Press release

Trade Finance Market Latest Trend and Future scope with Top Key Players | Bank of America, BNP Paribas, Citigroup Inc., Euler Hermes, HSBC Holdings plc, JPMorgan Chase & Co, Mitsubishi UFJ Financial Group

Latest Published Report by Allied Market Research Titled, “Trade Finance Market by Product Type (Supply Chain Finance and Export & Agency Finance), Service Providers (Banks, Trade Finance Houses, and Others), and End User (Exporters, Importers, and Traders): Global Opportunity Analysis and Industry Forecasts, 2020–2027”.Trade finance market is projected to witness a significant growth, due to increased disruption and advances in technology, to enhance digitized supply chain finance in the market. The market is largely fragmented, due to higher involvement of several traders, importers, and exporters globally.

These insights help to devise strategies and create new opportunities to achieve exceptional results. The research offers an extensive analysis of key players active in the global Trade Finance Market. Detailed analysis on operating business segments, product portfolio, business performance, and key strategic developments is offered in the research.

Request for a Free Sample Report (including TOC, Tables and Figures with Detailed Information) @ https://www.alliedmarketresearch.com/request-sample/4332

This makes it important to understand the practical implications of the Trade Finance Market. To gain a competitive advantage, the players must have something unique. By tapping into the untapped market segment, they can establish a relevant point of differentiation, and this report offers an extension analysis of untapped segments to benefit the market players and new entrants to gain the market share.

The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter’s Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and determine steps to be taken to gain competitive advantage.

The Trade Finance Market is evaluated based on its regional penetration, explaining the performance of the industry in each geographic regions covering provinces such as North America (United States, Canada and Mexico), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa).

The Interested Potential Key Market Players Can Enquire for the Report Purchase @ https://www.alliedmarketresearch.com/purchase-enquiry/4332

The report provides the SWOT analysis of the key market players including, Asian Development Bank (ADB), Bank of America, BNP Paribas, Citigroup Inc., Euler Hermes, HSBC Holdings plc, JPMorgan Chase & Co, Mitsubishi UFJ Financial Group, Inc., Royal Bank of Scotland, and Standard Chartered Bank which gives the business overview, financial analysis, and portfolio analysis of products and services. The latest news related to industry developments in terms of market expansions, acquisitions, growth -strategies, joint ventures, collaborations, product launches, market expansions etc. are included in the report for the better understanding of the stakeholders in framing strategic decisions to gain long term profitability and market share.

COVID-19 Scenario Analysis:

1. The COVID-19 pandemic is impacting society and the overall economy globally. The effect of this pandemic is increasing day by day as well as affecting the supply chain.

2. The COVID-19 crisis is making uncertainty in the stock Trade Finance Market trends, immense slowing of the supply chain, falling business confidence, and increasing panic among the customer segments.

3. The overall impact of the pandemic is impacting the production process of several industries, including semiconductor, electronics, and many more.

4. Trade barriers are further constraining the demand and supply outlook. As governments of different areas have already announced total lockdown and temporarily shutdown of industries, the overall production process is adversely affected.

5. However, the introduction of advanced software solutions will be an instrumental factor in influencing the growth of the Trade Finance Market forecast post pandemic.

Enquire for customization with Detailed Analysis of COVID-19 Impact in Report @ https://www.alliedmarketresearch.com/request-for-customization/4332?reqfor=covid

Key Benefits:

1. The report provides a qualitative and quantitative analysis of the current Trade Finance Market trends, forecasts, and market size from 2020 to 2027 to determine the prevailing opportunities.

2. Porter’s Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make strategic business decisions and determine the level of competition in the industry.

3. Top impacting factors & major investment pockets are highlighted in the research.

4. The major countries in each region are analyzed and their revenue contribution is mentioned.

5. The market report also provides an understanding of the current position of the market players active in the Trade Finance Market.

Highlights of the Report

1. Competitive landscape of the Trade Finance Market.

2. Revenue generated by each segment of the Trade Finance Market by 2027.

3. Factors expected to drive and create new opportunities in the Trade Finance Market.

4. Strategies to gain sustainable growth of the market.

5. Region that would create lucrative business opportunities during the forecast period.

6. Top impacting factors of the Trade Finance Market.

Trade Finance Market Segments:

By Product Type

• Supply Chain Finance

• Export & Agency Finance

By Service Providers

• Banks

• Trade Finance Houses

• Others

By End Users

• Exporters

• Importers

• Traders

By Region

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o France

o Spain

o Italy

o Russia

o Rest of Europe

• Asia-Pacific

o Japan

o India

o China

o Australia

o South Korea

o Rest of Asia-Pacific

• LAMEA

o Brazil

o Turkey

o Saudi Arabia

o South Africa

o Rest of LAMEA

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Latest Trend and Future scope with Top Key Players | Bank of America, BNP Paribas, Citigroup Inc., Euler Hermes, HSBC Holdings plc, JPMorgan Chase & Co, Mitsubishi UFJ Financial Group here

News-ID: 2266301 • Views: …

More Releases from Allied Market Research

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Indoor Farming Equipment Market Outlook, Top Key Players Analysis, Current Trend …

The report highlights numerous factors that influence the growth of the global Indoor farming equipment market such as market demand & forecast and qualitative and quantitative information. The qualitative data of market report includes pricing analysis, key regulations, macroeconomic factors, microeconomic factors, key impacting factors, company share analysis, market dynamics & challenges, strategic growth initiatives, and competition intelligence. The study cracks market demand in 15+ high-growth markets in the…

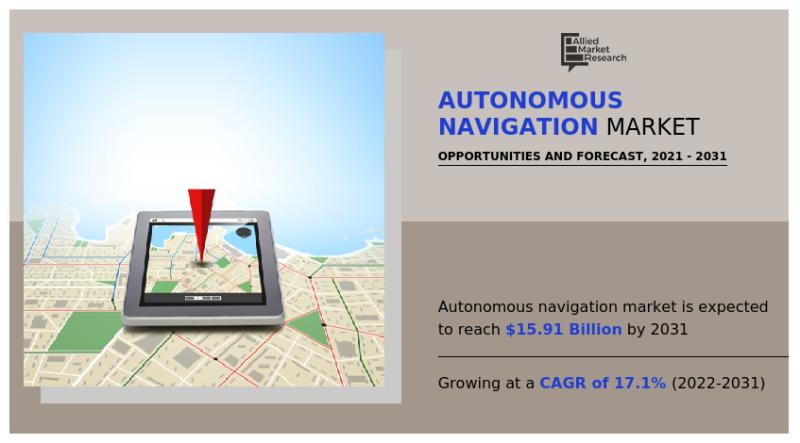

Autonomous Navigation Market Analysis and Forecast with a CAGR of 17.1% (2022-20 …

The global autonomous navigation market garnered $3.27 billion in 2021, and is estimated to generate $15.91 billion by 2031, manifesting a CAGR of 17.1% from 2022 to 2031.

Increase in demand for sense & avoid systems in autonomous system, rise in adoption of autonomous robot in commercial & military applications, and surge in demand for real-time data in military applications drive the growth of the global autonomous navigation market. During…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…