Press release

Instructional: The journey to recovery and reinvention continues for Payment Processing Solutions Market

The modern 21st century requires swift movements and actions in everyday routine life. One of the important tasks that all people want to get done without too much interruption is the payment. Whether the job is to make online transactions, bill payments, or ATM withdrawals; every person want the payment procedure to go smoothly without any hustle and bustle. For this, a new emerging market called as payment processing solutions ensures seamless payment methods.According to a report published by Research Dive, the global payment processing solutions is anticipated to fuel the market growth with a CAGR of 12.6% during the forecast 2019-2027.

Download FREE Sample Report of the Payment Processing Solutions Market @ https://www.researchdive.com/download-sample/416

The payment processing solutions consists of multiple payment options that are widely used by people globally. Some of the popular ones that are used by consumers and the merchants are as follows:

• Square:

This method is coupled with the POS (Point of Sale) system for in-person payment option; however square provides e-commerce payment options as well. This technique of payment is favored by retail shops, online selling platforms, and e-commerce shops.

If square is incorporated in the e-commerce website then it exempts from charging monthly fees to the user. However, the seller is charged with 2.9% + $0.30 on every transaction with this payment option. Apart from this, square ensures quick payments, prevents frauds, and has straightforward pricing choices.

Furthermore, the companies who are already associated with square are Wordpress, Wix, WooCommerce, X-Cart, and many more.

• Stripe:

This is considered as the top payment option because of its versatile nature. Stripe is beneficial for e-commerce shops, on-demand market place, subscription services, and businesses with multiple services and processes. Stripe helps in setting up of recurring payment options and supports in-person payments as well as online payments.

Check out How COVID-19 impact on the Payment Processing Solutions Market. Click here to Connect with Analyst @ https://www.researchdive.com/connect-to-analyst/416

Furthermore, the seller is charged with 2.9% + $0.30 for each card transaction and for international purchases 1% is added in the above stated figure. An ACH transfer is charged with 0.8% of the total transaction with additional maximum fees of $5.

Stripe accepts all major cards from almost all the countries which are as follows:

• Visa

• American Express

• MasterCard

• Discover

• UnionPay (China)

• JCB (Japan)

Apart from this, some other payment options are also included on Stripe which is as follows:

• Google Pay

• ACH (Automated Clearing House) transfer

• Masterpass

• Microsoft pay

• Apple pay

• American Express Checkout

• Visa checkout

• Apple Pay:

Almost half of the U.S.A population roam around with an Apple phone in their pockets because this company controls 54% of the mobile market in the region. This is considered as one of the trusted brands across the world. Apple Pay provides benefits like online as well as in-person payment option, easy to set-up on mobiles with no extra fees to the merchants, facial or fingerprint recognition for online shopping payment, and option to pay with just one click.

• PayPal:

This is a well-established brand and widely used digital wallet worldwide. PayPal is famous because it can be set-up effortlessly, provides security, and is reliable source of payment. This mode accepts various modes of payments like Venmo, PayPal, PayPal credit, and all credit and debit cards.

• Leaders Merchant Service:

This consists of both online and real life payment options and also provides security that assures end-to-end address verifications, secure socket layer encryption, card verification, and values authentication of payment.

Apart from this, any person that opens an account on leaders merchant service has the choice of obtaining free online processing software and a free mobile card reader for tablet and smartphones.

Furthermore, the user can procure iAccess that helps in managing payments online; thus tracking all the transactions on a timely basis.

• Payment Depot:

This method of payment comes with an unlimited membership fee of $0.05 per month and also has processing fees that range in $0.05 to $0.15 per transaction. The processing fee is considered as profitable for big businesses that garner heavy profits every month; thus attaining tremendous savings.

The annual membership comes with a 90-days-money-back guarantee. Therefore, one can return the entire equipment within 3 months if unsatisfied with the payment method. Apart from this, the provision regarding no cancellation fees has also made payment depot popular.

• ProMerchant:

This payment method comes with a virtual terminal that nullifies up-front costs while accepting credit or debit cards through emails, phones, website’s buy now option, and SMS. ProMerchant includes a payment gateway called as Authorise.net that allows cards like Visa, Discover, MasterCard, American Express, JCB, and many more to function. Apart from this, ProMerchant also gives out month-to-month deals that can be cancelled anytime.

• Prepaid Cards:

These types of cards are used by minors and those people that don’t own a bank account. Some of the online gaming companies use virtual currency that is stored for in-game transactions via prepaid cards. Mint, Ticketsurf, Paysafecard, and Telco card are the examples of prepaid cards.

• E- Wallets:

The e-wallets are linked with mobile wallets through NFC (Near Field Communication) technology. The users can easily set up an e-wallet account by a quick sign in procedure.

Apart from the above stated methods, there are some traditional methods of transactions that are still followed today by the elderly and the marginalized section of the society. These are cash payments, direct bank deposits, check payments, DD (Demand Draft) payments, and paying via challan. However, the modern ways of transaction are soon foreseen to take over these methods due to the sheer convenience of their usage.

Contact us:

Mr. Abhishek Paliwal

Research Dive

30 Wall St. 8th Floor, New York

NY 10005 (P)

+ 91 (788) 802-9103 (India)

+1 (917) 444-1262 (US)

Toll Free: +1-888-961-4454

E-mail: support@researchdive.com

LinkedIn: https://www.linkedin.com/company/research-dive/

Twitter: https://twitter.com/ResearchDive

Facebook: https://www.facebook.com/Research-Dive-1385542314927521

Blog: https://www.researchdive.com/blog

About Us:

Research Dive is a market research firm based in Pune, India. Maintaining the integrity and authenticity of the services, the firm provides the services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With unprecedented access to several paid data resources, team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable. Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive deliver the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Instructional: The journey to recovery and reinvention continues for Payment Processing Solutions Market here

News-ID: 2264006 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

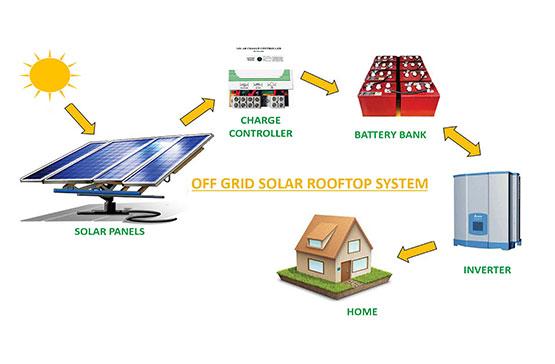

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…