Press release

Mortgage Outsourcing Massive Market Opportunity Opening Up : Mphasis, Invensis, Verity Global Solutions, AT Kearney

The Mortgage Outsourcing Market has witnessed continuous growth in the past few years and is projected to see some stability post Q2,2020 and may grow further during the forecast period (2021-2025). The assessment provides a 360° view and insights, outlining the key outcomes of the industry, current scenario witnesses a slowdown and study aims to unique strategies followed by key players. These insights also help the business decision-makers to formulate better business plans and make informed decisions for improved profitability. In addition, the study helps venture or private players in understanding the companies more precisely to make better informed decisions. Some of the key players in the Mortgage Outsourcing market are Mphasis, Invensis, Verity Global Solutions, AT Kearney, SLK Global Solutions, WNS, Outsource2india & Sutherland Global Services Inc.What's keeping Mphasis, Invensis, Verity Global Solutions, AT Kearney, SLK Global Solutions, WNS, Outsource2india & Sutherland Global Services Inc. Ahead in the Market? Benchmark yourself with strategic steps and conclusions recently published by HTF MI.

Get Sample Pdf with Latest Figures @: https://www.htfmarketreport.com/sample-report/3140895-global-mortgage-outsourcing-market-2

The Major Players Covered in this Report:

Mphasis, Invensis, Verity Global Solutions, AT Kearney, SLK Global Solutions, WNS, Outsource2india & Sutherland Global Services Inc.

By type, the market is split as:

, On-line & Offline

By the end users/application, sub-segments are:

Bank, Loan company & Other

Regional Analysis for Mortgage Outsourcing Market:

North America (Covered in Chapter 9), United States, Canada, Mexico, Europe (Covered in Chapter 10), Germany, UK, France, Italy, Spain, Russia, Others, Asia-Pacific (Covered in Chapter 11), China, Japan, South Korea, Australia, India, South America (Covered in Chapter 12), Brazil, Argentina, Columbia, Middle East and Africa (Covered in Chapter 13), UAE, Egypt & South Africa

For Consumer Centric Market, Survey Analysis can be included as part of customization which consider demographic factor such as Age, Gender, Occupation, Income Level or Education while gathering data. (if applicable)

Consumer Traits (If Applicable)

Buying patterns (e.g. comfort & convenience, economical, pride)

Buying behavior (e.g. seasonal, usage rate)

Lifestyle (e.g. health conscious, family orientated, community active)

Expectations (e.g. service, quality, risk, influence)

The Mortgage Outsourcing Market study covers current status, % share, future patterns, development rate, SWOT examination, sales channels, to anticipate growth scenarios for years 2020-2025. It aims to recommend analysis of the market with regards to growth trends, prospects, and players contribution in the market development. The report size market by 5 major regions, known as, North America, Europe, Asia Pacific (includes Asia & Oceania seperately), Middle East and Africa (MEA), and Latin America.

If you need any specific requirement Ask to our Expert @ https://www.htfmarketreport.com/enquiry-before-buy/3140895-global-mortgage-outsourcing-market-2

The Mortgage Outsourcing market factors described in this report are:

-Key Strategic Developments in Mortgage

Outsourcing Market:

The research includes the key strategic activities such as R&D plans, M&A completed, agreements, new launches, collaborations, partnerships & (JV) Joint ventures, and regional growth of the key competitors operating in the market at global and regional scale.

Key Market Features in Mortgage Outsourcing Market:

The report highlights Mortgage Outsourcing market features, including revenue, weighted average regional price, capacity utilization rate, production rate, gross margins, consumption, import & export, supply & demand, cost bench-marking, market share, CAGR, and gross margin.

Analytical Market Highlights & Approach

The Mortgage Outsourcing Market report provides the rigorously studied and evaluated data of the top industry players and their scope in the market by means of several analytical tools. The analytical tools such as Porters five forces analysis, feasibility study, SWOT analysis, and ROI analysis have been practiced reviewing the growth of the key players operating in the market.

Table of Contents :

Mortgage Outsourcing Market Study Coverage:

It includes major manufacturers, emerging players growth story, major business segments of Mortgage Outsourcing market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application and technology.

Mortgage Outsourcing Market Executive Summary

It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

Mortgage Outsourcing Market Production by Region

Mortgage Outsourcing Market Profile of Manufacturers

Players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

For Complete table of Contents please click here @ https://www.htfmarketreport.com/reports/3140895-global-mortgage-outsourcing-market-2

Key Points Covered in Mortgage Outsourcing Market Report:

Mortgage Outsourcing Overview, Definition and Classification

Market drivers and barriers

Mortgage Outsourcing Market Competition by Manufacturers

Mortgage Outsourcing Capacity, Production, Revenue (Value) by Region (2019-2025)

Mortgage Outsourcing Supply (Production), Consumption, Export, Import by Region (2019-2025)

Mortgage Outsourcing Production, Revenue (Value), Price Trend by Type {, On-line & Offline}

Mortgage Outsourcing Market Analysis by Application {Bank, Loan company & Other}

Mortgage Outsourcing Manufacturers Profiles/Analysis

Mortgage Outsourcing Manufacturing Cost Analysis

Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers

Marketing Strategy by Key Manufacturers/Players, Connected Distributors/Traders

Standardization, Regulatory and collaborative initiatives

Industry road map and value chain

Market Effect Factors Analysis ............

Buy Latest Version of Report Available Now at Discounted Pricing @ https://www.htfmarketreport.com/buy-now?format=1&report=3140895

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, LATAM, Europe or Southeast Asia or Just Eastern Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited which provides next-generation service for organizations with a deep focus on market intelligence, data analytics, and social intelligence, all uniquely delivered under one roof by skilled professionals. By combining and analyzing acquire lucid and most relevant data which would help in better decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Outsourcing Massive Market Opportunity Opening Up : Mphasis, Invensis, Verity Global Solutions, AT Kearney here

News-ID: 2269090 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Marking Coating Market Is Going to Boom | Major Giants Sherwin-Williams, PPG Ind …

The latest study released on the Global Marking Coating Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Marking Coating study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Xenon Gas Market Hits New High | Major Giants Air Liquide, Linde plc, Air Produc …

The latest study released on the Global Xenon Gas Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Xenon Gas study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Fluorosurfactants Market Is Going to Boom | Major Giants Chemours, 3M, Solvay, A …

The latest study released on the Global Fluorosurfactants Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fluorosurfactants study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these insights might…

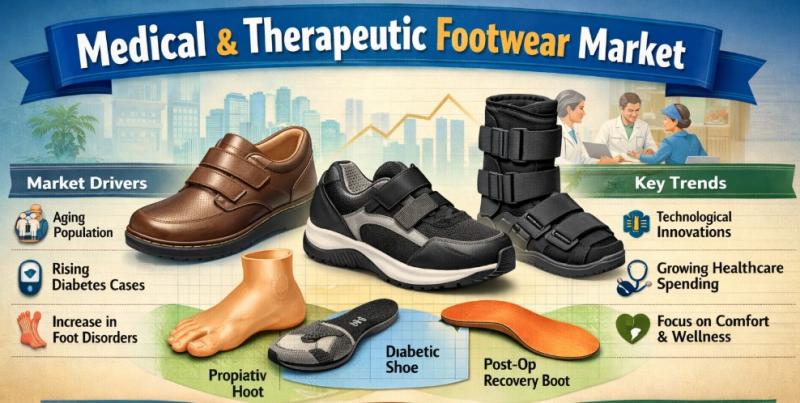

Medical & Therapeutic Footwear Market Is Likely to Experience a Tremendous Growt …

HTF MI just released the Global Medical & Therapeutic Footwear Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

Orthofeet, Dr. Comfort, Aetrex,…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…