Press release

COVID-19 Study: Fraud Detection & Prevention Market Opportunity Assessment to Reveal Lucrative Growth Prospects for Players

The COVID-19 pandemic has brought the businesses and the world to a standstill. While communities are grouping together to support one another, not every person is working cohesively for the common good. Since, the novel coronavirus reached the pandemic level, cybercrime has spiked with Checkphish reporting a million of attacks in May 2020 rising from 400 attacks in February 2020.Though technology has revolutionized the fraud detection departments, many approaches to fraud detection and prevention still fall flat when it comes to the high level of accuracy. But it is the organization and not the technology that should be held legally accountable for the decisions made. Thus, choosing a solution that delivers a high level of accuracy and accountability in fraud judgments is key. According to the Research Dive, the global fraud detection and prevention market is expected to observe additional growth in 2020. Originally, the global market was estimated to garner US$ 30.0 billion, but due to COVID-19 pandemic the market is now projected to reach up to US$ 31.5 billion by the end of 2020.

Here are some of the approaches to fraud detection and prevention management.

Access to Free Sample Report of Fraud Detection & Prevention Market (Including Full TOC, tables & Figure) Here! @ https://www.researchdive.com/download-sample/233

The Conventional Approach

It has now due to COVID-19 pandemic become common to adopt or implement basic rules-based approaches to fraud detection and prevention management. A logical program of sequential parameters is applied in basic rules-based systems as they use these parameters to detect instances of fraud and consequently perform automated actions.

The recent spike in advanced fraud cases means more sophisticated basic rules-based systems need to be adopted, as illustrated by the Association of Certified Fraud Examiners (ACFE), which estimated about 200% increase in the use of machine learning (ML) and artificial intelligence (AI) to detect fraud.

The Adaptive Approach

Machine learning has the capability to detect sophisticated frauds or fraudulent activities across huge or large volumes of data, ‘learning’ to become accustomed to new, unexpected threats, while considerably reducing false positives.

ML programs can be classified into two approaches

Supervised: In supervised ML algorithms, one can present it with both fraudulent as well as non-fraudulent records. In COVID-19 pandemic, this ‘labelled’ data can help in achieving the level of accuracy to produce a data model, which will predict whether fraud is present when assessing unknown or new fraud cases. On the other hand, supervised learning is incapable of scaling on-demand to evolving threats as it requires significant computation time for training, clean data, and a data scientist’s team, to build, maintain, and interpret.

Speak to our Expertise before buying Fraud Detection & Prevention Market Report@ https://www.researchdive.com/connect-to-analyst/233

Unsupervised: Unsupervised ML is useful for detecting fraudulent patterns where labelled data is not available. This model or approach will work off an untagged dataset, with unknown output values mapped with the input. It creates a function describing the structure of the data, and marks anything that doesn’t fit as an anomaly. This eventually saves time and enables the algorithm to mine at scale without any need for human input. However, a major drawback to unsupervised ML is its incapability to accurately explain its results, owing to the input data being unknown and unlabeled.

The Intelligent Approach

Intelligent automation or IA, via a visual model, copies the knowledge of the fraud experts and spreads over this knowledge to thousands of cases, while rapidly providing an audit trail for each decision. This includes its certainty level, data sources that were accessed, and every factor that goes into making each decision.

As compared to simple rules-based fraud detection tools, the modelling process in IA results in more reliable outcomes. An intelligent approach also handle uncertainties in the dataset. When the data is uncertain or missing, IA tries to find other data to help. If it is not able to find supporting data, IA is still able to make an inference, which will be unfilled with reduced certainty. Thus, unlike a fixed rules engine, IA doesn’t hit a dead end when data isn’t available.

In COVID-19 pandemic, an intelligent approach can impressively manage scale and deliver a high level of transparency. Moreover, COVID-19 won’t be the last widespread crisis the world will have to deal with. With the forthcoming risks of future pandemics, choosing the right fraud detection and prevention approach cannot be a matter of preference.

Request for Fraud Detection & Prevention Market Report Customization & Get 10% Discount on this Report@ https://www.researchdive.com/request-for-customization/233

Contact us:

Mr. Abhishek Paliwal

Research Dive

30 Wall St. 8th Floor, New York

NY 10005 (P)

+ 91 (788) 802-9103 (India)

+1 (917) 444-1262 (US)

Toll Free: +1-888-961-4454

E-mail: support@researchdive.com

LinkedIn: https://www.linkedin.com/company/research-dive/

Twitter: https://twitter.com/ResearchDive

Facebook: https://www.facebook.com/Research-Dive-1385542314927521

Blog: https://www.researchdive.com/blog

About Us

Research Dive is a market research firm based in Pune, India. Maintaining the integrity and authenticity of the services, the firm provides the services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With an unprecedented access to several paid data resources, team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable. Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive deliver the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release COVID-19 Study: Fraud Detection & Prevention Market Opportunity Assessment to Reveal Lucrative Growth Prospects for Players here

News-ID: 2260970 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

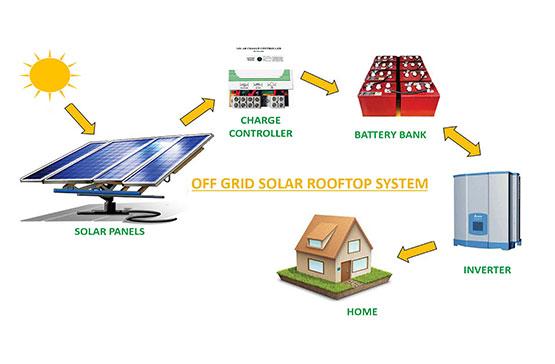

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…