Press release

The Rise of Usage-Based Insurance Market Revenue Growth is Unstoppable by 2027 | Allianz SE, Allstate Corporation, Aviva, AXA, Insurethebox, Liberty Mutual Insurance, Mapfre S.A

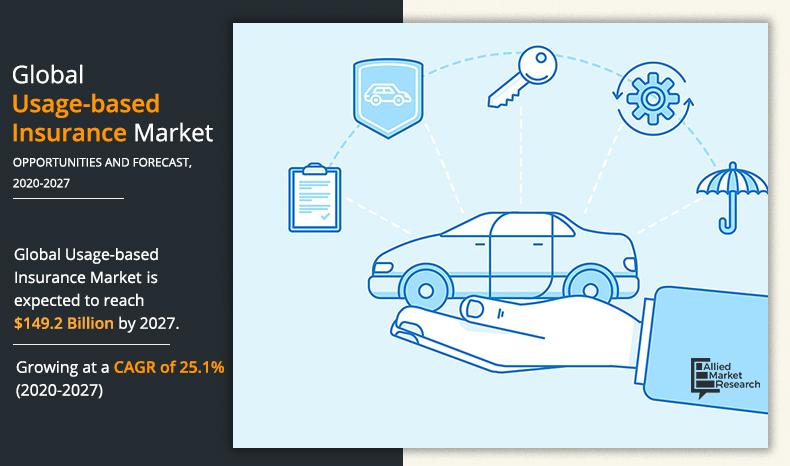

Allied Market Research published a new report, titled, "Usage-Based Insurance Market by Policy Type [Pay-As-You-Drive Insurance (PAYD), Pay-How-You-Drive Insurance (PHYD), and Manage-How-You-Drive Insurance (MHYD)], Technology (OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs), Vehicle Age (New Vehicles and Used Vehicles), Vehicle Type (Light-Duty Vehicle (LDV) and Heavy-Duty Vehicle (HDV)): Global Opportunity Analysis and Industry Forecast, 2021-2027."The latest analysis on Global Usage-Based Insurance Market is based on several organizations from different regions leading across the globe. The 250+ pages report offers significant information along with highlighting the drivers, restraints, and opportunities of the market. The study also aims to provide comprehensive information on the latest market trends, strategies, and competitions among the market players in the global Usage-Based Insurance Market. The analysis covers both the historical and forecasted data from 2014 to 2021 and 2021 to 2027 along with other segments including product overview, material required, and other growth aspects.

Download Research Sample with Industry Insights (250+ Pages PDF Report) @ https://www.alliedmarketresearch.com/request-sample/1742

Usage-Based Insurance Market Competitive Analysis:

Leading market players profiled in the global Usage-Based Insurance Market report include Allianz SE, Allstate Corporation, Aviva, AXA, Insurethebox, Liberty Mutual Insurance, Mapfre S.A., Nationwide Mutual Insurance Company, Progressive Corporation and UNIPOLSAI ASSICURAZIONI S.P.A.

These players have adopted several strategies including joint ventures, expansions, mergers & acquisitions, collaborations, and new product launches to strengthen their position in the industry.

Covid-19 Impact on the Global Usage-Based Insurance Market:

Usage-Based Insurance Market Research Report offers an outline of the market based on basic parameters such as market size, sales analysis, and key drivers. The market is expected to expand on a large scale during the forecast period (2021-2027). This report includes COVID-19 impacts on the market. The unprecedented arrival of the coronavirus pandemic (COVID-19) has troubled the complete lifestyles. This in turn has affected some of the market situations along with introducing new norms. The broad view of the research report, therefore, provides the users with the total impacts of covid19 on the industry and the market players.

Get detailed COVID-19 impact analysis on the Usage-Based Insurance Market @ https://www.alliedmarketresearch.com/request-for-customization/1742?reqfor=covid

Usage-Based Insurance Market Segmentation:

The research provides an in-depth segmentation of the global Usage-Based Insurance Market based on the product, type, end-user, and geography. It also presents a comprehensive examination of sales, revenue, growth rate, and market share of each for the historic period and the forecast period.

Usage-Based Insurance Market Regional Analysis:

The report offers a region-wise analysis of the market along with the competitive landscape in each region. The study covers regions including North America (the United States, Canada, and Mexico), Europe (Germany, France, UK, Russia, and Italy), Asia-Pacific (China, Japan, Korea, India, and Southeast Asia), South America (Brazil, Argentina, and Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa). These insights assist to formulate strategies and create new opportunities to accomplish remarkable outcomes.

KEY BENEFITS FOR STAKEHOLDERS

• This report offers analytical representation of the Usage-Based Insurance Market trends with recent trends and future predictions to outline the upcoming investment pockets.

• The overall potential intends to help in understanding the profitable trends to strengthen the base in the Usage-Based Insurance Market.

• The Usage-Based Insurance Market analysis provides extensive information based on key determinants of the market along with a detailed impact analysis.

• The recent market forecast is significantly examined from 2021 to 2027 to specify the financial ability.

• Porter’s five forces analysis demonstrates the effectiveness of the buyers and suppliers in the industry.

KEY QUESTIONS ANSWERED IN THE REPORT:

Q1. At what CAGR, the Usage-Based Insurance Market would grow from 2021 - 2027?

Q2. What will be the revenue of Global industry by the end of 2027?

Q3. How can I get sample report of Usage-Based Insurance Market?

Q4. Which are the factors that drives global industry Growth?

Q5. Who are the leading players in the Usage-Based Insurance Market?

Q6. How can I get company profiles of frontrunners of global market?

Q7. What are the segments of Usage-Based Insurance Market?

Q8. What are the major development strategies of Usage-Based Insurance Market Players?

Q9. By product, which segment would showcase the highest CAGR during the forecast period?

Q10. By Region, which segment holds a lead position in 2020?

Make Purchase Inquiry at https://www.alliedmarketresearch.com/purchase-enquiry/1742

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Rise of Usage-Based Insurance Market Revenue Growth is Unstoppable by 2027 | Allianz SE, Allstate Corporation, Aviva, AXA, Insurethebox, Liberty Mutual Insurance, Mapfre S.A here

News-ID: 2265347 • Views: …

More Releases from Allied Market Research

Auto Extended Warranty Market to Reach $60.82 Billion By 2030: Allied Market Res …

As per the report published by Allied Market Research, the global auto extended warranty market was accounting for $34.19 billion in 2020, and is expected to garner $60.82 billion by 2030, growing at a CAGR of 5.9% from 2021 to 2030.

Rise in awareness for extended warranty and surge in penetration of laptops, tablets, and smartphones have boosted the growth of the global auto extended warranty market. However, declining sales of…

Finance Cloud Market to Garner $90.11 Bn, Globally, by 2030 at 12.4% CAGR: Allie …

Allied Market Research recently published a report, titled, "Finance Cloud Market by Component (Solution [Financial Forecasting, Financial Reporting & Analysis, Security, Governance, Risk & Compliance, and Others] and Service), Enterprise Size (Large Enterprises and Small & Medium Enterprises (SMEs)), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), and Application (Revenue Management, Business Intelligence, Asset Management, Customer Relationship Management, Enterprise Resource Planning, and Others): Global Opportunity Analysis and Industry Forecast,…

Business Travel Insurance Market Expected to Reach $20.19 Billion By 2030: Says …

According to the report published by Allied Market Research, the global business travel insurance market was estimated at $3.61 billion in 2020 and is expected to hit $20.19 billion by 2030, registering a CAGR of 19.2% from 2021 to 2030. The report provides an in-depth analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive scenario, and varying market trends.

Download Sample Report (Get…

Global Wealth Management Market to Reach $3.43 Trillion at 10.7% CAGR by 2030: A …

Allied Market Research published a report, titled, "Wealth Management Market By Business Model (Human Advisory, Robo Advisory, and Hybrid Advisory), Provider (FinTech Advisors, Banks, Traditional Wealth Managers, and Others), and End-user Type (Retail and High Net Worth Individuals (HNIs): Global Opportunity Analysis and Industry Forecast, 2021-2030." According to the report, the global wealth management industry generated $1.25 trillion in 2020, and is anticipated to generate $3.43 trillion by 2030, witnessing…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…