contract (more colloquially, futures) is a standardized forward contract, a legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other.Contracts are negotiated at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said…

SRMEX Will Launch Mini Yen Futures

The new contract is aligned with SRMEX’s strategic plan to develop a strong offshore platform for the trading of a range of Emerging Market (EM) contracts.

Sapporo, 2016 - SRMEX, a key institution of the domestic financial market, an exchange that provides various economic entities with an opportunity to trade in an open market and offers investors effective investment opportunities, today announced that in a bid to further expand the…